ProShares Profile EMDV

... MSCI Emerging Markets. But why invest in the whole index if you can zero in on the companies with the longest history of dividend growth? Companies that consistently grow their dividends tend to be high-quality companies with the potential to withstand market turmoil and can still deliver strong ris ...

... MSCI Emerging Markets. But why invest in the whole index if you can zero in on the companies with the longest history of dividend growth? Companies that consistently grow their dividends tend to be high-quality companies with the potential to withstand market turmoil and can still deliver strong ris ...

The Importance of Asset Management

... first significant step in the financial industry towards a truly pan-European single market. The European asset management industry is today highly regulated and secure. Among other features, asset management companies are not allowed to trade for their own account. Hence, they do not generate any s ...

... first significant step in the financial industry towards a truly pan-European single market. The European asset management industry is today highly regulated and secure. Among other features, asset management companies are not allowed to trade for their own account. Hence, they do not generate any s ...

PSEG

... In the future, returns are expected to increase for PSEG, but not to the same extent as other companies in this report. As with other companies studied, the returns are expected to increase as electricity contracts expire and the company can take advantage of higher power prices in the wholesale mar ...

... In the future, returns are expected to increase for PSEG, but not to the same extent as other companies in this report. As with other companies studied, the returns are expected to increase as electricity contracts expire and the company can take advantage of higher power prices in the wholesale mar ...

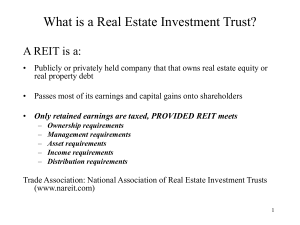

Real Estate Investment Trusts (REITs)

... • FFO means net income (computed in accordance with GAAP), excluding gains (or losses) from debt restructuring and sales of property, plus depreciation and amortization of assets uniquely significant to the real estate industry, and after adjustments for unconsolidated entities in which the REIT hol ...

... • FFO means net income (computed in accordance with GAAP), excluding gains (or losses) from debt restructuring and sales of property, plus depreciation and amortization of assets uniquely significant to the real estate industry, and after adjustments for unconsolidated entities in which the REIT hol ...

Venture Capital Investment and Small Business Affiliation Rules

... financed and what they lack in technical capability, they make up for in business acumen and financial wherewithal. Moreover, risky investments with large upsides are exactly the type of opportunities that can produce significant returns for venture capital funds. In the commercial marketplace, many ...

... financed and what they lack in technical capability, they make up for in business acumen and financial wherewithal. Moreover, risky investments with large upsides are exactly the type of opportunities that can produce significant returns for venture capital funds. In the commercial marketplace, many ...

as a PDF - CiteSeerX

... Lippo Bank (Solomon 1996).When the restructuring was proposed, many observers suspected that it was merely a means for the Riady family to extract assets from Lippo Life and Lippo Bank, and, as a result, there was some doubt as to whether it would be blocked by the shareholders or by the Indonesian ...

... Lippo Bank (Solomon 1996).When the restructuring was proposed, many observers suspected that it was merely a means for the Riady family to extract assets from Lippo Life and Lippo Bank, and, as a result, there was some doubt as to whether it would be blocked by the shareholders or by the Indonesian ...

The High Dividend Yield Return Advantage

... higher dividend yielding securities produce returns that are attractive relative to loweryielding portfolios and to overall stock market returns over long measurement periods. Stocks with high and apparent sustainable dividend yields that are competitive with high quality bond yields may be more res ...

... higher dividend yielding securities produce returns that are attractive relative to loweryielding portfolios and to overall stock market returns over long measurement periods. Stocks with high and apparent sustainable dividend yields that are competitive with high quality bond yields may be more res ...

Shifting the Lens – A De-Risking Toolkit for Impact Investment

... Over the last decade, we have seen both the supply and demand side of impact investing accelerate rapidly. On the demand side, charitable organisations are becoming increasingly market-based, enterprise is becoming more socially-motivated and the public sector is increasingly ‘spinning out’ provisio ...

... Over the last decade, we have seen both the supply and demand side of impact investing accelerate rapidly. On the demand side, charitable organisations are becoming increasingly market-based, enterprise is becoming more socially-motivated and the public sector is increasingly ‘spinning out’ provisio ...

