Note 3 Finansiell risikostyring_EN

... derivatives to hedge certain financial risk exposures. The objective of Hafslund’s risk management is to support the Group’s value creation and ensure the maintenance of a continued solid financial platform. Risk management frameworks and objectives comply with overall guidelines approved by the Boa ...

... derivatives to hedge certain financial risk exposures. The objective of Hafslund’s risk management is to support the Group’s value creation and ensure the maintenance of a continued solid financial platform. Risk management frameworks and objectives comply with overall guidelines approved by the Boa ...

PSSA 1.8 Percent and Simple Interest PSSA PREP

... In Chicago the sales tax on clothing is 8%. In Philadelphia there is no sales tax on clothing. How much more would you pay at a store in Chicago for a sweater that costs $79.99? ...

... In Chicago the sales tax on clothing is 8%. In Philadelphia there is no sales tax on clothing. How much more would you pay at a store in Chicago for a sweater that costs $79.99? ...

LG/15/11/1

... Measuring the volume of land • The Australian National Accounts includes commercial land as productive capital stock in its models for capital productivity and multi-factor productivity • Balance sheets are compiled on the basis that land volumes do change over time • Volume change may result from ...

... Measuring the volume of land • The Australian National Accounts includes commercial land as productive capital stock in its models for capital productivity and multi-factor productivity • Balance sheets are compiled on the basis that land volumes do change over time • Volume change may result from ...

Week Four Review Questions and Problems

... 8-5. Systematic risk is the variability in a security’s total returns that is directly associated with overall movements in the general market or economy. Nonsystematic risk is firm-specific, meaning that it only affects one firm or a small number of firms. Proper diversification cannot reduce syste ...

... 8-5. Systematic risk is the variability in a security’s total returns that is directly associated with overall movements in the general market or economy. Nonsystematic risk is firm-specific, meaning that it only affects one firm or a small number of firms. Proper diversification cannot reduce syste ...

Expected Cash Flow: a Novel Model of Evaluating Financial Assets

... The present paper aims to lay the foundation of a novel asset pricing model that would avoid the shortcomings of the universally recognised Discounted Cash Flow model (J. Williams, 1938), superseding the latter. The Discounted Cash Flow model (DCF) works good for explaining price formation for bank ...

... The present paper aims to lay the foundation of a novel asset pricing model that would avoid the shortcomings of the universally recognised Discounted Cash Flow model (J. Williams, 1938), superseding the latter. The Discounted Cash Flow model (DCF) works good for explaining price formation for bank ...

Edgeworth Binomial Trees - University of California, Berkeley

... skewness and greater-than-three kurtosis. Instead of specifying the entire risk-neutral distribution by the riskless return and volatility (as in the Black-Scholes case), this distribution is specified by its third and fourth central moments as well. An Edgeworth expansion is used to transform a sta ...

... skewness and greater-than-three kurtosis. Instead of specifying the entire risk-neutral distribution by the riskless return and volatility (as in the Black-Scholes case), this distribution is specified by its third and fourth central moments as well. An Edgeworth expansion is used to transform a sta ...

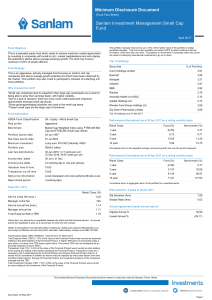

Sanlam Investment Management Small Cap Fund

... This is an aggressively managed, high-risk portfolio that aims to deliver capital growth over the long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified acr ...

... This is an aggressively managed, high-risk portfolio that aims to deliver capital growth over the long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified acr ...

УДК 336.7 JEL Code G10 С.М. ДЕНЬГА (Полтавський університет

... In the definition of a financial derivative according to P(S)A 13 [8] are allowed a inaccuracy, in particular, that this tool does not require any initial investment. With this statement we must be not agree because in particular for the opening of the first position on the stock exchange it is nece ...

... In the definition of a financial derivative according to P(S)A 13 [8] are allowed a inaccuracy, in particular, that this tool does not require any initial investment. With this statement we must be not agree because in particular for the opening of the first position on the stock exchange it is nece ...

MODEL MCQs – CAIIB, PAPER-2, MOD

... e. decision is inversely proportional to the number of estimates f. difficult to pinpoint the correct single estimate g. because it does not provide the extent of error h. a & c ...

... e. decision is inversely proportional to the number of estimates f. difficult to pinpoint the correct single estimate g. because it does not provide the extent of error h. a & c ...

INTRODUCING THE PRODUCER PRICE INDEX FOR SRI LANKA

... industry into a real value added. These industry measures of real value added are then divided by labor input to the industry to form estimates of industry labor productivity or are divided by an index of industry primary input usage to form estimate of industry total factor productivity. Productivi ...

... industry into a real value added. These industry measures of real value added are then divided by labor input to the industry to form estimates of industry labor productivity or are divided by an index of industry primary input usage to form estimate of industry total factor productivity. Productivi ...

Nonparametric Methods and Option Pricing

... Derivative securities are widely traded nancial instruments which inherit their statistical properties from those of the underlying assets and the features of the contract. The now famous Black and Scholes (1973) formula is one of the few cases where a call option is priced according to an analytic ...

... Derivative securities are widely traded nancial instruments which inherit their statistical properties from those of the underlying assets and the features of the contract. The now famous Black and Scholes (1973) formula is one of the few cases where a call option is priced according to an analytic ...

NaikLee RFS 90 - NYU Stern School of Business

... normal distributions agree with the properties of the empirical distribution of security prices. Diffusion price processes with a significant jump component could actually be one way to model times of high volatility in securities markets, such as we have observed in the past few years. Existing opt ...

... normal distributions agree with the properties of the empirical distribution of security prices. Diffusion price processes with a significant jump component could actually be one way to model times of high volatility in securities markets, such as we have observed in the past few years. Existing opt ...

Adjusting the Black-Scholes Framework in the Presence of a Volatility Skew

... • It is possible to borrow and lend cash at a known constant risk-free interest rate. • The price follows a Geometric Brownian motion with constant drift and volatility. • There are no transaction costs. • The stock does not pay a dividend. • All securities are perfectly divisible (i.e. it is possib ...

... • It is possible to borrow and lend cash at a known constant risk-free interest rate. • The price follows a Geometric Brownian motion with constant drift and volatility. • There are no transaction costs. • The stock does not pay a dividend. • All securities are perfectly divisible (i.e. it is possib ...

An introduction to diversification by risk factor PORTFOLIO INSIGHTS

... a closer look at the underlying risk factors in shares, bonds and property Last month’s edition of Portfolio Insights took a high level look at diversification and risk management. In this edition, we drill down further and consider how investors can achieve a truly diversified portfolio by intellig ...

... a closer look at the underlying risk factors in shares, bonds and property Last month’s edition of Portfolio Insights took a high level look at diversification and risk management. In this edition, we drill down further and consider how investors can achieve a truly diversified portfolio by intellig ...

Futures Contracts

... $210, you can allow the options to expire, which limits your loss to the price of the options. • If Apple’s stock is selling for $200 per share and you are convinced it will decline in price, you could engage in a short sale. With a short sale, you borrow the stock from your broker and sell it now, ...

... $210, you can allow the options to expire, which limits your loss to the price of the options. • If Apple’s stock is selling for $200 per share and you are convinced it will decline in price, you could engage in a short sale. With a short sale, you borrow the stock from your broker and sell it now, ...