Financial Accounting and Accounting Standards

... purchasing 1,000 metric tons of aluminum in January 2009. Allied wants to hedge the risk that it might pay higher prices for inventory in January 2009. Allied enters into an aluminum futures contract that gives Allied the right and the obligation to purchase 1,000 metric tons of aluminum for $1,550 ...

... purchasing 1,000 metric tons of aluminum in January 2009. Allied wants to hedge the risk that it might pay higher prices for inventory in January 2009. Allied enters into an aluminum futures contract that gives Allied the right and the obligation to purchase 1,000 metric tons of aluminum for $1,550 ...

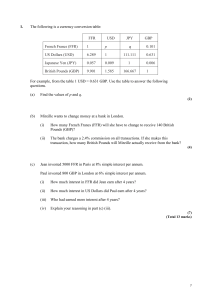

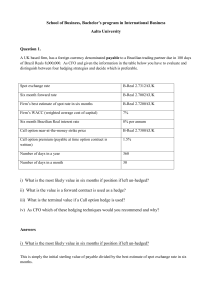

Practice Problems for FE 486B – Thursday, February 2, 2012 1

... 6) Explain what happens in an asset-price bubble. Explain what happens in an asset-price crash. In an asset price bubble, something else other than a change in the interest rate or a change in the expected income of the asset causes the asset price to rise. In most cases, the asset price rises becau ...

... 6) Explain what happens in an asset-price bubble. Explain what happens in an asset-price crash. In an asset price bubble, something else other than a change in the interest rate or a change in the expected income of the asset causes the asset price to rise. In most cases, the asset price rises becau ...

Market measures of performance and value

... To be able to summarise the concepts of value management and shareholder value-added. ...

... To be able to summarise the concepts of value management and shareholder value-added. ...

Fin 603 Week 11

... • Swap prices (in percentage yields) are approximately the average of the forward rates • The swap price represents the fixed rate that is an even trade-off for the bundle of FRAs ...

... • Swap prices (in percentage yields) are approximately the average of the forward rates • The swap price represents the fixed rate that is an even trade-off for the bundle of FRAs ...

Structural Models I

... Hedging Corporate Debt with Equity • An important implication of the Black-Scholes framework is that it is possible to hedge (in principle perfectly) an option with the underlying stock. • In the same way, the same framework implies that it should be possible to hedge the credit risk on a corporate ...

... Hedging Corporate Debt with Equity • An important implication of the Black-Scholes framework is that it is possible to hedge (in principle perfectly) an option with the underlying stock. • In the same way, the same framework implies that it should be possible to hedge the credit risk on a corporate ...

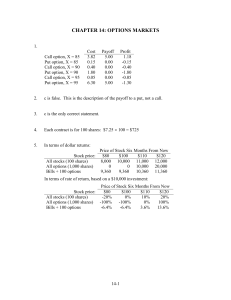

Introduction To Options - Michigan State University

... Mark Welch and James Mintert* Options give the agricultural industry a flexible pricing tool that helps with price risk management. Options offer a type of insurance against adverse price moves, require no margin deposits for buyers, and allow buyers to participate in favorable price moves. Commodit ...

... Mark Welch and James Mintert* Options give the agricultural industry a flexible pricing tool that helps with price risk management. Options offer a type of insurance against adverse price moves, require no margin deposits for buyers, and allow buyers to participate in favorable price moves. Commodit ...

Implied Trinomial Trees - EDOC HU - Humboldt

... and sell, respectively, at a fixed strike price at a given date. Options are important financial instruments used for hedging since they can be included into a portfolio to reduce risk. Corporate securities (e.g., bonds or stocks) may include option features as well. Last, but not least, some new finan ...

... and sell, respectively, at a fixed strike price at a given date. Options are important financial instruments used for hedging since they can be included into a portfolio to reduce risk. Corporate securities (e.g., bonds or stocks) may include option features as well. Last, but not least, some new finan ...

Summary on Financial Markets The three main functions of the

... Advantages of discounted cash flow models: • Easy to calculate. • Widely accepted in the analyst community. • FCFE model is useful for firms that currently do not pay a dividend. • Gordon growth model is useful for stable, mature, noncyclical firms. • Multistage models can be used for firms with non ...

... Advantages of discounted cash flow models: • Easy to calculate. • Widely accepted in the analyst community. • FCFE model is useful for firms that currently do not pay a dividend. • Gordon growth model is useful for stable, mature, noncyclical firms. • Multistage models can be used for firms with non ...

