why polish companies go public

... Despite the increasing interest in the decision to go public, the empirical evidence has been quite scarce, especially regarding companies from the Central Eastern European (CEE) region. The major reason for why empirical literature on this decision is underdeveloped is the difficulty in obtaining f ...

... Despite the increasing interest in the decision to go public, the empirical evidence has been quite scarce, especially regarding companies from the Central Eastern European (CEE) region. The major reason for why empirical literature on this decision is underdeveloped is the difficulty in obtaining f ...

Why Would Chinese Firms List Overseas? (PDF Available)

... Kong become ever hotter than before and the size becomes immensely large. The IPO of the Industrial and Commercial Banking Corporation in October 2006 was record-breaking. The debut valued at about US$139 billion, ranking it fifth among global banks. It is the world's largest IPO so far, raising an ...

... Kong become ever hotter than before and the size becomes immensely large. The IPO of the Industrial and Commercial Banking Corporation in October 2006 was record-breaking. The debut valued at about US$139 billion, ranking it fifth among global banks. It is the world's largest IPO so far, raising an ...

Listed vs Unlisted rgc - RARE Infrastructure Limited

... Potential investors should seek independent advice as to the suitability of the Fund to their investment needs. Treasury Group Investment Services Limited is the responsible entity for the RARE Infrastructure Value Fund (“RIVAF”), the RARE Series Value Fund and the RARE Series Emerging Markets Fund ...

... Potential investors should seek independent advice as to the suitability of the Fund to their investment needs. Treasury Group Investment Services Limited is the responsible entity for the RARE Infrastructure Value Fund (“RIVAF”), the RARE Series Value Fund and the RARE Series Emerging Markets Fund ...

Summary of Investment Objectives

... Understanding that a long-term positive correlation exists between performance volatility (risk) and statistical returns in the securities markets, the following short-term objective has been established: The portfolio should be invested to minimize the probability of large negative total returns, d ...

... Understanding that a long-term positive correlation exists between performance volatility (risk) and statistical returns in the securities markets, the following short-term objective has been established: The portfolio should be invested to minimize the probability of large negative total returns, d ...

Sources of firms` industry and country effects in

... and Del Negro (2004), Flavin (2004) and Phylaktis and Xia (in press) have shown that the industry effects have levelled or even surpassed the country effects in recent years, suggesting that international diversification across industries may now provide greater risk reductions than the traditional ...

... and Del Negro (2004), Flavin (2004) and Phylaktis and Xia (in press) have shown that the industry effects have levelled or even surpassed the country effects in recent years, suggesting that international diversification across industries may now provide greater risk reductions than the traditional ...

1 - University of Mauritius

... Lee and Swaminathan (2000) investigate the relation between trading volume and momentum in more detail. They indicate that stocks with high past turnover exhibit stronger momentum effects than stocks with low past turnover. In addition, they define early and late stage momentum strategies. Early st ...

... Lee and Swaminathan (2000) investigate the relation between trading volume and momentum in more detail. They indicate that stocks with high past turnover exhibit stronger momentum effects than stocks with low past turnover. In addition, they define early and late stage momentum strategies. Early st ...

Risk and risk management of Collateralized Debt Obligations

... CDOs and the Real Estate Market The housing market has suffered numerous recessions in the past. However, unlike the previous setbacks, the current housing recession has wreaked the greatest havoc in the financial market due to write-offs on collaterals associated with subprime mortgages. The write ...

... CDOs and the Real Estate Market The housing market has suffered numerous recessions in the past. However, unlike the previous setbacks, the current housing recession has wreaked the greatest havoc in the financial market due to write-offs on collaterals associated with subprime mortgages. The write ...

Default Option Exercise over the Financial Crisis and Beyond

... find that borrower default propensities are sensitive to measures of consumer sentiment, where our sentiment measure is orthogonalized to indicators of economic activity.3 We also find a structural break in mortgage default behavior in 2009. As shown in Figures 3, 4, and Table 9, not only does borr ...

