Overview of Investigation

... • Estimating risk premiums from the most successful country and ignoring evidence from stock markets that did not survive for the full sample period will impart an upward bias in estimates of expected returns. • The high realized equity premium obtained for the United States may not be indicative of ...

... • Estimating risk premiums from the most successful country and ignoring evidence from stock markets that did not survive for the full sample period will impart an upward bias in estimates of expected returns. • The high realized equity premium obtained for the United States may not be indicative of ...

IMPROVING THE EFFICIENCY OF THE ANGEL FINANCE MARKET

... From 1989 to 1993, gazelles (which accounted for no more than 3% of firms) added 4.4 million jobs to the economy, during a period when the economy hardly grew. Id. at 6. 17. Moreover, these rapid growth start-ups serve the beneficial role of culling less productive companies and industries, which al ...

... From 1989 to 1993, gazelles (which accounted for no more than 3% of firms) added 4.4 million jobs to the economy, during a period when the economy hardly grew. Id. at 6. 17. Moreover, these rapid growth start-ups serve the beneficial role of culling less productive companies and industries, which al ...

Government Intervention in Venture Capital in Canada: Toward

... lenders and those of early stage high-tech companies. The former are perceived to have been particularly reticent about providing financing to these firms because of their asset-light nature relative to more traditional industrial sectors. Loans to manufacturers, for example, can be secured against ...

... lenders and those of early stage high-tech companies. The former are perceived to have been particularly reticent about providing financing to these firms because of their asset-light nature relative to more traditional industrial sectors. Loans to manufacturers, for example, can be secured against ...

FIRMS, FAMILY OFFICES TURN TO WEALTH COUNSELORS LAW

... Bank of America, US Trust Private Wealth Management is downsizing its 34 hubs across the U.S. by as much as half and reorganizing certain offices in an effort to reduce costs and to make way for the integration of Merrill Lynch offices. It is also in the process of combining its multi-family office ...

... Bank of America, US Trust Private Wealth Management is downsizing its 34 hubs across the U.S. by as much as half and reorganizing certain offices in an effort to reduce costs and to make way for the integration of Merrill Lynch offices. It is also in the process of combining its multi-family office ...

SUNTRUST BANKS INC (Form: FWP, Received: 06

... results to differ materially from those described in the forward-looking statements include the following: changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital or liquidity; o ...

... results to differ materially from those described in the forward-looking statements include the following: changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital or liquidity; o ...

Canadians Hop Aboard Strategic-Beta Bandwagon

... Alternative active funds have no green. (They may also end up with a new name; this label is provisional.) They do not begin with a common, market-cap-weighted benchmark, as they either limit their investment universes or mix their assets so as to create unusual starting points. (A fund that invests ...

... Alternative active funds have no green. (They may also end up with a new name; this label is provisional.) They do not begin with a common, market-cap-weighted benchmark, as they either limit their investment universes or mix their assets so as to create unusual starting points. (A fund that invests ...

How to Invest in REITs

... • Company receives a dividends paid deduction • Taxes are paid at the shareholder level ...

... • Company receives a dividends paid deduction • Taxes are paid at the shareholder level ...

Professional Letter

... participants by American Century. All AIG VALIC participants investing in this fund should have been notified by AIG VALIC that existing assets in the Government Agency Fund were automatically mapped to the Capital Preservation Fund on August 31, 2007. Adds a socially responsible fund to AIG VALIC’s ...

... participants by American Century. All AIG VALIC participants investing in this fund should have been notified by AIG VALIC that existing assets in the Government Agency Fund were automatically mapped to the Capital Preservation Fund on August 31, 2007. Adds a socially responsible fund to AIG VALIC’s ...

Empirical Determinants and Patterns of Research and Development

... hypothesis about financially constrained firms. Moreover, some authors argue that conflicting evidence (e.g., provided by Kaplan and Zingales 1997 and Cleary 1999) can be explained by negative cash flow observations and a few influential sample points (Allayanis and Mozumdar 2004, from Khramov 2012) ...

... hypothesis about financially constrained firms. Moreover, some authors argue that conflicting evidence (e.g., provided by Kaplan and Zingales 1997 and Cleary 1999) can be explained by negative cash flow observations and a few influential sample points (Allayanis and Mozumdar 2004, from Khramov 2012) ...

