Directive on Alternative Investment Fund Managers

... Private equity is money invested in companies that are not publicly traded. Private equity companies have fewer public disclosure requirements than public companies. Capital for private equity funds is raised primarily from institutional investors. Leveraged buyouts (LBOs) are one of several types o ...

... Private equity is money invested in companies that are not publicly traded. Private equity companies have fewer public disclosure requirements than public companies. Capital for private equity funds is raised primarily from institutional investors. Leveraged buyouts (LBOs) are one of several types o ...

Hedge Funds How They Serve Investors in U.S. and Global Markets

... system and regulates in a consistent manner market participants performing the same functions—will include regulation of hedge funds and other private pools of capital. In testimony before Congress, CPIC outlined the principles its members believe should guide lawmakers in overhauling the regulatory ...

... system and regulates in a consistent manner market participants performing the same functions—will include regulation of hedge funds and other private pools of capital. In testimony before Congress, CPIC outlined the principles its members believe should guide lawmakers in overhauling the regulatory ...

Equity Auctions and the New Value Corollary to the

... Bonner Mall case on this issue. However, the parties settled the case before it could be argued. As a result, the certiorari petition was dismissed as moot. The most recent case in which the Supreme Court addressed the issue of the new value corollary’s continued existence under the Code is Bank of ...

... Bonner Mall case on this issue. However, the parties settled the case before it could be argued. As a result, the certiorari petition was dismissed as moot. The most recent case in which the Supreme Court addressed the issue of the new value corollary’s continued existence under the Code is Bank of ...

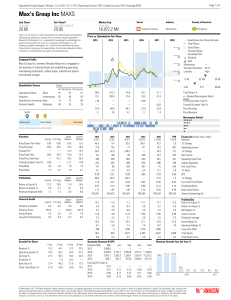

Max`s Group Inc MAXS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

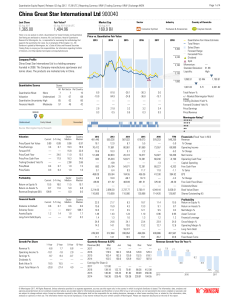

China Great Star International Ltd 900040

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

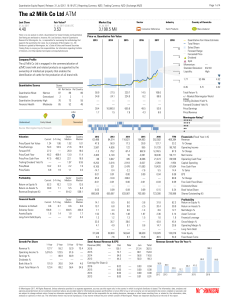

The a2 Milk Co Ltd ATM

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

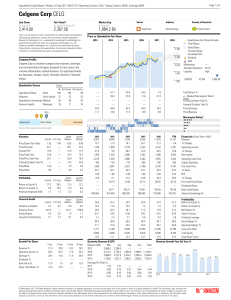

Celgene Corp CELG

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

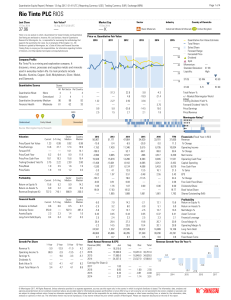

Rio Tinto PLC RIOS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

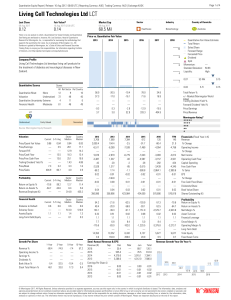

Living Cell Technologies Ltd LCT

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

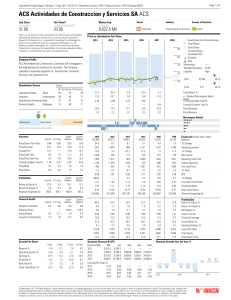

ACS Actividades de Construccion y Servicios SA ACS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

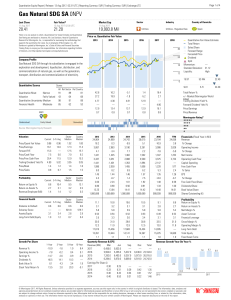

Gas Natural SDG SA 0NPV

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Liquidity Management Policy Summary

... within, or reasonably close to, 30 days or where conversion to cash over that period, by itself, would have a significant adverse impact on its realisable value. Liquidity risk for the Fund is the risk that the Fund is unable to meet its financial obligation to beneficiaries as they fall due, either ...

... within, or reasonably close to, 30 days or where conversion to cash over that period, by itself, would have a significant adverse impact on its realisable value. Liquidity risk for the Fund is the risk that the Fund is unable to meet its financial obligation to beneficiaries as they fall due, either ...