... find that borrower default propensities are sensitive to measures of consumer sentiment, where our sentiment measure is orthogonalized to indicators of economic activity.3 We also find a structural break in mortgage default behavior in 2009. As shown in Figures 3, 4, and Table 9, not only does borr ...

The Relationship Between Competition and Innovation: How

... (the Schumpeterian effect, based on the notion of ”creative destruction” introduced by Schumpeter, 1942). The most of theoretical contributions have focused on the interaction of these two opposing forces of the ”incentive-effect” under different market structures and characteristics of innovations. ...

... (the Schumpeterian effect, based on the notion of ”creative destruction” introduced by Schumpeter, 1942). The most of theoretical contributions have focused on the interaction of these two opposing forces of the ”incentive-effect” under different market structures and characteristics of innovations. ...

Mutual Funds

... considerable attention following the collapse of Long Term Capital Management. • Different from typical mutual funds, as follows: ...

... considerable attention following the collapse of Long Term Capital Management. • Different from typical mutual funds, as follows: ...

many firms on track to double in size

... at firms with $100 million to $250 million in AUM. These clients are often excellent conduits to their peers, too, and play an effective role connecting individuals with similar asset levels to their advisory team. Conversely, larger firms have fewer small relationships. At firms managing $100 mill ...

... at firms with $100 million to $250 million in AUM. These clients are often excellent conduits to their peers, too, and play an effective role connecting individuals with similar asset levels to their advisory team. Conversely, larger firms have fewer small relationships. At firms managing $100 mill ...

Select Risk Profile Portfolios – quarterly investment report

... For the UK, this quarter was still all about Brexit with a vote in parliament that gave the government permission to begin exiting the European Union. Theresa May signed Article 50 at the end of March, as the Scottish National Party demanded a second Scottish independence referendum. Meanwhile, the ...

... For the UK, this quarter was still all about Brexit with a vote in parliament that gave the government permission to begin exiting the European Union. Theresa May signed Article 50 at the end of March, as the Scottish National Party demanded a second Scottish independence referendum. Meanwhile, the ...

Trying To Understand All-Equity Firms

... or debt capacity, which is used later to make acquisitions and capital expenditures. Morellec (2004) presents a contingent claims model with manager-stockholder conflicts. The model can generate the low debt ratios observed in practice. In another paper, Ju et al. (2005) present a dynamic framework ...

... or debt capacity, which is used later to make acquisitions and capital expenditures. Morellec (2004) presents a contingent claims model with manager-stockholder conflicts. The model can generate the low debt ratios observed in practice. In another paper, Ju et al. (2005) present a dynamic framework ...

Voting and engagement - VBA beleggingsprofessionals

... Institutional investors have to have a response – Building your own policy or use international codes? – Which instruments are available for implementation? Engagement led divestment – Elaboration of the latest innovations Conclusion ...

... Institutional investors have to have a response – Building your own policy or use international codes? – Which instruments are available for implementation? Engagement led divestment – Elaboration of the latest innovations Conclusion ...

An Overview of Return-Based and Asset

... with professionals that the school has been developing since its establishment in 1906. EDHEC Business School has decided to draw on its extensive knowledge of the professional environment and has therefore focused its research on themes that satisfy the needs of professionals. EDHEC pursues an acti ...

... with professionals that the school has been developing since its establishment in 1906. EDHEC Business School has decided to draw on its extensive knowledge of the professional environment and has therefore focused its research on themes that satisfy the needs of professionals. EDHEC pursues an acti ...

Fairfield Entrepreneurs Association (FEA)

... • Entrepreneur of the Year and Hall of Fame Awards – 2004 Award Winner – Alan Unger, Polar Dreams - 11,500 New Jobs ...

... • Entrepreneur of the Year and Hall of Fame Awards – 2004 Award Winner – Alan Unger, Polar Dreams - 11,500 New Jobs ...

Rajiv Gandhi Equity Savings Scheme

... “Act” means the Income-tax Act, 1961 (43 of 1961); “demat account” means an account opened with the depository participant in accordance with the guidelines laid down by the Securities and Exchange Board of India established under section 3 of the Securities and Exchange Board of India Act, 1992 (15 ...

