Do Cash Flows of Growth Stocks Really Grow Faster?

... to two streams of cash flows that have the same present values and the same first-year returns, analogous to two dividend streams in a Miller and Modigliani (1961) setting. On the one hand, rebalanced portfolios are the standard practice in empirical asset pricing (for example, Fama and French (1992)) ...

... to two streams of cash flows that have the same present values and the same first-year returns, analogous to two dividend streams in a Miller and Modigliani (1961) setting. On the one hand, rebalanced portfolios are the standard practice in empirical asset pricing (for example, Fama and French (1992)) ...

Utilities

... * @param dice list of dice representing the roll * @return true if dice contains three-of-a-kind, false otherwise * @throws IllegalArgumentException if dice.size() != Yahtzee.NUMBER_OF_DICE ...

... * @param dice list of dice representing the roll * @return true if dice contains three-of-a-kind, false otherwise * @throws IllegalArgumentException if dice.size() != Yahtzee.NUMBER_OF_DICE ...

Determinants of abnormal returns in mergers

... expected that managers time these decisions to accomplish the maximum gain for their shareholders. Investors are willing to pay more for equity shares when the economy is strong. Therefore it is to be expected that factors that portray a strong economy such as low inflation, a low interest rate and ...

... expected that managers time these decisions to accomplish the maximum gain for their shareholders. Investors are willing to pay more for equity shares when the economy is strong. Therefore it is to be expected that factors that portray a strong economy such as low inflation, a low interest rate and ...

A Closer Look at the Virtues of Dividend-Paying

... with less risk, with a low correlation with other investment styles, thereby making them excellent portfolio diversifiers. Within the small- and mid-cap universes in particular, dividend-paying stocks have compounded money over the past three decades at a rate significantly higher than non-dividend ...

... with less risk, with a low correlation with other investment styles, thereby making them excellent portfolio diversifiers. Within the small- and mid-cap universes in particular, dividend-paying stocks have compounded money over the past three decades at a rate significantly higher than non-dividend ...

Large Price Changes and Subsequent Returns

... • By comparing the number of firms that announce earnings early or late based on chronological order, Givoly and Palmon (1982) provide early evidence that bad news seems to be delayed whereas good news earnings are announced earlier. • Chambers and Penman (1984) find that the abnormal returns over t ...

... • By comparing the number of firms that announce earnings early or late based on chronological order, Givoly and Palmon (1982) provide early evidence that bad news seems to be delayed whereas good news earnings are announced earlier. • Chambers and Penman (1984) find that the abnormal returns over t ...

The Hedge Fund Landscape

... only offers the investor many of the positive characteristics of a managed account, but also, if sensibly structured, can reduce the burden on managers and, therefore, also adverse selection bias. One simplified way to think of it is as a separately managed account wrapped in a fund structure. A sep ...

... only offers the investor many of the positive characteristics of a managed account, but also, if sensibly structured, can reduce the burden on managers and, therefore, also adverse selection bias. One simplified way to think of it is as a separately managed account wrapped in a fund structure. A sep ...

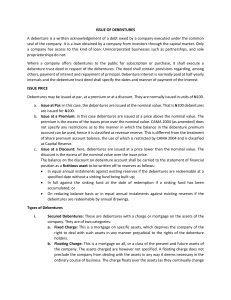

ISSUE OF DEBENTURES A debenture is a written

... company. Redeemable debentures may be redeemed at a premium (the company pays an amount higher than the nominal value of the debentures), at par (the company pays the nominal value), or at a discount (the company pays an amount lower than the nominal value of the debentures). It must be emphasised t ...

... company. Redeemable debentures may be redeemed at a premium (the company pays an amount higher than the nominal value of the debentures), at par (the company pays the nominal value), or at a discount (the company pays an amount lower than the nominal value of the debentures). It must be emphasised t ...

Integrated annual report and group annual financial statements

... Africa and, more recently, South-eastern Europe. Hyprop’s strategy is to own high-quality shopping centres in emerging markets, where such assets can be acquired or developed at attractive yields. Hyprop’s shopping centres dominate in terms of average size, which attracts new concept and flagship st ...

... Africa and, more recently, South-eastern Europe. Hyprop’s strategy is to own high-quality shopping centres in emerging markets, where such assets can be acquired or developed at attractive yields. Hyprop’s shopping centres dominate in terms of average size, which attracts new concept and flagship st ...

Essays in Financial Economics Sergey Iskoz

... Underwriter analysts issue recommendations that are on average more favorable than recommendations of other analysts. In Chapter 1, I investigate whether this bias matters for returns, and whether it matters for wealth redistribution between institutional and individual investors. I find that underw ...

... Underwriter analysts issue recommendations that are on average more favorable than recommendations of other analysts. In Chapter 1, I investigate whether this bias matters for returns, and whether it matters for wealth redistribution between institutional and individual investors. I find that underw ...

Essays on international capital flows and macroeconomic stability

... differently. Risk consistently affects bond flows more than share flows. The relationship between risk and portfolio flows is also found to be continuosly evolving and highly dependent on the macroeconomic environment. We further study the transmission channel linking portfolio flows to credit exten ...

