QUESTIONS

... more accurate than the carrying values if the historical cost figures are out of date. Answer (D) is incorrect. The amount another company would pay would be based on fair values, not book values. ...

... more accurate than the carrying values if the historical cost figures are out of date. Answer (D) is incorrect. The amount another company would pay would be based on fair values, not book values. ...

FAQs by Issuers

... in relation to other listed equity securities in India. A CRISIL IPO Grading is neither an audit of the issuer by CRISIL nor is it a credit rating. Every CRISIL IPO Grading is based on the information provided by the issuer or obtained by CRISIL from sources it considers reliable. CRISIL does not gu ...

... in relation to other listed equity securities in India. A CRISIL IPO Grading is neither an audit of the issuer by CRISIL nor is it a credit rating. Every CRISIL IPO Grading is based on the information provided by the issuer or obtained by CRISIL from sources it considers reliable. CRISIL does not gu ...

De Nederlandsche Bank Monetary and Economic Policy

... We bestuderen de dynamiek van de kapitaalstructuur van bedrijven in Centraal- en Oost-Europa om een beter begrip te krijgen voor de kwantitatieve en kwalitatieve ontwikkeling van de financiële systemen in deze regio. Het dynamische model dat we gebruiken endogeniseert de optimale leverage (dat wil z ...

... We bestuderen de dynamiek van de kapitaalstructuur van bedrijven in Centraal- en Oost-Europa om een beter begrip te krijgen voor de kwantitatieve en kwalitatieve ontwikkeling van de financiële systemen in deze regio. Het dynamische model dat we gebruiken endogeniseert de optimale leverage (dat wil z ...

The Impact of Collateral

... which will be phased in over the next few years — is a collaborative endeavour. Both sell-side and buyside firms work bilaterally with each other, and with central securities depositories (CSDs) to develop a fit for purpose cooperative processing model across the industry. Yet, at present, there is ...

... which will be phased in over the next few years — is a collaborative endeavour. Both sell-side and buyside firms work bilaterally with each other, and with central securities depositories (CSDs) to develop a fit for purpose cooperative processing model across the industry. Yet, at present, there is ...

Mission-Related Investing at the F.B. Heron Foundation

... investing. It was at this point that the board realized the extent to which it was challenging conventional thinking and made the decision to build internal management capacity, bringing certain functions in house. The board understood that Foundation systems and work flow might have to change to ac ...

... investing. It was at this point that the board realized the extent to which it was challenging conventional thinking and made the decision to build internal management capacity, bringing certain functions in house. The board understood that Foundation systems and work flow might have to change to ac ...

Policy Dialogue on Corporate Governance in China

... personnel department at the level of government that was supposed to supervise the SOE in question2. In line with the political nature of SOEs, their managers were “administrated” as party cadres in the same way as other officials serving in the government bureaucracy, and were ranked in the same sy ...

... personnel department at the level of government that was supposed to supervise the SOE in question2. In line with the political nature of SOEs, their managers were “administrated” as party cadres in the same way as other officials serving in the government bureaucracy, and were ranked in the same sy ...

Book CHI IPE 141 13628.indb

... to raise $100,000, promising contributors a watch for every $120 (approximately) they pledged. To his surprise, he raised the required capital in two hours. After 37 days he closed his campaign, having raised more than $10 million from 68,929 people and committed to producing 85,000 watches with exp ...

... to raise $100,000, promising contributors a watch for every $120 (approximately) they pledged. To his surprise, he raised the required capital in two hours. After 37 days he closed his campaign, having raised more than $10 million from 68,929 people and committed to producing 85,000 watches with exp ...

Brand equity, Age and the number of employees are in all models

... the Orbis database. The brand equity dimensions are measured as cross sectional variable and are regressed using a linear regression model with the company variables as control factors. The evaluations on brands are collected using a survey, which is distributed in 16 countries in Europe and the Uni ...

... the Orbis database. The brand equity dimensions are measured as cross sectional variable and are regressed using a linear regression model with the company variables as control factors. The evaluations on brands are collected using a survey, which is distributed in 16 countries in Europe and the Uni ...

