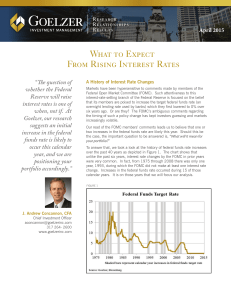

What to Expect From Rising Interest Rates

... The information provided in this material should not be considered as a recommendation to buy, sell or hold any particular security. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is n ...

... The information provided in this material should not be considered as a recommendation to buy, sell or hold any particular security. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is n ...

a diversified portfolio of alternative strategies

... Portfolio may not be successful in implementing its investment strategy, and may not employ a successful investment strategy, either of which could result in the Portfolio being liquidated at any time without shareholder approval and/or at a time that may not be favorable for certain shareholders. D ...

... Portfolio may not be successful in implementing its investment strategy, and may not employ a successful investment strategy, either of which could result in the Portfolio being liquidated at any time without shareholder approval and/or at a time that may not be favorable for certain shareholders. D ...

Valuing and Hedging American Put Options Using

... sample option valuation function is not a di erentiable function of the state variables. Thus it is not possible to form a hedged portfolio from the derivatives of the option valuation function. Similarly, Hutchinson, Lo, and Poggio estimate the value of S&P call options nonparametrically, and creat ...

... sample option valuation function is not a di erentiable function of the state variables. Thus it is not possible to form a hedged portfolio from the derivatives of the option valuation function. Similarly, Hutchinson, Lo, and Poggio estimate the value of S&P call options nonparametrically, and creat ...

jointly hedging jump-to-default risk and mark-to

... One must keep in mind that the required equity-deltas for MTMneutrality are highly model-dependent1 . The resulting hedge ratios might differ when different models are applied. For instance, for the equity-delta of the stock options, should we use a creditequity model or the market standard Black-Sc ...

... One must keep in mind that the required equity-deltas for MTMneutrality are highly model-dependent1 . The resulting hedge ratios might differ when different models are applied. For instance, for the equity-delta of the stock options, should we use a creditequity model or the market standard Black-Sc ...

Lecture 1

... • If he buys IBM shares, he is exposed to three risks: – Prices in the U.S. equity market generally. – The price of IBM stock specifically. – The dollar/sterling exchange rate. ...

... • If he buys IBM shares, he is exposed to three risks: – Prices in the U.S. equity market generally. – The price of IBM stock specifically. – The dollar/sterling exchange rate. ...

Arbitrage Opportunities in Misspecified Stochastic volatility Models

... model has so far mainly been studied in the case of the Black-Scholes model with misspecified volatility [13, 25]. In this paper we go one step further, and analyze the effects of misspecification of the volatility itself, the volatility of volatility and of the correlation between the underlying a ...

... model has so far mainly been studied in the case of the Black-Scholes model with misspecified volatility [13, 25]. In this paper we go one step further, and analyze the effects of misspecification of the volatility itself, the volatility of volatility and of the correlation between the underlying a ...

Review of Statistics in Finance

... The expected value measures the most likely outcome and is one measure of central tendency. However, it should be noted that expected value may or may not be an element in the population. For example, say a share price one year from now can be either $75 or $125, each with .5 or 50% probability. Alt ...

... The expected value measures the most likely outcome and is one measure of central tendency. However, it should be noted that expected value may or may not be an element in the population. For example, say a share price one year from now can be either $75 or $125, each with .5 or 50% probability. Alt ...

download

... The conversion provision of a convertible security grant the securityholder the right to convert the security into predetermined number of shares of the common stock of the issuer. An exchangeable security grants the securityholder the right to exchange the security for common stock of a firm other ...

... The conversion provision of a convertible security grant the securityholder the right to convert the security into predetermined number of shares of the common stock of the issuer. An exchangeable security grants the securityholder the right to exchange the security for common stock of a firm other ...

Rolling Up a Put Option as Prices Increase

... Agricultural producers commonly use put options to protect themselves against price declines that can occur during the production year. A put option of a futures contract gives the buyer the right to sell the underlying commodity at a specified price (its strike price) for a fixed period of time ...