... differently. Risk consistently affects bond flows more than share flows. The relationship between risk and portfolio flows is also found to be continuosly evolving and highly dependent on the macroeconomic environment. We further study the transmission channel linking portfolio flows to credit exten ...

private wealth and charitable planning seminar

... of trust administration in the United States has been changed forever. Possibly the most important of these changes in trust administration are those reflecting the movement to facilitate the ability of trustees to invest for total return in keeping with the notion of modern portfolio theory. It is ...

... of trust administration in the United States has been changed forever. Possibly the most important of these changes in trust administration are those reflecting the movement to facilitate the ability of trustees to invest for total return in keeping with the notion of modern portfolio theory. It is ...

Armour Residential REIT, Inc.

... reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of Agency Securities and interest rate contracts. Cash Cash includes cash on deposit with financial institutions and investments in high qua ...

... reporting period. Actual results could differ from those estimates. Significant estimates affecting the accompanying financial statements include the valuation of Agency Securities and interest rate contracts. Cash Cash includes cash on deposit with financial institutions and investments in high qua ...

Chapter 11 Dividend Policy

... Discuss the factors to be considered in formulating the dividend policy of a stock-exchange listed company. (10 marks) (ACCA F9 Financial Management December 2010 Q4(d)) ...

... Discuss the factors to be considered in formulating the dividend policy of a stock-exchange listed company. (10 marks) (ACCA F9 Financial Management December 2010 Q4(d)) ...

first capital realty inc.

... Our largest shareholder, the Gazit Group, is also a principal investor in Equity One. As a result of this transaction, we now participate in a bigger and more diversified U.S. portfolio with a highly experienced local management team. Subsequent to the Equity One transaction, our U.S. subsidiaries o ...

... Our largest shareholder, the Gazit Group, is also a principal investor in Equity One. As a result of this transaction, we now participate in a bigger and more diversified U.S. portfolio with a highly experienced local management team. Subsequent to the Equity One transaction, our U.S. subsidiaries o ...

Capital Flows to Developing Countries: The Allocation Puzzle

... developing countries seems to be the opposite of the predictions of the standard textbook model. This is the allocation puzzle. The main purpose of this paper being to establish the allocation puzzle, we run a number of robustness exercises. First, our main measure of capital inflows is very aggrega ...

... developing countries seems to be the opposite of the predictions of the standard textbook model. This is the allocation puzzle. The main purpose of this paper being to establish the allocation puzzle, we run a number of robustness exercises. First, our main measure of capital inflows is very aggrega ...

2013-2 ESMA Report - Review of practices related to

... accounting practices related to impairment testing of goodwill and other intangible assets. It evaluates the appropriateness of the related disclosures in the 2011 IFRS financial statements of a sample of 235 issuers with significant amounts of goodwill and includes recommendations to enhance the ap ...

... accounting practices related to impairment testing of goodwill and other intangible assets. It evaluates the appropriateness of the related disclosures in the 2011 IFRS financial statements of a sample of 235 issuers with significant amounts of goodwill and includes recommendations to enhance the ap ...

Financial Value of Brands in Mergers and Acquisitions: Is Value in

... was attributed to brands with the purchase of Gillette, and at other end, less than 1.51% was attributed to the brand value in the acquisition of Latitude by Cisco Systems. What is the source of heterogeneity in the target firms’ brand value across M&As? The extant marketing literature suggests that ...

... was attributed to brands with the purchase of Gillette, and at other end, less than 1.51% was attributed to the brand value in the acquisition of Latitude by Cisco Systems. What is the source of heterogeneity in the target firms’ brand value across M&As? The extant marketing literature suggests that ...

Chapter 28 Investment Policy and the Framework of the CFA Institute

... 24. Suppose that the pre-tax holding period returns on two stocks are the same. Stock A has a high dividend payout policy and stock B has a low dividend payout policy. If you are an individual in a high marginal tax bracket and do not intend to sell the stocks during the holding period, __________. ...

... 24. Suppose that the pre-tax holding period returns on two stocks are the same. Stock A has a high dividend payout policy and stock B has a low dividend payout policy. If you are an individual in a high marginal tax bracket and do not intend to sell the stocks during the holding period, __________. ...

Equilibrium interest rate and liquidity premium under

... transactions costs on both the rate of return on the liquid asset and the liquidity of the illiquid asset in the ...

... transactions costs on both the rate of return on the liquid asset and the liquidity of the illiquid asset in the ...

why doesn`t capital flow from rich to poor countries?

... 2 See Gertler and Rogoff (1990) and Gordon and Bovenberg (1996). 3 Before 1945, European imperial powers granted trading rights to monopoly companies, an action that created one-way flows. In theory a large capital-exporting economy can limit capital flows in order to push interest rates in a favora ...

... 2 See Gertler and Rogoff (1990) and Gordon and Bovenberg (1996). 3 Before 1945, European imperial powers granted trading rights to monopoly companies, an action that created one-way flows. In theory a large capital-exporting economy can limit capital flows in order to push interest rates in a favora ...

NBER WORKING PAPER SERIES Sergey Iskoz Jiang Wang

... However, in this example, we do not need a risk model to identify the informed manager. In fact, simply by looking at the distribution of P&L, we should be able to tell who the informed manager is. Figure 2 shows the unconditional distribution of the P&L for both the informed and the uninformed mana ...

... However, in this example, we do not need a risk model to identify the informed manager. In fact, simply by looking at the distribution of P&L, we should be able to tell who the informed manager is. Figure 2 shows the unconditional distribution of the P&L for both the informed and the uninformed mana ...