... “Act” means the Income-tax Act, 1961 (43 of 1961); “demat account” means an account opened with the depository participant in accordance with the guidelines laid down by the Securities and Exchange Board of India established under section 3 of the Securities and Exchange Board of India Act, 1992 (15 ...

The Impact of Costs and Returns on the Investment

... The Swiss pension fund system is part of the so-called ‘2. Säule‘ of the Swiss retirement plan. The ‘2. Säule‘ covers all pension fund payments related to a person’s professional life. The pension fund scheme helps employees (i) to save money for retirement and (ii) to hedge against invalidity and d ...

... The Swiss pension fund system is part of the so-called ‘2. Säule‘ of the Swiss retirement plan. The ‘2. Säule‘ covers all pension fund payments related to a person’s professional life. The pension fund scheme helps employees (i) to save money for retirement and (ii) to hedge against invalidity and d ...

CRA Investment Fund Audited Financial Statements

... The preparation of combined financial statements in accordance with accounting principles generally accepted in the United States of America requires the Companies to report information regarding their exposure to various tax positions taken by the Companies. Management has determined whether any ta ...

... The preparation of combined financial statements in accordance with accounting principles generally accepted in the United States of America requires the Companies to report information regarding their exposure to various tax positions taken by the Companies. Management has determined whether any ta ...

Equity and Bond Ownership in America, 2008

... U.S. households grew dramatically between 1989 and 2001, but have since tapered off. In the fi rst quarter of 2008, 47 percent of U.S. households (54.5 million) owned equities and/or bonds. The overall ownership rate in 2008 is still much higher than it was in 1989. » Willingness to take risks has d ...

... U.S. households grew dramatically between 1989 and 2001, but have since tapered off. In the fi rst quarter of 2008, 47 percent of U.S. households (54.5 million) owned equities and/or bonds. The overall ownership rate in 2008 is still much higher than it was in 1989. » Willingness to take risks has d ...

10.xxx Endowment Funds - UNT Health Science Center

... consistent with overall investment objectives defined herein while protecting the real value of the endowment principal. An endowment should be excluded from the target distribution until the endowment has been established for one complete quarter. The target distribution of spendable income to each ...

... consistent with overall investment objectives defined herein while protecting the real value of the endowment principal. An endowment should be excluded from the target distribution until the endowment has been established for one complete quarter. The target distribution of spendable income to each ...

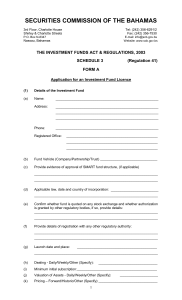

The Investment Funds Act, 2003 - Securities Commission of the

... THE INVESTMENT FUNDS ACT & REGULATIONS, 2003 SCHEDULE 3 ...

... THE INVESTMENT FUNDS ACT & REGULATIONS, 2003 SCHEDULE 3 ...

Study on Obstacles and Solutions to China’s Low-Carbon Industrial Investment Fund

... organize sales in the same time, as a result, high risk is its essential character. Banks and other traditional financing sources are widespread in resource allocation on an adverse selection problem, they tend to invest the funds to the enterprises which are more mature development, less risk and t ...

... organize sales in the same time, as a result, high risk is its essential character. Banks and other traditional financing sources are widespread in resource allocation on an adverse selection problem, they tend to invest the funds to the enterprises which are more mature development, less risk and t ...

Cross-country analysis of family firm performances during a global

... As mentioned in the literature review, a lot of research has been done to the performance of family firms versus nonfamily firms. Many studies argue that in a firm the agency theory maximizes profits. In a family firm the agent-principal relationship between the owner and the manager is missing and ...

... As mentioned in the literature review, a lot of research has been done to the performance of family firms versus nonfamily firms. Many studies argue that in a firm the agency theory maximizes profits. In a family firm the agent-principal relationship between the owner and the manager is missing and ...

Cash

... ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. ...

... ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.