Property Portfolio - Falcon Real Estate Investment

... properties that we have purchased and for which we have provided asset management, Falcon has earned a reputation for providing world class advisory services in U.S. real estate. For more information on our firm and updates on all of the other activities in which the company is engaged, please visit ...

... properties that we have purchased and for which we have provided asset management, Falcon has earned a reputation for providing world class advisory services in U.S. real estate. For more information on our firm and updates on all of the other activities in which the company is engaged, please visit ...

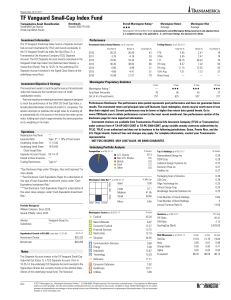

TF Vanguard Small-Cap Index Fund

... of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two utility funds with 10-year ...

... of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two utility funds with 10-year ...

When does corporate venture capital investment

... general venture capital market. The average life span of a CVC fund is far shorter than that of independent venture capital funds. Furthermore, they found that corporate investors pay a premium to secure equity stakes in entrepreneurial ventures relative to traditional VCs, which may result in lower ...

... general venture capital market. The average life span of a CVC fund is far shorter than that of independent venture capital funds. Furthermore, they found that corporate investors pay a premium to secure equity stakes in entrepreneurial ventures relative to traditional VCs, which may result in lower ...

Stock Market Liquidity and the Cost of Issuing Equity

... market liquidity on the total cost of raising capital beyond that found by Corwin (2003). Our findings also complement previous studies that examine the link between liquidity and firms’ cost of equity. Our paper establishes a link between stock market liquidity and the cost of raising capital; this ...

... market liquidity on the total cost of raising capital beyond that found by Corwin (2003). Our findings also complement previous studies that examine the link between liquidity and firms’ cost of equity. Our paper establishes a link between stock market liquidity and the cost of raising capital; this ...

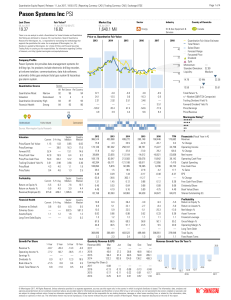

Pason Systems Inc PSI

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Contribution of the private sector to Climate Change Long

... guidance was given in the questionnaire on how to understand key terms. Third, activities of Swiss companies, to which no monetary value could be assigned, were also covered by the questionnaire and listed in a separate section. Using this approach, we identified at least CHF 0.2-0.8 billion of priv ...

... guidance was given in the questionnaire on how to understand key terms. Third, activities of Swiss companies, to which no monetary value could be assigned, were also covered by the questionnaire and listed in a separate section. Using this approach, we identified at least CHF 0.2-0.8 billion of priv ...

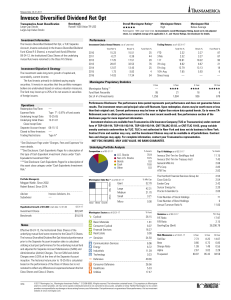

Invesco Diversified Dividend Ret Opt

... of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two utility funds with 10-year ...

... of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two utility funds with 10-year ...

Outside Entrepreneurial Capital

... rejection). The lowest rejection rate was among leasing firms (5%). Banks comprised the median and mean highest percentage of outside finance in terms of which type of source was approached and which type of source provided the finance. Regarding banks and VC funds in particular, our multivariate an ...

... rejection). The lowest rejection rate was among leasing firms (5%). Banks comprised the median and mean highest percentage of outside finance in terms of which type of source was approached and which type of source provided the finance. Regarding banks and VC funds in particular, our multivariate an ...

A Primer on Non-Traded REITs and other Alternative Real Estate

... diversified real estate exposure. Mutual fund portfolios are managed by registered investment advisers. Shares in the funds are bought from a mutual fund company and sold back to the mutual fund company directly from the Fund or through a Fund’s broker at the end of the business day and at their net ...

... diversified real estate exposure. Mutual fund portfolios are managed by registered investment advisers. Shares in the funds are bought from a mutual fund company and sold back to the mutual fund company directly from the Fund or through a Fund’s broker at the end of the business day and at their net ...

Understanding Privet Placement Trading Platforms

... lead to a flood of inexperienced brokers and want to be brokers into the market. When you combine the recent increase in participation, with private nature of these programs, it can be like swimming in shark infested waters if you are not properly informed. It can sometimes take years of going throu ...

... lead to a flood of inexperienced brokers and want to be brokers into the market. When you combine the recent increase in participation, with private nature of these programs, it can be like swimming in shark infested waters if you are not properly informed. It can sometimes take years of going throu ...

Credit Expansion and Neglected Crash Risk * Matthew Baron

... this contrast indicates two different types of sentiment—credit expansions are associated with neglect of tail risk, while low dividend yield is associated with optimism about the overall distribution of future economic fundamentals. Nevertheless, they are not independent predictors of the bank equi ...

... this contrast indicates two different types of sentiment—credit expansions are associated with neglect of tail risk, while low dividend yield is associated with optimism about the overall distribution of future economic fundamentals. Nevertheless, they are not independent predictors of the bank equi ...

The Re-emergence of Collective Investment Trust Funds | Manning

... As the retirement plan industry has evolved, so has the structure of investment vehicles used in 401(k) plans. Collective Investment Trust funds (CITs) have been available for decades (first launched in 1927) and were offered in very early 401(k) plans. However, the early versions of CITs provided i ...

