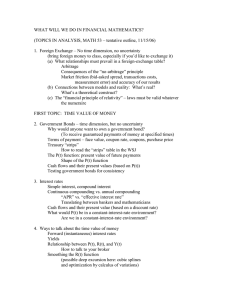

TopicsInAnalysis

... Does certainty equivalent depend on mean and variance? What does Barry Schwartz think of all this? 8. Uncertain future payments (uncertainty and time) Expected values of cash flows Higher discount rates as a proxy for uncertainty (Bringing in the lawyers: “We agree that the truth is between 3.2% and ...

... Does certainty equivalent depend on mean and variance? What does Barry Schwartz think of all this? 8. Uncertain future payments (uncertainty and time) Expected values of cash flows Higher discount rates as a proxy for uncertainty (Bringing in the lawyers: “We agree that the truth is between 3.2% and ...

FridayMarch28thMeeting - Sites at Lafayette

... $3 billions in bond sales Signed one year agreement with NYPA ...

... $3 billions in bond sales Signed one year agreement with NYPA ...

The cost of capital reflects the cost of funds

... A) fair market value minus the accounting value. B) original purchase price minus annual depreciation expense. C) original purchase price minus accumulated depreciation. D) depreciated value plus recaptured depreciation. Table 4 Computer Disk Duplicators, Inc. has been considering several capital in ...

... A) fair market value minus the accounting value. B) original purchase price minus annual depreciation expense. C) original purchase price minus accumulated depreciation. D) depreciated value plus recaptured depreciation. Table 4 Computer Disk Duplicators, Inc. has been considering several capital in ...

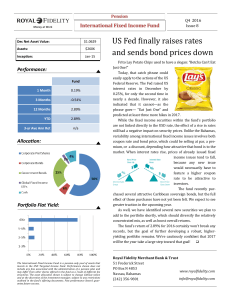

US Fed finally raises rates and sends bond prices down

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

Lecture 8

... – Based on the law of one price : two items that are the same cannot sell at different prices. – Requires fewer assumptions than CAPM – Assumption : each investor, when given the opportunity to increase the return of his portfolio without increasing risk, will do so. ...

... – Based on the law of one price : two items that are the same cannot sell at different prices. – Requires fewer assumptions than CAPM – Assumption : each investor, when given the opportunity to increase the return of his portfolio without increasing risk, will do so. ...

Investment Analysis

... o Raises the issue of measuring risk. o Raises the issue of suitable risk premia. Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, ...

... o Raises the issue of measuring risk. o Raises the issue of suitable risk premia. Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, ...

Mean-Variance Analysis in Portfolio Choice and Capital Markets. Frank J. Brochure

... In 1952, Harry Markowitz published "Portfolio Selection," a paper which revolutionized modern investment theory and practice. The paper proposed that, in selecting investments, the investor should consider both expected return and variability of return on the portfolio as a whole. Portfolios that mi ...

... In 1952, Harry Markowitz published "Portfolio Selection," a paper which revolutionized modern investment theory and practice. The paper proposed that, in selecting investments, the investor should consider both expected return and variability of return on the portfolio as a whole. Portfolios that mi ...

top fund fortissimo - (c)

... An asset's volatility is the standard deviation of its return. As a measure of dispersion, it evaluates the uncertainty of asset prices, which is often equated to their risk. Volatility can be calculated ex post (retrospectively) or estimated ex ante (anticipatively). YTM (Yield To Maturity) A yield ...

... An asset's volatility is the standard deviation of its return. As a measure of dispersion, it evaluates the uncertainty of asset prices, which is often equated to their risk. Volatility can be calculated ex post (retrospectively) or estimated ex ante (anticipatively). YTM (Yield To Maturity) A yield ...

FUTURES TRADING week two: recap and lessons

... The latest UK and international news, comment and analysis on soft commodities , agriculture companies and farm investment ...

... The latest UK and international news, comment and analysis on soft commodities , agriculture companies and farm investment ...

Word

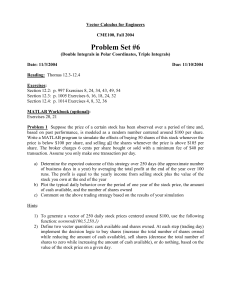

... Problem 1 Suppose the price of a certain stock has been observed over a period of time and, based on past performance, is modeled as a random number centered around $100 per share. Write a MATLAB program to simulate the effects of buying 50 shares of this stock whenever the price is below $100 per s ...

... Problem 1 Suppose the price of a certain stock has been observed over a period of time and, based on past performance, is modeled as a random number centered around $100 per share. Write a MATLAB program to simulate the effects of buying 50 shares of this stock whenever the price is below $100 per s ...

FIN 508: Financial Management

... 1. Find the present value, or future value, of various cash flows. 2. Calculate the intrinsic value of a stock or a bond. 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and return in portfolio management. 5. Apply the capital asset pricing model i ...

... 1. Find the present value, or future value, of various cash flows. 2. Calculate the intrinsic value of a stock or a bond. 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and return in portfolio management. 5. Apply the capital asset pricing model i ...

subject : c 306 business financial management

... a. The company will produce the detergent in a vacant facility that they renovated five years ago at a cost of $700,000. b. The company will need to use some equipment that it could have leased to another company. This equipment lease could have generated $200,000 per year in after-tax income. c. Th ...

