Expected Returns, Yield Spreads, and Asset Pricing Tests

... to average realized) stock returns. Our basic approach builds on the observation that debt and equity are financial claims written on the same set of real assets and hence must share common risk factors. In particular, our analysis explores this insight to show how one can use corporate bond data t ...

... to average realized) stock returns. Our basic approach builds on the observation that debt and equity are financial claims written on the same set of real assets and hence must share common risk factors. In particular, our analysis explores this insight to show how one can use corporate bond data t ...

67075084I_en.pdf

... noted that because it limits itself to short-term impacts, this model omits the long-term effects (Buiter, 1977 and 1980). However, there are also those who maintain that public investment can have a complementary effect (crowding-in) with respect to private investment, especially when it is made in ...

... noted that because it limits itself to short-term impacts, this model omits the long-term effects (Buiter, 1977 and 1980). However, there are also those who maintain that public investment can have a complementary effect (crowding-in) with respect to private investment, especially when it is made in ...

Privatization CP -

... order. After all, what US families also do when they are in debt is to sell stuff. Infrastructure privatization in the US has been slow to take off in comparison to continental Europe, the UK, Canada and Australia. The effects of this can be seen in the difference in quality of US infrastructure com ...

... order. After all, what US families also do when they are in debt is to sell stuff. Infrastructure privatization in the US has been slow to take off in comparison to continental Europe, the UK, Canada and Australia. The effects of this can be seen in the difference in quality of US infrastructure com ...

Budgeting for Investment

... between up-front costs and long-term economic benefits, and the presumed resulting bias against capital spending, would be to segregate specified investments into a separate capital budget. Private sector accounting and the budgets of most states already make this distinction. Many advocates of a se ...

... between up-front costs and long-term economic benefits, and the presumed resulting bias against capital spending, would be to segregate specified investments into a separate capital budget. Private sector accounting and the budgets of most states already make this distinction. Many advocates of a se ...

the role of pension funds in financing green growth

... issuance, other development banks have become involved (EIB, ADB) and the US government has introduced interesting initiatives. Other more exotic green financial vehicles have also been launched – with mixed success. Green infrastructure funds are also likely to be an important way for pension funds ...

... issuance, other development banks have become involved (EIB, ADB) and the US government has introduced interesting initiatives. Other more exotic green financial vehicles have also been launched – with mixed success. Green infrastructure funds are also likely to be an important way for pension funds ...

Li, Yu Qiong

... their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficient and competitive capital markets. IIROC carries out its regulatory responsibilities through ...

... their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while maintaining efficient and competitive capital markets. IIROC carries out its regulatory responsibilities through ...

Moving from private to public ownership: Selling out to

... and the resulting trade-offs. In an IPO, owners sell off a portion of their stake in the private firm. The dilution effects of an IPO are relatively minimal since the average IPO in our sample leaves the original owners with approximately half of the post-transaction ownership of the firm. However, ...

... and the resulting trade-offs. In an IPO, owners sell off a portion of their stake in the private firm. The dilution effects of an IPO are relatively minimal since the average IPO in our sample leaves the original owners with approximately half of the post-transaction ownership of the firm. However, ...

Market Turmoil and Destabilizing Speculation Supplementary Material

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

Private Sector Investment Survey (PSIS) 2010

... billion and repayments of Shs.880billion respectively. There were ix ...

... billion and repayments of Shs.880billion respectively. There were ix ...

the benefits of sell-side research

... Stock prices move in line with analyst coverage ................................................................................. 4 Analyst coverage leads to increases in liquidity .................................................................................. 5 Analyst coverage causes higher ins ...

... Stock prices move in line with analyst coverage ................................................................................. 4 Analyst coverage leads to increases in liquidity .................................................................................. 5 Analyst coverage causes higher ins ...

Sparinvest White paper - Risk Containment in Emerging Markets

... from high-inflation regimes to controlled inflation, with concomitant high productivity growth due to import of technology. Being able to identify countries and companies that are benefiting from this (or at least not suffering too much from currency depreciations) is an integral part of successful ...

... from high-inflation regimes to controlled inflation, with concomitant high productivity growth due to import of technology. Being able to identify countries and companies that are benefiting from this (or at least not suffering too much from currency depreciations) is an integral part of successful ...

How to Read a Value Line Fund Advisor Report

... The broad categories used for the Risk and Overall Ranks allow for easy comparison of a large number of funds. While some may find it useful to see funds ranked within narrow categories, such a system makes it impossible to meaningfully compare funds across these categories. For example, if small-co ...

... The broad categories used for the Risk and Overall Ranks allow for easy comparison of a large number of funds. While some may find it useful to see funds ranked within narrow categories, such a system makes it impossible to meaningfully compare funds across these categories. For example, if small-co ...

Leverage, maturities of debt and stock performance

... stocks with higher long-term debt earn lower returns. However, the relationship between longterm debt and stock returns is not significant. In asset pricing models, leverage is mostly ignored due to mixed results. The conflicting evidence of the relation between leverage and equity returns motivates ...

... stocks with higher long-term debt earn lower returns. However, the relationship between longterm debt and stock returns is not significant. In asset pricing models, leverage is mostly ignored due to mixed results. The conflicting evidence of the relation between leverage and equity returns motivates ...

LEVERAGE, HEDGE FUNDS AND RISK

... the position or portfolio level. Prime brokerage financing is generally easy to obtain but financing terms can be changed on short notice. Prime brokerage financing is also typically of short duration, resulting in a potential mismatch between the duration of the firm’s assets (take longer to liquid ...

... the position or portfolio level. Prime brokerage financing is generally easy to obtain but financing terms can be changed on short notice. Prime brokerage financing is also typically of short duration, resulting in a potential mismatch between the duration of the firm’s assets (take longer to liquid ...

