Kenon Holdings Ltd.

... proxies, to attend and vote on his or her behalf. A proxy need not be a shareholder of record (member). To vote by proxy, you should complete, sign and date the enclosed proxy card and return it promptly to Computershare in accordance with the instructions set forth in the AGM Notice, not less than ...

... proxies, to attend and vote on his or her behalf. A proxy need not be a shareholder of record (member). To vote by proxy, you should complete, sign and date the enclosed proxy card and return it promptly to Computershare in accordance with the instructions set forth in the AGM Notice, not less than ...

Investment consultants` recommendations of fund managers

... each consultant. We also use data on the actual performance of the products rated by consultants, their relevant benchmarks, and the capital allocated to each fund. We first analyze what drives consultants’ recommendations. We do so by comparing recommendations with various attributes of fund manag ...

... each consultant. We also use data on the actual performance of the products rated by consultants, their relevant benchmarks, and the capital allocated to each fund. We first analyze what drives consultants’ recommendations. We do so by comparing recommendations with various attributes of fund manag ...

Distress Anomaly and Shareholder Risk: International Evidence Assaf Eisdorfer

... The second explanation that we explore is the limits to arbitrage. Distressed stocks are harder to arbitrage (see, for example, CHS (2008) and Eisdorfer, Goyal, and Zhdanov (2013)). General market illiquidity exacerbates this effect, which makes distressed stocks more risky. We use two country-wide ...

... The second explanation that we explore is the limits to arbitrage. Distressed stocks are harder to arbitrage (see, for example, CHS (2008) and Eisdorfer, Goyal, and Zhdanov (2013)). General market illiquidity exacerbates this effect, which makes distressed stocks more risky. We use two country-wide ...

inventory cost flow method

... The weighted average cost method is a compromise between FIFO and LIFO. The effect of cost (price) trends is averaged in determining the cost of merchandise sold and the ending inventory. ...

... The weighted average cost method is a compromise between FIFO and LIFO. The effect of cost (price) trends is averaged in determining the cost of merchandise sold and the ending inventory. ...

Collateral Valuation In Clearing And Settlement System:

... addition, the SEC’s system of haircuts in the US is a one-month 95% Value-at-Risk measure. VaR can be calculated by either parametric or non-parametric approach. The nonparametric approach does not make any assumption about the shape of the loss random variable. The nature of asymmetric loss distrib ...

... addition, the SEC’s system of haircuts in the US is a one-month 95% Value-at-Risk measure. VaR can be calculated by either parametric or non-parametric approach. The nonparametric approach does not make any assumption about the shape of the loss random variable. The nature of asymmetric loss distrib ...

Communicating Asset Risk: How Name

... stronger home bias for risk judgments than for volatility judgments in our study. For the same reason, we also expected a smaller home bias effect on judgments of expected returns. The second irrational bias potentially used in asset choice as the result of providing investors with asset names is us ...

... stronger home bias for risk judgments than for volatility judgments in our study. For the same reason, we also expected a smaller home bias effect on judgments of expected returns. The second irrational bias potentially used in asset choice as the result of providing investors with asset names is us ...

Inflation and Real Estate Investments

... periods of high inflation. Possible solutions to this problem include computing a semicorrelation coefficient using data from only those months in which inflation was relatively high, or weighting each month according to the level of inflation during that month. Second, use of the contemporaneous co ...

... periods of high inflation. Possible solutions to this problem include computing a semicorrelation coefficient using data from only those months in which inflation was relatively high, or weighting each month according to the level of inflation during that month. Second, use of the contemporaneous co ...

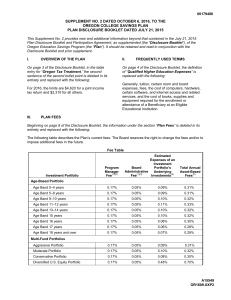

Disclosure Booklet - Oregon College Savings Plan

... Manager a fee at an annual rate of 0.17% of the average daily net assets of the Investment Portfolio. That annual rate for the Plan Manager Fee applies so long as the total assets in the Plan (with the exception of the Principal Plus Interest Portfolio) remain above $1.0 billion. If the total market ...

... Manager a fee at an annual rate of 0.17% of the average daily net assets of the Investment Portfolio. That annual rate for the Plan Manager Fee applies so long as the total assets in the Plan (with the exception of the Principal Plus Interest Portfolio) remain above $1.0 billion. If the total market ...

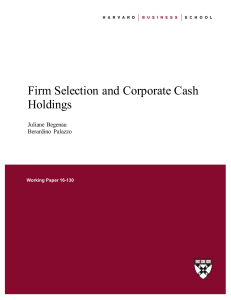

Firm Selection and Corporate Cash Holdings

... end, we construct random subsamples from the data that control for both selection effects so that (1) R&D–intensive entrants in the stock market have an average cash–to–assets ratio as in 1974-1978 (pre-secular increase), and (2) the proportion of R&D–intensive entrants is the same as in 1974-1978. ...