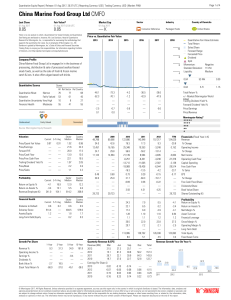

China Marine Food Group Ltd CMFO

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Corruption`s Impact on Liquidity, Investment

... corruption. This research suggests a possible nonlinear relation between corruption and the economy because, at some levels, corruption can be beneficial (i.e., it greases the wheels of commerce) and, at other levels, corruption might be harmful (thus, putting sand in the wheels of an economy). Mos ...

... corruption. This research suggests a possible nonlinear relation between corruption and the economy because, at some levels, corruption can be beneficial (i.e., it greases the wheels of commerce) and, at other levels, corruption might be harmful (thus, putting sand in the wheels of an economy). Mos ...

Does The Firm Information Environment Influence Financing

... pronounced among firms that relied on selective disclosure. Following prior research, we initially identify selective disclosure firms as those having analyst coverage. Firms provide information to analysts which is relevant to their formation of earnings expectations. In fact, the “majority of sell ...

... pronounced among firms that relied on selective disclosure. Following prior research, we initially identify selective disclosure firms as those having analyst coverage. Firms provide information to analysts which is relevant to their formation of earnings expectations. In fact, the “majority of sell ...

Time-Zone Arbitrage in Vanguard International

... Historically, U.S.-based mutual funds have calculated their value using stale prices for the assets that trade in foreign markets. The predictability of change in the stale prices when the foreign market opens creates an arbitrage opportunity. Consider an example: an investor stores her money in a U ...

... Historically, U.S.-based mutual funds have calculated their value using stale prices for the assets that trade in foreign markets. The predictability of change in the stale prices when the foreign market opens creates an arbitrage opportunity. Consider an example: an investor stores her money in a U ...

Reporting Form SRF 530.0 Investments

... The asset class types are: cash, fixed income, equity, property, infrastructure, commodities and ‘other’. The asset domicile types are: Australia domicile, international domicile and ‘not applicable’. Where the domicile is not known, report domicile type as ‘not applicable’. The asset listing types ...

... The asset class types are: cash, fixed income, equity, property, infrastructure, commodities and ‘other’. The asset domicile types are: Australia domicile, international domicile and ‘not applicable’. Where the domicile is not known, report domicile type as ‘not applicable’. The asset listing types ...

Screening techniques, sustainability and risk adjusted returns.

... apparent was that most fund companies used a negative screen again cluster munition, anti personnel mines and uranium munition. These screens stems from the UN convention from 1980 against the use of some conventional weapons (CCW, 1980, p. 3), the Ottawa convention from 1997 (Mine Ban Treaty, 1997) ...

... apparent was that most fund companies used a negative screen again cluster munition, anti personnel mines and uranium munition. These screens stems from the UN convention from 1980 against the use of some conventional weapons (CCW, 1980, p. 3), the Ottawa convention from 1997 (Mine Ban Treaty, 1997) ...

Sustainable Landscapes: Investor Mapping in Asia

... conservation commercially attractive and/or necessary for conventional businesses, as they pursue profit ...

... conservation commercially attractive and/or necessary for conventional businesses, as they pursue profit ...

LONG TERM PORTFOLIO - American Psychological Association

... overall investment strategy, including, but not limited to, amounts to be invested in equities, bonds, short-term holdings and real estate; (b) monitor the performance of the investment managers, if any; (c) research and develop alternative investments; (d) and advise the Treasurer and appropriate s ...

... overall investment strategy, including, but not limited to, amounts to be invested in equities, bonds, short-term holdings and real estate; (b) monitor the performance of the investment managers, if any; (c) research and develop alternative investments; (d) and advise the Treasurer and appropriate s ...

Geometric Average Capitalization

... When a fund owns stocks from only one of the seven style zones (US, Canada, Latin America, Europe, Japan, Australia/NZ, and Asia ex-Japan), the geometric average capitalization of the fund can be compared to the large-, mid-, and small-cap divisions of the Morningstar Style BoxTM. In these cases, th ...

... When a fund owns stocks from only one of the seven style zones (US, Canada, Latin America, Europe, Japan, Australia/NZ, and Asia ex-Japan), the geometric average capitalization of the fund can be compared to the large-, mid-, and small-cap divisions of the Morningstar Style BoxTM. In these cases, th ...