Financial Contracting and the Choice between Private Placement

... placement markets, referred to as “switchers,” are fundamentally different from firms that borrow only from the private market, referred to as “non-switchers.” For example, we find that switchers tend to be larger and have higher credit risk ratings than non-switchers. Hence, it is also important t ...

... placement markets, referred to as “switchers,” are fundamentally different from firms that borrow only from the private market, referred to as “non-switchers.” For example, we find that switchers tend to be larger and have higher credit risk ratings than non-switchers. Hence, it is also important t ...

Webcast Presentation—Artisan Partners Global Equity Team

... Country Allocation: Historical country exposure percentages reflect country designations as classified by MSCI as of the date shown. Securities not classified by MSCI reflect country designations as of the date the report was generated. Sector Allocation: Sector exposure percentages reflect sector d ...

... Country Allocation: Historical country exposure percentages reflect country designations as classified by MSCI as of the date shown. Securities not classified by MSCI reflect country designations as of the date the report was generated. Sector Allocation: Sector exposure percentages reflect sector d ...

Sprott Bridging Income Fund LP Overview

... This presentation contains forward-looking statements which reflect the current expectations of management regarding future growth, results of operations, performance and business prospects and opportunities. Wherever possible, words such as “may”, “would”, “could”, “will”, “anticipate”, “believe”, ...

... This presentation contains forward-looking statements which reflect the current expectations of management regarding future growth, results of operations, performance and business prospects and opportunities. Wherever possible, words such as “may”, “would”, “could”, “will”, “anticipate”, “believe”, ...

What are commercial mortgage-backed securities?

... was resolved. The value of US CMBS outstanding grew from USD42 billion in 1990 to approximately USD900 billion by 2007.2 Since then, the size of the market has declined to USD565 billon, as loans have been paid down and issuance slowed following the global financial crisis.3 However, origination act ...

... was resolved. The value of US CMBS outstanding grew from USD42 billion in 1990 to approximately USD900 billion by 2007.2 Since then, the size of the market has declined to USD565 billon, as loans have been paid down and issuance slowed following the global financial crisis.3 However, origination act ...

Cross-sectional volatility and return dispersion

... In the past few years, the return spread between successful and unsuccessful active managers has increased dramatically. Moreover, many investors have experienced manager and fund tracking errors that far exceeded expectations. These phenomena are not so much a result of managers taking larger bets ...

... In the past few years, the return spread between successful and unsuccessful active managers has increased dramatically. Moreover, many investors have experienced manager and fund tracking errors that far exceeded expectations. These phenomena are not so much a result of managers taking larger bets ...

THE IMPACT OWNERSHIP STRUCTURE ON THE

... take for their investments. Company’s performance can be evaluated in three dimensions. The first dimension is company’s productivity, or processing inputs into outputs efficiently. The second is profitability dimension, or the level of which company’s earnings are bigger than its costs. The third d ...

... take for their investments. Company’s performance can be evaluated in three dimensions. The first dimension is company’s productivity, or processing inputs into outputs efficiently. The second is profitability dimension, or the level of which company’s earnings are bigger than its costs. The third d ...

Asset Allocation

... patterns of return and risk There is now a consensus in empirical finance that expected asset returns, and also variances and covariances, are, to some extent, predictable. Pioneering work on the predictability of asset class returns in the U.S. market was carried out by Keim and Stambaugh (1986), C ...

... patterns of return and risk There is now a consensus in empirical finance that expected asset returns, and also variances and covariances, are, to some extent, predictable. Pioneering work on the predictability of asset class returns in the U.S. market was carried out by Keim and Stambaugh (1986), C ...

Download (PDF)

... weak treatment effects, and the differential responses in different subsamples are consistent with the hypothesis that only the behavior of a small set of financially sophisticated people are well captured by models that presume full rationality in financial decision making. The above observations lead u ...

... weak treatment effects, and the differential responses in different subsamples are consistent with the hypothesis that only the behavior of a small set of financially sophisticated people are well captured by models that presume full rationality in financial decision making. The above observations lead u ...

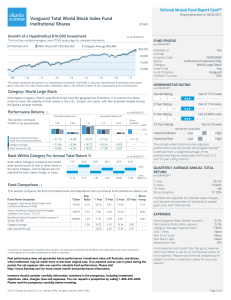

Vanguard Total World Stock Index Fund Institutional Shares

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

... the funds will fluctuate up to and after the target dates. There is no guarantee the funds will provide adequate income at or through retirement. Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Lower rated securities are subject to greater ...

