Chapter 6

... Measuring Returns To measure the level of wealth created by an investment rather than the change in wealth, need to cumulate returns over time Cumulative Wealth Index, CWIn, over n periods, = WI (1 TR )(1 TR )...(1 TR ) ...

... Measuring Returns To measure the level of wealth created by an investment rather than the change in wealth, need to cumulate returns over time Cumulative Wealth Index, CWIn, over n periods, = WI (1 TR )(1 TR )...(1 TR ) ...

ACCT5341 SP05 Exam 1a 031405

... instruments booked at fair value on any reporting date would have what impact on hedge accounting? a. This would eliminate all hedge accounting treatments for financial instruments. [XXXXX Para 247 on Page 132] b. This would have no impact on SFAS 133 hedge accounting rules unless the FASB changed S ...

... instruments booked at fair value on any reporting date would have what impact on hedge accounting? a. This would eliminate all hedge accounting treatments for financial instruments. [XXXXX Para 247 on Page 132] b. This would have no impact on SFAS 133 hedge accounting rules unless the FASB changed S ...

preparing for rising interest rates

... increases. Narrowly focused investments typically exhibit higher volatility. Please see summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective. HYHG does not attempt to mitigate factors other than rising T ...

... increases. Narrowly focused investments typically exhibit higher volatility. Please see summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective. HYHG does not attempt to mitigate factors other than rising T ...

Lectures 5 - 7

... It is most commonly applied when valuing an entire business process or system compared to just individual assets. It includes not just the original cost, but also the soft costs of engineering, installation, maintenance, and add-ons. It will also reflect the benefits of marketing and distribut ...

... It is most commonly applied when valuing an entire business process or system compared to just individual assets. It includes not just the original cost, but also the soft costs of engineering, installation, maintenance, and add-ons. It will also reflect the benefits of marketing and distribut ...

“SFAS 157 identifies a fair value hierarchy to rank the reliability of

... Measurements, last September, corporations have begun to prepare for implementation. Additionally, SFAS 157 has led to an increased awareness of the concept of fair value by the private equity industry. The Private Equity Industry Guidelines Group (PEIGG) is in the process of revising its current va ...

... Measurements, last September, corporations have begun to prepare for implementation. Additionally, SFAS 157 has led to an increased awareness of the concept of fair value by the private equity industry. The Private Equity Industry Guidelines Group (PEIGG) is in the process of revising its current va ...

Real Options

... > Suppose that the price of oil is volatile > If the price of oil next year falls, the expected perpetual annual cash flows would be $0.8MM, resulting in a project NPV of ($2MM) > If the price rises, these cash flows will rise to $1.4MM, resulting in a project NPV of ...

... > Suppose that the price of oil is volatile > If the price of oil next year falls, the expected perpetual annual cash flows would be $0.8MM, resulting in a project NPV of ($2MM) > If the price rises, these cash flows will rise to $1.4MM, resulting in a project NPV of ...

IRS Releases 871(m) Final Regulations – New Tests for Dividend

... For these purposes, the delta of an equity derivative that is embedded in a debt instrument or other derivative is determined without taking into account changes in the market value of the debt instrument or other derivative that are not directly related to the equity element of the instrument. For ...

... For these purposes, the delta of an equity derivative that is embedded in a debt instrument or other derivative is determined without taking into account changes in the market value of the debt instrument or other derivative that are not directly related to the equity element of the instrument. For ...

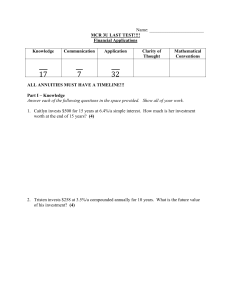

Test Chapter 8 Spring `14

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

Chapter 20

... Clearing and Margining • Premium payable in full by buyer (taker) and credited to account of seller (writer) at time of trade. • At the same time, seller must lodge a deposit with the Clearing House to ensure performance in the event of price movement adverse to the position of seller. • Deposit le ...

... Clearing and Margining • Premium payable in full by buyer (taker) and credited to account of seller (writer) at time of trade. • At the same time, seller must lodge a deposit with the Clearing House to ensure performance in the event of price movement adverse to the position of seller. • Deposit le ...