... As the retirement plan industry has evolved, so has the structure of investment vehicles used in 401(k) plans. Collective Investment Trust funds (CITs) have been available for decades (first launched in 1927) and were offered in very early 401(k) plans. However, the early versions of CITs provided i ...

Business Relationships, Corporate Governance, and Firm

... Prior research suggests that private placements affect agency costs and facilitate relationshipspecific investments. The positive association between block size and changes in firm value is consistent with a reduction in agency costs (Hertzel and Smith (1993) and Wruck (1989)) There is also a sugges ...

... Prior research suggests that private placements affect agency costs and facilitate relationshipspecific investments. The positive association between block size and changes in firm value is consistent with a reduction in agency costs (Hertzel and Smith (1993) and Wruck (1989)) There is also a sugges ...

Asian Passports, the coming of age An overview and its demand

... beyond their borders to address their investment needs. Overall, Asia Pacific-based pension funds have invested an average of 19% of the region’s total portfolio in foreign markets in 2008, and that has now grown to 31% by 2014. Japan, the recent entrant to the ARFP scheme is among the most aggressi ...

... beyond their borders to address their investment needs. Overall, Asia Pacific-based pension funds have invested an average of 19% of the region’s total portfolio in foreign markets in 2008, and that has now grown to 31% by 2014. Japan, the recent entrant to the ARFP scheme is among the most aggressi ...

reinventing venture capital towards a new economic

... funds. Creating four or five private ‘super-funds’ would allow each fund to manage a portfolio of high-risk investments in the way that the leading US funds are able to do, rather than being forced into a ‘safety-first’ investment strategy through lack of funds. It would also enable the funds to mak ...

... funds. Creating four or five private ‘super-funds’ would allow each fund to manage a portfolio of high-risk investments in the way that the leading US funds are able to do, rather than being forced into a ‘safety-first’ investment strategy through lack of funds. It would also enable the funds to mak ...

Expected Returns on Major Asset Classes

... one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time and place for which it is being estimated. Other premia, or difference ...

... one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time and place for which it is being estimated. Other premia, or difference ...

Trading and Returns under Periodic Market Closures

... of the liquidity traders to time their trade of given sizes. But they do not provide a complete justification for the behavior of liquidity traders. For example, trade sizes are exogenously specified and not all investors can time their trade. See also Spiegel and Subrahmanyan (1995). Our model diff ...

... of the liquidity traders to time their trade of given sizes. But they do not provide a complete justification for the behavior of liquidity traders. For example, trade sizes are exogenously specified and not all investors can time their trade. See also Spiegel and Subrahmanyan (1995). Our model diff ...

Do Institutional Investors Alleviate Agency Problems

... Easterbrook (1984) and Jensen (1986) develop an agency-based theory which implies that higher payouts keep managers in the capital markets where monitoring costs are lower than those alternatively incurred by current shareholders. Therefore, payouts reduce agency costs. Agency-based theory recognize ...

... Easterbrook (1984) and Jensen (1986) develop an agency-based theory which implies that higher payouts keep managers in the capital markets where monitoring costs are lower than those alternatively incurred by current shareholders. Therefore, payouts reduce agency costs. Agency-based theory recognize ...

Financing Innovation Working Paper

... Looking first at bank financing, Mann (2014) shows that debt financing is not only common for innovating firms, but that furthermore, patents are often used as collateral in such instances. He notes that 16% of the aggregate stock of patents at the US Patent and Trademark Office (USPTO) has been ple ...

... Looking first at bank financing, Mann (2014) shows that debt financing is not only common for innovating firms, but that furthermore, patents are often used as collateral in such instances. He notes that 16% of the aggregate stock of patents at the US Patent and Trademark Office (USPTO) has been ple ...

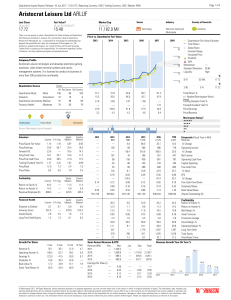

Aristocrat Leisure Ltd ARLUF

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

Real Estate Joint Venture Interests as Securities

... offer mailed by defendants omitted the economic inducements of the proposed and promised exploration well, it would have been a quite different proposition." Id. at 348. For a thorough discussion of the importance of the manner of the offer in determining the existence of a security, see generally R ...

... offer mailed by defendants omitted the economic inducements of the proposed and promised exploration well, it would have been a quite different proposition." Id. at 348. For a thorough discussion of the importance of the manner of the offer in determining the existence of a security, see generally R ...

Systemic Risk and Hedge Funds

... such as return history, assets under management, and recent fund flows. In Section 6, we present three other approaches to measuring systemic risk in the hedge-fund industry: risk models for hedge-fund indexes, regression models relating the banking sector to hedge funds, and regime-switching models ...

... such as return history, assets under management, and recent fund flows. In Section 6, we present three other approaches to measuring systemic risk in the hedge-fund industry: risk models for hedge-fund indexes, regression models relating the banking sector to hedge funds, and regime-switching models ...

ACCE 457b PLAN FALL MEETING

... Insurance products and plan administrative services, if applicable, are provided by Principal Life Insurance Company. Principal mutual funds are part of the Principal Funds, Inc. series. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Princor ...

... Insurance products and plan administrative services, if applicable, are provided by Principal Life Insurance Company. Principal mutual funds are part of the Principal Funds, Inc. series. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Princor ...

Expected Returns on Major Asset Classes

... one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time and place for which it is being estimated. Other premia, or difference ...

... one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time and place for which it is being estimated. Other premia, or difference ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.