Quarterly Report Q2/2016

... to 24.8 percent. We spent a total of 117 million euros for research and development, corresponding to a ratio to sales of 2.5 percent, which was 0.1 percentage points below the prior-year quarter. We reduced administrative expenses from 224 million euros to 211 million euros. At 4.5 percent, these a ...

... to 24.8 percent. We spent a total of 117 million euros for research and development, corresponding to a ratio to sales of 2.5 percent, which was 0.1 percentage points below the prior-year quarter. We reduced administrative expenses from 224 million euros to 211 million euros. At 4.5 percent, these a ...

Does Investor Identity Matter in Equity Issues

... indication of reduced agency problems. Alternatively, an increase in affiliated ownership may increase agency problems by allowing insiders to become more entrenched while the 4 We measure long-term abnormal returns beginning from 3-days prior to the announcement of the equity issue. So, even if the ...

... indication of reduced agency problems. Alternatively, an increase in affiliated ownership may increase agency problems by allowing insiders to become more entrenched while the 4 We measure long-term abnormal returns beginning from 3-days prior to the announcement of the equity issue. So, even if the ...

Wyndham Vacation Ownership

... actual results, performance or achievements of Wyndham Worldwide to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements. Important assum ...

... actual results, performance or achievements of Wyndham Worldwide to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements. Important assum ...

Free Cash Flow, Growth Opportunities, And Dividends: Does Cross

... as the resources not paid out as dividends (i.e., retained by the company) can be used to fund profitable projects which take advantage of the available growth opportunities. If lower dividend payments are not in place when growth opportunities are stronger, underinvestment in worthwhile projects ma ...

... as the resources not paid out as dividends (i.e., retained by the company) can be used to fund profitable projects which take advantage of the available growth opportunities. If lower dividend payments are not in place when growth opportunities are stronger, underinvestment in worthwhile projects ma ...

Admission Document

... Copies of this document will be available free of charge to the public during normal business hours on any day (except Saturdays, Sundays and public holidays) from the date of this document until the date which is one month after the date of Admission at the offices of the Company and from the Compa ...

... Copies of this document will be available free of charge to the public during normal business hours on any day (except Saturdays, Sundays and public holidays) from the date of this document until the date which is one month after the date of Admission at the offices of the Company and from the Compa ...

Policy Dialogue on Corporate Governance in China

... central government as part of its SOE reform strategy. In particular, the idea of establishing the first tier agency has not been tried at the central government level. In terms of the second tier institutions, however, the central government did take some relevant actions. Many parent companies of ...

... central government as part of its SOE reform strategy. In particular, the idea of establishing the first tier agency has not been tried at the central government level. In terms of the second tier institutions, however, the central government did take some relevant actions. Many parent companies of ...

CTAs: Shedding light on the black box

... derivatives of price such as volatility) to extract returns from markets. While CTAs as a strategy have been in existence since the 1970s, their stellar positive performance during the 2008 crisis attracted the attention (once again) of the investment community. This recent focus by allocators on th ...

... derivatives of price such as volatility) to extract returns from markets. While CTAs as a strategy have been in existence since the 1970s, their stellar positive performance during the 2008 crisis attracted the attention (once again) of the investment community. This recent focus by allocators on th ...

1 INVESTMENT: UNIT - 1 Investment involves making of a sacrifice

... have variable dividend and hence belong to the high risk high return category; preference shares and debentures have fixed returns with lower risk. The classification of corporate securities that can be chosen as investment avenues can be depicted as shown below. Equity Shares-: By investing in shar ...

... have variable dividend and hence belong to the high risk high return category; preference shares and debentures have fixed returns with lower risk. The classification of corporate securities that can be chosen as investment avenues can be depicted as shown below. Equity Shares-: By investing in shar ...

Maximum likelihood estimation of the equity premium

... dividends in a simple and econometrically-motivated way. As in the previous literature, our work is based on the long-run relation between prices, returns and dividends. However, our implementation is quite different, and grows directly out of maximum likelihood estimation of autoregressive process ...

... dividends in a simple and econometrically-motivated way. As in the previous literature, our work is based on the long-run relation between prices, returns and dividends. However, our implementation is quite different, and grows directly out of maximum likelihood estimation of autoregressive process ...

Westfield Form ADV Part 2A - Westfield Capital Management

... in Rule 205-3. In measuring clients' assets for the calculation of performance-based fees, Westfield will include realized and unrealized capital gains and losses. Performance-based fee arrangements may create an incentive for Westfield to recommend investments that may be riskier or more speculativ ...

... in Rule 205-3. In measuring clients' assets for the calculation of performance-based fees, Westfield will include realized and unrealized capital gains and losses. Performance-based fee arrangements may create an incentive for Westfield to recommend investments that may be riskier or more speculativ ...

hussman strategic dividend value fund

... $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The Example also takes into account that the investment m ...

... $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The Example also takes into account that the investment m ...

Analyst Recommendations, Mutual Fund Herding, and

... Finally, we find evidence that sell-herding by unskilled managers results in the strongest return reversals, which indicates that stock return reversals are primarily due to managers with short-term career concerns overreacting to analyst revisions. Unskilled managers do not appear to impact stock ...

... Finally, we find evidence that sell-herding by unskilled managers results in the strongest return reversals, which indicates that stock return reversals are primarily due to managers with short-term career concerns overreacting to analyst revisions. Unskilled managers do not appear to impact stock ...