QFI CORE Model Solutions Fall 2014

... models, and their effectiveness in assessing financial strategies. Commentary on Question: Candidates are expected to list key characteristics of both the Gaussian (nonscalable) and fractal (scalable) models. Several candidates mentioned the same characteristic multiple times using different phrasin ...

... models, and their effectiveness in assessing financial strategies. Commentary on Question: Candidates are expected to list key characteristics of both the Gaussian (nonscalable) and fractal (scalable) models. Several candidates mentioned the same characteristic multiple times using different phrasin ...

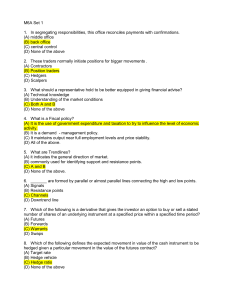

In segregating responsibilities, this office reconciles payments with

... 47. Technical and statistical analysis not only help identify the entry and exit points but also ______. (A) helps to identify the trend if there is one. (B) helps minimize loss. (C) ensures that there will be profit. (D) None of the above. 48. The type of hedge that can be used when the maturity da ...

... 47. Technical and statistical analysis not only help identify the entry and exit points but also ______. (A) helps to identify the trend if there is one. (B) helps minimize loss. (C) ensures that there will be profit. (D) None of the above. 48. The type of hedge that can be used when the maturity da ...

Working group results from the Târnava Marè focal area

... First session working group 2 (Târnava Marè) CBA framework and ecosystem services ...

... First session working group 2 (Târnava Marè) CBA framework and ecosystem services ...

Valuation of Financial Assets

... • If market price is less than intrinsic value, stock is undervalued and should be purchased. • If market price is greater than intrinsic value, stock is overvalued and should be sold. • If market price equals intrinsic value, stock is in equilibrium and may be held or purchased. ...

... • If market price is less than intrinsic value, stock is undervalued and should be purchased. • If market price is greater than intrinsic value, stock is overvalued and should be sold. • If market price equals intrinsic value, stock is in equilibrium and may be held or purchased. ...

BMO Asset Management Global Equity Fund

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

Practice Set #1 and Solutions

... The answer is that in a world with limited resources, money has a time value, or an alternative use. This gives rise to interest rates (and yield and returns etc.) that expresses the alternative use of money and thus resources over time. The simple outcome of this limited resource problem is that €1 ...

... The answer is that in a world with limited resources, money has a time value, or an alternative use. This gives rise to interest rates (and yield and returns etc.) that expresses the alternative use of money and thus resources over time. The simple outcome of this limited resource problem is that €1 ...

Revisiting the low volatility anomaly

... strategies and investing in index strategies that track them has become increasingly popular in recent years. However, it is important not to confuse the two, as they differ hugely in the outcome they are targeting, as shown in figure 2. Low volatility investing seeks to harness the premium in low v ...

... strategies and investing in index strategies that track them has become increasingly popular in recent years. However, it is important not to confuse the two, as they differ hugely in the outcome they are targeting, as shown in figure 2. Low volatility investing seeks to harness the premium in low v ...

IASB Update Note No. 6 – Peter Wright and Nick Dexter This is the

... IASB Update Note No. 6 – Peter Wright and Nick Dexter This is the sixth in a series of Notes covering the deliberations of the IASB on the issue of an insurance standard to replace IFRS 4. It is the first dealing with the period following publication in July 2010 of the Exposure Draft of the standar ...

... IASB Update Note No. 6 – Peter Wright and Nick Dexter This is the sixth in a series of Notes covering the deliberations of the IASB on the issue of an insurance standard to replace IFRS 4. It is the first dealing with the period following publication in July 2010 of the Exposure Draft of the standar ...

file

... Competing arguments: Low income households are • less mobile (relative income position and regional location) -> „trading up the ladder“ is less likely • Wages are less variable than other components of income therefore total income might be less variable (as long as employed) ...

... Competing arguments: Low income households are • less mobile (relative income position and regional location) -> „trading up the ladder“ is less likely • Wages are less variable than other components of income therefore total income might be less variable (as long as employed) ...