* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download FUTURES TRADING week two: recap and lessons

Survey

Document related concepts

Transcript

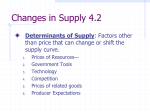

Evaluation group members Harmony Bee Lina Ruiji MFRE Portfolio Performance A DELIGHTFUL TREND Sep.23 Monday morning Sep.27 Friday Night Rank Username Portfolio Value %Return 1 ten017 101,109.32 1.11% 2 UBC-FRE501-Win2013-a 100,376.82 0.38% 3 sueyjiang 100,166.82 0.17% 4 jmfercov 100,049.32 0.05% 5 abamex 100,049.32 0.05% 6 UBC-FRE501-Win2013-b 100,049.32 0.05% 22% 78% POSITIVE RETURN INITIAL PERFORMANCE Rank Username Portfolio Value %Return 1 wrj1991 123,110.24 23.11% 2 behzad 116,407.81 16.41% 3 Amandaji 113,777.93 13.78% 4 LindaMao 109,653.15 9.65% 104,909.93 4.91% 5 48% Mia 52% 6 brendanmccaffery 103,652.77 3.65% 7 dongp 102,667.47 2.67% 8 Airlie 102,615.60 2.62% 9 YiwenChen 102,483.55 2.48% 10 sueyjiang 102,155.91 2.16% 11 Weilin 101,215.42 1.22% 12 yifeipeng 100,547.92 FINAL PERFORMANCE 0.55% 13 UBC-FRE501-Win2013-a 100,292.93 0.29% 14 UBC-FRE501-Win2013-b 100,090.44 0.09% MFRE Portfolio Performance Behzad PORTFOLIO VALUE %RETURN RANK $ 90,746.80 $113,777.93 $ 96,836.80 $116,407.81 $ 93,624.24 $123,110.24 - 9.25% 13.78% - 3.16% 16.41% - 6.38% 23.11% 24 17 20 3 2 1 MFRE Portfolio Performance Alex Rank 8 → 27 $99,574.30(-0.43%) $81,958.02(-18.04%) Mia Rank 27 → 5 $ 86,634.24(-13.37%) $104,909,93(4.91%) MFRE Portfolio Performance $ 93,286.66 -6.71% Rank 21 $128,321.17 28.32% Rank 1 $ 94,467.51 -5.53% Rank 22 MFRE Portfolio Performance Market Recap What Happened? Not a lot! It was a pretty quiet week! Until Monday’s USDA Report. Then things started to move quickly! (we’ll get to that in a minute) Soybeans What Was Going On Last Week? SOYBEAN week ending at 0.25% gain Surging US export sales – steady demand from China Corn What Was Going On Last Week? CORN week ending, advanced 0.65% First weekly gain in a month Prediction: downward trend as there is an improve in US midwest condition Wheat What Was Going On Last Week? WHEAT week ending, gain 5.4% Price climbing to two months high (robust demand): Argentina winter crop -- Argentina is one of the largest wheat exporter Flood in China – import more Wheat shortage in Russia – ban export USDA Grain Report USDA GRAIN REPORT : 11AM Monday September 30th DID YOU GO SHORT? USDA Grain Report CORN Futures plunged to a 3 year low closing at 441.5 USDA boosted its inventory estimates by 25%. “The market is going to be dealing with big corn supplies for the next year, and that’s going to limit rallies” Dale Durcholz (taken from bloomberg.com) There is talk of corn hitting a low of almost 400?! USDA Grain Report WHEAT Futures for December delivery fell 0.7% to 678.5 countering a price rise in the previous five sessions (the longest rally since mid-March). The report was in linen with expectations and upped its stock and production estimates and also revised world demand upwards. SOYBEANS Lost 2.75% (the largest drop in six months) and closed at 1,282.75 as supplies topped analyst estimates by 11% (original estimates of 661 bushels revised to 694 bushels). Inventories are at 141 bushels and demand predictions have tumbled 41% from August estimates. Strategies for the week ahead 1. Stay V.S Trade? 2. Notice harvest season & weather report 3. Think globally, act locally 4. don’t panic when prices shrink, believe your research 5. get up early! Resources and Information agfax.com Daily news updates on Southern cotton, rice, peanuts, corn, wheat and soybeans and information on insect, weed and disease control in row crops. futuresmag.com News, analysis, and strategies for futures, options, and derivative traders. Includes charts, daily columns, blogs, and video. commodityhq.com Educational content, analysis, and commentary regarding commodities and futures. agrimoney.com The latest UK and international news, comment and analysis on soft commodities , agriculture companies and farm investment Best 5 Blog Winners! Why You Rocked! Creativity was king… or at least it should be! (we’ll get into the reasons why in a minute) Assigned a ranking based on the following 4 criteria. Why You Rocked! Different Styles Airlie is the creativity Queen! Have you read her blog?!? You should! Not only did she analyze her portfolio and the market on a daily basis, but she brilliantly ties it all back the farm with stories from her childhood. Amanda is the Queen of strategy! Who needs Bloomberg. Maybe she’ll offer subscriptions. All the Top 5s Thoughtful and insightful analysis Original and easy to read Concise writing style with good flow Good strategizing Why You Rocked! BACK TO CREATIVITY.. Everyone’s blogs were excellent and a lot of work has gone into them but…. We spend all day tracking the market and the blogs are starting to look a bit like the financial news we see all day. Especially when we have to read 25 of them! step out of your comfort zone and embrace your inner storyteller! (next week’s review group, you can thank us later)