Document

... Face value is generally denominated in units of 100 or 1,000 of currency. But it may not be issued at 1,000 and probably won’t trade at that amount. Trading price is shown as a % of the face value. Interest will be based on this face value. − Difficult to resolve if the company faces problems ...

... Face value is generally denominated in units of 100 or 1,000 of currency. But it may not be issued at 1,000 and probably won’t trade at that amount. Trading price is shown as a % of the face value. Interest will be based on this face value. − Difficult to resolve if the company faces problems ...

Lecture 5

... When the spot price rises above the strike price, the intrinsic value become positive Put options behave in the opposite manner On the date of maturity, an option will have a value equal to its intrinsic value (zero time remaining means zero time value) The time value of an option exists bec ...

... When the spot price rises above the strike price, the intrinsic value become positive Put options behave in the opposite manner On the date of maturity, an option will have a value equal to its intrinsic value (zero time remaining means zero time value) The time value of an option exists bec ...

Option Prices and the Cross Section of Equity Returns

... Chang, Christoffersen and Jacobs (JFE, 2013) Regress returns on market skew. Sort on skew beta ...

... Chang, Christoffersen and Jacobs (JFE, 2013) Regress returns on market skew. Sort on skew beta ...

Economics 330 Money and Banking Lecture 18

... instrument at exercise (strike) price up until expiration date (American) or on expiration date (European) Hedging with Options Buy same # of put option contracts as would sell of futures Disadvantage: pay premium Advantage: protected if i , gain if i Additional advantage if macro hedge: avoids a ...

... instrument at exercise (strike) price up until expiration date (American) or on expiration date (European) Hedging with Options Buy same # of put option contracts as would sell of futures Disadvantage: pay premium Advantage: protected if i , gain if i Additional advantage if macro hedge: avoids a ...

OPTIONS

... Total profit = $2.60 100 3 = $780; The option finished out of the money. CALL PAYOFF c 62. You purchased four WXO 30 call option contracts at a quoted price of $.34. What is your net gain or loss on this investment if the price of WXO is $33.60 on the option expiration date? c. $1,304 62. Total ...

... Total profit = $2.60 100 3 = $780; The option finished out of the money. CALL PAYOFF c 62. You purchased four WXO 30 call option contracts at a quoted price of $.34. What is your net gain or loss on this investment if the price of WXO is $33.60 on the option expiration date? c. $1,304 62. Total ...

Options

... • FE is concerned with the design and valuation of “derivative securities” • A derivative security is a contract whose payoff is tied to (derived from) the value of another variable, called the underlying – Buy now a fixed amount of oil for a fixed price per barrel to be delivered in eight weeks • V ...

... • FE is concerned with the design and valuation of “derivative securities” • A derivative security is a contract whose payoff is tied to (derived from) the value of another variable, called the underlying – Buy now a fixed amount of oil for a fixed price per barrel to be delivered in eight weeks • V ...

Note présentée au Collège

... Variance swaps are contracts that allow investors to gain exposure to the variance (squared volatility) against current implied volatility. According to market practice, the strike and the vega notional are expressed in terms of volatility. For the variance notional, this gives: Variance notional ...

... Variance swaps are contracts that allow investors to gain exposure to the variance (squared volatility) against current implied volatility. According to market practice, the strike and the vega notional are expressed in terms of volatility. For the variance notional, this gives: Variance notional ...

Chapter 11

... Shift risk from those who don’t want to carry risk to those who are willing to do so. Bring additional information into the market from hedgers, speculators, market expectations. Lower commissions and margin requirements than in spot market ...

... Shift risk from those who don’t want to carry risk to those who are willing to do so. Bring additional information into the market from hedgers, speculators, market expectations. Lower commissions and margin requirements than in spot market ...

Currency derivatives Currency derivatives are a contract between

... 1. A security derived from a debt instrument, share, loan whether secured or unsecured, risk instrument or contract for differences or any other form of security. 2. A contract which derives its value from the prices, or index of prices, of underlying securities. Derivatives are securities under th ...

... 1. A security derived from a debt instrument, share, loan whether secured or unsecured, risk instrument or contract for differences or any other form of security. 2. A contract which derives its value from the prices, or index of prices, of underlying securities. Derivatives are securities under th ...

