Comparative Analysis of Blue Chip Fund

... This type of investment is more suited for long term investing in equity mutual funds, as there are no taxes on long term capital gains. Also, equity mutual funds are prone to short term risk, but in the long term they typically give good returns. This option benefits from the power of compounding s ...

... This type of investment is more suited for long term investing in equity mutual funds, as there are no taxes on long term capital gains. Also, equity mutual funds are prone to short term risk, but in the long term they typically give good returns. This option benefits from the power of compounding s ...

CHAPTER 03 AA Analyzing Business Transactions Using T

... Liabilities and Equity QUESTION: What are liabilities? ANSWER: Liabilities are debts or obligations of a business QUESTION: What is owner’s equity? ANSWER: Owner’s equity is the term used by sole proprietorships. It is the financial interest of an owner of a business. It is also called proprietorsh ...

... Liabilities and Equity QUESTION: What are liabilities? ANSWER: Liabilities are debts or obligations of a business QUESTION: What is owner’s equity? ANSWER: Owner’s equity is the term used by sole proprietorships. It is the financial interest of an owner of a business. It is also called proprietorsh ...

Estimating Equity Risk Premiums Report

... post ERP or the excess return, can be defined as the return of a stock market index minus the risk free return calculated as an annual percent over some historical period. The term ex ante ERP (or just ERP) will be used for the expected future annual return of a stock market index over the yield of ...

... post ERP or the excess return, can be defined as the return of a stock market index minus the risk free return calculated as an annual percent over some historical period. The term ex ante ERP (or just ERP) will be used for the expected future annual return of a stock market index over the yield of ...

CHAPTER_3,5_solutions

... multiplier). If the firm’s margins were to erode slightly, the ROE would be heavily impacted. 8. The book-to-bill ratio is intended to measure whether demand is growing or falling. It is closely followed because it is a barometer for the entire high-tech industry where levels of revenues and earning ...

... multiplier). If the firm’s margins were to erode slightly, the ROE would be heavily impacted. 8. The book-to-bill ratio is intended to measure whether demand is growing or falling. It is closely followed because it is a barometer for the entire high-tech industry where levels of revenues and earning ...

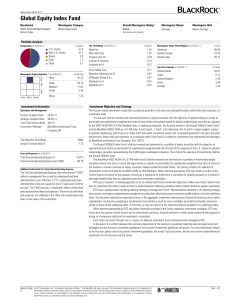

Global Equity Index Fund

... by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U.S. IMI Index Fund E (each, a "Fund", and collectively, the "Funds") in target weights, subject to periodic rebalancing. Each Fund is an "i ...

... by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U.S. IMI Index Fund E (each, a "Fund", and collectively, the "Funds") in target weights, subject to periodic rebalancing. Each Fund is an "i ...

Institutional non-bank lending and the role of Debt Funds

... The dynamic in this market segment shows that its importance is growing and increasing volumes in nonbank lending appear to be a trend (see also Preqin, 2014). So far, only the minority of existing Debt Funds focus on EIF’s core final beneficiaries - SMEs and mid-caps. Most of them are targeting the ...

... The dynamic in this market segment shows that its importance is growing and increasing volumes in nonbank lending appear to be a trend (see also Preqin, 2014). So far, only the minority of existing Debt Funds focus on EIF’s core final beneficiaries - SMEs and mid-caps. Most of them are targeting the ...

NBER WORKING PAPER SERIES THE EQUITY PREMIUM IN RETROSPECT Rajnish Mehra

... Poor’s (S&P) industrial portfolios. Cowles reported dividends, so that, unlike the earlier indexes for the period 1802–1871, a total return calculation was possible. ...

... Poor’s (S&P) industrial portfolios. Cowles reported dividends, so that, unlike the earlier indexes for the period 1802–1871, a total return calculation was possible. ...