Expected Returns on Major Asset Classes

... one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time and place for which it is being estimated. Other premia, or difference ...

... one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time and place for which it is being estimated. Other premia, or difference ...

Chap4

... fund assets through new flows from their clients. With the fund’s management and other fees spread over a larger number of dollars, the expense ratio should decline, providing a benefit to existing investors as well. According to the ICI (2007), 32 percent of stock mutual funds, 35 percent of bond m ...

... fund assets through new flows from their clients. With the fund’s management and other fees spread over a larger number of dollars, the expense ratio should decline, providing a benefit to existing investors as well. According to the ICI (2007), 32 percent of stock mutual funds, 35 percent of bond m ...

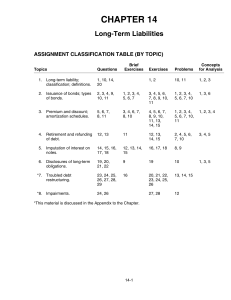

CHAPTER 14 Long-Term Liabilities

... 11. The call feature of a bond issue grants the issuer the privilege of purchasing, after a certain date at a stated price, outstanding bonds for the purpose of reducing indebtedness or taking advantage of lower interest rates. The call feature does not affect the amortization of bond discount or pr ...

... 11. The call feature of a bond issue grants the issuer the privilege of purchasing, after a certain date at a stated price, outstanding bonds for the purpose of reducing indebtedness or taking advantage of lower interest rates. The call feature does not affect the amortization of bond discount or pr ...

Prospectus published on 20 September 2013

... The number of holdings in the Portfolio will usually range between 60 and 80 when fully invested. Asset allocation Investment exposure to convertible securities will normally make up the majority of total assets and may take the form of convertible bonds, convertible notes, convertible preference sh ...

... The number of holdings in the Portfolio will usually range between 60 and 80 when fully invested. Asset allocation Investment exposure to convertible securities will normally make up the majority of total assets and may take the form of convertible bonds, convertible notes, convertible preference sh ...

Fundamentals Corporate Finance . pdf

... and sell products and services at a profit. In order to produce, it needs many assets— plant, equipment, offices, computers, technology, and so on. The company has to decide (1) which assets to buy and (2) how to pay for them. The financial manager plays a key role in both these decisions. The inves ...

... and sell products and services at a profit. In order to produce, it needs many assets— plant, equipment, offices, computers, technology, and so on. The company has to decide (1) which assets to buy and (2) how to pay for them. The financial manager plays a key role in both these decisions. The inves ...

FX Pulse - Morgan Stanley

... next. However, USD/JPY is one place where we expect USD gains to be moderate, especially as challenges to global risk appetite increase. Relative JPY strength is a likely result of increased asset market volatility. To capture this dynamic, we recommend short CAD/JPY positions. Bearish Commodity Cur ...

... next. However, USD/JPY is one place where we expect USD gains to be moderate, especially as challenges to global risk appetite increase. Relative JPY strength is a likely result of increased asset market volatility. To capture this dynamic, we recommend short CAD/JPY positions. Bearish Commodity Cur ...

WP123

... many credited Chile’s use of capital inflow controls in the late 1990s9 with shielding the economy from the currency crises that struck its Latin American peers. 10 The debate over capital controls shifted remarkably quickly, culminating in the IMF tentatively endorsing capital inflow controls in ce ...

... many credited Chile’s use of capital inflow controls in the late 1990s9 with shielding the economy from the currency crises that struck its Latin American peers. 10 The debate over capital controls shifted remarkably quickly, culminating in the IMF tentatively endorsing capital inflow controls in ce ...

Expected Returns on Major Asset Classes

... one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time and place for which it is being estimated. Other premia, or difference ...

... one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time and place for which it is being estimated. Other premia, or difference ...

IPE EDHEC-Risk Research Insights Spring 2014

... concentration but does not necessarily mean holding a well-diversified value index. It is in this spirit, as part of the Smart Beta 2.0 approach4, that ERI Scientific Beta offers smart factor indices that are constructed using ...

... concentration but does not necessarily mean holding a well-diversified value index. It is in this spirit, as part of the Smart Beta 2.0 approach4, that ERI Scientific Beta offers smart factor indices that are constructed using ...

мυнαммαd нαѕηαιη ѕαdιq - vuZs Virtual University Community

... ( Marks: 1 ) - Please choose one Which of the following statement is the best representative of vertical analysis? Vertical analysis in the income statement causes all accounts to be related as a percentage of net income. Vertical analysis in the balance sheet causes all accounts to be related as a ...

... ( Marks: 1 ) - Please choose one Which of the following statement is the best representative of vertical analysis? Vertical analysis in the income statement causes all accounts to be related as a percentage of net income. Vertical analysis in the balance sheet causes all accounts to be related as a ...

THIS DOCUMENT IS IMPORTANT AND REQUIRES

... nominated adviser and broker to the Company for the purposes of the AIM Rules for Companies and, as such, its responsibilities are owed solely to the London Stock Exchange and are not owed to the Company or any Director or any other entity or person in connection with this documen ...

... nominated adviser and broker to the Company for the purposes of the AIM Rules for Companies and, as such, its responsibilities are owed solely to the London Stock Exchange and are not owed to the Company or any Director or any other entity or person in connection with this documen ...