Final February 9, 2002

... The riskless rate of interest is 0.06 per year, and the expected rate of return on the market portfolio is 0.15 per year. a. According to the CAPM, what is the efficient way for an investor to achieve an expected rate of return of 0.10 per year? (5 marks) b. If the standard deviation of the rate of ...

... The riskless rate of interest is 0.06 per year, and the expected rate of return on the market portfolio is 0.15 per year. a. According to the CAPM, what is the efficient way for an investor to achieve an expected rate of return of 0.10 per year? (5 marks) b. If the standard deviation of the rate of ...

Portfolio Selection and the Asset Allocation Decision

... Generates a frontier of efficient portfolios which are equally good Does not address the issue of riskless borrowing or lending Different investors will estimate the efficient frontier differently ...

... Generates a frontier of efficient portfolios which are equally good Does not address the issue of riskless borrowing or lending Different investors will estimate the efficient frontier differently ...

Quiz 3

... dividends on preferred stock _____ treated as an expense of the firm for tax purposes. a. b. c. d. e. ...

... dividends on preferred stock _____ treated as an expense of the firm for tax purposes. a. b. c. d. e. ...

Equity-Style Portfolio Construction

... groupings known as sub-styles. Examples: 1. Within either value or growth style, one could have sub-styles based on size: Small-Size Value, LargeSize Value, Small-Size Growth, Large-Size Growth. 2. Within either value or growth style, one could have sub-styles based on P/e, BV/MV, etc. 3. Within gro ...

... groupings known as sub-styles. Examples: 1. Within either value or growth style, one could have sub-styles based on size: Small-Size Value, LargeSize Value, Small-Size Growth, Large-Size Growth. 2. Within either value or growth style, one could have sub-styles based on P/e, BV/MV, etc. 3. Within gro ...

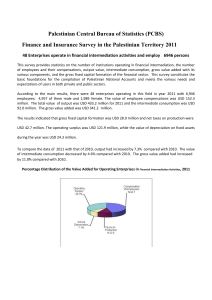

Palestinian Central Bureau of Statistics (PCBS) Finance and

... expectations of users in both private and public sectors. According to the main results, there were 48 enterprises operating in this field in year 2011 with 6,946 employees: 4,957 of them male and 1,989 female. The value of employee compensations was USD 152.3 million. The total value of output was ...

... expectations of users in both private and public sectors. According to the main results, there were 48 enterprises operating in this field in year 2011 with 6,946 employees: 4,957 of them male and 1,989 female. The value of employee compensations was USD 152.3 million. The total value of output was ...

BMFPA Presentation

... iFAST - Asia’s largest Wealth Management Platform •An Award winning and online Wealth Management Platform based in Singapore. •Providing solutions to financial advisors to help manage their clients portfolio with international standards and practices •Using high end technology, research and tools fo ...

... iFAST - Asia’s largest Wealth Management Platform •An Award winning and online Wealth Management Platform based in Singapore. •Providing solutions to financial advisors to help manage their clients portfolio with international standards and practices •Using high end technology, research and tools fo ...

Mackenzie Cundill Value Fund – Series C

... as of March 31, 2016 including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values ...

... as of March 31, 2016 including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values ...

AN0008 - ANZ Australian Equities Capital

... The only weakness in the market was in Telecommunications which fell 4.7% as heavyweight Telstra was downgraded on concerns its growth profile was flat to negative. However, Vocus rebounded +11.6% after experiencing tough market downgrades over the previous period. Interest rate-sensitive names acro ...

... The only weakness in the market was in Telecommunications which fell 4.7% as heavyweight Telstra was downgraded on concerns its growth profile was flat to negative. However, Vocus rebounded +11.6% after experiencing tough market downgrades over the previous period. Interest rate-sensitive names acro ...

Lecture9RiskAndReturnLessonsFromMarketHistory

... Average Stock Returns and RiskFree Returns • The Risk Premium – The added return (over and above the risk-free rate) resulting from bearing risk – One of the most significant observations of stock market data is the long-run excess of stock return over the risk-free return • Average excess return f ...

... Average Stock Returns and RiskFree Returns • The Risk Premium – The added return (over and above the risk-free rate) resulting from bearing risk – One of the most significant observations of stock market data is the long-run excess of stock return over the risk-free return • Average excess return f ...

How_Much_International

... While equilibrium levels exist only in the dreams of economists, we do know that cash flows follow returns, and returns are mean reverting. Were it not so, a country or region with sustained higher than global risk adjusted returns would eventually own all the world's capital. Perhaps it's possible, ...

... While equilibrium levels exist only in the dreams of economists, we do know that cash flows follow returns, and returns are mean reverting. Were it not so, a country or region with sustained higher than global risk adjusted returns would eventually own all the world's capital. Perhaps it's possible, ...

Another mixed year for world stock markets

... Sterling had a mixed year, which reduced the returns for UK investors in some foreign markets, but enhanced them in others. The pound was down 4.3% against the Japanese Yen, but up 5.5% against the Euro. The dollar rose by 5.1% against sterling, helped by the Fed’s long-awaited first interest rate r ...