Currency Briefing Users Guide

... borrow and lend at the extremes of the band are unlimited. Other central banks use similar mechanisms. It is also notable that the target rates are generally short-term rates. The actual rate that borrowers and lenders receive on the market will depend on (perceived) credit risk, maturity and other ...

... borrow and lend at the extremes of the band are unlimited. Other central banks use similar mechanisms. It is also notable that the target rates are generally short-term rates. The actual rate that borrowers and lenders receive on the market will depend on (perceived) credit risk, maturity and other ...

monte carlo simulation in financial engineering

... is how to evaluate derivative securities “fairly”. Derivatives are financial instruments whose payoffs are derived from underlying market variables such as stock prices, commodity prices, market indices and interest rates, etc. A standard example of such derivatives is European options contingent on ...

... is how to evaluate derivative securities “fairly”. Derivatives are financial instruments whose payoffs are derived from underlying market variables such as stock prices, commodity prices, market indices and interest rates, etc. A standard example of such derivatives is European options contingent on ...

Vline Sample Page.pmd

... 9. The stock’s highest and lowest price of the year. 10. Dividend Yield—cash dividends estimated to be declared in the next 12 months divided by the recent price. 11. Target Price Range—the range in which a stock price is likely to trade in the years 2012-14. Also shown in the "Projections” box on t ...

... 9. The stock’s highest and lowest price of the year. 10. Dividend Yield—cash dividends estimated to be declared in the next 12 months divided by the recent price. 11. Target Price Range—the range in which a stock price is likely to trade in the years 2012-14. Also shown in the "Projections” box on t ...

Portfolio consists of assets with varying expected returns, risks and

... define a region bounded by a hyperbola called the Efficient Frontier which represents portfolios with the lowest risk for a given level of expected return, or equivalently portfolios with the highest expected return for given risk level. The Markowitz portfolio theory says that every rational invest ...

... define a region bounded by a hyperbola called the Efficient Frontier which represents portfolios with the lowest risk for a given level of expected return, or equivalently portfolios with the highest expected return for given risk level. The Markowitz portfolio theory says that every rational invest ...

Chapter 5

... with the same agreed-upon delivery price and underlying asset (based on mark to market). The margining of futures eliminates much of this credit risk by ...

... with the same agreed-upon delivery price and underlying asset (based on mark to market). The margining of futures eliminates much of this credit risk by ...

When Valuing a Manufacturing Business, Work With a Pro

... a firm’s entire fair market value. But because manufacturing companies are quite assetintensive, asset-based methods may have greater relevance and, therefore, may be weighted more heavily. As a result, appraisals of equipment, machinery and inventory play an important role in these valuations. ...

... a firm’s entire fair market value. But because manufacturing companies are quite assetintensive, asset-based methods may have greater relevance and, therefore, may be weighted more heavily. As a result, appraisals of equipment, machinery and inventory play an important role in these valuations. ...

pdf

... instruments. On the other hand they don’t tell an individual investor how best to invest his money. That’s the issue of portfolio optimization, which requires an entirely different type of analysis and is discussed in the course Capital Markets and Portfolio Theory. Importance of the forward price. ...

... instruments. On the other hand they don’t tell an individual investor how best to invest his money. That’s the issue of portfolio optimization, which requires an entirely different type of analysis and is discussed in the course Capital Markets and Portfolio Theory. Importance of the forward price. ...

Advanced Calculus with Financial Engineering

... • Computing implied volatility from the Black–Scholes model. • Risk–neutral pricing and the Black–Scholes formula. • Interpretation of the N (d1 ) and N (d2 ) terms from the Black–Scholes formula. • Actual and risk–neutral probabilities that European call or put options expire in the money. Textbook ...

... • Computing implied volatility from the Black–Scholes model. • Risk–neutral pricing and the Black–Scholes formula. • Interpretation of the N (d1 ) and N (d2 ) terms from the Black–Scholes formula. • Actual and risk–neutral probabilities that European call or put options expire in the money. Textbook ...

Derivatives

... Keynes and Hicks-- Speculators will only enter the market if they expect to have a positive profit. If more speculators are holding a long position, it implies that the futures price is less than the expected spot price A second explanation can be found by looking at the relationship between risk an ...

... Keynes and Hicks-- Speculators will only enter the market if they expect to have a positive profit. If more speculators are holding a long position, it implies that the futures price is less than the expected spot price A second explanation can be found by looking at the relationship between risk an ...