Investment Analysis

... Unless differently stated, we will always use spot rates. In practice, quoted interest rates are often used. ...

... Unless differently stated, we will always use spot rates. In practice, quoted interest rates are often used. ...

FX Derivatives Terminology Education Module: 5

... Implied Volatility is the volatility parameter derived from the option price. Option traders use the Black&Scholes pricing formula (and its derivatives) to derive volatility. Like a currency, Implied Volatility is a commodity that is traded by dealers and quoted on market screens. ...

... Implied Volatility is the volatility parameter derived from the option price. Option traders use the Black&Scholes pricing formula (and its derivatives) to derive volatility. Like a currency, Implied Volatility is a commodity that is traded by dealers and quoted on market screens. ...

Advanced Derivatives: swaps beyond plain vanilla Structured notes

... Diff swaps: (currency hedged basis swap) Floating for floating swap Floating rates are in different currencies All swap payments in one currency Example: swap 5 year gilt (£) yield for 5 year CMT T-note yield swap payments in $ ...

... Diff swaps: (currency hedged basis swap) Floating for floating swap Floating rates are in different currencies All swap payments in one currency Example: swap 5 year gilt (£) yield for 5 year CMT T-note yield swap payments in $ ...

colour ppt

... While there are similarities between exchange-traded options and futures contract, there are also some important differences. • An option owner-an investor with a long position- can simply allow the option to die, unexercised. The same opportunity is not available to an investor with a long position ...

... While there are similarities between exchange-traded options and futures contract, there are also some important differences. • An option owner-an investor with a long position- can simply allow the option to die, unexercised. The same opportunity is not available to an investor with a long position ...

4.1 Exponential Functions

... 7. Personal Finance: Interest - A loan shark lends you $100 at 2% compound interest per week (that is a weekly, not annual rate). a. How much will you owe after 3 years? b. In “street” language, the profit on such a loan is known as the “vigorish” or the “vig”. Fins the shark’s vig. 8. Personal Fina ...

... 7. Personal Finance: Interest - A loan shark lends you $100 at 2% compound interest per week (that is a weekly, not annual rate). a. How much will you owe after 3 years? b. In “street” language, the profit on such a loan is known as the “vigorish” or the “vig”. Fins the shark’s vig. 8. Personal Fina ...

The Option Greeks and Market Making

... The Option Greeks and Market Making Continuing, buying the option on 60,000 shares will add 30,000 delta to the book, and so the book’s new delta is 12,900. The dealer must short or sell off from inventory 12,900 shares in order to be delta zero. There are no feedback effects on gamma and so the de ...

... The Option Greeks and Market Making Continuing, buying the option on 60,000 shares will add 30,000 delta to the book, and so the book’s new delta is 12,900. The dealer must short or sell off from inventory 12,900 shares in order to be delta zero. There are no feedback effects on gamma and so the de ...

Introduction to Pricing and Hedging Continuous Time

... N (0, T )-distributed. In general (unless µ = r) the option price given by formula (23) leads to an arbitrage opportunity, meaning that there will be a risk-free way to make a profit by managing a particular portfolio. This is one of the key ideas presented next that is used to determine the fair, o ...

... N (0, T )-distributed. In general (unless µ = r) the option price given by formula (23) leads to an arbitrage opportunity, meaning that there will be a risk-free way to make a profit by managing a particular portfolio. This is one of the key ideas presented next that is used to determine the fair, o ...

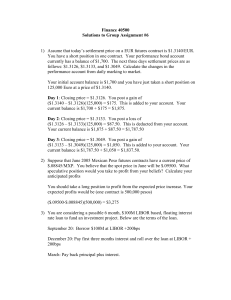

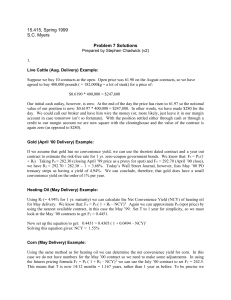

Solutions

... 2) Suppose that June 2005 Mexican Peso futures contracts have a current price of $.08845/MXP. You believe that the spot price in June will be $.09500. What speculative position would you take to profit from your beliefs? Calculate your anticipated profits You should take a long position to profit fr ...

... 2) Suppose that June 2005 Mexican Peso futures contracts have a current price of $.08845/MXP. You believe that the spot price in June will be $.09500. What speculative position would you take to profit from your beliefs? Calculate your anticipated profits You should take a long position to profit fr ...

