FREE Sample Here - We can offer most test bank and

... 4. A significant part of this text is devoted to valuation. What causes an asset to have value today? Answer: This question offers the opportunity to discuss the importance of future cash flows (and not historical cash flows) properly discounted for determining present values. Ask the students why t ...

... 4. A significant part of this text is devoted to valuation. What causes an asset to have value today? Answer: This question offers the opportunity to discuss the importance of future cash flows (and not historical cash flows) properly discounted for determining present values. Ask the students why t ...

KCR-Presentation-Final_a

... The All-Asset Portfolio (AAP) is a portfolio of model systems developed by Patrick Berch with Butler, Lanz and Wagler. The model performance presented has been back-tested and is strictly hypothetical. The performance was gathered using historical data obtained from yahoo finance, Reuters DataLink, ...

... The All-Asset Portfolio (AAP) is a portfolio of model systems developed by Patrick Berch with Butler, Lanz and Wagler. The model performance presented has been back-tested and is strictly hypothetical. The performance was gathered using historical data obtained from yahoo finance, Reuters DataLink, ...

as PDF

... Naturally, some areas and some years see the 6% appreciation rate go as high as 12%. A lot of investors (like myself) refinance after they have created an extra 20% equity (see year 5) and buy a new property with the money and start all over. If you held the property for 10 years, it would be worth ...

... Naturally, some areas and some years see the 6% appreciation rate go as high as 12%. A lot of investors (like myself) refinance after they have created an extra 20% equity (see year 5) and buy a new property with the money and start all over. If you held the property for 10 years, it would be worth ...

Looking Back and Thinking Ahead Looking Back

... duration of their assets. Relative Value Swap: At any given point in time, some sectors of the bond market offer better value than others. Moreover, the relative advantage of the different sectors (as measured by their yield spread relationships) is constantly changing. Mortgage-backed securities ve ...

... duration of their assets. Relative Value Swap: At any given point in time, some sectors of the bond market offer better value than others. Moreover, the relative advantage of the different sectors (as measured by their yield spread relationships) is constantly changing. Mortgage-backed securities ve ...

A corporate bond maturing in 5 years carries a 10% coupon rate and

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

AIRLINE VALUATION USING DISCOUNTED CASH FLOW METHOD

... Abstract: Since the beginning of the 1990s value based concept is discussed intensively as a new way for company management. According to its keynote capital augmentation and company’s value growth are priority aims of any organization. This article is devoted to discounted cash flow method, which i ...

... Abstract: Since the beginning of the 1990s value based concept is discussed intensively as a new way for company management. According to its keynote capital augmentation and company’s value growth are priority aims of any organization. This article is devoted to discounted cash flow method, which i ...

Document

... e. The firm’s required return is 20%. The tax rate is 34%. 11. Calculate the project’s Payback, NPV, and IRR (base-case). 12. Scenario analysis: Suppose the company believes that all of its estimates (sale quantity, price, variable cost/unit, and fixed cost) are accurate within ±10 percent. What are ...

... e. The firm’s required return is 20%. The tax rate is 34%. 11. Calculate the project’s Payback, NPV, and IRR (base-case). 12. Scenario analysis: Suppose the company believes that all of its estimates (sale quantity, price, variable cost/unit, and fixed cost) are accurate within ±10 percent. What are ...

Answers - UCSB Economics

... hold in their portfolio based upon the risk of each asset’s return. A risk adverse individual will consider holding risky assets only if they provide compensation for the extra risk involved. Portfolio diversification is the idea that a portfolio which holds diversified assets actually maintains les ...

... hold in their portfolio based upon the risk of each asset’s return. A risk adverse individual will consider holding risky assets only if they provide compensation for the extra risk involved. Portfolio diversification is the idea that a portfolio which holds diversified assets actually maintains les ...

Document

... The number of stocks selected depends on a unique cut off rate such that all stocks with higher ratios of Excess return to beta will be included and all stocks with lower ratios excluded. ...

... The number of stocks selected depends on a unique cut off rate such that all stocks with higher ratios of Excess return to beta will be included and all stocks with lower ratios excluded. ...

principles of finance

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

rate_note

... • Assumption: All cash–flows occur within one year • Approximation: The compound–interest accumulation function is approximated by simple–interest accumulation function Remark: Since the simple interest rate that solves the equation of value depends on the reference time, the reference time is alway ...

