The Dividend Controversy

... who want higher dividends sell some shares to get cash. Those who want lower dividends use high dividends to buy more shares. ...

... who want higher dividends sell some shares to get cash. Those who want lower dividends use high dividends to buy more shares. ...

Lecture 7 a

... Growth can be derived from applying the return on equity to the percentage of earnings plowed back into operations. ...

... Growth can be derived from applying the return on equity to the percentage of earnings plowed back into operations. ...

Ch 24 Perf measurement 2/e

... Method II is not perfect, but is the best of the three techniques. It at least attempts to focus on market timing by examining the returns for portfolios constructed from bond market indexes using actual weights in various indexes versus year-average weights. The problem with this method is that the ...

... Method II is not perfect, but is the best of the three techniques. It at least attempts to focus on market timing by examining the returns for portfolios constructed from bond market indexes using actual weights in various indexes versus year-average weights. The problem with this method is that the ...

ThrIvenT LArge CAP vALue PorTfoLIo

... lower or higher than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-847-4836 or visit Thrivent.com for most recent month-end performance results. Periods less than one year are not an ...

... lower or higher than the performance data quoted. Market volatility can significantly affect short-term performance, and more recent returns may be different from those shown. Call 800-847-4836 or visit Thrivent.com for most recent month-end performance results. Periods less than one year are not an ...

chap5

... not vary too much over time, changes in the nominal interest rate will simply track changes in the inflation rate. However, this assumes that the inflation rate is easy to predict. Changes in the money supply are the primary determinant of the inflation rate and unfortunately, changes in the money ...

... not vary too much over time, changes in the nominal interest rate will simply track changes in the inflation rate. However, this assumes that the inflation rate is easy to predict. Changes in the money supply are the primary determinant of the inflation rate and unfortunately, changes in the money ...

15 Mosec

... • Although the senior tranche is expected to be paid off by July 15, cash flows till Nov 15 can be utilized if there is still principal outstanding. • Subordinated strip is 25.4% of total cash flows. • Senior tranche can withstand an overall default rate of 33% and still have 7% IRR (200 bps premium ...

... • Although the senior tranche is expected to be paid off by July 15, cash flows till Nov 15 can be utilized if there is still principal outstanding. • Subordinated strip is 25.4% of total cash flows. • Senior tranche can withstand an overall default rate of 33% and still have 7% IRR (200 bps premium ...

Governance, Transparency and Good Portfolio Management

... 3. Current Technology Challenges SILO SYSTEMS – Narrow Applicability: 1) Focus on only one asset (stocks/bonds) or one aspect (e.g., risk or performance measurement; trading) ...

... 3. Current Technology Challenges SILO SYSTEMS – Narrow Applicability: 1) Focus on only one asset (stocks/bonds) or one aspect (e.g., risk or performance measurement; trading) ...

Lecture 12

... It is important to understand the relation between risk and return so we can determine appropriate risk-adjusted discount rates for our NPV analysis. At least as important, the relation between risk and return is useful for investors (who buy securities), corporations (that sell securities to fi ...

... It is important to understand the relation between risk and return so we can determine appropriate risk-adjusted discount rates for our NPV analysis. At least as important, the relation between risk and return is useful for investors (who buy securities), corporations (that sell securities to fi ...

Some Lessons from Capital Market History

... • We can examine returns in the financial markets to help us determine the appropriate returns on non-financial assets • Lessons from capital market history – There is a reward for bearing risk – The greater the potential reward, the greater the risk – This is called the risk-return trade-off ...

... • We can examine returns in the financial markets to help us determine the appropriate returns on non-financial assets • Lessons from capital market history – There is a reward for bearing risk – The greater the potential reward, the greater the risk – This is called the risk-return trade-off ...

Short Duration Income Y Share Fund Fact Sheet

... sensitive the fund is to shifts in interest rates. Standard deviation measures how widely a set of values varies from the mean. It is a historical measure of the variability of return earned by an investment portfolio over a 3-year period. Consider these risks before investing: Putnam Short Duration ...

... sensitive the fund is to shifts in interest rates. Standard deviation measures how widely a set of values varies from the mean. It is a historical measure of the variability of return earned by an investment portfolio over a 3-year period. Consider these risks before investing: Putnam Short Duration ...

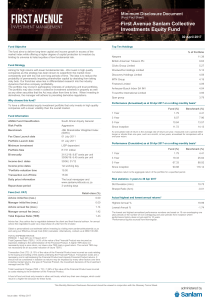

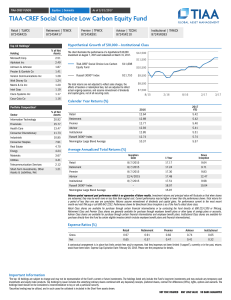

TIAA-CREF Social Choice Low Carbon Equity Fund

... Returns quoted represent past performance which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown. T ...

... Returns quoted represent past performance which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown. T ...

Georgia State University Student Managed Fund Portfolio

... Use the expected rate of return (K) that you calculated in #6 For simplicity, you can assume that the expected rate of return (K) is constant for both the high-growth period and the terminal period. Assume that Altria pays its annual dividend amount in a single lump payment at the end of each ...

