Derivatives Market in inDia: a success story

... for membership in terms of capital continuation to the SEBI circular the limit. The NSCCL monitors the adequacy (net worth, security deposdated January 15, 2008, regarding CMs for initial margin violation and its, and so on) are quite stringent. the introduction of the volatility exposure margin vio ...

... for membership in terms of capital continuation to the SEBI circular the limit. The NSCCL monitors the adequacy (net worth, security deposdated January 15, 2008, regarding CMs for initial margin violation and its, and so on) are quite stringent. the introduction of the volatility exposure margin vio ...

Pioneers: Better be smart

... Last year, Lyxor, which has been in this area since 2008, joined forces with JP Morgan to launch a new range of risk-factor ETFs based on five factors that Lyxor research shows has a solid theoretical grounding. They include value, which it defines as a composite of book-toprice, earnings yield and ...

... Last year, Lyxor, which has been in this area since 2008, joined forces with JP Morgan to launch a new range of risk-factor ETFs based on five factors that Lyxor research shows has a solid theoretical grounding. They include value, which it defines as a composite of book-toprice, earnings yield and ...

Defensive or offensive?

... marginal cost of returns foregone when the markets were up. So tail-risk hedging is still worthwhile even if the expected payoff is negative. The marginal utility of returns is different, depending on where the overall market is. Positive returns during a lower-tail event like 2008 are much more val ...

... marginal cost of returns foregone when the markets were up. So tail-risk hedging is still worthwhile even if the expected payoff is negative. The marginal utility of returns is different, depending on where the overall market is. Positive returns during a lower-tail event like 2008 are much more val ...

Price/Book and Price/Sales Ratios

... Perhaps the biggest advantage of the price/sales ratio is that it is based on the difficult-to-manipulate sales figure. Also, because sales are generally more stable than earnings, price/sales (P/S) can be a good tool for sifting through cyclicals and other companies with fluctuating earnings. Take ...

... Perhaps the biggest advantage of the price/sales ratio is that it is based on the difficult-to-manipulate sales figure. Also, because sales are generally more stable than earnings, price/sales (P/S) can be a good tool for sifting through cyclicals and other companies with fluctuating earnings. Take ...

Extending Factor Models of Equity Risk to Credit Risk, Default Correlation, and Corporate Sustainability

... Include a term structure of interest rates so that as the implied expiration date moves around around, the interest rate changes appropriately If you choose Black-Scholes as your option model, then you can sol e BS for the implied time to expiration solve e piration using sing a Taylor Ta lor series ...

... Include a term structure of interest rates so that as the implied expiration date moves around around, the interest rate changes appropriately If you choose Black-Scholes as your option model, then you can sol e BS for the implied time to expiration solve e piration using sing a Taylor Ta lor series ...

Description of financial instruments and investment risks

... However the situation of the issuer (seller) of options, futures and forwards is different. The issuer must buy or sell the underlying assets for an agreed price. This means that, for example, if the holder decides to exercise the option then the option issuer must sell the underlying asset for an a ...

... However the situation of the issuer (seller) of options, futures and forwards is different. The issuer must buy or sell the underlying assets for an agreed price. This means that, for example, if the holder decides to exercise the option then the option issuer must sell the underlying asset for an a ...

Econ 231 / 232 Examples Using MAPLE

... Figure 3 clearly illustrates the bias of the quasi-linear utility function towards good y. Example three illustrates the similarities and differences between consumer and producer theory. The MAPLE syntax indicates that although they illustrate different economic concepts, clearly they are both prob ...

... Figure 3 clearly illustrates the bias of the quasi-linear utility function towards good y. Example three illustrates the similarities and differences between consumer and producer theory. The MAPLE syntax indicates that although they illustrate different economic concepts, clearly they are both prob ...

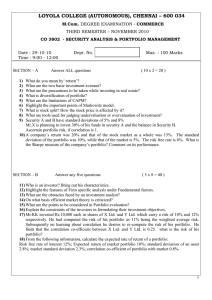

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 12) Highlight the features of Firm specific analysis under Fundamental factors. 13) What are the obstacles faced by an investment analyst? 14) On what basis efficient market theory is criticized? 15) What are the points to be considered in Portfolio evaluation? 16) Explain the constraints of the inv ...

... 12) Highlight the features of Firm specific analysis under Fundamental factors. 13) What are the obstacles faced by an investment analyst? 14) On what basis efficient market theory is criticized? 15) What are the points to be considered in Portfolio evaluation? 16) Explain the constraints of the inv ...

A EXTENDED WITH ROBUST OPTION REPLICATION FOR BLACK-

... When dealing with a stock price model such as (4) a delicate problem which has to be considered is the possibility of arbitrage opportunities. As a general result it is known that an arbitrage free stock price model admits an equivalent martingale measure and thus needs to be a semi-martingale at le ...

... When dealing with a stock price model such as (4) a delicate problem which has to be considered is the possibility of arbitrage opportunities. As a general result it is known that an arbitrage free stock price model admits an equivalent martingale measure and thus needs to be a semi-martingale at le ...

