Impairment Measurement of the impairment loss: Debt

... – Amortised cost = PV of future cash receipts (payments) discounted at effective interest rate – Interest expense (income) = carrying amount at beginning of period x effective interest rate © 2011 IFRS Foundation ...

... – Amortised cost = PV of future cash receipts (payments) discounted at effective interest rate – Interest expense (income) = carrying amount at beginning of period x effective interest rate © 2011 IFRS Foundation ...

The informal investment context - Asociación española de ciencia

... family connection». The main difference between this and the definition of a business angel is that it does not specify that the investors take an active part in the projects that they finance, so it does not envisage the transfer of smart capital that characterises «angel investments». Nor does thi ...

... family connection». The main difference between this and the definition of a business angel is that it does not specify that the investors take an active part in the projects that they finance, so it does not envisage the transfer of smart capital that characterises «angel investments». Nor does thi ...

Informational Asymmetry and the Demand for IPOs: An Explanation

... uncertainty is imperfect information. There exists, in fact, huge informational asymmetries in the IPO markets, and various economic theories about such markets still argue over which entities do and which do not have reliable information regarding the value of a firm. There are many entities involv ...

... uncertainty is imperfect information. There exists, in fact, huge informational asymmetries in the IPO markets, and various economic theories about such markets still argue over which entities do and which do not have reliable information regarding the value of a firm. There are many entities involv ...

Venture Capital Fund

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

... These materials provided by WithumSmith+Brown, PC (“Withum”) are intended to provide general information on a particular subject or subjects and are not to be considered an authoritative or necessarily an exhaustive treatment of such subject(s) and are not intended to be a substitute for reading the ...

Cooperative Equity and Ownership: An Introduction

... In any business enterprise, assets are those things of value (cash, inventory, equipment, accounts receivable) that are owned by the company, liabilities are those things of value (accounts payable, loans) that are owed by the company to others, and owner equity is the difference between the two. In ...

... In any business enterprise, assets are those things of value (cash, inventory, equipment, accounts receivable) that are owned by the company, liabilities are those things of value (accounts payable, loans) that are owed by the company to others, and owner equity is the difference between the two. In ...

Two Agency-Cost Explanations of Dividends

... o needless to say, only a prospering firm can continue to pay dividends over time, but a firm with a long record of prosperity would not need the verification available from the dividend signal ...

... o needless to say, only a prospering firm can continue to pay dividends over time, but a firm with a long record of prosperity would not need the verification available from the dividend signal ...

TMP 38E050 Advanced Topics Economics of Competition and

... • Kamien & Zang (QJE 1990): In quantity competition, does 4. Mergers and Acquisitions monopolization of industries take place when acquisition process is endogenous? • In quantity game, total industry profit increases with a decreasing number of firms • Any firm increases its profit as number of fi ...

... • Kamien & Zang (QJE 1990): In quantity competition, does 4. Mergers and Acquisitions monopolization of industries take place when acquisition process is endogenous? • In quantity game, total industry profit increases with a decreasing number of firms • Any firm increases its profit as number of fi ...

Important information on Fidelity Advisor Stable Value Portfolio

... Duration: Duration is a measure of a security's price sensitivity to changes in interest rates. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity short ...

... Duration: Duration is a measure of a security's price sensitivity to changes in interest rates. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity short ...

The Policy Implications of Decumulation in Retirement in New Zealand

... towards services provided in the home, under ‘ageing in place‘ policies (Age Concern, ; Dalziel, 2001; Dwyer, Gray, & Renwick, 2000; Ministry of Health, 2002). However, in spite of some evidence of a shift, expenditure on residential care is still more than twice the amount spent on home services an ...

... towards services provided in the home, under ‘ageing in place‘ policies (Age Concern, ; Dalziel, 2001; Dwyer, Gray, & Renwick, 2000; Ministry of Health, 2002). However, in spite of some evidence of a shift, expenditure on residential care is still more than twice the amount spent on home services an ...

