REPORT OF THE INVESTMENT COMMITTEE The dominant theme

... The Foundation portfolio earned 14.1% in calendar 2013, well ahead of our primary investment objective of earning a 5% real return (that is, adjusted for inflation) each year. Similarly, the strong 2013 ...

... The Foundation portfolio earned 14.1% in calendar 2013, well ahead of our primary investment objective of earning a 5% real return (that is, adjusted for inflation) each year. Similarly, the strong 2013 ...

Sample Questions

... If the market risk premium (kM - kRF) increases, the required return on all stocks with positive betas would increase. Therefore, statement a is false. Since the required return for all positive beta stocks will increase, the return for Portfolio P must increase as well. Therefore, statement b is fa ...

... If the market risk premium (kM - kRF) increases, the required return on all stocks with positive betas would increase. Therefore, statement a is false. Since the required return for all positive beta stocks will increase, the return for Portfolio P must increase as well. Therefore, statement b is fa ...

Invesors turn to mobile home parks for higher returns

... Clarke, a partner in NM Apartment Advisors. Cash-on-cash return is a technique for calculating the return on an investment for which there is no secondary market. It equals the annual dollar income divided by the total dollar investment, expressed as a percentage. The area also is attractive, Frerke ...

... Clarke, a partner in NM Apartment Advisors. Cash-on-cash return is a technique for calculating the return on an investment for which there is no secondary market. It equals the annual dollar income divided by the total dollar investment, expressed as a percentage. The area also is attractive, Frerke ...

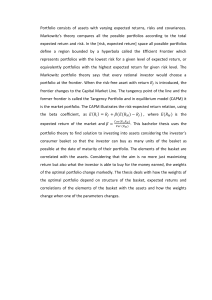

Structure Determines Performance = + + + +

... After fees, traditional management typically reduces returns. 4% Stock Picking and Market Timing ...

... After fees, traditional management typically reduces returns. 4% Stock Picking and Market Timing ...

SECOND MIDTERM

... c. Calculate b1, b2 and b3 for a portfolio with equal amounts invested in X, Y and Z. What is the expected rate of return on the portfolio? d. Suppose stock Z’s expected return is 3% higher than you calculated in part (b). Is this an “arbitrage” profit opportunity? Explain. ...

... c. Calculate b1, b2 and b3 for a portfolio with equal amounts invested in X, Y and Z. What is the expected rate of return on the portfolio? d. Suppose stock Z’s expected return is 3% higher than you calculated in part (b). Is this an “arbitrage” profit opportunity? Explain. ...

RETURN, RISK, AND THE SECURITY MARKET LINE

... To calculate the variances of the returns on our two stocks, we first determine the squared deviations from the expected return. We then multiply each possible squared deviation by ...

... To calculate the variances of the returns on our two stocks, we first determine the squared deviations from the expected return. We then multiply each possible squared deviation by ...

Exam 2

... of the machine is $600,000 and its economic life is five years. The machine is fully depreciated by the straight-line method and will produce 20,000 calculators in the first year. The variable cost per unit is $20, while fixed costs are $1,000,000. The corporate tax rate for the company is 30 percen ...

... of the machine is $600,000 and its economic life is five years. The machine is fully depreciated by the straight-line method and will produce 20,000 calculators in the first year. The variable cost per unit is $20, while fixed costs are $1,000,000. The corporate tax rate for the company is 30 percen ...

P(x) - tcann

... Does the following refer to a probability distribution? If so, determine the mean and standard deviation. Which x-values, if any, would be considered unusual? Use the 2 process. ...

... Does the following refer to a probability distribution? If so, determine the mean and standard deviation. Which x-values, if any, would be considered unusual? Use the 2 process. ...

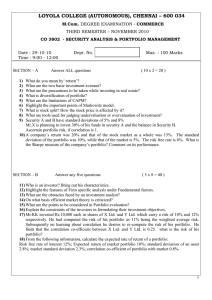

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 10) A company’s return was 20% and that of the stock market as a whole was 15%. The standard deviation of the portfolio was 10%, while that of the market is 5%. The risk free rate is 6%. What is the Sharpe measure of the company’s portfolio? Comment on its performance. ...

... 10) A company’s return was 20% and that of the stock market as a whole was 15%. The standard deviation of the portfolio was 10%, while that of the market is 5%. The risk free rate is 6%. What is the Sharpe measure of the company’s portfolio? Comment on its performance. ...

Two Ways to Calculate the Rate of Return on a Portfolio

... same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is right? Which is best? Actually there is no right or wrong or best – they just have different meani ...

... same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is right? Which is best? Actually there is no right or wrong or best – they just have different meani ...

Chapter 011 Risk and Return

... (finance.yahoo.com) for the last five years. Collect information in an Excel file. 3) Calculate monthly returns as the percentage change in the monthly prices. 4) Compute the mean monthly returns and standard deviations for the monthly returns of each of the stocks. Compute annual statistics. 5) Cal ...

... (finance.yahoo.com) for the last five years. Collect information in an Excel file. 3) Calculate monthly returns as the percentage change in the monthly prices. 4) Compute the mean monthly returns and standard deviations for the monthly returns of each of the stocks. Compute annual statistics. 5) Cal ...