U.S. Treasury Department Unveils New Reporting Requirement for

... monthly basis, information relating to foreign “long-term” securities held by U.S. residents, as well as information relating to U.S. long-term securities owned by foreign residents. Reporting on the new “TIC Form SLT” will be required of major U.S. companies, funds and their investment advisers, an ...

... monthly basis, information relating to foreign “long-term” securities held by U.S. residents, as well as information relating to U.S. long-term securities owned by foreign residents. Reporting on the new “TIC Form SLT” will be required of major U.S. companies, funds and their investment advisers, an ...

Capital raising in Australia

... Commonwealth Government bonds is an important first step in growing a similar retail interest in corporate debt issues. Questions were asked about the methods employed by some companies to raise equity capital, and particularly, whether retail investors were treated fairly. While it is difficult to ...

... Commonwealth Government bonds is an important first step in growing a similar retail interest in corporate debt issues. Questions were asked about the methods employed by some companies to raise equity capital, and particularly, whether retail investors were treated fairly. While it is difficult to ...

Financial Risk Capacity

... equity shocks are amplified through a substitution of equity financing for debt. In BS amplification operates through fire sales.6 This paper differs from the literature in some important aspects. First, intermediaries do not operate production; they reallocate capital. Second, they issue liabilitie ...

... equity shocks are amplified through a substitution of equity financing for debt. In BS amplification operates through fire sales.6 This paper differs from the literature in some important aspects. First, intermediaries do not operate production; they reallocate capital. Second, they issue liabilitie ...

chapter 3

... look to the equity, or owner-supplied funds, to provide a margin of safety, so if the stockholders have provided only a small proportion of the total financing, the firm’s risks are borne mainly by its creditors. (3) If the firm earns more on investments financed with borrowed funds than it pays in ...

... look to the equity, or owner-supplied funds, to provide a margin of safety, so if the stockholders have provided only a small proportion of the total financing, the firm’s risks are borne mainly by its creditors. (3) If the firm earns more on investments financed with borrowed funds than it pays in ...

Alternative Assets: The Next Frontier for Defined Contribution

... significant liquidity constraints during the market downturn as a result of limited liquidity and valuation guidelines and the increased trading volatility of retail investors. However, we are now seeing the development of structures addressing the liquidity and valuation challenges experienced by t ...

... significant liquidity constraints during the market downturn as a result of limited liquidity and valuation guidelines and the increased trading volatility of retail investors. However, we are now seeing the development of structures addressing the liquidity and valuation challenges experienced by t ...

The Case for Dividend Growers in Volatile Markets

... balance sheets. Their dividend yields may not be the highest, but they could be attractive to investors looking for disciplined companies that can endure difficult market and economic environments relatively well. In particular, dividend growers may provide some downside protection in falling market ...

... balance sheets. Their dividend yields may not be the highest, but they could be attractive to investors looking for disciplined companies that can endure difficult market and economic environments relatively well. In particular, dividend growers may provide some downside protection in falling market ...

What kinds of firms diversify?

... • Large: $1.9 trillion in assets under management (AUM) at end 2007 • Roughly 10,000 managers • up from $100 billion and <1,000 managers in 1990 What are hedge funds? • Private investment vehicles for “sophisticated” (e.g., wealthy) investors • Similar to mutual funds in that they invest in a portfo ...

... • Large: $1.9 trillion in assets under management (AUM) at end 2007 • Roughly 10,000 managers • up from $100 billion and <1,000 managers in 1990 What are hedge funds? • Private investment vehicles for “sophisticated” (e.g., wealthy) investors • Similar to mutual funds in that they invest in a portfo ...

Q1 - 2017 Commentary - The Canadian ETF Association

... As of February 2017, ETFs accounted for 8.0% of all investment fund assets (mutual funds and ETFs, collectively), an increase of 1.1 percentage points from a year earlier. Over this time period, ETFs posted double digit asset growth of 35.1%, while mutual fund assets grew by 15.0%—a still powerful r ...

