THIS DOCUMENT IS IMPORTANT AND REQUIRES

... nominated adviser and broker to the Company for the purposes of the AIM Rules for Companies and, as such, its responsibilities are owed solely to the London Stock Exchange and are not owed to the Company or any Director or any other entity or person in connection with this documen ...

... nominated adviser and broker to the Company for the purposes of the AIM Rules for Companies and, as such, its responsibilities are owed solely to the London Stock Exchange and are not owed to the Company or any Director or any other entity or person in connection with this documen ...

Trading Account: Items - IndiaStudyChannel.com

... Q. Discuss the role of accountants in modern business organization. (June 00) Role of Accountants in Modern Business Organization: Accounting is an age-old profession. In old days of accounting, the main function of an accountant was to maintain the records of the business. However over the years, t ...

... Q. Discuss the role of accountants in modern business organization. (June 00) Role of Accountants in Modern Business Organization: Accounting is an age-old profession. In old days of accounting, the main function of an accountant was to maintain the records of the business. However over the years, t ...

Inventory Valuation Practices and Reporting

... a flow of materials, or for a function it has to accomplish for a company (Friberg, Nilsson & Warnbring, 2006). Inventory represents a large (if not largest) portion of assets of manufacturing firms and as such, makes up an important part of the balance sheet items. It is, therefore, crucial for inv ...

... a flow of materials, or for a function it has to accomplish for a company (Friberg, Nilsson & Warnbring, 2006). Inventory represents a large (if not largest) portion of assets of manufacturing firms and as such, makes up an important part of the balance sheet items. It is, therefore, crucial for inv ...

SECURITIES AND EXCHANGE COMMISSION Washington, D. C.

... On January 13, 1999, two complaints were filed against the Company and its subsidiary, Lane Bryant, Inc., as well as other defendants, including many national retailers. Both complaints relate to labor practices allegedly employed on the island of Saipan, Commonwealth of the Northern Mariana Islands ...

... On January 13, 1999, two complaints were filed against the Company and its subsidiary, Lane Bryant, Inc., as well as other defendants, including many national retailers. Both complaints relate to labor practices allegedly employed on the island of Saipan, Commonwealth of the Northern Mariana Islands ...

- Backpack

... • There is no legal obligation for firms to pay dividends to common shareholders • Shareholders cannot force a Board of Directors to declare a dividend, and courts will not interfere with the BOD’s right to make the dividend decision because: – Board members are jointly and severally liable for any ...

... • There is no legal obligation for firms to pay dividends to common shareholders • Shareholders cannot force a Board of Directors to declare a dividend, and courts will not interfere with the BOD’s right to make the dividend decision because: – Board members are jointly and severally liable for any ...

Investor Preferences and Demand for Active Management

... we present several cross-sectional analyses which strengthen our main findings. We first group funds based upon the extent of their active management, as proxied by the active share measure (Cremers and Petajisto, 2009). More active funds can be more appealing to investors seeking upside potential o ...

... we present several cross-sectional analyses which strengthen our main findings. We first group funds based upon the extent of their active management, as proxied by the active share measure (Cremers and Petajisto, 2009). More active funds can be more appealing to investors seeking upside potential o ...

Placing and Admission to AIM

... Management (UK) Limited (“Belvoir”), has been drawn up in accordance with the AIM Rules for Companies. This document does not contain an offer of transferable securities to the public in the United Kingdom within the meaning of section 102B of the Financial Services and Markets Act 2000 (as amended) ...

... Management (UK) Limited (“Belvoir”), has been drawn up in accordance with the AIM Rules for Companies. This document does not contain an offer of transferable securities to the public in the United Kingdom within the meaning of section 102B of the Financial Services and Markets Act 2000 (as amended) ...

