An introduction to diversification by risk factor PORTFOLIO INSIGHTS

... a closer look at the underlying risk factors in shares, bonds and property Last month’s edition of Portfolio Insights took a high level look at diversification and risk management. In this edition, we drill down further and consider how investors can achieve a truly diversified portfolio by intellig ...

... a closer look at the underlying risk factors in shares, bonds and property Last month’s edition of Portfolio Insights took a high level look at diversification and risk management. In this edition, we drill down further and consider how investors can achieve a truly diversified portfolio by intellig ...

NOTEBOOK12.1 - Plymouth State College

... sources of funding. The two major sources are stocks (selling equity) and bonds (issuing debt), with a third, and not inconsequential, source being the internally generated capitalization from earnings. This area is also referred to as "the capital structure" decision, in which the financial manager ...

... sources of funding. The two major sources are stocks (selling equity) and bonds (issuing debt), with a third, and not inconsequential, source being the internally generated capitalization from earnings. This area is also referred to as "the capital structure" decision, in which the financial manager ...

Using the CAPM

... β will measure the percentage effect in the dependent variable that is caused by a 1 percent change in the independent variable (the slope of the regression line). And α will be the excess return on the security when the market’s excess return is zero (the Y intercept) Ri – Rf = α + β (Rm – Rf) + e ...

... β will measure the percentage effect in the dependent variable that is caused by a 1 percent change in the independent variable (the slope of the regression line). And α will be the excess return on the security when the market’s excess return is zero (the Y intercept) Ri – Rf = α + β (Rm – Rf) + e ...

GEM * Majeure Gestion d*Actifs

... You are a portfolio manager. The economic research team has given you the following expectations for the risk free rate, 2%, and the market return 8% with a variance of 18%. You can invest in a stock AA which has a covariance to the market portfolio of 0.56. 1) Graph the CML and situate the stock. W ...

... You are a portfolio manager. The economic research team has given you the following expectations for the risk free rate, 2%, and the market return 8% with a variance of 18%. You can invest in a stock AA which has a covariance to the market portfolio of 0.56. 1) Graph the CML and situate the stock. W ...

JDEP384hLecture12.pdf

... The key to getting a grip on pricing of derivatives is to keep the arbitrage principle in mind. Using it, one can verify A forward contract for delivery at time T of an asset with spot price S (0) at time t = 0 (now) has fair price given by F ...

... The key to getting a grip on pricing of derivatives is to keep the arbitrage principle in mind. Using it, one can verify A forward contract for delivery at time T of an asset with spot price S (0) at time t = 0 (now) has fair price given by F ...

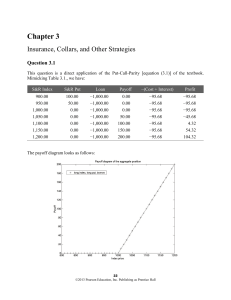

Chapter 3

... The strategy of buying a call (or put) and selling a call (or put) at a higher strike is called call (put) bull spread. In order to draw the profit diagrams, we need to find the future value of the cost of entering in the bull spread positions. We have: Cost of call bull spread: ($120.405 − $93.809) ...

... The strategy of buying a call (or put) and selling a call (or put) at a higher strike is called call (put) bull spread. In order to draw the profit diagrams, we need to find the future value of the cost of entering in the bull spread positions. We have: Cost of call bull spread: ($120.405 − $93.809) ...

Transfer pricing of intangibles

... Example: Price Premium Theory: an intangible can warrant a price premium over and above a generic product In practice: how much more you can charge for a bike with a Batman logo on it compared to the same bike without the logo premium ...

... Example: Price Premium Theory: an intangible can warrant a price premium over and above a generic product In practice: how much more you can charge for a bike with a Batman logo on it compared to the same bike without the logo premium ...

Perspective article: “Why the use of options as hedging instruments

... Options are commonly being used in the market as building blocks for different structured products. Some of the more ‘simple’ type of structured products, such as zero cost collars and participating forwards, are likely to qualify for hedge accounting under AASB 9. Zero cost collars consist of a com ...

... Options are commonly being used in the market as building blocks for different structured products. Some of the more ‘simple’ type of structured products, such as zero cost collars and participating forwards, are likely to qualify for hedge accounting under AASB 9. Zero cost collars consist of a com ...