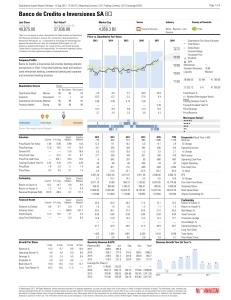

Banco de Credito e Inversiones SA BCI

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Optimal Consumption and Portfolio Choices with Risky

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

Tsung Sheng Liu , Polaris Financial Group, Taiwan

... (1) Raising demand in investment tools as interest rate falls to record low. (2) Globalization, liberalization, lead to the new space in new financial products development. (3) Intensively market competition forces the investment trust companies to enhance its product development capability and leve ...

... (1) Raising demand in investment tools as interest rate falls to record low. (2) Globalization, liberalization, lead to the new space in new financial products development. (3) Intensively market competition forces the investment trust companies to enhance its product development capability and leve ...

Offering and Investor Fees - Handout

... (caution, as it can also hinder an investor). These fees are available once investor funds clear, whether or not escrow minimums are met, and are not refunded to the investor should they opt to cancel their commitment (the definition of ‘non-contingent’). Administration fees, set by the issuer (or p ...

... (caution, as it can also hinder an investor). These fees are available once investor funds clear, whether or not escrow minimums are met, and are not refunded to the investor should they opt to cancel their commitment (the definition of ‘non-contingent’). Administration fees, set by the issuer (or p ...

NEWMONT MINING CORP /DE/ (Form: 8-K

... * Effective January 1, 2004, the Company began consolidating Batu Hijau and changed to co-product cost accounting for copper and gold, whereby production costs are allocated in proportion to the sales revenue generated by each product. As a result, reported cash costs are impacted by relative moveme ...

... * Effective January 1, 2004, the Company began consolidating Batu Hijau and changed to co-product cost accounting for copper and gold, whereby production costs are allocated in proportion to the sales revenue generated by each product. As a result, reported cash costs are impacted by relative moveme ...

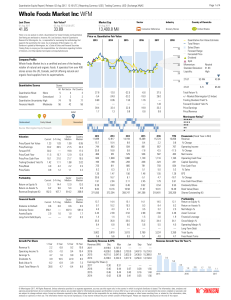

Whole Foods Market Inc WFM

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

An Overview of Investor Sentiment in Stock Market

... intentions to buy stocks. Massa and Yadav (2015) show mutual funds employ portfolio strategies based on market sentiment. Ling et al. (2014) find a positive association between investor sentiment and subsequent private market returns. Chang, Hsieh, and Wang (2015) also conclude that individual inves ...

... intentions to buy stocks. Massa and Yadav (2015) show mutual funds employ portfolio strategies based on market sentiment. Ling et al. (2014) find a positive association between investor sentiment and subsequent private market returns. Chang, Hsieh, and Wang (2015) also conclude that individual inves ...

Alternative Investment Fund Managers Directive

... preferred strategy for “complying” with the AIFMD.43 However, this strategy is dangerous and has infinite pitfalls, primarily because “[r]everse solicitation is not a strategy. By definition, one can’t ‘do’ reverse solicitation—it is a passive activity reactive to third-party inquiries of interest i ...

... preferred strategy for “complying” with the AIFMD.43 However, this strategy is dangerous and has infinite pitfalls, primarily because “[r]everse solicitation is not a strategy. By definition, one can’t ‘do’ reverse solicitation—it is a passive activity reactive to third-party inquiries of interest i ...

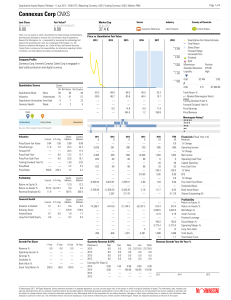

Connexus Corp CNXS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

fund fact sheet user`s guide

... fund companies with an average default rate calculation to come up with a weightedaverage credit quality. The weighted-average credit quality is currently a letter that roughly corresponds to the scale used by a leading NRSRO. Bond funds are assigned a style box placement of “low”, “medium”, or “hig ...

... fund companies with an average default rate calculation to come up with a weightedaverage credit quality. The weighted-average credit quality is currently a letter that roughly corresponds to the scale used by a leading NRSRO. Bond funds are assigned a style box placement of “low”, “medium”, or “hig ...

Liquidity Shocks and the Business Cycle: What next?

... Some authors use liquidity as a synonym of volume of trade. In the context of the model, the distinction between liquid assets and traded assets is important. For example, there could be states in which equity is entirely liquid, but it is not traded at all. ...

... Some authors use liquidity as a synonym of volume of trade. In the context of the model, the distinction between liquid assets and traded assets is important. For example, there could be states in which equity is entirely liquid, but it is not traded at all. ...

fund accounting training

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.