... Sterling had a mixed year, which reduced the returns for UK investors in some foreign markets, but enhanced them in others. The pound was down 4.3% against the Japanese Yen, but up 5.5% against the Euro. The dollar rose by 5.1% against sterling, helped by the Fed’s long-awaited first interest rate r ...

home1

... c) Calculate the standard deviation of return for Intel and Washington Post d) Calculate the Sharpe Ratio for Intel and Washington Post over the period 2. Download the HP monthly stock data from http://finance.yahoo.com/q/hp?s=HPQ&a=00&b=2&c=1990&d=09&e=1&f=2006&g=m a) Calculate the monthly VAR at 9 ...

... c) Calculate the standard deviation of return for Intel and Washington Post d) Calculate the Sharpe Ratio for Intel and Washington Post over the period 2. Download the HP monthly stock data from http://finance.yahoo.com/q/hp?s=HPQ&a=00&b=2&c=1990&d=09&e=1&f=2006&g=m a) Calculate the monthly VAR at 9 ...

Cost of Capital Corporations often use different costs of capital for

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

Economics 471 Lecture 2 Elementary Probability, Portfolio Theory

... get a “tails”. If you flip tails immediately you get $2, if you flip one Head and then a Tail you get $4, and so forth: #H ...

... get a “tails”. If you flip tails immediately you get $2, if you flip one Head and then a Tail you get $4, and so forth: #H ...

Exchange Fund Results for 2003

... The reported investment return of 10.2% is computed in US dollar terms in accordance with AIMR Global Investment Performance Standards. The difference between investment return as reported and simple return is attributable primarily to the difference between gross assets at year-end and average inve ...

... The reported investment return of 10.2% is computed in US dollar terms in accordance with AIMR Global Investment Performance Standards. The difference between investment return as reported and simple return is attributable primarily to the difference between gross assets at year-end and average inve ...

aia-qb

... (a) Calculate the mean and standard deviation of the returns of securities A and B. (b) Calculate the covariance of returns of the two securities (c) Calculate the correlation coefficient of the returns of the two securities. (d) Calculate the risk and return of portfolios with the following weighti ...

... (a) Calculate the mean and standard deviation of the returns of securities A and B. (b) Calculate the covariance of returns of the two securities (c) Calculate the correlation coefficient of the returns of the two securities. (d) Calculate the risk and return of portfolios with the following weighti ...

Voluminous Data Can be Simplified to Inform Business Decisions

... frontier are sub-optimal, because they do not provide enough return for the level of risk or have a higher level of risk for the defined rate of return. ...

... frontier are sub-optimal, because they do not provide enough return for the level of risk or have a higher level of risk for the defined rate of return. ...

Question and Problem Answers Chapter 5

... 3) substitute in F1 to get Z = 11/9 Construct a portfolio of 7 /9 IBM, 11/9 AT&T and short sell Compaq. The portfolio’s betas will also be 1.0, 0.8, and 0.5 and the expected return is also 14.2%. ...

... 3) substitute in F1 to get Z = 11/9 Construct a portfolio of 7 /9 IBM, 11/9 AT&T and short sell Compaq. The portfolio’s betas will also be 1.0, 0.8, and 0.5 and the expected return is also 14.2%. ...

chapter 27 powerpoint abridged for students

... Example: Buy $1000 worth of Microsoft stock, hold for 30 years. If rate of return = 0.08, FV = $10,063 If rate of return = 0.10, FV = $17,450 THE BASIC TOOLS OF FINANCE ...

... Example: Buy $1000 worth of Microsoft stock, hold for 30 years. If rate of return = 0.08, FV = $10,063 If rate of return = 0.10, FV = $17,450 THE BASIC TOOLS OF FINANCE ...

Quarterly Newsletter - March 1999 : Pinney and Scofield : http://www

... We would like to use this letter to make a distinction between performance management and diversification management. We believe that diversification management is the safest and most reliable way to achieve a longterm acceptable rate of return on an investment portfolio. A diversified portfolio wil ...

... We would like to use this letter to make a distinction between performance management and diversification management. We believe that diversification management is the safest and most reliable way to achieve a longterm acceptable rate of return on an investment portfolio. A diversified portfolio wil ...

2 - JustAnswer

... for the developer has just offered you $190,000 for your land. If you accept this offer, what will be your holding period return on this investment? Percentage holding period return (based on equity investment only) = [($190,000 - $110,000)/$33,000] x 100% = 242.42% over the 6 month holding period. ...

... for the developer has just offered you $190,000 for your land. If you accept this offer, what will be your holding period return on this investment? Percentage holding period return (based on equity investment only) = [($190,000 - $110,000)/$33,000] x 100% = 242.42% over the 6 month holding period. ...

Solutions to Chapter 9

... The value of the portfolio for the equal weighted index is the simple average of the prices of the stocks in the index. For any week, the value of the index is the current simple average price of the stocks in the index divided by the average stock price for the first week of the index, multiplied b ...

... The value of the portfolio for the equal weighted index is the simple average of the prices of the stocks in the index. For any week, the value of the index is the current simple average price of the stocks in the index divided by the average stock price for the first week of the index, multiplied b ...