Dynamic Correlation or Tail Dependence Hedging for Portfolio

... From a modeling perspective, our paper is inspired by the large literature on modeling asset comovements. Popular choices for the time-varying correlation phenomenon are multivariate GARCH models (e.g. Bollerslev et al. (1988) or the principal component GARCH of Alexander (2002)), the parsimonious ...

... From a modeling perspective, our paper is inspired by the large literature on modeling asset comovements. Popular choices for the time-varying correlation phenomenon are multivariate GARCH models (e.g. Bollerslev et al. (1988) or the principal component GARCH of Alexander (2002)), the parsimonious ...

Real Options, Volatility, and Stock Returns∗

... volatility by considering only part of return volatility. Second, by construction, it could be spuriously correlated with stock returns. Third, and most importantly, idiosyncratic volatility can be related to uncertainty about future growth rates, and, thus, it can be positively related to firm val ...

... volatility by considering only part of return volatility. Second, by construction, it could be spuriously correlated with stock returns. Third, and most importantly, idiosyncratic volatility can be related to uncertainty about future growth rates, and, thus, it can be positively related to firm val ...

Paper 16 - Institute of Cost Accountants of India

... qualifying asset, the amount of borrowing costs eligible for capitalisation on that asset should be determined as the actual borrowing costs incurred on that borrowing during the period. Hence, the capitalisation of borrowing costs should be restricted to the actual amount of interest expenditure i. ...

... qualifying asset, the amount of borrowing costs eligible for capitalisation on that asset should be determined as the actual borrowing costs incurred on that borrowing during the period. Hence, the capitalisation of borrowing costs should be restricted to the actual amount of interest expenditure i. ...

Griffin Institutional Access Real Estate Fund (Form: N

... repurchase offer. The Repurchase Offer Amount will be no less than 5% and no more than 25% of the total number of shares outstanding on the Repurchase Request Deadline. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarter ...

... repurchase offer. The Repurchase Offer Amount will be no less than 5% and no more than 25% of the total number of shares outstanding on the Repurchase Request Deadline. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarter ...

The Cross-Sectional Dispersion of Stock Returns, Alpha

... Samuelson [2004] argues that broader use of inexpensive equity indexing would boost wealth overall and make equity investors better off. French [2008] attempts to quantify this loss of wealth; he estimates that pursuing active rather than passive equity strategies caused investors’ average annual r ...

... Samuelson [2004] argues that broader use of inexpensive equity indexing would boost wealth overall and make equity investors better off. French [2008] attempts to quantify this loss of wealth; he estimates that pursuing active rather than passive equity strategies caused investors’ average annual r ...

Do Retail Trades Move Markets? - Faculty Directory | Berkeley-Haas

... Individual investors predominantly buy (sell) the same stocks as each other contemporaneously. Furthermore, they predominantly buy (or sell) the same stocks one week (or month) as they did the previous week (or month). (3) Stocks heavily bought by individual investors one week (i.e., stocks for whic ...

... Individual investors predominantly buy (sell) the same stocks as each other contemporaneously. Furthermore, they predominantly buy (or sell) the same stocks one week (or month) as they did the previous week (or month). (3) Stocks heavily bought by individual investors one week (i.e., stocks for whic ...

Analyszing the Cash and Carry Wholesaler`s Right of Existence in

... importance of the cash and carry wholesaler in the distribution channel. If there had been no room for the cash and carry wholesaler in the distribution channel, this market would not have grown so rapidly. Makro is pursuing even higher growth as expressed in the following objective: "Our objective ...

... importance of the cash and carry wholesaler in the distribution channel. If there had been no room for the cash and carry wholesaler in the distribution channel, this market would not have grown so rapidly. Makro is pursuing even higher growth as expressed in the following objective: "Our objective ...

Takeovers, Freezeouts, and Risk Arbitrage

... This paper develops a dynamic model of tender o¤ers in which there is trading on the target’s shares during the takeover, and bidders can freeze out target shareholders (compulsorily acquire remaining shares not tendered at the bid price), features that prevail on almost all takeovers. We show that ...

... This paper develops a dynamic model of tender o¤ers in which there is trading on the target’s shares during the takeover, and bidders can freeze out target shareholders (compulsorily acquire remaining shares not tendered at the bid price), features that prevail on almost all takeovers. We show that ...

Annual Report 2004 ¦ Zurich Financial Services

... Net income grew by 29 percent to USD 2.6 billion. This generated a return on equity of 13.3 percent, an increase of 1.2 percentage points compared with 2003. Our result was based on strong underlying improvements both in our General Insurance and Life Insurance businesses, record earnings contributi ...

... Net income grew by 29 percent to USD 2.6 billion. This generated a return on equity of 13.3 percent, an increase of 1.2 percentage points compared with 2003. Our result was based on strong underlying improvements both in our General Insurance and Life Insurance businesses, record earnings contributi ...

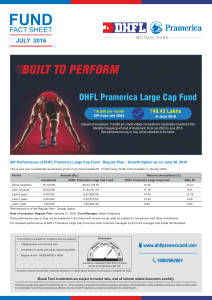

DHFL Pramerica Large Cap Fund

... ^ Scheme Benchmark. # Standard Benchmark. *Based on standard investment of ` 10,000 made at the beginning of the relevant period. Since Inception returns have been calculated from the date of inception till June 30, 2016. Past performance may or may not be sustained in future and should not be used ...

... ^ Scheme Benchmark. # Standard Benchmark. *Based on standard investment of ` 10,000 made at the beginning of the relevant period. Since Inception returns have been calculated from the date of inception till June 30, 2016. Past performance may or may not be sustained in future and should not be used ...