Underwriting Costs of Seasoned Equity Offerings

... (holding constant firms’ attributes) and the increased propensity of smaller firms to undertake equity offerings (see also Friend, Blume and Crockett 1970, and Securities and Exchange Commission 1971). Calomiris (1995) and Calomiris and Raff (1995) further documented these trends found that there ha ...

... (holding constant firms’ attributes) and the increased propensity of smaller firms to undertake equity offerings (see also Friend, Blume and Crockett 1970, and Securities and Exchange Commission 1971). Calomiris (1995) and Calomiris and Raff (1995) further documented these trends found that there ha ...

Does Asymmetric Information Drive Capital Structure Decisions?

... Market microstructure proxies of information asymmetry are based on the notion—set forth by an extensive theoretical literature—that market liquidity in general, and transaction costs (e.g., the bid-ask spread) in particular, consist of three primary components: order processing, inventory, and adve ...

... Market microstructure proxies of information asymmetry are based on the notion—set forth by an extensive theoretical literature—that market liquidity in general, and transaction costs (e.g., the bid-ask spread) in particular, consist of three primary components: order processing, inventory, and adve ...

Liquidity risk, Leverage and Long

... We examine the risk-return characteristics of a rolling portfolio investment strategy where more than six thousand Nasdaq initial public offering (IPO) stocks are bought and held for up to five years. The average long-run portfolio return is low, but IPO stocks appear as ”longshots”, as five-year bu ...

... We examine the risk-return characteristics of a rolling portfolio investment strategy where more than six thousand Nasdaq initial public offering (IPO) stocks are bought and held for up to five years. The average long-run portfolio return is low, but IPO stocks appear as ”longshots”, as five-year bu ...

Investment advisory and Treasury Management Services

... To devise, review & monitor the investment portfolios and investment avenues, and advise the management in a professional manner on a periodic basis. To apprise the management of the continued effectiveness of the investments from time to time. Constantly monitor the portfolio to identify any risks ...

... To devise, review & monitor the investment portfolios and investment avenues, and advise the management in a professional manner on a periodic basis. To apprise the management of the continued effectiveness of the investments from time to time. Constantly monitor the portfolio to identify any risks ...

proyecto de escisión - Precio de Cementos Pacasmayo

... FOSSAL shall have the same Directors of CPSAA (provided that the nominated members accept said appointment) and CPSAA shall be the General Manager of FOSSAL. FOSSAL shall adopt and follow the same Good Corporate Governance policies currently in place in CPSAA. ...

... FOSSAL shall have the same Directors of CPSAA (provided that the nominated members accept said appointment) and CPSAA shall be the General Manager of FOSSAL. FOSSAL shall adopt and follow the same Good Corporate Governance policies currently in place in CPSAA. ...

Default Option Exercise over the Financial Crisis and Beyond

... option exercise were driven by a myriad of factors, notably including local economic fundamentals, sentiment, and unintended effects of federal crisis-related policy. In literature dating to the 1980s, default is modeled in terms of borrower exercise of the mortgage put option (see literature review ...

... option exercise were driven by a myriad of factors, notably including local economic fundamentals, sentiment, and unintended effects of federal crisis-related policy. In literature dating to the 1980s, default is modeled in terms of borrower exercise of the mortgage put option (see literature review ...

ucits – past, present and future

... Directive 2 in that light. This question whether the UCITS Directive in its current form remains an appropriate European response to the changing investment management landscape is an issue with which the European Commission is actively engaging through its Green Paper on the Enhancement of the EU F ...

... Directive 2 in that light. This question whether the UCITS Directive in its current form remains an appropriate European response to the changing investment management landscape is an issue with which the European Commission is actively engaging through its Green Paper on the Enhancement of the EU F ...

Chapter 5. Classifications

... “Equity in mutual funds” would be proposed as a supplementary or memorandum item under equity. It would include equity in mutual funds, unit trusts, and other collective investment schemes, other than life insurance and pension funds to be identified separately from “equity finance” in view of their ...

... “Equity in mutual funds” would be proposed as a supplementary or memorandum item under equity. It would include equity in mutual funds, unit trusts, and other collective investment schemes, other than life insurance and pension funds to be identified separately from “equity finance” in view of their ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.