Sample Glossary of Investment-Related Terms for

... Interest Rate Risk: The possibility that a bond’s or bond fund’s market value will decrease due to rising interest rates. When interest rates (and bond yields) go up, bond prices usually go down and vice versa. International Fund: A fund that invests primarily in the securities of companies located, ...

... Interest Rate Risk: The possibility that a bond’s or bond fund’s market value will decrease due to rising interest rates. When interest rates (and bond yields) go up, bond prices usually go down and vice versa. International Fund: A fund that invests primarily in the securities of companies located, ...

Morgan Creek Capital

... South Sea Bubble, “Life expectancy in 18th Century England was just 21 years old, owing to smallpox, typhus and ...

... South Sea Bubble, “Life expectancy in 18th Century England was just 21 years old, owing to smallpox, typhus and ...

Corporate Payout Policy and Product Market Competition

... to increases in productivity, especially among those firms in which managers are less aligned with shareholders. Guadalupe and Pérez-González (2005) find evidence that the private benefits of managerial control, a measure of the magnitude of the conflict between managers and shareholders, decrease w ...

... to increases in productivity, especially among those firms in which managers are less aligned with shareholders. Guadalupe and Pérez-González (2005) find evidence that the private benefits of managerial control, a measure of the magnitude of the conflict between managers and shareholders, decrease w ...

To: Clients and Friends June 30, 2004 The articles below contain

... proposed interpretation that would have allowed NASD members to use related performance information in marketing mutual funds. It was anticipated that approval of this interpretation would lead to NASD members being permitted to use related performance information in the marketing of hedge funds. On ...

... proposed interpretation that would have allowed NASD members to use related performance information in marketing mutual funds. It was anticipated that approval of this interpretation would lead to NASD members being permitted to use related performance information in the marketing of hedge funds. On ...

T t l d p t t - The University of Chicago Booth School of Business

... We obtained virtually all of the data used in this paper from Morningstar Inc. The primary data source is Morningstar’s January 1994 Mutual Funds OnDisc. From this CD-ROM, we got data on mutual fund returns, assets under management, minimum initial purchase requirements, and expense ratios as well a ...

... We obtained virtually all of the data used in this paper from Morningstar Inc. The primary data source is Morningstar’s January 1994 Mutual Funds OnDisc. From this CD-ROM, we got data on mutual fund returns, assets under management, minimum initial purchase requirements, and expense ratios as well a ...

Estimating Risk Premiums

... final problem. Markets that exhibit this characteristic, and let us assume that the US market is one such example, represent "survivor markets”. In other words, assume that one had invested in the ten largest equity markets in the world in 1926, of which the United States was one. In the period ext ...

... final problem. Markets that exhibit this characteristic, and let us assume that the US market is one such example, represent "survivor markets”. In other words, assume that one had invested in the ten largest equity markets in the world in 1926, of which the United States was one. In the period ext ...

14-0187 Attachment - Settlement Agreement - Afam Elue

... the Investment Dealers Association of Canada and Market Regulation Services Inc., IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficient and competitive capital markets. IIROC carries out its regulatory re ...

... the Investment Dealers Association of Canada and Market Regulation Services Inc., IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficient and competitive capital markets. IIROC carries out its regulatory re ...

capital markets and economic growth: long-‐term

... Figure 14: Ratio of securitizations to outstanding debt securities in Europe and the US ..................................... 41 Figure 15: Ratio of stock market trading volume to market cap ........................... ...

... Figure 14: Ratio of securitizations to outstanding debt securities in Europe and the US ..................................... 41 Figure 15: Ratio of stock market trading volume to market cap ........................... ...

International Financial Integration and Crisis Contagion ∗ Michael B. Devereux Changhua Yu

... theirs and emphasizes the balance sheet channel of firms (investors). Moreover, we provide a model of endogenous portfolio choice by investors (firms) and bankers, and study explicitly the transmission of crises through the fire sale of assets. Second, this paper makes a contribution to studying slo ...

... theirs and emphasizes the balance sheet channel of firms (investors). Moreover, we provide a model of endogenous portfolio choice by investors (firms) and bankers, and study explicitly the transmission of crises through the fire sale of assets. Second, this paper makes a contribution to studying slo ...