Leveraged and Inverse ETFs(Slides)

... may trade in these instruments. All investments carry risk. Investing in funds can lead to profit or loss. Before making any investment decisions, investors should consult the fund’s prospectus. ...

... may trade in these instruments. All investments carry risk. Investing in funds can lead to profit or loss. Before making any investment decisions, investors should consult the fund’s prospectus. ...

Chapter 14

... attractive way of financing new investment. Consequently, the payout ratio might be expected to decline. On the other hand, higher interest rates would cause rd, rs, and firms’ MCCs to rise—that would mean that fewer projects would qualify for capital budgeting and the residual would increase (other ...

... attractive way of financing new investment. Consequently, the payout ratio might be expected to decline. On the other hand, higher interest rates would cause rd, rs, and firms’ MCCs to rise—that would mean that fewer projects would qualify for capital budgeting and the residual would increase (other ...

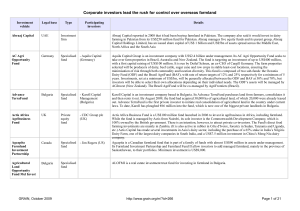

The new farm owners table

... invest in agricultural land and farming operations in emerging market countries. Altima invests in agribusinesses in Latin America and the Russia/Ukraine/Kazakhstan (RUK) region. Three-quarters of its portfolio goes into farm companies (producing agricultural crops) and 25% goes into publicly-listed ...

... invest in agricultural land and farming operations in emerging market countries. Altima invests in agribusinesses in Latin America and the Russia/Ukraine/Kazakhstan (RUK) region. Three-quarters of its portfolio goes into farm companies (producing agricultural crops) and 25% goes into publicly-listed ...

Challenges facing venture capitalists in developing economies

... use of arbitration for Venture Capital (VC) related dispute resolutions due to the inefficient legal environment (Ribeiro & Carvalho, 2008, p.124). The purpose of this thesis is to investigate main challenges facing VC firms in developing countries with particular emphasis on environmental and gover ...

... use of arbitration for Venture Capital (VC) related dispute resolutions due to the inefficient legal environment (Ribeiro & Carvalho, 2008, p.124). The purpose of this thesis is to investigate main challenges facing VC firms in developing countries with particular emphasis on environmental and gover ...

Tilburg University The Life Cycle of the Firm with

... of new equity. The return on the initial investment is retained and reinvested during an internal growth phase of the firm. The firm keeps reinvesting its earnings for a while. Eventually, however, the firm stops investing and starts distributing dividends. Sinn's work establishes how the capital in ...

... of new equity. The return on the initial investment is retained and reinvested during an internal growth phase of the firm. The firm keeps reinvesting its earnings for a while. Eventually, however, the firm stops investing and starts distributing dividends. Sinn's work establishes how the capital in ...

Capital Markets Union

... the capital markets using public issuance or venture capital. This shows the difficulty smaller NFCs have in diversifying their sources of funding. Alternatives to traditional methods of financing are limited. Alternatives to bank loans and large capital markets remain limited. Private equity and ve ...

... the capital markets using public issuance or venture capital. This shows the difficulty smaller NFCs have in diversifying their sources of funding. Alternatives to traditional methods of financing are limited. Alternatives to bank loans and large capital markets remain limited. Private equity and ve ...

Topic 4

... grants etc. But this allegiance is fickle and quickly diverted if opportunities for profit appear greater elsewhere – The fact that multinational corporations are relatively footloose means they can move operations to where costs are cheapest and play off one government against the other in the proc ...

... grants etc. But this allegiance is fickle and quickly diverted if opportunities for profit appear greater elsewhere – The fact that multinational corporations are relatively footloose means they can move operations to where costs are cheapest and play off one government against the other in the proc ...

Financial Market Shocks and the Macroeconomy

... In addition to including two types of firms, the model includes two types of investors, informed and uninformed, and two types of shocks. The first, a technology shock observed by the informed investors, affects the productivity of both the public and private firms. The second, which we describe as a ...

... In addition to including two types of firms, the model includes two types of investors, informed and uninformed, and two types of shocks. The first, a technology shock observed by the informed investors, affects the productivity of both the public and private firms. The second, which we describe as a ...

Private equity demystified

... We published the first edition of Private Equity Demystified in August 2008. There followed a period of unprecedented financial turmoil. The second edition built on the first edition to reflect the effects of the recession and examined the way in which the banking market changed its approach to priv ...

... We published the first edition of Private Equity Demystified in August 2008. There followed a period of unprecedented financial turmoil. The second edition built on the first edition to reflect the effects of the recession and examined the way in which the banking market changed its approach to priv ...

NBER WORKING PAPER SERIES THE LIMITS OF FINANCIAL GLOBALIZATION René M. Stulz

... as the developed countries in the late 1970s, but there is more variance in the index among developing countries in 1997 than there was among developed countries in the late 1970s. Kaminsky and Schmuckler (2002) provide another index, which measures the liberalization of equity investment, the fina ...

... as the developed countries in the late 1970s, but there is more variance in the index among developing countries in 1997 than there was among developed countries in the late 1970s. Kaminsky and Schmuckler (2002) provide another index, which measures the liberalization of equity investment, the fina ...

Mutual Funds Investment

... concerned. For any individual who intends to allocate his assets into proper forms of investment and want to diversify his Investment Portfolio as well as the risks, Mutual Funds can be proved as the biggest opportunity. Investors gets a lot of advantages with the Mutual Fund Investment. Firstly, th ...

... concerned. For any individual who intends to allocate his assets into proper forms of investment and want to diversify his Investment Portfolio as well as the risks, Mutual Funds can be proved as the biggest opportunity. Investors gets a lot of advantages with the Mutual Fund Investment. Firstly, th ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.