CHAPTER 9 - U of L Class Index

... since the size and the time pattern of returns from the bond over its life are known amounts. Specifically, a bond promises to make interest payments during the life of the bond (usually every 6 months) plus payment of principal on the bond’s maturity date. With common stock, there are no such guara ...

... since the size and the time pattern of returns from the bond over its life are known amounts. Specifically, a bond promises to make interest payments during the life of the bond (usually every 6 months) plus payment of principal on the bond’s maturity date. With common stock, there are no such guara ...

Understanding Volatility/Standard Deviation within investment funds.

... Terms and conditions apply. Where relevant life assurance tax applies. This presentation is of a general nature and should not be relied upon without taking appropriate professional advice. The content is for information purposes only and does not constitute an offer or recommendation to invest in t ...

... Terms and conditions apply. Where relevant life assurance tax applies. This presentation is of a general nature and should not be relied upon without taking appropriate professional advice. The content is for information purposes only and does not constitute an offer or recommendation to invest in t ...

Schilling Ch 7

... rises above the exercise price, the value of the call rises with the value of the stock, dollar for dollar (thus the 45-degree angle) ...

... rises above the exercise price, the value of the call rises with the value of the stock, dollar for dollar (thus the 45-degree angle) ...

Online Appendix: Payoff Diagrams for Futures and Options

... Writing a put is the reverse of buying one. Again, the writer loses when the holder gains, so the maximum payoff is the premium. The best outcome for an option writer is to have the option expire worthless, so that it is never exercised. Looking at Figure 9A.6, we can see that the put writer’s losse ...

... Writing a put is the reverse of buying one. Again, the writer loses when the holder gains, so the maximum payoff is the premium. The best outcome for an option writer is to have the option expire worthless, so that it is never exercised. Looking at Figure 9A.6, we can see that the put writer’s losse ...

Solutions to Chapter 9

... decades. These increases, which resulted in large capital losses on long-term bonds, were almost surely unanticipated by investors who bought those bonds in prior years. The results from this period demonstrate the perils of attempting to measure “normal” maturity (or risk) premiums from historical ...

... decades. These increases, which resulted in large capital losses on long-term bonds, were almost surely unanticipated by investors who bought those bonds in prior years. The results from this period demonstrate the perils of attempting to measure “normal” maturity (or risk) premiums from historical ...

Institute of Actuaries of India Subject SA6 – Investment May 2013 Examinations

... rates are higher for longer terms since the risks/uncertainties would increase as the term increases thereby seeking higher returns for longer term. If there is a reversal in the yield curve whereby it has become downward sloping then it is abnormal and the trend in the market may be bearish. This c ...

... rates are higher for longer terms since the risks/uncertainties would increase as the term increases thereby seeking higher returns for longer term. If there is a reversal in the yield curve whereby it has become downward sloping then it is abnormal and the trend in the market may be bearish. This c ...

Quantitative Techniques and Financial Mathematics

... To calculate the present value,we discount the expected payoff by the rate of return offered by equivalent investment alternatives in the capital or financial markets.This rate of return is often called as discount rate,hurdle rate or oppurtunity cost of capital. It is referred to as oppurtunity cos ...

... To calculate the present value,we discount the expected payoff by the rate of return offered by equivalent investment alternatives in the capital or financial markets.This rate of return is often called as discount rate,hurdle rate or oppurtunity cost of capital. It is referred to as oppurtunity cos ...

Notes on Stochastic Finance

... c) Buy the risky asset using the amount St − e −r(T −t) K + e −r(T −t) K = St . d) Hold the risky asset until maturity (do nothing, constant portfolio strategy). e) At maturity T , hand in the asset to the option holder, who gives the price K in exchange. f) Use the amount K = e r(T −t) e −r(T −t) K ...

... c) Buy the risky asset using the amount St − e −r(T −t) K + e −r(T −t) K = St . d) Hold the risky asset until maturity (do nothing, constant portfolio strategy). e) At maturity T , hand in the asset to the option holder, who gives the price K in exchange. f) Use the amount K = e r(T −t) e −r(T −t) K ...

Document

... • A new concept is elicitability, that means that there exists a function such that one can measure whether a measure is better then another. • In other words, a measure is elicitable if it results from the optimization of a function. For example, minimizing a quadratic function yields the mean, whi ...

... • A new concept is elicitability, that means that there exists a function such that one can measure whether a measure is better then another. • In other words, a measure is elicitable if it results from the optimization of a function. For example, minimizing a quadratic function yields the mean, whi ...

Financial Derivatives and Hedging

... Using futures and forward markets as a vehicle to… “CATCH THE MARKET” Objective: “LOCKING IN A PRICE” ...

... Using futures and forward markets as a vehicle to… “CATCH THE MARKET” Objective: “LOCKING IN A PRICE” ...

The Details of our Investment Process

... conferences on an ongoing basis. We willingly lend our expertise to planning their financial futures and act as a resource for any investment or finance-related question they may have. We maintain high ethical standards and earn our clients’ trust over time. If we execute these responsibilities cons ...

... conferences on an ongoing basis. We willingly lend our expertise to planning their financial futures and act as a resource for any investment or finance-related question they may have. We maintain high ethical standards and earn our clients’ trust over time. If we execute these responsibilities cons ...

Time Value of Money

... account earns 8% interest compounded semi-annually. Assuming no other deposits were made, what will be the balance of the bank account at the end of 10 years? ...

... account earns 8% interest compounded semi-annually. Assuming no other deposits were made, what will be the balance of the bank account at the end of 10 years? ...

DETERMINANTS OF IMPLIED VOLATILITY FUNCTION ON THE

... collect from the NSE website. We consider only liquid prices of near month options, for which we carried out the following filtering criteria. First, we deleted the options closing prices with zero transactions. Second, we eliminated the last five trading days to expiration (as in the case of Beber, ...

... collect from the NSE website. We consider only liquid prices of near month options, for which we carried out the following filtering criteria. First, we deleted the options closing prices with zero transactions. Second, we eliminated the last five trading days to expiration (as in the case of Beber, ...

Jamie Arimany

... (or higher) 1yr interest next year, then go for option A. If you believe that the market will not offer interest rates as high as 9.04% then fix your money in for 2 years at 7% with option B. Examples with the Forward Rate ...

... (or higher) 1yr interest next year, then go for option A. If you believe that the market will not offer interest rates as high as 9.04% then fix your money in for 2 years at 7% with option B. Examples with the Forward Rate ...

4-_chap013_ppt_edited

... Both of them are items or activities when a contingent event occurs then the item or activity move on one of the sides... Letter of credits or guarantees are the examples of off balance sheet activities. If a customer default occur (who has been given a guarante) , the FI’s contingent liabilit ...

... Both of them are items or activities when a contingent event occurs then the item or activity move on one of the sides... Letter of credits or guarantees are the examples of off balance sheet activities. If a customer default occur (who has been given a guarante) , the FI’s contingent liabilit ...

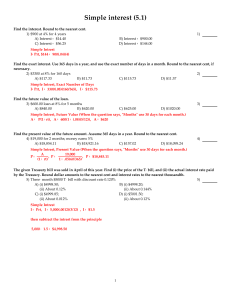

Simple interest (5.1)

... Find the payment made by the ordinary annuity with the given present value. 20) $50,000 monthly payments for 45 years; interest rate is 4.6% compounded monthly. A) $2,063,010.45 B) $14,695,906.14 C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity ...

... Find the payment made by the ordinary annuity with the given present value. 20) $50,000 monthly payments for 45 years; interest rate is 4.6% compounded monthly. A) $2,063,010.45 B) $14,695,906.14 C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity ...