Valuation

... • Invoke standard arbitrage arguments by replicating the undeveloped reserve’s payoff by holding a portfolio of developed reserves and riskless bonds. – Holding nonproducing developed reserves feasible but inefficient – Holding producing developed reserves - works ...

... • Invoke standard arbitrage arguments by replicating the undeveloped reserve’s payoff by holding a portfolio of developed reserves and riskless bonds. – Holding nonproducing developed reserves feasible but inefficient – Holding producing developed reserves - works ...

foreign currency option - Dixie State University

... • Foreign currency options are financial contracts that give the holder the right, but not the obligation, to buy or sell a specified amount of currency at a predetermined price on or before a specified maturity date • The use of currency options as a speculative device for a buyer arise from the fa ...

... • Foreign currency options are financial contracts that give the holder the right, but not the obligation, to buy or sell a specified amount of currency at a predetermined price on or before a specified maturity date • The use of currency options as a speculative device for a buyer arise from the fa ...

Other binomial approaches –

... We have explored the equivalent martingale method for derivative pricing and also examined the central role of the replicating portfolio. Recall that for a European call option with strike price, k, and expiration date T, and letting t=0, the value of the derivative is equivalent to the expectation; ...

... We have explored the equivalent martingale method for derivative pricing and also examined the central role of the replicating portfolio. Recall that for a European call option with strike price, k, and expiration date T, and letting t=0, the value of the derivative is equivalent to the expectation; ...

Document

... Manage for tax efficiency: ETFs, traditional index funds, taxmanaged funds, individual stocks. Check to see if munis offer better after-tax return than comparable taxable bond funds. (Favorite firm for munis: Fidelity.) Use taxequivalent yield function of Morningstar’s Bond Calculator. Don’t go craz ...

... Manage for tax efficiency: ETFs, traditional index funds, taxmanaged funds, individual stocks. Check to see if munis offer better after-tax return than comparable taxable bond funds. (Favorite firm for munis: Fidelity.) Use taxequivalent yield function of Morningstar’s Bond Calculator. Don’t go craz ...

Dan diBartolomeo

... For firm’s with no debt or negative book value, we simply assume that non-survival will be coincident with stock price to zero, since a firm with a positive stock price should be able to sell shares to raise cash to pay debt If you have a stock with 40% a year volatility you need a 2.5 standard ...

... For firm’s with no debt or negative book value, we simply assume that non-survival will be coincident with stock price to zero, since a firm with a positive stock price should be able to sell shares to raise cash to pay debt If you have a stock with 40% a year volatility you need a 2.5 standard ...

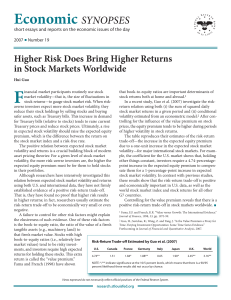

Higher Risk Does Bring Higher Returns in Stock Markets Worldwide

... that book-to-equity ratios are important determinants of market volatility—that is, the size of fluctuations in stock returns both at home and abroad.1 In a recent study, Guo et al. (2007) investigate the riskstock returns—to gauge stock market risk. When riskreturn relation using both (i) the sum o ...

... that book-to-equity ratios are important determinants of market volatility—that is, the size of fluctuations in stock returns both at home and abroad.1 In a recent study, Guo et al. (2007) investigate the riskstock returns—to gauge stock market risk. When riskreturn relation using both (i) the sum o ...

U.S. EQUITY HIGH VOLATILITY PUT WRITE INDEX FUND (NYSE

... Tax Efficiency Risk. Unlike most exchange-traded funds, the Fund effects creations and redemptions for cash, rather than inkind redemptions. If the Fund recognizes gains on sales, this generally will cause the Fund to recognize gains than would otherwise be required if it were able to distribute por ...

... Tax Efficiency Risk. Unlike most exchange-traded funds, the Fund effects creations and redemptions for cash, rather than inkind redemptions. If the Fund recognizes gains on sales, this generally will cause the Fund to recognize gains than would otherwise be required if it were able to distribute por ...

Introduction_to_Volatility

... To get the basic idea of what volatility is please read the article Putting volatility to work written by Ravi Kant Jain and published in the Active Trader Magazine (April 2001). Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate ...

... To get the basic idea of what volatility is please read the article Putting volatility to work written by Ravi Kant Jain and published in the Active Trader Magazine (April 2001). Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate ...

Homework 1

... demand curve at every price level by 1.15. At the new demand curve, if the price is 140, there is excess demand; if the price is 150, there is excess supply. This means that the price goes to a new equilibrium somewhere between 140 and 150. P ...

... demand curve at every price level by 1.15. At the new demand curve, if the price is 140, there is excess demand; if the price is 150, there is excess supply. This means that the price goes to a new equilibrium somewhere between 140 and 150. P ...

Chp. 1.1 Simple Interest

... Term (T): The contracted duration of an investment or loan. Principal (P): The original amount of money invested or loaned Future Value (A): The amount A, that an investment will be worth after a specified period of time. ...

... Term (T): The contracted duration of an investment or loan. Principal (P): The original amount of money invested or loaned Future Value (A): The amount A, that an investment will be worth after a specified period of time. ...

DAL_Pitch_2014_12_07_Simon_Wong

... In 2012, Delta purchased an oil refinery outside of Philadelphia, a novel approach to reduce its fuel costs ...

... In 2012, Delta purchased an oil refinery outside of Philadelphia, a novel approach to reduce its fuel costs ...