... Agricultural producers commonly use put options to protect themselves against price declines that can occur during the production year. A put option of a futures contract gives the buyer the right to sell the underlying commodity at a specified price (its strike price) for a fixed period of time ...

Deriving Market Expectations for the Euro-Dollar

... therefore relevant for both market participants and policy-makers. Indicators of uncertainty and market sentiment are closely watched by policy-makers and investors. Value-at-risk analysis relies on these indicators. Higher uncertainty will cause risk managers to hedge their portfolios against sharp ...

... therefore relevant for both market participants and policy-makers. Indicators of uncertainty and market sentiment are closely watched by policy-makers and investors. Value-at-risk analysis relies on these indicators. Higher uncertainty will cause risk managers to hedge their portfolios against sharp ...

Digital Options

... exercise types). Like all American options, its market price may not be lower than the intrinsic value, so the American option price rises more steeply than the European equivalent as it gets closer to the strike. However, the option has no time value when it is ITM (In the Money) and should be exer ...

... exercise types). Like all American options, its market price may not be lower than the intrinsic value, so the American option price rises more steeply than the European equivalent as it gets closer to the strike. However, the option has no time value when it is ITM (In the Money) and should be exer ...

Lecture 6 - IEI: Linköping University

... The plots show two different ways to insure against the possibility of the price of Amazon stock falling below $45. The orange line in (a) indicates the value on the expiration date of a position that is long one share of Amazon stock and one European put option with a strike of $45 (the blue dashed ...

... The plots show two different ways to insure against the possibility of the price of Amazon stock falling below $45. The orange line in (a) indicates the value on the expiration date of a position that is long one share of Amazon stock and one European put option with a strike of $45 (the blue dashed ...

Recovering Risk-Neutral Densities from Exchange Rate Options: Evidence in Turkey

... expectations and market uncertainty about the future course of the financial asset prices. Options contracts give the right to buy or sell an asset in the future at a price (strike) set now. Options have a value since there is a chance that the options can be exercised, that is, the underlying asset ...

... expectations and market uncertainty about the future course of the financial asset prices. Options contracts give the right to buy or sell an asset in the future at a price (strike) set now. Options have a value since there is a chance that the options can be exercised, that is, the underlying asset ...

Lecture 7 a

... If the company did not plowback some earnings, the stock price would remain at $41.67. With the plowback, the price rose to $75.00. The difference between these two numbers (75.00-41.67=33.33) is called the Present Value of Growth Opportunities (PVGO). ...

... If the company did not plowback some earnings, the stock price would remain at $41.67. With the plowback, the price rose to $75.00. The difference between these two numbers (75.00-41.67=33.33) is called the Present Value of Growth Opportunities (PVGO). ...

Factsheet Floating Rate Income Trust USD

... The chart illustrates the growth of a hypothetical $10,000 investment in the fund's common shares based on market price beginning on the date noted with all distributions reinvested. Ending value as as of the date at the top of this document. ...

... The chart illustrates the growth of a hypothetical $10,000 investment in the fund's common shares based on market price beginning on the date noted with all distributions reinvested. Ending value as as of the date at the top of this document. ...

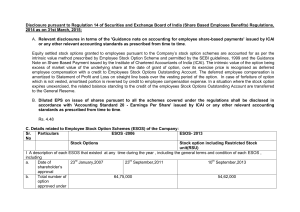

Share Based Employee Benefits

... 23rd January,2007 23rd September,2011 10th September,2013 shareholder’s approval b. Total number of ...

... 23rd January,2007 23rd September,2011 10th September,2013 shareholder’s approval b. Total number of ...

06effectiveness

... If the underlying is the price of corn, then the minimum value of an option on corn is either zero or the current spot price of corn minus the discounted risk-free present value of the strike price. In other words if the option cannot be exercised early, discount the present value of the strike pric ...

... If the underlying is the price of corn, then the minimum value of an option on corn is either zero or the current spot price of corn minus the discounted risk-free present value of the strike price. In other words if the option cannot be exercised early, discount the present value of the strike pric ...