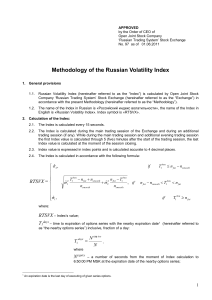

Methodology of the Volatility Index Calculation

... price of a futures contract, which is an underlying asset for nearby/next options series (hereinafter referred to as the “underlying futures contract”). ...

... price of a futures contract, which is an underlying asset for nearby/next options series (hereinafter referred to as the “underlying futures contract”). ...

Institute of Actuaries of India Subject CT8 – Financial Economics INDICATIVE SOLUTIONS

... from credit rating transition probabilities drawn from established rating agencies. c) The JLT model assumes that the transition intensities between default states are deterministic. An adaptation could be to assume that the transition intensity between states is stochastic and dependent on a separa ...

... from credit rating transition probabilities drawn from established rating agencies. c) The JLT model assumes that the transition intensities between default states are deterministic. An adaptation could be to assume that the transition intensity between states is stochastic and dependent on a separa ...

MATH2510 MATH2510 This paper consists of 3 printed Only

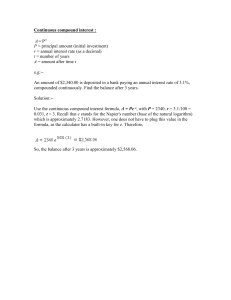

... The yield curve is flat; the continuously compounded interest rate is is 5%. What is the arbitrage-free price of a 6-month forward contract on the bond? B2. How would the answer to B1 change if the yield curve were not flat, but rather you were given zero-coupon bonds prices Pt (in particular the va ...

... The yield curve is flat; the continuously compounded interest rate is is 5%. What is the arbitrage-free price of a 6-month forward contract on the bond? B2. How would the answer to B1 change if the yield curve were not flat, but rather you were given zero-coupon bonds prices Pt (in particular the va ...

pdf

... function of S(T ) alone. So it can be expressed as the payoff of a suitable option, i.e. there is a function f (depending on T ) such that B = f (S(T )). (It is not hard to find a formula for f , using the information given above.) If an option with payoff f were available in the marketplace, you co ...

... function of S(T ) alone. So it can be expressed as the payoff of a suitable option, i.e. there is a function f (depending on T ) such that B = f (S(T )). (It is not hard to find a formula for f , using the information given above.) If an option with payoff f were available in the marketplace, you co ...

Institute of Actuaries of India MARKING SCHEDULE October 2009 EXAMINATION

... The overall limit and frequency of monitoring has to take into account the volatility of underlying variables and the overall exposures. The main problem with this limit is that it prevents to write profitable business even if the customer is currently in profit and may impact the relationship and ...

... The overall limit and frequency of monitoring has to take into account the volatility of underlying variables and the overall exposures. The main problem with this limit is that it prevents to write profitable business even if the customer is currently in profit and may impact the relationship and ...

implied volatility - AlphaShark Trading

... ADT a trader bought 22,000 ADT April 43 Calls for $.30. The stock has increase $3 in value, the Delta of these Calls were $.10. In theory the Calls should increase in value $.30 from $.30 to $.60. ...

... ADT a trader bought 22,000 ADT April 43 Calls for $.30. The stock has increase $3 in value, the Delta of these Calls were $.10. In theory the Calls should increase in value $.30 from $.30 to $.60. ...

QuizWeek06a

... An option's delta is also called its hedge ratio. It depicts the elasticity of the premium (price of the option) vis-a-vis price movements of the underlying asset of liability. Technically is is the partial derivative of the premium with respect to the underlying. It is the C/S ratio in the Black-Sc ...

... An option's delta is also called its hedge ratio. It depicts the elasticity of the premium (price of the option) vis-a-vis price movements of the underlying asset of liability. Technically is is the partial derivative of the premium with respect to the underlying. It is the C/S ratio in the Black-Sc ...

Geometry ACT Review 3 1. If , what is the value of 30x? 2. If what is

... value; P is the amount deposited; and n is the number of compounding periods. What is the value of a savings account after 4 years if $15,000 is deposited at 5% annual interest compounded yearly? ...

... value; P is the amount deposited; and n is the number of compounding periods. What is the value of a savings account after 4 years if $15,000 is deposited at 5% annual interest compounded yearly? ...