1 - Member and Committee Information

... The total Fund return for calendar year 2015 was 2.2%, against a benchmark return of 4.1% and the average fund return of 2.9%, placing the Fund in the 62nd percentile of funds in the WM All Funds Universe, a universe made up of public and private sector funds. (Note that 1st percentile ranking is hi ...

... The total Fund return for calendar year 2015 was 2.2%, against a benchmark return of 4.1% and the average fund return of 2.9%, placing the Fund in the 62nd percentile of funds in the WM All Funds Universe, a universe made up of public and private sector funds. (Note that 1st percentile ranking is hi ...

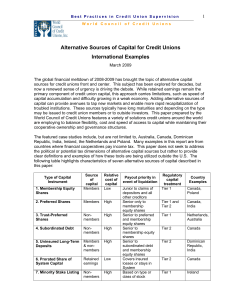

Alternative Sources of Capital for Credit Unions

... Although U.S. credit unions have separate statutory capital requirements per the Federal Credit Union Act, U.S. banks and credit unions in many countries are influenced by the Basel Accord on Capital Adequacy. Therefore, as a starting point we define what is meant by the terms Tier 1 and Tier 2 capi ...

... Although U.S. credit unions have separate statutory capital requirements per the Federal Credit Union Act, U.S. banks and credit unions in many countries are influenced by the Basel Accord on Capital Adequacy. Therefore, as a starting point we define what is meant by the terms Tier 1 and Tier 2 capi ...

II. Foreign portfolio investment[7]

... According to the World Bank, about half of the M&A activity in East Asia in recent years has been in such non-tradeable industries as wholesale and retail trade, real estate, and the financial sector, particularly involving the re-capitalization of the banking industry after the financial crisis. Ta ...

... According to the World Bank, about half of the M&A activity in East Asia in recent years has been in such non-tradeable industries as wholesale and retail trade, real estate, and the financial sector, particularly involving the re-capitalization of the banking industry after the financial crisis. Ta ...

Implications of Behavioural Economics for Mandatory

... However, a growing research literature in behavioural economics suggests that plan members make systematic errors with respect to their retirement saving, leading ultimately to reductions in economic welfare. While lack of adequate disclosure or knowledge over financial matters may be partially res ...

... However, a growing research literature in behavioural economics suggests that plan members make systematic errors with respect to their retirement saving, leading ultimately to reductions in economic welfare. While lack of adequate disclosure or knowledge over financial matters may be partially res ...

Foreign Institutional Investors and Corporate Governance in

... this movement are institutional investors, both domestic and foreign. Many initiatives have been launched to encourage and convince institutional investors to play a more active role. However, not enough is known about how institutional investors utilize CG in their investment decisions, in particul ...

... this movement are institutional investors, both domestic and foreign. Many initiatives have been launched to encourage and convince institutional investors to play a more active role. However, not enough is known about how institutional investors utilize CG in their investment decisions, in particul ...

Superannuation funds and alternative asset investment

... assets, such as direct investments in private equity and infrastructure, is their relative illiquidity. While this is not in itself a concern, the relationship between the liquidity of a fund’s assets and the likelihood of payments from the fund, as a result of members either retiring or moving to o ...

... assets, such as direct investments in private equity and infrastructure, is their relative illiquidity. While this is not in itself a concern, the relationship between the liquidity of a fund’s assets and the likelihood of payments from the fund, as a result of members either retiring or moving to o ...

IOSR Journal of Humanities and Social Science (JHSS)

... This is because three of the variables examined are statistically significant and the variables are percentage distribution of public investment which is significant at 10%, external reserve which is statistically significant at 1% and gross domestic product that is statistically significant at 10%. ...

... This is because three of the variables examined are statistically significant and the variables are percentage distribution of public investment which is significant at 10%, external reserve which is statistically significant at 1% and gross domestic product that is statistically significant at 10%. ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.

![II. Foreign portfolio investment[7]](http://s1.studyres.com/store/data/009465518_1-aaeccb882c08a66cd754bf0cd0f9039d-300x300.png)