Document

... remove the amount of the receivable from our books by crediting accounts receivable and reducing the amount we have set aside as an allowance by debiting the allowance for doubtful accounts. The effect – assuming that the uncollected accounts receivable is not larger than the allowance for doubtful ...

... remove the amount of the receivable from our books by crediting accounts receivable and reducing the amount we have set aside as an allowance by debiting the allowance for doubtful accounts. The effect – assuming that the uncollected accounts receivable is not larger than the allowance for doubtful ...

FORM 10-K - corporate

... CĪON Investment Corporation, or the Company, was incorporated under the general corporation laws of the State of Maryland on August 9, 2011. When used in this Annual Report on Form 10-K, the terms “we,” “us,” “our” or similar terms refer to the Company and its consolidated subsidiaries. In addition, ...

... CĪON Investment Corporation, or the Company, was incorporated under the general corporation laws of the State of Maryland on August 9, 2011. When used in this Annual Report on Form 10-K, the terms “we,” “us,” “our” or similar terms refer to the Company and its consolidated subsidiaries. In addition, ...

NBER WORKING PAPER SERIES THE VARIABILITY OF IPO INITIAL RETURNS Michelle Lowry

... we find significant differences in the accuracy of price discovery during the IPO period (i.e., a significantly lower level and volatility of initial returns for auction IPOs) but little difference in the provision of auxiliary services (analyst coverage and market making) to issuers. The size of th ...

... we find significant differences in the accuracy of price discovery during the IPO period (i.e., a significantly lower level and volatility of initial returns for auction IPOs) but little difference in the provision of auxiliary services (analyst coverage and market making) to issuers. The size of th ...

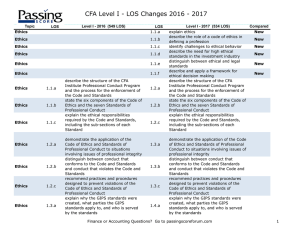

CFA Level I - LOS Changes 2016 - 2017

... calculate and interpret the net present value (NPV) and the internal rate of return (IRR) of an investment contrast the NPV rule to the IRR rule, and identify problems associated with the IRR rule calculate and interpret a holding period return (total return) calculate and compare the moneyweighted ...

... calculate and interpret the net present value (NPV) and the internal rate of return (IRR) of an investment contrast the NPV rule to the IRR rule, and identify problems associated with the IRR rule calculate and interpret a holding period return (total return) calculate and compare the moneyweighted ...

Two Essays on Managerial Behaviors in the Mutual Fund Industry

... changes over quarter-end and compare trading in the first three quarters with that in the fourth quarter. Their results show that funds sell more losers in the fourth quarter. Since their method compares the purchase and sales over quarter-end, it would not be able to test whether a fund manager has ...

... changes over quarter-end and compare trading in the first three quarters with that in the fourth quarter. Their results show that funds sell more losers in the fourth quarter. Since their method compares the purchase and sales over quarter-end, it would not be able to test whether a fund manager has ...

Overnight Versus Intraday Expected Returns

... all of the results presented below, we use the VWAP price during this first half hour as the daily open price. Our findings are robust to using the other three proxies for the open price (results available upon request). To further ensure that our VWAP price is not driven by very small orders, we ex ...

... all of the results presented below, we use the VWAP price during this first half hour as the daily open price. Our findings are robust to using the other three proxies for the open price (results available upon request). To further ensure that our VWAP price is not driven by very small orders, we ex ...

Xerox Corporation

... project. Another item used heavily in the intrinsic valuations is cost of equity, cost of debt, and weighted average cost of capital. The liquidity ratios which materially altered our overall decision on valuing Xerox included the quick asset ratio and accounts receivable days. Xerox quick asset rat ...

... project. Another item used heavily in the intrinsic valuations is cost of equity, cost of debt, and weighted average cost of capital. The liquidity ratios which materially altered our overall decision on valuing Xerox included the quick asset ratio and accounts receivable days. Xerox quick asset rat ...

On Path–dependency of Constant Proportion Portfolio

... and typically the insured component of the investment can be translated into the expression BT = ηV0p , ...

... and typically the insured component of the investment can be translated into the expression BT = ηV0p , ...

Multiple Choice Questions 1. A payment made out of a

... requires all shareholders to sell a portion of their shares. is utilized only by firms that do not pay dividends. decreases both the number of shares outstanding and the market price per share. has no effect on a firm's financial statements. is essentially the same as a cash dividend program provide ...

... requires all shareholders to sell a portion of their shares. is utilized only by firms that do not pay dividends. decreases both the number of shares outstanding and the market price per share. has no effect on a firm's financial statements. is essentially the same as a cash dividend program provide ...

Predicting Mutual Fund Performance: The Win

... wouldn’t significantly change the empirical results. 2 In fact, for measures with additional controls, we acquire qualitatively similar results. Consequently, we use m1 for most of our empirical tests as our win-loss record measure. Unless the fund manager changes component stocks in the portfolio r ...

... wouldn’t significantly change the empirical results. 2 In fact, for measures with additional controls, we acquire qualitatively similar results. Consequently, we use m1 for most of our empirical tests as our win-loss record measure. Unless the fund manager changes component stocks in the portfolio r ...

Dividends, Share Repurchases, and the Substitution Hypothesis

... find that the share repurchase activity over the last two decades has helped the average total payout ratio of firms to stay relatively constant despite the decline in the average dividend payout ratio. We also find that as a percentage of the total number of firms distributing cash to their equityh ...