Panasonic acquired 57.01% of the outstanding shares in Zetes

... shares of Zetes, and Cobepa SA, holding 24.67% of the outstanding shares in Zetes, and certain other individual shareholders, including the management of Zetes, representing a total of 50.95% of outstanding shares in Zetes. ...

... shares of Zetes, and Cobepa SA, holding 24.67% of the outstanding shares in Zetes, and certain other individual shareholders, including the management of Zetes, representing a total of 50.95% of outstanding shares in Zetes. ...

Evaluation of Active Management of the Norwegian Government

... performance broken down by fixed income and equity strategies and by external vs. internal performance. NBIM also provided information about fees, capital allocations to external funds, and benchmarks returns, all in NOK. Given the sensitive nature of this information it is not all detailed in o ...

... performance broken down by fixed income and equity strategies and by external vs. internal performance. NBIM also provided information about fees, capital allocations to external funds, and benchmarks returns, all in NOK. Given the sensitive nature of this information it is not all detailed in o ...

Idiosyncratic Risk and the Cross-Section of Stock Returns Ren´

... The regime-switching model indicates clearly that the CSV is counter-cyclical, the dispersion of returns being high and quite variable when economic growth subsides. We analyze further the relation between CSV and economic and financial variables. In particular, we find that there exists a substanti ...

... The regime-switching model indicates clearly that the CSV is counter-cyclical, the dispersion of returns being high and quite variable when economic growth subsides. We analyze further the relation between CSV and economic and financial variables. In particular, we find that there exists a substanti ...

Weatherford International plc

... and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction w ...

... and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction w ...

Index Methodology Template w_Cover

... The primary accounting standard followed by MSCI is the local GAAP. If the company does not report in local GAAP but reports in other GAAPs, such as IAS or US GAAP, then MSCI will follow the latter. For a large number of European countries and some other countries in the Asia-Pacific, MSCI started f ...

... The primary accounting standard followed by MSCI is the local GAAP. If the company does not report in local GAAP but reports in other GAAPs, such as IAS or US GAAP, then MSCI will follow the latter. For a large number of European countries and some other countries in the Asia-Pacific, MSCI started f ...

Word - corporate

... to senior debt, such as senior bank debt, and are often unsecured. As such, other creditors may rank senior to us in the event of insolvency. However, mezzanine loans rank senior to common and preferred equity in a borrowers’ capital structure. Mezzanine loans may have both elements of debt and equi ...

... to senior debt, such as senior bank debt, and are often unsecured. As such, other creditors may rank senior to us in the event of insolvency. However, mezzanine loans rank senior to common and preferred equity in a borrowers’ capital structure. Mezzanine loans may have both elements of debt and equi ...

Liquidity transformation in asset management

... of equity and long-term corporate bond funds collected from the SEC form N-SAR filings. Importantly, our data set covers holdings of both cash and cash substitutes such as money market mutual fund shares. In recent years, cash substitutes have become an increasingly important source of liquidity for ...

... of equity and long-term corporate bond funds collected from the SEC form N-SAR filings. Importantly, our data set covers holdings of both cash and cash substitutes such as money market mutual fund shares. In recent years, cash substitutes have become an increasingly important source of liquidity for ...

Prospectus of Zurich Investment Funds ICVC

... of the Instrument of Incorporation is available on request from Zurich Investment Services (UK) Limited. This Prospectus has been issued for the purpose of section 21 of the Financial Services and Markets Act 2000 by Zurich Investment Services (UK) Limited. The distribution of this Prospectus in cer ...

... of the Instrument of Incorporation is available on request from Zurich Investment Services (UK) Limited. This Prospectus has been issued for the purpose of section 21 of the Financial Services and Markets Act 2000 by Zurich Investment Services (UK) Limited. The distribution of this Prospectus in cer ...

Cooperative Equity and Ownership: An Introduction

... companies, the more money a person invests, the more equity in the business he or she would own. Both control and financial rewards are driven by the amount of money invested and the more of one, the more of the other. Cooperatives are distinguished from other organizations in that member use, or pa ...

... companies, the more money a person invests, the more equity in the business he or she would own. Both control and financial rewards are driven by the amount of money invested and the more of one, the more of the other. Cooperatives are distinguished from other organizations in that member use, or pa ...

Measuring and explaining the volatility of capital flows towards

... all too often triggered financial crises with sometimes devastating consequences for the real economy. As a result, the volatility of capital flows has increasingly become a source of concern for policy-makers. Consequently, a number of countries have tried to hedge against this risk through ‘self-ins ...

... all too often triggered financial crises with sometimes devastating consequences for the real economy. As a result, the volatility of capital flows has increasingly become a source of concern for policy-makers. Consequently, a number of countries have tried to hedge against this risk through ‘self-ins ...

Estimating the Likelihood that a U.S. Multinational Firm Has Cash

... disclosures. We show that firms in the top decile of trapped cash based on our model hold approximately 15.9% of assets (8.1 times pre-tax foreign income) in foreign cash compared to 7.7% of assets (1.6 times pre-tax foreign income) for firms in the bottom decile of trapped cash (p-value=0.0004 and ...

... disclosures. We show that firms in the top decile of trapped cash based on our model hold approximately 15.9% of assets (8.1 times pre-tax foreign income) in foreign cash compared to 7.7% of assets (1.6 times pre-tax foreign income) for firms in the bottom decile of trapped cash (p-value=0.0004 and ...

The Closed-End Fund Market, 2014

... common shares to investors during an initial public offering. Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. Closed-end funds also are permitted to issue one class of preferred shares in ad ...

... common shares to investors during an initial public offering. Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. Closed-end funds also are permitted to issue one class of preferred shares in ad ...