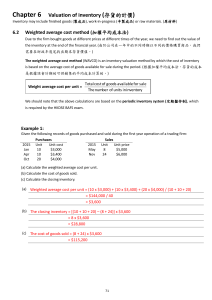

Chapter 6 Valuation of inventory (非流動資產折舊)

... Weighted average cost method (加權平均成本法) Due to the firm bought goods at different prices at different times of the year, we need to find out the value of the inventory at the end of the financial year. (由於公司在一年中的不同時期以不同的價格購買商品,我們 需要在財政年度尾找出期末存貨價值。) The weighted average cost method (WAVCO) is an inven ...

... Weighted average cost method (加權平均成本法) Due to the firm bought goods at different prices at different times of the year, we need to find out the value of the inventory at the end of the financial year. (由於公司在一年中的不同時期以不同的價格購買商品,我們 需要在財政年度尾找出期末存貨價值。) The weighted average cost method (WAVCO) is an inven ...

Informed Trading, Liquidity Provision, and Stock Selection by Mutual

... Funds (see Figure 1A). The investment paid o¤ after two years, when the stock price reached $40. The market eventually agreed with Mr. Gabelli, after Lufthansa took over HGC at $76 per share. See Greenwald, Kahn, Sonkin and Biema (2001) for details on this case. ...

... Funds (see Figure 1A). The investment paid o¤ after two years, when the stock price reached $40. The market eventually agreed with Mr. Gabelli, after Lufthansa took over HGC at $76 per share. See Greenwald, Kahn, Sonkin and Biema (2001) for details on this case. ...

Tick Size and Institutional Trading Costs: Evidence from Mutual Funds

... method of owning equities is through mutual funds.2 Therefore, to measure the impact of reducing the tick size on retail investors, one must examine mutual fund trading costs. We measure changes in mutual fund trading costs over the two recent tick size reductions in U.S. equity markets: the switch ...

... method of owning equities is through mutual funds.2 Therefore, to measure the impact of reducing the tick size on retail investors, one must examine mutual fund trading costs. We measure changes in mutual fund trading costs over the two recent tick size reductions in U.S. equity markets: the switch ...

Financial Markets and the Real Economy

... the market premium. The Fama–French model describes average returns of 25 size and book/market sorted portfolios given the average returns of the three-factor portfolios. But why is the average market return what it is? Why are the average returns of the Fama–French value and size portfolios what th ...

... the market premium. The Fama–French model describes average returns of 25 size and book/market sorted portfolios given the average returns of the three-factor portfolios. But why is the average market return what it is? Why are the average returns of the Fama–French value and size portfolios what th ...

RADIUS GOLD INC. (Form: 20-F, Received: 05/15

... Except where otherwise indicated, all information extracted from or based on the Consolidated Financial Statements of the Company are presented in accordance with IFRS. No dividends have been declared in any of the years presented above. Exchange Rate Information In this Annual Report, unless otherw ...

... Except where otherwise indicated, all information extracted from or based on the Consolidated Financial Statements of the Company are presented in accordance with IFRS. No dividends have been declared in any of the years presented above. Exchange Rate Information In this Annual Report, unless otherw ...

Semi-Annual Report

... With nearly all negative-yield debt concentrated in the Eurozone and Japan, we believe there should be little surprise there has been record demand at U.S. government debt auctions this year. In May, demand for two-, five-, and seven-year U.S. Treasury notes soared to all-time highs. Relative to eq ...

... With nearly all negative-yield debt concentrated in the Eurozone and Japan, we believe there should be little surprise there has been record demand at U.S. government debt auctions this year. In May, demand for two-, five-, and seven-year U.S. Treasury notes soared to all-time highs. Relative to eq ...

View the 2016 Financial Report

... ExperienceSM. True Value improved its performance in the J.D. Power Rankings and achieved the number one retailer position in the 2016 Temkin Experience Ratings. Also, through partnership with DreamWorks Animation to promote the Trolls movie, True Value became a paint destination by targeting young ...

... ExperienceSM. True Value improved its performance in the J.D. Power Rankings and achieved the number one retailer position in the 2016 Temkin Experience Ratings. Also, through partnership with DreamWorks Animation to promote the Trolls movie, True Value became a paint destination by targeting young ...