... find that the share repurchase activity over the last two decades has helped the average total payout ratio of firms to stay relatively constant despite the decline in the average dividend payout ratio. We also find that as a percentage of the total number of firms distributing cash to their equityh ...

Introduction to Credit Risk Modeling, An

... probability (DP), a loss fraction called the loss given default (LGD), describing the fraction of the loan’s exposure expected to be lost in case of default, and the exposure at default (EAD) subject to be lost in the considered time period. The loss of any obligor is then defined by a loss variable ...

... probability (DP), a loss fraction called the loss given default (LGD), describing the fraction of the loan’s exposure expected to be lost in case of default, and the exposure at default (EAD) subject to be lost in the considered time period. The loss of any obligor is then defined by a loss variable ...

Market Consistent Embedded Value Report 2015

... The positive development in the shareholders’ economic value of the life in-force business was primarily based on the following factors: ‒ The overall more favorable economic conditions end of 2015 compared to end of 2014, including higher interest rates and lower credit spreads in Europe, as well a ...

... The positive development in the shareholders’ economic value of the life in-force business was primarily based on the following factors: ‒ The overall more favorable economic conditions end of 2015 compared to end of 2014, including higher interest rates and lower credit spreads in Europe, as well a ...

Hedge Fund Innovation - American Economic Association

... ary) which differ in market impact. Furthermore, the definition of an innovator is flexible. It needs not be the first company in the new market. Instead, a notion of an early-entry is adopted where a group of firms is considered innovative (Christensen, Suárez, and Utterback, 1998; Utterback and S ...

... ary) which differ in market impact. Furthermore, the definition of an innovator is flexible. It needs not be the first company in the new market. Instead, a notion of an early-entry is adopted where a group of firms is considered innovative (Christensen, Suárez, and Utterback, 1998; Utterback and S ...

RTF - Vornado Realty Trust

... FFO is computed in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines FFO as net income or loss determined in accordance with Generally Accepted Accounting Principles (“GAAP”), excluding extraordina ...

... FFO is computed in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines FFO as net income or loss determined in accordance with Generally Accepted Accounting Principles (“GAAP”), excluding extraordina ...

Guideline - OSFI-BSIF

... minimum Total Ratio of 100% may be considered acceptable. However, life insurers are exposed to more risks than those for which calculations are specified. Consequently, the minimum Total Ratio for life insurers is set at 120% rather than 100% to cover operational risks that are not explicitly measu ...

... minimum Total Ratio of 100% may be considered acceptable. However, life insurers are exposed to more risks than those for which calculations are specified. Consequently, the minimum Total Ratio for life insurers is set at 120% rather than 100% to cover operational risks that are not explicitly measu ...

SUP-MULTI-0115 ALLIANCEBERNSTEIN ALL MARKET GROWTH

... are designed for use in two or more securities markets, such as Europe and Asia. Derivatives The Underlying Portfolios may, but are not required to, use derivatives for hedging or other risk management purposes or as part of their investment practices. Derivatives ...

... are designed for use in two or more securities markets, such as Europe and Asia. Derivatives The Underlying Portfolios may, but are not required to, use derivatives for hedging or other risk management purposes or as part of their investment practices. Derivatives ...

The Leverage Effect on Stock Returns-EFMA

... competitive industries returns will be lower due to pressures from competition. In those industries higher tax rates will further lower the cash flows and returns. However tax shields are still important as sources of additional cash flows. Therefore we would expect corporate taxes to increase the ...

... competitive industries returns will be lower due to pressures from competition. In those industries higher tax rates will further lower the cash flows and returns. However tax shields are still important as sources of additional cash flows. Therefore we would expect corporate taxes to increase the ...

RBC Funds (Lux) - RBC Global Asset Management

... We are pleased to provide you with this annual report for RBC Funds (Lux) (the “Fund”) for the year ended October 31, 2016. The Fund The Fund is an open-ended investment company with variable capital. The Fund has multiple Sub-Funds, each of which has its own investment policy and restrictions. Duri ...

... We are pleased to provide you with this annual report for RBC Funds (Lux) (the “Fund”) for the year ended October 31, 2016. The Fund The Fund is an open-ended investment company with variable capital. The Fund has multiple Sub-Funds, each of which has its own investment policy and restrictions. Duri ...

Estimating the required return on equity

... implementation of the Sharpe-Lintner CAPM, and in relation to approaches for estimating the required return on equity that are consistent with the new Rules. 2 For example, at the ERA Stakeholder Forum there was a detailed discussion of how it was inappropriate to take a statistical confidence inter ...

... implementation of the Sharpe-Lintner CAPM, and in relation to approaches for estimating the required return on equity that are consistent with the new Rules. 2 For example, at the ERA Stakeholder Forum there was a detailed discussion of how it was inappropriate to take a statistical confidence inter ...

Market Discipline and Internal Governance in the Mutual Fund Industry

... The portfolio management industry has undergone dramatic growth in the last few decades, thereby also generating an increasing interest among regulators and academics. The question how to ensure efficient governance of delegated portfolio management has attracted particular attention. Most theoreti ...

... The portfolio management industry has undergone dramatic growth in the last few decades, thereby also generating an increasing interest among regulators and academics. The question how to ensure efficient governance of delegated portfolio management has attracted particular attention. Most theoreti ...