... • Assumption: All cash–flows occur within one year • Approximation: The compound–interest accumulation function is approximated by simple–interest accumulation function Remark: Since the simple interest rate that solves the equation of value depends on the reference time, the reference time is alway ...

Merrill Finch Inc

... Note that the estimated returns of U.S. Rubber do not always move in the same direction as the overall economy. For example, when the economy is below average, consumers purchase fewer tires than they would if the economy was stronger. However, if the economy is in a flat-out recession, a large numb ...

... Note that the estimated returns of U.S. Rubber do not always move in the same direction as the overall economy. For example, when the economy is below average, consumers purchase fewer tires than they would if the economy was stronger. However, if the economy is in a flat-out recession, a large numb ...

Week Four Review Questions and Problems

... The return on Japanese investment is now worth less in dollars. Therefore, the investor’s return will be less after the currency adjustment. EXAMPLE: Assume a Canadian investor in the Japanese market has a 30% gain in one year, but the Yen declines in value relative to the dollar by 10%. The percent ...

... The return on Japanese investment is now worth less in dollars. Therefore, the investor’s return will be less after the currency adjustment. EXAMPLE: Assume a Canadian investor in the Japanese market has a 30% gain in one year, but the Yen declines in value relative to the dollar by 10%. The percent ...

Performance Evaluation

... The initial value is compounded forward at the interest rate R because P0 is a "time-zero" value. The rest of the cash flows is split into two: half is modeled as being paid at the beginning (and thus needs to be compounded forward at the rate R), while the other half is modeled as being paid at the ...

... The initial value is compounded forward at the interest rate R because P0 is a "time-zero" value. The rest of the cash flows is split into two: half is modeled as being paid at the beginning (and thus needs to be compounded forward at the rate R), while the other half is modeled as being paid at the ...

Performance Evaluation

... because P0 is a "time-zero" value. The rest of the cash flows is split into two: half is modeled as being paid at the beginning (and thus needs to be compounded forward at the rate R), while the other half is modeled as being paid at the end and thus does not need any compounding since its "spot on ...

... because P0 is a "time-zero" value. The rest of the cash flows is split into two: half is modeled as being paid at the beginning (and thus needs to be compounded forward at the rate R), while the other half is modeled as being paid at the end and thus does not need any compounding since its "spot on ...

Phd Economics, Siena - Finance – Final exam (16 April 2014

... 3. A restaurant chain wants to open a new restaurant in Siena, and it has two options: 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with ...

... 3. A restaurant chain wants to open a new restaurant in Siena, and it has two options: 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with ...

View/Open - Pan Africa Christian University

... 2 million as capital for the project. Towards this end, he has approached the bank manager who has advised him to open a savings account with the bank and start depositing money every end of the month. The bank Manager has offered to pay martin a compound interest on deposits at a rate of 12% p.a. a ...

... 2 million as capital for the project. Towards this end, he has approached the bank manager who has advised him to open a savings account with the bank and start depositing money every end of the month. The bank Manager has offered to pay martin a compound interest on deposits at a rate of 12% p.a. a ...

1 - BrainMass

... 16. Which of the following statements is true of the relative attractiveness of the 2 proposed payment plans to the firm? a. both should be equally attractive b. the variable fee could be increased beyond $.25 per check and that plan could still be preferable c. the fixed fee plan is more attractive ...

... 16. Which of the following statements is true of the relative attractiveness of the 2 proposed payment plans to the firm? a. both should be equally attractive b. the variable fee could be increased beyond $.25 per check and that plan could still be preferable c. the fixed fee plan is more attractive ...

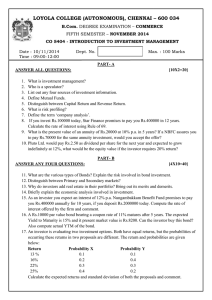

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... Calculate the rate of interest using Rule of 69. 9. What is the present value of an annuity of Rs.20000 at 10% p.a. in 5 years? If a NBFC assures you to pay Rs.70000 for the same annuity investment, would you accept the offer? 10. Pluto Ltd. would pay Rs.2.50 as dividend per share for the next year ...

... Calculate the rate of interest using Rule of 69. 9. What is the present value of an annuity of Rs.20000 at 10% p.a. in 5 years? If a NBFC assures you to pay Rs.70000 for the same annuity investment, would you accept the offer? 10. Pluto Ltd. would pay Rs.2.50 as dividend per share for the next year ...