Actuarial Appraisal Value - Actuarial Considerations in Insurance

... banking community to measure the relative richness of a transaction. There are no hard and fast rules for presenting price/book; typically, investment bankers rely on reported numbers. The extent to which the ABV adjustments flow through to price/book may depend on the home jurisdiction of the acqui ...

... banking community to measure the relative richness of a transaction. There are no hard and fast rules for presenting price/book; typically, investment bankers rely on reported numbers. The extent to which the ABV adjustments flow through to price/book may depend on the home jurisdiction of the acqui ...

Ohio Deferred Compensation Investment Performance Report—As

... performance cannot guarantee future results. Current investment results may be lower or higher than quoted in this report. The principal value and investment return of an investment will fluctuate so that an investor's units/shares, when redeemed, may be worth more or less than their original cost. ...

... performance cannot guarantee future results. Current investment results may be lower or higher than quoted in this report. The principal value and investment return of an investment will fluctuate so that an investor's units/shares, when redeemed, may be worth more or less than their original cost. ...

Investment Process

... portfolio potential to produce long-term outperformance over the market. 5. Enforce Risk Controls in an Attempt to Reduce Risk • No individual position may exceed 10% of the portfolio and no one sector shall account for more than 40% of the portfolio. • The portfolio incorporates a dynamic real-time ...

... portfolio potential to produce long-term outperformance over the market. 5. Enforce Risk Controls in an Attempt to Reduce Risk • No individual position may exceed 10% of the portfolio and no one sector shall account for more than 40% of the portfolio. • The portfolio incorporates a dynamic real-time ...

CHAPTER 1: INTRODUCTION

... Factors driving the growth of derivative products 1.Increased volatility in asset prices in financial markets, 2. Increased integration of national financial markets with the international markets, 3. Marked improvement in communication facilities and sharp decline in their costs, 4. Develo ...

... Factors driving the growth of derivative products 1.Increased volatility in asset prices in financial markets, 2. Increased integration of national financial markets with the international markets, 3. Marked improvement in communication facilities and sharp decline in their costs, 4. Develo ...

7. Equivalent Martingale Measures So far we have considered

... pricing exploiting PDEs implied by arbitragefree portfolios. Another approach is to change the probability measure to another probability measure implied by arbitrage-free markets such that under that the (risk-free return discounted) prices become martingales. ...

... pricing exploiting PDEs implied by arbitragefree portfolios. Another approach is to change the probability measure to another probability measure implied by arbitrage-free markets such that under that the (risk-free return discounted) prices become martingales. ...

Prepare your portfolio for rising interest rates

... Important Risks: Mutual funds are actively managed and their characteristics will vary. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, ...

... Important Risks: Mutual funds are actively managed and their characteristics will vary. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, ...

A Brief Guide to Financial Derivatives and Hedge Funds

... Initially, they were used to reduce exposure to changes in foreign exchange rates, interest rates, or stock indexes. For example, if an American company expects payment for a shipment of goods in British Pound Sterling, it may enter into a derivative contract with another party to reduce the risk ...

... Initially, they were used to reduce exposure to changes in foreign exchange rates, interest rates, or stock indexes. For example, if an American company expects payment for a shipment of goods in British Pound Sterling, it may enter into a derivative contract with another party to reduce the risk ...

CASE 2

... In the world of skateboard attire, instinct and marketing savvy are prerequisites to success. Moogy Ellis had both. During 2013, his international skateboarding company, Ryan, rocketed to $900 million in sales after 10 years in business. His fashion line covered the skateboarders from head to toe wi ...

... In the world of skateboard attire, instinct and marketing savvy are prerequisites to success. Moogy Ellis had both. During 2013, his international skateboarding company, Ryan, rocketed to $900 million in sales after 10 years in business. His fashion line covered the skateboarders from head to toe wi ...

Why Has The Value Changed this Year

... a substantial increase in the value of that company’s stock. Similarly, a substantial decline in the cash flow capacity will normally result in a decline in value. Cash flow capacity is sometimes referred to as anticipated benefits. An important point to be made is that the anticipated benefits figu ...

... a substantial increase in the value of that company’s stock. Similarly, a substantial decline in the cash flow capacity will normally result in a decline in value. Cash flow capacity is sometimes referred to as anticipated benefits. An important point to be made is that the anticipated benefits figu ...

Foreign Currency Transactions and Hedging

... Derivative is used to hedge fair value exposure or cash flow exposure to foreign exchange risk Forward contracts are used for non-cancellable sales or purchase order o Highly effective if matches the terms of the underlying transaction o Critical terms: currency type/amount and settlement date ...

... Derivative is used to hedge fair value exposure or cash flow exposure to foreign exchange risk Forward contracts are used for non-cancellable sales or purchase order o Highly effective if matches the terms of the underlying transaction o Critical terms: currency type/amount and settlement date ...