... As of February 2017, ETFs accounted for 8.0% of all investment fund assets (mutual funds and ETFs, collectively), an increase of 1.1 percentage points from a year earlier. Over this time period, ETFs posted double digit asset growth of 35.1%, while mutual fund assets grew by 15.0%—a still powerful r ...

Co-Investment Funds - IP Conference

... Network of entrepreneurs, located in the incubator Follow on financing by the incubator (up to EUR 200k) Connected to a VC fund, managed by the same manager Organization and investment lead by experienced entrepreneurs and investment professionals International setup Creates an environment of entrep ...

... Network of entrepreneurs, located in the incubator Follow on financing by the incubator (up to EUR 200k) Connected to a VC fund, managed by the same manager Organization and investment lead by experienced entrepreneurs and investment professionals International setup Creates an environment of entrep ...

Download attachment

... United Kingdom and rest of Europe: Except as otherwise specified herein, this material is communicated by UBS Limited, a subsidiary of UBS AG, to persons who are market counterparties or intermediate customers (as detailed in the FSA Rules) and is only available to such persons. The information cont ...

... United Kingdom and rest of Europe: Except as otherwise specified herein, this material is communicated by UBS Limited, a subsidiary of UBS AG, to persons who are market counterparties or intermediate customers (as detailed in the FSA Rules) and is only available to such persons. The information cont ...

User`s guide

... is the balance sheet of the stock of external financial assets and liabilities. The position at the end of a specific period reflects financial transactions, valuation changes and other adjustments that occurred during the period and affected the level of assets and liabilities. Foreign direct inves ...

... is the balance sheet of the stock of external financial assets and liabilities. The position at the end of a specific period reflects financial transactions, valuation changes and other adjustments that occurred during the period and affected the level of assets and liabilities. Foreign direct inves ...

Proposal - Mountain Plains Management Conference

... The DuPont Model remains today a highly preferred system of financial analysis having withstood the challenge of newer valuation methods introduced in the 1990s. Blumenthal (1998) presents both sides of the debate involving traditional financial ratio analysis (namely, the DuPont Model) on one side ...

... The DuPont Model remains today a highly preferred system of financial analysis having withstood the challenge of newer valuation methods introduced in the 1990s. Blumenthal (1998) presents both sides of the debate involving traditional financial ratio analysis (namely, the DuPont Model) on one side ...

RESEARCH DISCUSSION PAPER A Survey of Housing

... typically inject equity). The trend of increased housing equity withdrawal evident in a number of countries over the past decade or so has prompted a number of surveys to help better understand this development. Many of these had a narrow focus on housing equity withdrawal not related to property tr ...

... typically inject equity). The trend of increased housing equity withdrawal evident in a number of countries over the past decade or so has prompted a number of surveys to help better understand this development. Many of these had a narrow focus on housing equity withdrawal not related to property tr ...

Key Fundraising Issues: Placement Agents

... • Placement agents may be large, global firms or smaller niche firms. • The niche firms usually specialize in one sector or location, e.g. energy or the Far East. • In some locations, local assistance can be important. ...

... • Placement agents may be large, global firms or smaller niche firms. • The niche firms usually specialize in one sector or location, e.g. energy or the Far East. • In some locations, local assistance can be important. ...

What is an investment?

... • Ethical investment (also known as socially responsible investment) is investing for financial return, but having regard to other criteria such as environmental protection, health, human rights. ...

... • Ethical investment (also known as socially responsible investment) is investing for financial return, but having regard to other criteria such as environmental protection, health, human rights. ...

what stock market returns to expect for the future?

... future should be lower than in the past since greater diversification means less risk for the investor. Second, the average cost of investing in mutual funds has declined due to the reduced importance of funds with high investment fees and the growth of index funds. While the decline in costs has af ...

... future should be lower than in the past since greater diversification means less risk for the investor. Second, the average cost of investing in mutual funds has declined due to the reduced importance of funds with high investment fees and the growth of index funds. While the decline in costs has af ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.