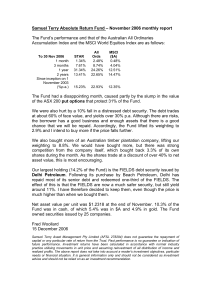

November 2006 - Samuel Terry

... at about 60% of face value, and yields over 30% p.a. Although there are risks, the borrower has a good business and enough assets that there is a good chance that we will be repaid. Accordingly, the Fund lifted its weighting to 2.9% and I intend to buy more if the price falls further. We also bought ...

... at about 60% of face value, and yields over 30% p.a. Although there are risks, the borrower has a good business and enough assets that there is a good chance that we will be repaid. Accordingly, the Fund lifted its weighting to 2.9% and I intend to buy more if the price falls further. We also bought ...

Option Pricing - Department of Mathematics, Indian Institute of Science

... Loosely speaking arbitrage means an opportunity to make risk free profit. Throughout we will assume the absence of arbitrage opportunities, i.e., there is no risk free profit available in the market. This will be made precise later. We now derive a formula relating European put and call prices, often ...

... Loosely speaking arbitrage means an opportunity to make risk free profit. Throughout we will assume the absence of arbitrage opportunities, i.e., there is no risk free profit available in the market. This will be made precise later. We now derive a formula relating European put and call prices, often ...

problems to prep for the final

... The price of the European call option is $0.1243. Note: We could have simply used the shorter “binomial” pricing formula since we were looking for the price of a European option and did not need the ∆’s and the B 0 s in the intermediate nodes. Problem 100.4. (2 points) The premium on a standard call ...

... The price of the European call option is $0.1243. Note: We could have simply used the shorter “binomial” pricing formula since we were looking for the price of a European option and did not need the ∆’s and the B 0 s in the intermediate nodes. Problem 100.4. (2 points) The premium on a standard call ...

Review Questions

... 1) A discount bond has a face value of $200, a market price of $150 and 2 years to maturity. Find the yield. 2) A coupon bond has a face value of $1000, a coupon rate of 5%, a market price of $980 and one year to maturity. Find the yield. 3) A coupon bond has a face value of $1000, a coupon rate of ...

... 1) A discount bond has a face value of $200, a market price of $150 and 2 years to maturity. Find the yield. 2) A coupon bond has a face value of $1000, a coupon rate of 5%, a market price of $980 and one year to maturity. Find the yield. 3) A coupon bond has a face value of $1000, a coupon rate of ...

Fin30233_F2016_Hedging and VAR with DeltaGamma

... Since Delta-Gamma VaR is nonlinear function of Delta and Gamma, cannot simply add VaR, as in Delta-VaR. For portfolio of linear and/or nonlinear derivatives on a single underlying: 1) compute portfolio Delta Dp 2) compute portfolio Gamma Gp ...

... Since Delta-Gamma VaR is nonlinear function of Delta and Gamma, cannot simply add VaR, as in Delta-VaR. For portfolio of linear and/or nonlinear derivatives on a single underlying: 1) compute portfolio Delta Dp 2) compute portfolio Gamma Gp ...

File

... Topic: Accounting for Equity Index and -Equity Stock Futures and Options 1. What are derivatives and what are its characteristics? Answer Derivative is a generic term for contracts like futures, options and swaps. The values of these contracts depend on value of the underlying assets, called bases. ...

... Topic: Accounting for Equity Index and -Equity Stock Futures and Options 1. What are derivatives and what are its characteristics? Answer Derivative is a generic term for contracts like futures, options and swaps. The values of these contracts depend on value of the underlying assets, called bases. ...

Percent Applications

... Percent Increase and Decrease An account had $28000 in it in January. In December it had $18000. What was the percent of change in the value of the account? ...

... Percent Increase and Decrease An account had $28000 in it in January. In December it had $18000. What was the percent of change in the value of the account? ...

solutions

... waiting to exercise, but there is a “volatility benefit” from waiting. To show this more rigorously, consider the following portfolio: lend $X and short one share of stock. The cost to establish the portfolio is (X – S 0). The payoff at time T (with zero interest earnings on the loan) is (X – S T). ...

... waiting to exercise, but there is a “volatility benefit” from waiting. To show this more rigorously, consider the following portfolio: lend $X and short one share of stock. The cost to establish the portfolio is (X – S 0). The payoff at time T (with zero interest earnings on the loan) is (X – S T). ...

Final February 9, 2002

... The riskless rate of interest is 0.06 per year, and the expected rate of return on the market portfolio is 0.15 per year. a. According to the CAPM, what is the efficient way for an investor to achieve an expected rate of return of 0.10 per year? (5 marks) b. If the standard deviation of the rate of ...

... The riskless rate of interest is 0.06 per year, and the expected rate of return on the market portfolio is 0.15 per year. a. According to the CAPM, what is the efficient way for an investor to achieve an expected rate of return of 0.10 per year? (5 marks) b. If the standard deviation of the rate of ...

SU54 - CMAPrepCourse

... Correct Answer: B A change in prices can be minimized or avoided by hedging. Hedging is the process of using offsetting commitments to minimize or avoid the impact of adverse price movements. The automobile company desires to stabilize the price of steel so that its cost to the company will not rise ...

... Correct Answer: B A change in prices can be minimized or avoided by hedging. Hedging is the process of using offsetting commitments to minimize or avoid the impact of adverse price movements. The automobile company desires to stabilize the price of steel so that its cost to the company will not rise ...

note on weighted average strike asian options

... studies average rate options but only considers options with a zero strike price. Kemna and Vorst(1990,1992) propose a Monte Carlo methodology which employs the corresponding geometric option as a control variable. Carverhill and Clewlow(1990) use the Fourier Transformation to evaluate numerically t ...

... studies average rate options but only considers options with a zero strike price. Kemna and Vorst(1990,1992) propose a Monte Carlo methodology which employs the corresponding geometric option as a control variable. Carverhill and Clewlow(1990) use the Fourier Transformation to evaluate numerically t ...

Improvement Bonds - Contra Costa County

... Property in California is assessed upon change of ownership at full cash value. Full cash value is defined by state law as "...the amount of cash or its equivalent that property would bring if exposed for sale in the open market." Therefore, when a buyer assumes a debt related to the property, such ...

... Property in California is assessed upon change of ownership at full cash value. Full cash value is defined by state law as "...the amount of cash or its equivalent that property would bring if exposed for sale in the open market." Therefore, when a buyer assumes a debt related to the property, such ...

Collective Investments

... underlying assets. Their price can therefore be above or below the value of all the assets in the fund. This is called trading at a ‘premium’ or ‘discount’. In addition to the money invested by shareholders, the investment trust can borrow to make additional ...

... underlying assets. Their price can therefore be above or below the value of all the assets in the fund. This is called trading at a ‘premium’ or ‘discount’. In addition to the money invested by shareholders, the investment trust can borrow to make additional ...