Short-term Expectations in Listed Firms: The Effects of Different

... both transient and more long-term owners.8 Many institutional investors such as mutual fund managers face short-term compensation schemes tied to recent fund performance, and are involved in active trading, elements which can make their focus rather short-term, such as on returns from daily up to a ...

... both transient and more long-term owners.8 Many institutional investors such as mutual fund managers face short-term compensation schemes tied to recent fund performance, and are involved in active trading, elements which can make their focus rather short-term, such as on returns from daily up to a ...

Safe: Cap and Discount

... hereunder for its own account for investment, not as a nominee or agent, and not with a view to, or for resale in connection with, the distribution thereof, and the Investor has no present intention of selling, granting any participation in, or otherwise distributing the same. The Investor has such ...

... hereunder for its own account for investment, not as a nominee or agent, and not with a view to, or for resale in connection with, the distribution thereof, and the Investor has no present intention of selling, granting any participation in, or otherwise distributing the same. The Investor has such ...

THEME: THE CHANGING ECONOMIC LANDSCAPE WITHIN EAC

... Some of them have grabbed attention making bad investments in several Wall Street financial firms such as Citigroup, Morgan Stanley, and Merrill Lynch. These firms needed a cash infusion due to losses resulting from mismanagement and the subprime mortgage crisis. SWFs invest in a variety of asset cl ...

... Some of them have grabbed attention making bad investments in several Wall Street financial firms such as Citigroup, Morgan Stanley, and Merrill Lynch. These firms needed a cash infusion due to losses resulting from mismanagement and the subprime mortgage crisis. SWFs invest in a variety of asset cl ...

SME Access to External Finance BIS ECONOMICS PAPER NO. 16 JANUARY 2012

... than previously, most SMEs are now paying less for finance overall. Average interest rates on variable rate lending were 5.39% in November 2008 compared to 3.5% in November 2011. This is due to the decline in the Bank of England Interest rate, although margins are higher than pre-recession levels. ...

... than previously, most SMEs are now paying less for finance overall. Average interest rates on variable rate lending were 5.39% in November 2008 compared to 3.5% in November 2011. This is due to the decline in the Bank of England Interest rate, although margins are higher than pre-recession levels. ...

The Financial Structure of Startup Firms: The Role of

... threaten to walk away. Therefore, firms with a high degree of asset specificity should be financed primarily by the entrepreneur’s own resources, followed by external equity such as venture capital, and last by external debt. Insights gleaned from theory suggest that startups would use internal fun ...

... threaten to walk away. Therefore, firms with a high degree of asset specificity should be financed primarily by the entrepreneur’s own resources, followed by external equity such as venture capital, and last by external debt. Insights gleaned from theory suggest that startups would use internal fun ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... 16.1 The Private Sector under Communism The story of the private sector under communism can be quickly told, in part because there is not much to say and in part because other authors have covered this ground thoroughly. This section provides information on how Communist regimes limited private acti ...

... 16.1 The Private Sector under Communism The story of the private sector under communism can be quickly told, in part because there is not much to say and in part because other authors have covered this ground thoroughly. This section provides information on how Communist regimes limited private acti ...

NBER WORKING PAPER SERIES PUTTING THE BRAKES ON SUDDEN STOPS:

... interested in particular in studying how the guarantees affect asset positions, asset price volatility, business cycle dynamics, and the magnitude and probability of Sudden Stops. Asset price guarantees have not been widely studied in quantitative equilibrium asset pricing theory, with the notable e ...

... interested in particular in studying how the guarantees affect asset positions, asset price volatility, business cycle dynamics, and the magnitude and probability of Sudden Stops. Asset price guarantees have not been widely studied in quantitative equilibrium asset pricing theory, with the notable e ...

Delay in the Expansion from 2.5G to 3G Wireless Networks

... Insatiable appetite for acquisitions: Under Bernard J. Ebbers, WorldCom raced to make more than 70 acquisitions in two decades. Among the biggest, were MFS Communications (the deal made WorldCom a major Internet player), and MCI, the second –largest telecommunications company in the U.S. after AT&T. ...