... a. The company will produce the detergent in a vacant facility that they renovated five years ago at a cost of $700,000. b. The company will need to use some equipment that it could have leased to another company. This equipment lease could have generated $200,000 per year in after-tax income. c. Th ...

Schroder USD Bond Fund

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

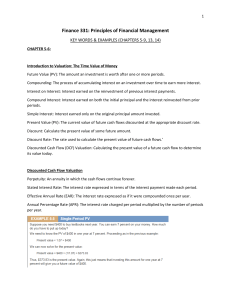

Finance Glossary

... Coupon: The stated interest payment made on a bond. Face Value: The principal amount of a bond that is repaid at the end of the term. Also called Par Value. Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the principal amount of a bond is pai ...

... Coupon: The stated interest payment made on a bond. Face Value: The principal amount of a bond that is repaid at the end of the term. Also called Par Value. Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the principal amount of a bond is pai ...

Expected Return Standard Deviation Increasing Utility

... Example: Suppose that the value of the Best Candy stock is sensitive to the price of sugar. In years when world sugar crops are low, the price of sugar increases and Best Candy suffers considerable ...

... Example: Suppose that the value of the Best Candy stock is sensitive to the price of sugar. In years when world sugar crops are low, the price of sugar increases and Best Candy suffers considerable ...

Presentation

... transactions • Indian experience– not quite “impossible trinity” but monetary policy hamstrung by flows • Different problems with inflows and outflows ...

... transactions • Indian experience– not quite “impossible trinity” but monetary policy hamstrung by flows • Different problems with inflows and outflows ...

EDITOR`S CORNER Managing Investments for

... An investor should demand acceptable risk, measured against all three objectives, while the manager adds value to at least two of the three measures most of the time. Although performance can be evaluated regularly, it is also important to recognize that the whims of the capital markets can bring ab ...

... An investor should demand acceptable risk, measured against all three objectives, while the manager adds value to at least two of the three measures most of the time. Although performance can be evaluated regularly, it is also important to recognize that the whims of the capital markets can bring ab ...

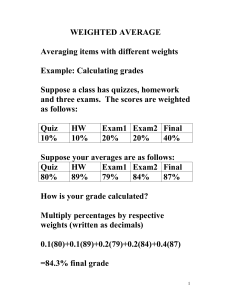

WEIGHTED AVERAGE Averaging items with different weights

... Let X be a variable that takes the values v1 , v 2 ,K , v N , and let w1 , w2 ,K , w N denote the respective weights for these values, with w1 + w2 + L + w N = 1 . The weighted average for X is given by: w1 ⋅ v1 + w2 ⋅ v 2 + L + w N ⋅ v N ...

... Let X be a variable that takes the values v1 , v 2 ,K , v N , and let w1 , w2 ,K , w N denote the respective weights for these values, with w1 + w2 + L + w N = 1 . The weighted average for X is given by: w1 ⋅ v1 + w2 ⋅ v 2 + L + w N ⋅ v N ...

Capital Budgeting - University of North Florida

... Because acquisition of long-term assets requires a period of time for the company to get its ‘money’ back Time lines should show all cash inflows and outflows Operating cash flows from revenues and expenses Investing cash flows from acquisition and disposition ...

... Because acquisition of long-term assets requires a period of time for the company to get its ‘money’ back Time lines should show all cash inflows and outflows Operating cash flows from revenues and expenses Investing cash flows from acquisition and disposition ...

INTERPRETATION AND METHODOLOGY Financial ratios Return

... 2. The ratios are calculated using the data from the last published Audited financial reports and last paid dividend. If the companies according to the requirements of Law, are preparing consolidated financial statements, for calculation of the ratios data from the consolidated statements will be us ...

... 2. The ratios are calculated using the data from the last published Audited financial reports and last paid dividend. If the companies according to the requirements of Law, are preparing consolidated financial statements, for calculation of the ratios data from the consolidated statements will be us ...

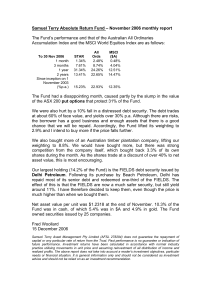

November 2006 - Samuel Terry

... at about 60% of face value, and yields over 30% p.a. Although there are risks, the borrower has a good business and enough assets that there is a good chance that we will be repaid. Accordingly, the Fund lifted its weighting to 2.9% and I intend to buy more if the price falls further. We also bought ...

... at about 60% of face value, and yields over 30% p.a. Although there are risks, the borrower has a good business and enough assets that there is a good chance that we will be repaid. Accordingly, the Fund lifted its weighting to 2.9% and I intend to buy more if the price falls further. We also bought ...

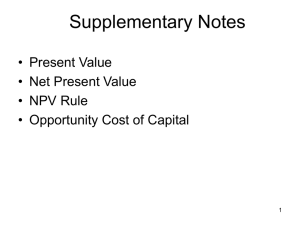

PPT

... • Replacing “1” with “t” allows the formula to be used for cash flows that exist at any point in time. ...

... • Replacing “1” with “t” allows the formula to be used for cash flows that exist at any point in time. ...