performance summary contributors to performance detractors from

... Though the year-over-year Consumer Price Index (CPI) increased slightly in the first quarter, the portfolio managers do not see inflation as being problematic as there is very little ability to pass through higher commodity prices to consumers. Corporate bonds generally offer investors a significant ...

... Though the year-over-year Consumer Price Index (CPI) increased slightly in the first quarter, the portfolio managers do not see inflation as being problematic as there is very little ability to pass through higher commodity prices to consumers. Corporate bonds generally offer investors a significant ...

test two review problems

... The mode hourly wage is The median hourly wage is The mean (or average) hourly wage is 15. (refers to data in problem 13) The range of the hourly wages is The standard deviation of the hourly wages is ...

... The mode hourly wage is The median hourly wage is The mean (or average) hourly wage is 15. (refers to data in problem 13) The range of the hourly wages is The standard deviation of the hourly wages is ...

Can someone please provide some assistance with responding to the

... post below. The question the student answered was: what are the most critical concepts involved with successful capital structure patterns? Can certain steps be overlooked? Why or why not? I need help with writing a response to the students post below. My response has to be significant and advanced ...

... post below. The question the student answered was: what are the most critical concepts involved with successful capital structure patterns? Can certain steps be overlooked? Why or why not? I need help with writing a response to the students post below. My response has to be significant and advanced ...

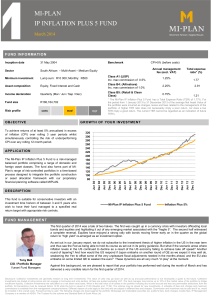

mi-plan ip inflation plus 5 fund

... investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are quoted excluding VAT. The fund manager may borrow up to 10% of the market value of the portfolio to bridge insufficient liquidity. Collective investments are calculated on a net asset value basis, whi ...

... investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are quoted excluding VAT. The fund manager may borrow up to 10% of the market value of the portfolio to bridge insufficient liquidity. Collective investments are calculated on a net asset value basis, whi ...

Schroders plc – Statement of financial position

... The distributable profits of Schroders plc are £2.3 billion (2014: £2.1 billion) and comprise retained profits of £2.4 billion (2014: £2.2 billion), included within the ‘Profit and loss reserve’, less amounts held within the own shares reserve. The Group’s ability to pay dividends is however restric ...

... The distributable profits of Schroders plc are £2.3 billion (2014: £2.1 billion) and comprise retained profits of £2.4 billion (2014: £2.2 billion), included within the ‘Profit and loss reserve’, less amounts held within the own shares reserve. The Group’s ability to pay dividends is however restric ...

CFI-Letterhead Template

... Assume a company is valued at $1,000,000 and is generating $60,000 in net profits a year. The Return on Asset (ROA) is therefore 6%. Is the return adequate or not? Here is how people tend to answer this question: 1. Business is operating at above breakeven so return is adequate. 2. The return is gre ...

... Assume a company is valued at $1,000,000 and is generating $60,000 in net profits a year. The Return on Asset (ROA) is therefore 6%. Is the return adequate or not? Here is how people tend to answer this question: 1. Business is operating at above breakeven so return is adequate. 2. The return is gre ...

UNIT 1:

... 1. Lexar is evaluating its financing requirements for the next year. Information regarding current year and expected sales and net income for the next year is presented below. The firm does not pay any dividends. What is the amount of discretionary financing need? ...

... 1. Lexar is evaluating its financing requirements for the next year. Information regarding current year and expected sales and net income for the next year is presented below. The firm does not pay any dividends. What is the amount of discretionary financing need? ...

Fund Facts

... should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Fund Managers Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purposes only and i ...

... should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Fund Managers Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purposes only and i ...

Risks in International Investing

... $2.00 / £. The one year forward exchange rate for the pound is $1.95/£. • How can you earn a riskless arbitrage profit based on these quotes? 1.Borrow $1 at 6.15%: Will owe $1.0615 in one year 2.Convert $1 to pounds: $1 / $2.00/£ = £0.50 3.Invest £0.50 at 10%: Will yield £.50 x 1.10 = £0.55. 4.Sell ...

... $2.00 / £. The one year forward exchange rate for the pound is $1.95/£. • How can you earn a riskless arbitrage profit based on these quotes? 1.Borrow $1 at 6.15%: Will owe $1.0615 in one year 2.Convert $1 to pounds: $1 / $2.00/£ = £0.50 3.Invest £0.50 at 10%: Will yield £.50 x 1.10 = £0.55. 4.Sell ...

bam_513financial_mangement_final_exam

... sales forecast for the preceding year and financial statements for the coming year. sales forecast for the coming year and the cash budget for the preceding year. cash budget for the coming year and sales forecast for the preceding year. sales forecast for the coming year and financial statements fo ...

... sales forecast for the preceding year and financial statements for the coming year. sales forecast for the coming year and the cash budget for the preceding year. cash budget for the coming year and sales forecast for the preceding year. sales forecast for the coming year and financial statements fo ...