Analysing and Decomposing the Sources of Added

... To see this, we first introduce a formal decomposition of investor welfare in terms of performance and hedging benefits, and show that a residual term remains, which can be interpreted as a cross-effect emanating from the interaction between performance and hedging motives. This result, which we cal ...

... To see this, we first introduce a formal decomposition of investor welfare in terms of performance and hedging benefits, and show that a residual term remains, which can be interpreted as a cross-effect emanating from the interaction between performance and hedging motives. This result, which we cal ...

Discussion Document 92 (v 8) Assessment of Group Solvency

... inappropriate means1 may be used to develop double gearing and internal creation of capital. This can be performed through different channels using regulated or non-regulated entities. The assessment of capital adequacy on a group-wide basis should adjust for forms of intra-group transactions, inclu ...

... inappropriate means1 may be used to develop double gearing and internal creation of capital. This can be performed through different channels using regulated or non-regulated entities. The assessment of capital adequacy on a group-wide basis should adjust for forms of intra-group transactions, inclu ...

Income Statement

... The four criteria that must be met for revenue to be recognized under the accrual basis of accounting are (1) delivery has occurred or services have been rendered, (2) there is persuasive evidence of an arrangement for customer payment, (3) the price is fixed or determinable, and (4) collection is r ...

... The four criteria that must be met for revenue to be recognized under the accrual basis of accounting are (1) delivery has occurred or services have been rendered, (2) there is persuasive evidence of an arrangement for customer payment, (3) the price is fixed or determinable, and (4) collection is r ...

Is Default Risk Priced in Equity Returns?

... quarter 4)4 is reasonable. I measure a firm’s ME by its weekly ME, which is a stock’s price multiplied by the number of share outstanding on the last trading date of a week. The CDS data are the mid-premiums of 5-year senior CDSs from CMA. The prices of the same security from different data sources, ...

... quarter 4)4 is reasonable. I measure a firm’s ME by its weekly ME, which is a stock’s price multiplied by the number of share outstanding on the last trading date of a week. The CDS data are the mid-premiums of 5-year senior CDSs from CMA. The prices of the same security from different data sources, ...

The Performance of IPO Investment Strategies and Pseudo Market

... Initial Public Offerings (IPOs) frequently attract a lot of public attention due to extensive marketing and broad media coverage. In particular, IPOs often serve as a “gateway drug” to the stock market for private investors. For example, large IPOs like those of Deutsche Telekom AG and Deutsche Post ...

... Initial Public Offerings (IPOs) frequently attract a lot of public attention due to extensive marketing and broad media coverage. In particular, IPOs often serve as a “gateway drug” to the stock market for private investors. For example, large IPOs like those of Deutsche Telekom AG and Deutsche Post ...

prospectus

... offset arrangements, acquired fund fees and expenses, and extraordinary expenses) do not exceed an annual rate of 0.40% of the R6 Shares’ average daily net assets. This reimbursement arrangement may not be changed or terminated during this time period without approval of the Fund’s Board of Trustee ...

... offset arrangements, acquired fund fees and expenses, and extraordinary expenses) do not exceed an annual rate of 0.40% of the R6 Shares’ average daily net assets. This reimbursement arrangement may not be changed or terminated during this time period without approval of the Fund’s Board of Trustee ...

The Value Relevance of Financial Accounting Information - S-WoBA

... as a linear function of book value of equity and earnings assume efficient markets. This is often stated as a limitation to the inferences that can be made from the value relevance tests. However, as Barth et al. (2001) point out, share prices reflect investors´ consensus beliefs about the underlyin ...

... as a linear function of book value of equity and earnings assume efficient markets. This is often stated as a limitation to the inferences that can be made from the value relevance tests. However, as Barth et al. (2001) point out, share prices reflect investors´ consensus beliefs about the underlyin ...