... Use the expected rate of return (K) that you calculated in #6 For simplicity, you can assume that the expected rate of return (K) is constant for both the high-growth period and the terminal period. Assume that Altria pays its annual dividend amount in a single lump payment at the end of each ...

Engineering Economics - Inside Mines

... The acceptance or rejection of a project based on the IRR criterion is made by comparing the calculated rate with the required rate of return, or cutoff rate established by the firm. If the IRR exceeds the required rate the project should be accepted; if not, it should be rejected. If the required r ...

... The acceptance or rejection of a project based on the IRR criterion is made by comparing the calculated rate with the required rate of return, or cutoff rate established by the firm. If the IRR exceeds the required rate the project should be accepted; if not, it should be rejected. If the required r ...

FIN APPRAISAL Agriculture Projects

... • Cash flow prepared on an annual basis over the economic life of assets • Identify the costs and benefits • Compare incremental benefits with incremental costs • Income and expenditure pertaining to the investment alone to be reckoned • For deciding the price – price paid or received at the farm-ga ...

... • Cash flow prepared on an annual basis over the economic life of assets • Identify the costs and benefits • Compare incremental benefits with incremental costs • Income and expenditure pertaining to the investment alone to be reckoned • For deciding the price – price paid or received at the farm-ga ...

Assume that you recently graduated with a major in

... collects past-due debts; and American Foam manufactures mattresses and other foam products. Barney Smith also maintains an “index fund” which owns a market-weighted fraction of all publicly traded stocks; you can invest in that fund, and thus obtain average stock market results. Given the situation ...

... collects past-due debts; and American Foam manufactures mattresses and other foam products. Barney Smith also maintains an “index fund” which owns a market-weighted fraction of all publicly traded stocks; you can invest in that fund, and thus obtain average stock market results. Given the situation ...

AER Better Regulation Rate of Return Factsheet

... historical estimates of the MRP show a long term average of about 6 per cent. We also have regard to another financial model, the dividend growth model, to determine whether we should adopt an estimate above, below or consistent with the historical estimate. This is a symmetric consideration. As at ...

... historical estimates of the MRP show a long term average of about 6 per cent. We also have regard to another financial model, the dividend growth model, to determine whether we should adopt an estimate above, below or consistent with the historical estimate. This is a symmetric consideration. As at ...

BM410-08 Theory 1 - Risk and Return 20Sep05

... Using the historical risk premiums as your guide from the chart earlier, what is your estimate of the expected annual HPR on the S&P500 stock portfolio if the current risk-free interest rate is 5.0%. What does the risk premium represent? ...

... Using the historical risk premiums as your guide from the chart earlier, what is your estimate of the expected annual HPR on the S&P500 stock portfolio if the current risk-free interest rate is 5.0%. What does the risk premium represent? ...

Midterm 1 - Quantos Analytics

... 1. If shareholders are unhappy with a CEO’s performance, they are most likely to: (a) buy more shares in an effort to gain control of the firm. (b) file a shareholder resolution. (c) replace the CEO through a grassroots shareholder uprising. (d) Solution: sell their shares. 2. An investment is said ...

... 1. If shareholders are unhappy with a CEO’s performance, they are most likely to: (a) buy more shares in an effort to gain control of the firm. (b) file a shareholder resolution. (c) replace the CEO through a grassroots shareholder uprising. (d) Solution: sell their shares. 2. An investment is said ...

Solutions to Chapter 11

... 10. In 2010, the Dow was nearly four times its 1990 level. Therefore, in 2010, a 40-point movement was far less significant in percentage terms than it was in 1990. We would expect to see more 40-point days in 2010 even if market risk as measured by percentage returns is no higher than it was in 199 ...

... 10. In 2010, the Dow was nearly four times its 1990 level. Therefore, in 2010, a 40-point movement was far less significant in percentage terms than it was in 1990. We would expect to see more 40-point days in 2010 even if market risk as measured by percentage returns is no higher than it was in 199 ...

FIN550 final exam

... bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percent. 19. What is the expected sustainable growth rate? ...

... bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percent. 19. What is the expected sustainable growth rate? ...

capital investment

... Kinky's Copying Service is considering expanding operations to include new holographic color copying services. The new service is expected to result in additional sales of $600,000 in the first year, increasing by 12% per year as word of the color copies spreads. Labor and material costs are predict ...

... Kinky's Copying Service is considering expanding operations to include new holographic color copying services. The new service is expected to result in additional sales of $600,000 in the first year, increasing by 12% per year as word of the color copies spreads. Labor and material costs are predict ...

Segregation of Duties - Cash

... SEGREGATION OF DUTIES – CASH HANDLING The following matrix is to be used as a guide to determine if segregation of duties is sufficient to provide reasonable assurance that University assets and employees are protected. Consult with the Office of Business Affairs if your department needs assistance ...

... SEGREGATION OF DUTIES – CASH HANDLING The following matrix is to be used as a guide to determine if segregation of duties is sufficient to provide reasonable assurance that University assets and employees are protected. Consult with the Office of Business Affairs if your department needs assistance ...