Who Owns Our PFI Schemes: And Why It Matters

... investment company to seek to extract every last drop of potential profit from the PFI scheme, leaving the public sector exposed to increased risk of the project underperforming or even failing. f. ...

... investment company to seek to extract every last drop of potential profit from the PFI scheme, leaving the public sector exposed to increased risk of the project underperforming or even failing. f. ...

ExerCh15

... The working capital and current ratio incorrectly include intangible assets and property, plant, and equipment as a part of current assets. Both are noncurrent. The quick ratio has both an incorrect numerator and denominator. The numerator of the quick ratio is incorrectly calculated as the sum of i ...

... The working capital and current ratio incorrectly include intangible assets and property, plant, and equipment as a part of current assets. Both are noncurrent. The quick ratio has both an incorrect numerator and denominator. The numerator of the quick ratio is incorrectly calculated as the sum of i ...

PCFRC Releases Meeting Highlights, Future of Private Company Reporting Discussed

... those statements is the preferred approach. o The Committee realizes there could be other major alternatives for private company accounting that should be explored. Ms. O’Dell pointed out recent events and trends affecting private company accounting, including: o The issuance of the International Fi ...

... those statements is the preferred approach. o The Committee realizes there could be other major alternatives for private company accounting that should be explored. Ms. O’Dell pointed out recent events and trends affecting private company accounting, including: o The issuance of the International Fi ...

A Modern, Behavior-Aware Approach to Asset Allocation and

... the future holds. We can be vaguely right instead of precisely wrong. Nevertheless, we believe there are pragmatic improvements that can be made to address some of the MPT’s flaws. In our opinion, the most glaring of these flaws is the failure to acknowledge the role of investor behavior in long-ter ...

... the future holds. We can be vaguely right instead of precisely wrong. Nevertheless, we believe there are pragmatic improvements that can be made to address some of the MPT’s flaws. In our opinion, the most glaring of these flaws is the failure to acknowledge the role of investor behavior in long-ter ...

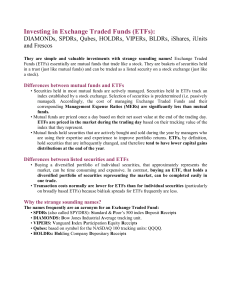

Investing in Exchange Traded Funds (ETFs):

... invested either in a sector or an individual security. Concentrations can influence the volatility and performance of the ETF. One possible solution is to own a “capped” version of the ETF where maximum weight in the portfolio is established. Several “capped” ETFs are available on the Toronto Exchan ...

... invested either in a sector or an individual security. Concentrations can influence the volatility and performance of the ETF. One possible solution is to own a “capped” version of the ETF where maximum weight in the portfolio is established. Several “capped” ETFs are available on the Toronto Exchan ...

Discount for Lack of Marketability in Preferred Financings

... “simple analytical upper bound on the value of marketability using option‐ pricing theory…and shows that discounts for lack of marketability can potentially be large even when the illiquidity period is very short.”7 Longstaff’s tool is based on a look‐back option approach8 whic ...

... “simple analytical upper bound on the value of marketability using option‐ pricing theory…and shows that discounts for lack of marketability can potentially be large even when the illiquidity period is very short.”7 Longstaff’s tool is based on a look‐back option approach8 whic ...

fiduciary duty in the - Principles for Responsible Investment

... Netherlands, the UK and Scandinavia. However, it was also noted that Germany’s financial system and investment culture is in many ways different from its peers. Germany’s financial culture is often characterised as a “savings” rather than “investment” culture, with a preference for stability and sec ...

... Netherlands, the UK and Scandinavia. However, it was also noted that Germany’s financial system and investment culture is in many ways different from its peers. Germany’s financial culture is often characterised as a “savings” rather than “investment” culture, with a preference for stability and sec ...

equity method of accounting

... Dividends from associate’s pre-acquisition earnings Dr Cash at bank Cr Investment in X Ltd Share of associate’s profit Dr Investment in X Ltd Cr Share of associate’s profit ...

... Dividends from associate’s pre-acquisition earnings Dr Cash at bank Cr Investment in X Ltd Share of associate’s profit Dr Investment in X Ltd Cr Share of associate’s profit ...