Value Versus Growth - CORDA Investment Management

... The point being, predicting weather conditions, rain storms, and other events like droughts is plainly difficult. So, too, is attempting to predict or time the market. Since one cannot accurately predict when a single company will appreciate in value, building a diversified portfolio of companies w ...

... The point being, predicting weather conditions, rain storms, and other events like droughts is plainly difficult. So, too, is attempting to predict or time the market. Since one cannot accurately predict when a single company will appreciate in value, building a diversified portfolio of companies w ...

Acct 2220 Zeigler - GQ #3 (Chp 10)

... A. The return that a company must pay to attract investors and satisfy creditors. (Pg 302/303) B. The maximum acceptable rate of return on investments. C. The calculated internal rate of return on investments. D. The interest rate the bank charges its best customers. (No, typically called the “Prime ...

... A. The return that a company must pay to attract investors and satisfy creditors. (Pg 302/303) B. The maximum acceptable rate of return on investments. C. The calculated internal rate of return on investments. D. The interest rate the bank charges its best customers. (No, typically called the “Prime ...

Ch10std

... For stock returns, a more spread out distribution means there is a higher probability of returns being farther away from the mean (or expected return). For our estimate of the expected return, we can use the mean of returns from a sample of stock returns. For our estimate of the risk, we can u ...

... For stock returns, a more spread out distribution means there is a higher probability of returns being farther away from the mean (or expected return). For our estimate of the expected return, we can use the mean of returns from a sample of stock returns. For our estimate of the risk, we can u ...

Asset Allocation and Diversification

... decline, another might be enjoying growth and this can help provide positive returns. ...

... decline, another might be enjoying growth and this can help provide positive returns. ...

Lecture Presentation for Investments, 7e

... basis, they are now comparable with all other annualized returns. ...

... basis, they are now comparable with all other annualized returns. ...

chapter 10: arbitrage pricing theory and multifactor models of risk

... deviation decreases by a factor of 5 = 2.23607 (from $134,164 to $60,000). ...

... deviation decreases by a factor of 5 = 2.23607 (from $134,164 to $60,000). ...

WASATCH LARGE CAP VALUE PORTFOLIO

... from the representative accounts. Portfolio Characteristics are calculated by Wasatch using data from FactSet, Bloomberg and internal models. Est. 5-year EPS Growth %: Estimated percentage increase in earnings per share (EPS) per year of the portfolio’s holdings over the next 5 years. These returns ...

... from the representative accounts. Portfolio Characteristics are calculated by Wasatch using data from FactSet, Bloomberg and internal models. Est. 5-year EPS Growth %: Estimated percentage increase in earnings per share (EPS) per year of the portfolio’s holdings over the next 5 years. These returns ...

Answers8

... reject project B if the required return is 6 percent. II. always accept project A and always reject project B. III. always reject project A any time the discount rate is greater than 9 percent. IV. accept project A any time the discount rate is less than 9 percent. a. I and II only b. III and IV onl ...

... reject project B if the required return is 6 percent. II. always accept project A and always reject project B. III. always reject project A any time the discount rate is greater than 9 percent. IV. accept project A any time the discount rate is less than 9 percent. a. I and II only b. III and IV onl ...

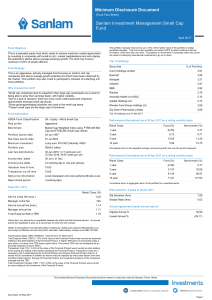

Sanlam Investment Management Small Cap Fund

... This is a philosophy which enables our fund managers to make rational - not emotional - decisions based on in-depth research. This gives them insight into what an asset is truly worth, not what investors are willing to pay based on greed or fear. We take a more practical (pragmatic) approach and inv ...

... This is a philosophy which enables our fund managers to make rational - not emotional - decisions based on in-depth research. This gives them insight into what an asset is truly worth, not what investors are willing to pay based on greed or fear. We take a more practical (pragmatic) approach and inv ...

letter to shareholders

... and (2) multiple expansion. Crescent has made a recent investment in Wal-Mart. We hesitate to discuss it because the position is so small, but we thought it beneficial to illustrate some of what we are finding to do in this current environment of relative value. We look at Wal-Mart as a bond with an ...

... and (2) multiple expansion. Crescent has made a recent investment in Wal-Mart. We hesitate to discuss it because the position is so small, but we thought it beneficial to illustrate some of what we are finding to do in this current environment of relative value. We look at Wal-Mart as a bond with an ...

investment portfolio management. objectives and constraints

... To assemble an optimal portfolio, the investment manager must have a clear understanding of the investor’s attitude toward risk and return. One way to assess investor’s risk tolerance is to ask them to examine subjective probability distributions for various portfolios and to indicate which combinat ...

... To assemble an optimal portfolio, the investment manager must have a clear understanding of the investor’s attitude toward risk and return. One way to assess investor’s risk tolerance is to ask them to examine subjective probability distributions for various portfolios and to indicate which combinat ...