... end, we construct random subsamples from the data that control for both selection effects so that (1) R&D–intensive entrants in the stock market have an average cash–to–assets ratio as in 1974-1978 (pre-secular increase), and (2) the proportion of R&D–intensive entrants is the same as in 1974-1978. ...

A Natural Experiment on Dynamic Asset Allocation

... asset allocation. Suppose that a mutual fund manager is in charge of two portfolios one is aggressive and the other is conservative and both portfolios have a market value of $100. Given the current information set provided to her, the manager allocates $50 and $30 to common stocks for the aggre ...

... asset allocation. Suppose that a mutual fund manager is in charge of two portfolios one is aggressive and the other is conservative and both portfolios have a market value of $100. Given the current information set provided to her, the manager allocates $50 and $30 to common stocks for the aggre ...

Firm Selection and Corporate Cash Holdings

... end, we construct random subsamples from the data that control for both selection effects so that (1) R&D–intensive entrants in the stock market have an average cash–to–assets ratio as in 1974-1978 (pre-secular increase), and (2) the proportion of R&D–intensive entrants is the same as in 1974-1978. ...

... end, we construct random subsamples from the data that control for both selection effects so that (1) R&D–intensive entrants in the stock market have an average cash–to–assets ratio as in 1974-1978 (pre-secular increase), and (2) the proportion of R&D–intensive entrants is the same as in 1974-1978. ...

NBER WORKING PAPER SERIES AN EMPIRICAL INVESTIGATION

... institutions in the U.S. and Australia. As shown by Acemoglu, Johnson, and Robinson (2001, 2002), if European settlement was discouraged by diseases or if surplus extraction was more beneficial, then the European colonizers set up an institutional structure where the protection of property rights wa ...

... institutions in the U.S. and Australia. As shown by Acemoglu, Johnson, and Robinson (2001, 2002), if European settlement was discouraged by diseases or if surplus extraction was more beneficial, then the European colonizers set up an institutional structure where the protection of property rights wa ...

Why Does the Law of One Price Fail?

... mutual funds charge fees, showed how to calculate the impact of loads and expense ratios on portfolio value, and listed the expense ratio, load, and dollar cost of the expense ratio and load for a one-year $10,000 investment in each of the four funds participants could select. All of the fee sheet i ...

... mutual funds charge fees, showed how to calculate the impact of loads and expense ratios on portfolio value, and listed the expense ratio, load, and dollar cost of the expense ratio and load for a one-year $10,000 investment in each of the four funds participants could select. All of the fee sheet i ...

Portfolio Risk Calculation and Stochastic Portfolio Optimization by A

... 3. COPULA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...

... 3. COPULA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...

Margin Credit and Stock Return Predictability

... Consistent with our hypothesis of an inverse relationship between margin credit and future returns, we find that a one standard-deviation increase in MC predicts that the next month’s market return would be lower by 1.1 percentage point. MC generates an in-sample R2 value of 6.25% for next month’s r ...

... Consistent with our hypothesis of an inverse relationship between margin credit and future returns, we find that a one standard-deviation increase in MC predicts that the next month’s market return would be lower by 1.1 percentage point. MC generates an in-sample R2 value of 6.25% for next month’s r ...

Introduction to Share Buyback Valuation

... its current market price and holding the shares for eternity is called the value yield and is estimated using Monte Carlo simulation in [7]. For the S&P 500 index the estimated mean value yield is which is calculated from the current P/Book of the S&P 500 index. For the period 1984-2011 the mean val ...

... its current market price and holding the shares for eternity is called the value yield and is estimated using Monte Carlo simulation in [7]. For the S&P 500 index the estimated mean value yield is which is calculated from the current P/Book of the S&P 500 index. For the period 1984-2011 the mean val ...

Lyxor Index Fund December 2014

... Investment Company with Variable Capital (SICAV) incorporated under Luxembourg Law and listed on the official list of Undertakings for Collective Investment, authorised under Part I of the ...

... Investment Company with Variable Capital (SICAV) incorporated under Luxembourg Law and listed on the official list of Undertakings for Collective Investment, authorised under Part I of the ...

northstar realty europe corp. - corporate

... ability to divest non-strategic properties, our management’s track record and our ability to raise and effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that ...

... ability to divest non-strategic properties, our management’s track record and our ability to raise and effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that ...

Do Stocks with Dividends Outperform the Market during Recessions?

... was not irrelevant and investment policy was not the sole determinant of value in frictionless markets, a theoretical environment where all costs and constraints associated with transactions are non-existent. Miller and Modigliani’s assumptions forced one hundred percent free cash flow payout, there ...

... was not irrelevant and investment policy was not the sole determinant of value in frictionless markets, a theoretical environment where all costs and constraints associated with transactions are non-existent. Miller and Modigliani’s assumptions forced one hundred percent free cash flow payout, there ...