Exponential Function

... 7. Personal Finance: Interest - A loan shark lends you $100 at 2% compound interest per week (that is a weekly, not annual rate). a. How much will you owe after 3 years? b. In “street” language, the profit on such a loan is known as the “vigorish” or the “vig”. Fins the shark’s vig. 8. Personal Fina ...

... 7. Personal Finance: Interest - A loan shark lends you $100 at 2% compound interest per week (that is a weekly, not annual rate). a. How much will you owe after 3 years? b. In “street” language, the profit on such a loan is known as the “vigorish” or the “vig”. Fins the shark’s vig. 8. Personal Fina ...

Document

... •Basis is defined as the difference between cash and futures prices: Basis = Cash prices - Future prices. Basis can be either positive or negative (in Index futures, basis generally is negative). •Basis may change its sign several times during the life of the contract. •Basis turns to zero at maturi ...

... •Basis is defined as the difference between cash and futures prices: Basis = Cash prices - Future prices. Basis can be either positive or negative (in Index futures, basis generally is negative). •Basis may change its sign several times during the life of the contract. •Basis turns to zero at maturi ...

option to purchase right of pre-emption (first refusal)

... can be registered against the title deeds relevant to the property. Again here the owner of the property is limiting his ability to sell the property on the open market. The owner is not governed by a price as is the case in an option but he cannot accept an offer to purchase from a third party but ...

... can be registered against the title deeds relevant to the property. Again here the owner of the property is limiting his ability to sell the property on the open market. The owner is not governed by a price as is the case in an option but he cannot accept an offer to purchase from a third party but ...

An alternative school of thought

... endowment model made popular by Yale’s David Swensen. What diversification benefits do they offer? Their risk-reward profile is more attractive—the return an investor can get per unit of risk is higher. But it’s not just about delivering something different; it’s about delivering something better. I ...

... endowment model made popular by Yale’s David Swensen. What diversification benefits do they offer? Their risk-reward profile is more attractive—the return an investor can get per unit of risk is higher. But it’s not just about delivering something different; it’s about delivering something better. I ...

interest rate options

... This means that the price of an option may remain unchanged or decrease even though investors’ expectations as to the movement of interest rates have been met. Credit risk The credit risk to which the buyer of an interest-rate option is exposed derives from the possibility of counterparty default, d ...

... This means that the price of an option may remain unchanged or decrease even though investors’ expectations as to the movement of interest rates have been met. Credit risk The credit risk to which the buyer of an interest-rate option is exposed derives from the possibility of counterparty default, d ...

Distinguishing between `Normal` and `Extreme` Price Volatility in

... unstable so that volatility persists endogenously. Interventionist public policy is needed to deal with chronic food panics. Since neither view of ‘normal’ price volatility is a theoretical imperative, we propose an empirical scheme for diagnosing real-world market dynamics from observed price serie ...

... unstable so that volatility persists endogenously. Interventionist public policy is needed to deal with chronic food panics. Since neither view of ‘normal’ price volatility is a theoretical imperative, we propose an empirical scheme for diagnosing real-world market dynamics from observed price serie ...

A Differential Tree Approach to Price Path-Dependent

... methods, it renters the scene in disguise because the number of approximating functions required increases with the dimensionality of the state, as has been documented by Glasserman and Yu [3] and Egloff [4]. We developed in Schellhorn [5] a "backward Taylor expansion" using the ClarkOcone formula, ...

... methods, it renters the scene in disguise because the number of approximating functions required increases with the dimensionality of the state, as has been documented by Glasserman and Yu [3] and Egloff [4]. We developed in Schellhorn [5] a "backward Taylor expansion" using the ClarkOcone formula, ...

Derivatives - MyCourses

... requirement, which allows a buyer to avoid almost all capital outflow initially (though some counterparties might set collateral requirements). Given the lack of standardization in these contracts, there is very little scope for a secondary market in forwards. FOREWARD RATE AGREEMENT: FRA. A forward ...

... requirement, which allows a buyer to avoid almost all capital outflow initially (though some counterparties might set collateral requirements). Given the lack of standardization in these contracts, there is very little scope for a secondary market in forwards. FOREWARD RATE AGREEMENT: FRA. A forward ...