Frequently Asked Questions on Rajiv Gandhi Equity Savings

... market, the Government of India announced a scheme named Rajiv Gandhi Equity Savings Scheme, 2012 (RGESS). 2) What benefits does RGESS offer to small investors? Under RGESS, a new section 80CCG has been introduced in the Income Tax Act, 1961 on ‘Deduction in respect of investment under an equity sav ...

... market, the Government of India announced a scheme named Rajiv Gandhi Equity Savings Scheme, 2012 (RGESS). 2) What benefits does RGESS offer to small investors? Under RGESS, a new section 80CCG has been introduced in the Income Tax Act, 1961 on ‘Deduction in respect of investment under an equity sav ...

mySTART® Nominated Securities and Funds

... markets. The investment objective is to provide investors with a long run level of return consistent with international share markets as well as diversification away from New Zealand dollar dominated investments. Investment returns will vary substantially from year to year and may be negative. ...

... markets. The investment objective is to provide investors with a long run level of return consistent with international share markets as well as diversification away from New Zealand dollar dominated investments. Investment returns will vary substantially from year to year and may be negative. ...

Chapter 17 - McGraw Hill Higher Education

... “America West Airlines announced today that its Board of Directors has authorized the purchase of up to 2.5 million shares of its Class B common stock on the open market as circumstances warrant over the next two years. . . . “Following the approval of the stock repurchase program by the company’s B ...

... “America West Airlines announced today that its Board of Directors has authorized the purchase of up to 2.5 million shares of its Class B common stock on the open market as circumstances warrant over the next two years. . . . “Following the approval of the stock repurchase program by the company’s B ...

Immigrant Investor Programme - Guidelines for Funds

... that is made through the medium of an investment fund would be considered within the evaluation process set up for the IIP. This document is therefore intended to set out some guidelines for those involved in fund management as well as those considering making an application under the IIP in respect ...

... that is made through the medium of an investment fund would be considered within the evaluation process set up for the IIP. This document is therefore intended to set out some guidelines for those involved in fund management as well as those considering making an application under the IIP in respect ...

Establishing China`s Green Financial System Detailed

... became insufficient and attracting private capital into environmental industry became an urgent priority. Bank lending served as an early means of attracting private capital into the environmental ...

... became insufficient and attracting private capital into environmental industry became an urgent priority. Bank lending served as an early means of attracting private capital into the environmental ...

Bear Stearns

... with the calendar year and decreased earnings from the crash were not reported until mid-1995. The securities industry is so competitive that when employees’ bonuses took a hit from reduced revenues, several senior bond executives left for other firms. In 1997, Bear Stearns teamed up with National M ...

... with the calendar year and decreased earnings from the crash were not reported until mid-1995. The securities industry is so competitive that when employees’ bonuses took a hit from reduced revenues, several senior bond executives left for other firms. In 1997, Bear Stearns teamed up with National M ...

Key Takeaways From The FCA Consultation

... acting in an agency capacity or executing a client order; or (b) it satisfies the following conditions: (i) it does not hold client money or securities in relation to investment services that it provides and is not authorised to do so; (ii) the only 3 investment service 3 it undertakes is dealing on ...

... acting in an agency capacity or executing a client order; or (b) it satisfies the following conditions: (i) it does not hold client money or securities in relation to investment services that it provides and is not authorised to do so; (ii) the only 3 investment service 3 it undertakes is dealing on ...

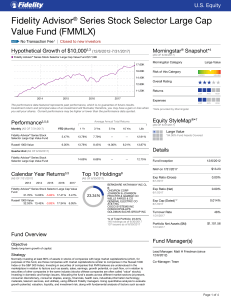

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... prospectus (before waivers or reimbursements). This ratio also includes Acquired Fund Fees and Expenses, which are expenses indirectly incurred by a fund through its ownership of shares in other investment companies. If the investment option is not a mutual fund, the expense ratio may be calculated ...

... prospectus (before waivers or reimbursements). This ratio also includes Acquired Fund Fees and Expenses, which are expenses indirectly incurred by a fund through its ownership of shares in other investment companies. If the investment option is not a mutual fund, the expense ratio may be calculated ...