Note 22 - Measurement of fair value of financial instruments

... market price utilised for financial assets is the applicable buy price, for financial liabilities the applicable sell price is used. These instruments are included in level 1. Instruments included in level 1 are exclusively equity instruments quoted on the Oslo Stock Exchange and classified as held ...

... market price utilised for financial assets is the applicable buy price, for financial liabilities the applicable sell price is used. These instruments are included in level 1. Instruments included in level 1 are exclusively equity instruments quoted on the Oslo Stock Exchange and classified as held ...

Pricing Volatility Derivatives with General Risk Functions Alejandro Balbás University Carlos III

... Using infinitely many options • Theorem 2: Let be a, b ∈ ℜ ∪ {−∞, ∞} and g : (a, b) → ℜ an arbitrary function such that g and its first derivative exist and are continuous out of a finite set D = {d1 < d 2 < ... < d m } ⊂ (a, b) . Suppose that g may be extended and become continuous on (a, d1 ] , a ...

... Using infinitely many options • Theorem 2: Let be a, b ∈ ℜ ∪ {−∞, ∞} and g : (a, b) → ℜ an arbitrary function such that g and its first derivative exist and are continuous out of a finite set D = {d1 < d 2 < ... < d m } ⊂ (a, b) . Suppose that g may be extended and become continuous on (a, d1 ] , a ...

Foreign Currency Derivatives

... Speculating in the options market • If Hans were to speculate in the options market, his viewpoint would determine what type of option to buy or sell • As a buyer of a call option, Hans purchases the August call on francs at a strike price of 58 ½ ($0.5850/Sfr) and a premium of 0.50 or $0.0050/Sfr ...

... Speculating in the options market • If Hans were to speculate in the options market, his viewpoint would determine what type of option to buy or sell • As a buyer of a call option, Hans purchases the August call on francs at a strike price of 58 ½ ($0.5850/Sfr) and a premium of 0.50 or $0.0050/Sfr ...

Measurement of Market Risk

... • Specified probability over a nominated period of time • Volatility in financial markets is calculated as the standard deviation of the percentage changes in the relevant asset price over a specified asset period • Volatility for calculation of VaR is specified as the standard deviation of the perc ...

... • Specified probability over a nominated period of time • Volatility in financial markets is calculated as the standard deviation of the percentage changes in the relevant asset price over a specified asset period • Volatility for calculation of VaR is specified as the standard deviation of the perc ...

Financial Reporting and Analysis Chapter 11 Web Solutions

... exercise price is below the $52 market price for Rugulo stock. (Remember, Kenton bought “put” options—options to sell Rugulo at $50 per share.) The options still have value on July 31 because there is some chance Rugolo’s stock will fall below $50 before the options expire. That’s what has happened ...

... exercise price is below the $52 market price for Rugulo stock. (Remember, Kenton bought “put” options—options to sell Rugulo at $50 per share.) The options still have value on July 31 because there is some chance Rugolo’s stock will fall below $50 before the options expire. That’s what has happened ...

Multiple-Choice Quiz (with answer key)

... Together with a Russian co-author, Professor Shiller conducted a survey in the U.S. and in Russia in 1991. The survey asked: ''Grain traders in capitalist countries sometimes hold grain without selling it, putting it in temporary storage in anticipation of higher prices later. Do you think this spec ...

... Together with a Russian co-author, Professor Shiller conducted a survey in the U.S. and in Russia in 1991. The survey asked: ''Grain traders in capitalist countries sometimes hold grain without selling it, putting it in temporary storage in anticipation of higher prices later. Do you think this spec ...

Analogy Based Valuation of Currency Options

... underlying currency follows jump diffusion and/or stochastic volatility, then the replicating portfolio argument fails regardless of transaction costs, and analogy makers cannot be arbitraged away. Siddiqi (2014) studies the implications of analogy making for equity index options and shows that it p ...

... underlying currency follows jump diffusion and/or stochastic volatility, then the replicating portfolio argument fails regardless of transaction costs, and analogy makers cannot be arbitraged away. Siddiqi (2014) studies the implications of analogy making for equity index options and shows that it p ...

Asset/Liability Management Day 4

... rates change when management at the bank say they change. We do know however that there is often some response to market rate changes. To model this sensitivity we use a Beta factor. This is the percentage of rate change each account will move with a 100 basis point movement in Fed Funds. ...

... rates change when management at the bank say they change. We do know however that there is often some response to market rate changes. To model this sensitivity we use a Beta factor. This is the percentage of rate change each account will move with a 100 basis point movement in Fed Funds. ...