... Insatiable appetite for acquisitions: Under Bernard J. Ebbers, WorldCom raced to make more than 70 acquisitions in two decades. Among the biggest, were MFS Communications (the deal made WorldCom a major Internet player), and MCI, the second –largest telecommunications company in the U.S. after AT&T. ...

capital markets players survey 2013

... Table 5: Total Assets in the Ugandan and Kenyan Capital Markets .................................................... 16 Table 6: Total Balance Sheet Assets by Licence Category in Uganda and Kenya .............................. 17 Table 7: Licence Category of Market Players with Agents .............. ...

... Table 5: Total Assets in the Ugandan and Kenyan Capital Markets .................................................... 16 Table 6: Total Balance Sheet Assets by Licence Category in Uganda and Kenya .............................. 17 Table 7: Licence Category of Market Players with Agents .............. ...

Determinants of Going-Public Decision in an Emerging

... investigation was based on two types of firms: (a) all those firms that had an IPO between 1972 and 2000 and (b) all those firms that stayed private during the period. A probit model was used to examine the relationship between the product market characteristics of firms immediately before going pu ...

... investigation was based on two types of firms: (a) all those firms that had an IPO between 1972 and 2000 and (b) all those firms that stayed private during the period. A probit model was used to examine the relationship between the product market characteristics of firms immediately before going pu ...

INTRODUCTION HIGHLIGHTS Regulatory Issues Market

... with the FRB buying US $85 Billion worth of bonds monthly. The announcement by Mr. Bernanke of the end to the FRB’s bond purchases by mid-2014 precipitated a sell-off of shares globally by panicky investors. The panicky sell-offs began in New York before spreading to other major global financial cen ...

... with the FRB buying US $85 Billion worth of bonds monthly. The announcement by Mr. Bernanke of the end to the FRB’s bond purchases by mid-2014 precipitated a sell-off of shares globally by panicky investors. The panicky sell-offs began in New York before spreading to other major global financial cen ...

Quantitative Easing - Pensions and Lifetime Savings Association

... it will increase deficits (again, for DB schemes), because of the disproportionate negative impact on liabilities compared to the positive impact on assets, resulting in more challenging recovery plans and employers having to make increased contributions to their company pension schem ...

... it will increase deficits (again, for DB schemes), because of the disproportionate negative impact on liabilities compared to the positive impact on assets, resulting in more challenging recovery plans and employers having to make increased contributions to their company pension schem ...

Ambiguous Growth and Asset Prices in Production Economies

... intertemporal substitution in consumption (henceforth, EIS), and stock holders with high EIS. Thus, separating the SDF (also known as the pricing kernel) for pricing bonds and stock returns. This method addresses the excess volatility of the risk free rate problem. In our research, we show that it i ...

... intertemporal substitution in consumption (henceforth, EIS), and stock holders with high EIS. Thus, separating the SDF (also known as the pricing kernel) for pricing bonds and stock returns. This method addresses the excess volatility of the risk free rate problem. In our research, we show that it i ...

measuring risk-adjusted returns in alternative investments

... • Under this theorem, as the number of randomly distributed independent variables becomes large, the distribution of the collection’s mean approaches normality. • This would be OK for a portfolio’s return if its strategies would never be influenced by a dominant event. ...

... • Under this theorem, as the number of randomly distributed independent variables becomes large, the distribution of the collection’s mean approaches normality. • This would be OK for a portfolio’s return if its strategies would never be influenced by a dominant event. ...

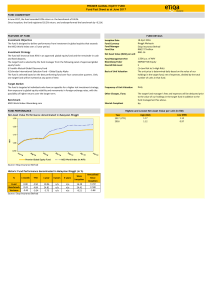

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... 1 Market Risk - The risk of losses in the value of an investment fund, due to factors that affect the overall performance of financial markets. These factors could be the current situation or future outlook, and could be both local and foreign. These factors could include the economy, politics, gove ...

... 1 Market Risk - The risk of losses in the value of an investment fund, due to factors that affect the overall performance of financial markets. These factors could be the current situation or future outlook, and could be both local and foreign. These factors could include the economy, politics, gove ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.