Chapter 03 PowerPoint

... Using financial statement information— Benchmarking • Ratios are not very helpful by themselves; they need to be compared with something • Time-trend analysis – Used to see how the firm’s performance is changing over time – Internal and external uses ...

... Using financial statement information— Benchmarking • Ratios are not very helpful by themselves; they need to be compared with something • Time-trend analysis – Used to see how the firm’s performance is changing over time – Internal and external uses ...

The Case for Investing in High Yield Municipal

... regarding congressional support dominates investment theses for holding the bonds. Another headline grabbing entity is the city of Chicago, particularly Chicago Public Schools (CPS). Chicago has different challenges, which include underfunded pensions, but similar to Puerto Rico in that these holdin ...

... regarding congressional support dominates investment theses for holding the bonds. Another headline grabbing entity is the city of Chicago, particularly Chicago Public Schools (CPS). Chicago has different challenges, which include underfunded pensions, but similar to Puerto Rico in that these holdin ...

NBER WORKING PAPER SERIES QUANTITATIVE IMPLICATION OF A DEBT-DEFLATION

... East Asia in 1997, even in countries where there was no devaluation of the currency, as in Hong Kong where equity prices fell by 20 percent. Sudden Stops also induced higher asset price volatility. The volatility of weekly emerging-market dollar returns doubled from 2 to 4 percent during the 1997 Ea ...

... East Asia in 1997, even in countries where there was no devaluation of the currency, as in Hong Kong where equity prices fell by 20 percent. Sudden Stops also induced higher asset price volatility. The volatility of weekly emerging-market dollar returns doubled from 2 to 4 percent during the 1997 Ea ...

Angels, Entrepreneurship, and Employment

... financial intermediaries such as banks and professional venture capital firms undoubtedly play an important role, but much of the capital supplied to new firms takes place through a less formal channel of wealthy individuals investing their own funds, often termed angel finance. For example, Puri an ...

... financial intermediaries such as banks and professional venture capital firms undoubtedly play an important role, but much of the capital supplied to new firms takes place through a less formal channel of wealthy individuals investing their own funds, often termed angel finance. For example, Puri an ...

GOVERNMENT SHAREHOLDING AND FINANCIAL HEALTH OF

... Internally, managers use accounting information to make decisions about investment projects. Externally, accounting data can be used by stakeholders to monitor decisions of managers: shareholders can monitor managers and contracts involving investment or loans; the government can monitor tax complia ...

... Internally, managers use accounting information to make decisions about investment projects. Externally, accounting data can be used by stakeholders to monitor decisions of managers: shareholders can monitor managers and contracts involving investment or loans; the government can monitor tax complia ...

Download attachment

... would have found much respite for the reasons that we have already outlined. It is a useful rule of thumb to estimate that the average investor lost around 20 per cent of his net wealth during the crisis: this holds for Muslim investors as well as conventional investors. The singular focus of these ...

... would have found much respite for the reasons that we have already outlined. It is a useful rule of thumb to estimate that the average investor lost around 20 per cent of his net wealth during the crisis: this holds for Muslim investors as well as conventional investors. The singular focus of these ...

INVESTMENT POLICY STATEMENT APPROVED JANUARY 30

... “Baa" or better by Moody’s or “BBB” or better by Standard & Poor’s; b. Maintain a Beta less than 1.2X the blended benchmark index; c. Invest no more than 25% of the portfolio in any one economic sector; d. Assure that no position of any one issuer shall exceed 5% of the manager’s total portfolio as ...

... “Baa" or better by Moody’s or “BBB” or better by Standard & Poor’s; b. Maintain a Beta less than 1.2X the blended benchmark index; c. Invest no more than 25% of the portfolio in any one economic sector; d. Assure that no position of any one issuer shall exceed 5% of the manager’s total portfolio as ...

Chapter 9

... Chapter 10 uses the rate of return concepts covered in previous chapters, along with the concept of the weighted average cost of capital (WACC), to develop a corporate cost of capital for use in capital budgeting. We begin by describing the logic of the WACC, and why it should be used in capital bud ...

... Chapter 10 uses the rate of return concepts covered in previous chapters, along with the concept of the weighted average cost of capital (WACC), to develop a corporate cost of capital for use in capital budgeting. We begin by describing the logic of the WACC, and why it should be used in capital bud ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.