Practice Problems Ch. 10 Loanable Funds Mkt

... B) supply; left; rise C) demand; right; rise D) demand; left; fall ...

... B) supply; left; rise C) demand; right; rise D) demand; left; fall ...

Accounting for financial instruments with characteristics of debt and

... 2.2 Accounting standards guidance and definitions IAS 32 states the requirements for presentation and classification of financial instruments into financial assets, financial liabilities and equity instruments and provides guidance about the classification of interest, dividends and gains or losses ...

... 2.2 Accounting standards guidance and definitions IAS 32 states the requirements for presentation and classification of financial instruments into financial assets, financial liabilities and equity instruments and provides guidance about the classification of interest, dividends and gains or losses ...

Essays on Dynamic Macroeconomics - Institute for International

... pay off when really needed. Their marginal valuation of equity will therefore be lower and the result is a lower equilibrium price and a higher average return. Chapter 4 finally, deals with the problem of how aggregate productivity risk should be allocated between taxpayers and retirees in a pay-as-y ...

... pay off when really needed. Their marginal valuation of equity will therefore be lower and the result is a lower equilibrium price and a higher average return. Chapter 4 finally, deals with the problem of how aggregate productivity risk should be allocated between taxpayers and retirees in a pay-as-y ...

Treasury Stock

... Stages of Equity Financing o The progression leading to a public offering might include some or all of these steps: o Investment by the founders of the business. o Investment by friends and family of the founders. o Outside investment by “angel” investors (wealthy individuals in the business commun ...

... Stages of Equity Financing o The progression leading to a public offering might include some or all of these steps: o Investment by the founders of the business. o Investment by friends and family of the founders. o Outside investment by “angel” investors (wealthy individuals in the business commun ...

Corporate Diversification and the Cost of Capital

... unit cash flows may help reduce idiosyncratic risk, this should have no effect on systematic risk.1 In this paper, we present evidence that is contrary to the conventional view. We show that diversified firms have a lower cost of capital than portfolios of comparable stand-alone firms and that the r ...

... unit cash flows may help reduce idiosyncratic risk, this should have no effect on systematic risk.1 In this paper, we present evidence that is contrary to the conventional view. We show that diversified firms have a lower cost of capital than portfolios of comparable stand-alone firms and that the r ...

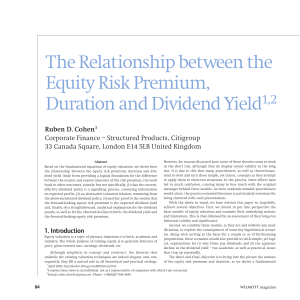

The Relationship between the Equity Risk Premium

... Equations 3.6a–c. Our next goal is to assess the historical validity and significance of each of these components, hopefully to establish precisely why the market behaved as it did. For this, we reproduce Figures 1–3, where all data relating to S, δ and E have been obtained from Shiller’s tables of ...

... Equations 3.6a–c. Our next goal is to assess the historical validity and significance of each of these components, hopefully to establish precisely why the market behaved as it did. For this, we reproduce Figures 1–3, where all data relating to S, δ and E have been obtained from Shiller’s tables of ...

The IPO Exit

... Companies controlled by a sponsor following an IPO need to consider whether to include provisions in their organizational documents that enable them to retain control over such companies. Common provisions include multiple or dual-class share classes with disparate voting rights and veto rights, or ...

... Companies controlled by a sponsor following an IPO need to consider whether to include provisions in their organizational documents that enable them to retain control over such companies. Common provisions include multiple or dual-class share classes with disparate voting rights and veto rights, or ...

Private banking

... with USD 50,000 or less in investable assets, some exclusive private banks only accept clients with at least USD 500,000 worth of investable assets. The rationale is that such high levels of wealth allow these individuals to participate in alternative investments such as hedge funds and real estate. ...

... with USD 50,000 or less in investable assets, some exclusive private banks only accept clients with at least USD 500,000 worth of investable assets. The rationale is that such high levels of wealth allow these individuals to participate in alternative investments such as hedge funds and real estate. ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.