Investments

... Derivative instruments: Value is determined by, or derived from, the value of another instrument vehicle, called the underlying asset or security Risk shifting - Especially shifting the risk of asset price changes or interest rate changes to another party willing to bear that risk ...

... Derivative instruments: Value is determined by, or derived from, the value of another instrument vehicle, called the underlying asset or security Risk shifting - Especially shifting the risk of asset price changes or interest rate changes to another party willing to bear that risk ...

Innovations in Financial Engineering Solution to Homework One 3

... converted. The instrument should be converted at node D since conversion will improve the value to 41.22 × 3.5 = 144.27. At node C the value of the instrument, if not converted, is (97.90 + 5)e−0.7 = 95.94. Because 19.47 × 3.6 is less than this, the instrument should not be converted at node C. At n ...

... converted. The instrument should be converted at node D since conversion will improve the value to 41.22 × 3.5 = 144.27. At node C the value of the instrument, if not converted, is (97.90 + 5)e−0.7 = 95.94. Because 19.47 × 3.6 is less than this, the instrument should not be converted at node C. At n ...

day 6

... – If the underlying asset is volatile, the derivative is even more volatile because it is so leveraged. – For the interest rate swap, a 1% interest rate change can cause thousands of dollars per year change in cash flows. A very small investment, can produce returns (positive or negative) of several ...

... – If the underlying asset is volatile, the derivative is even more volatile because it is so leveraged. – For the interest rate swap, a 1% interest rate change can cause thousands of dollars per year change in cash flows. A very small investment, can produce returns (positive or negative) of several ...

Professor Banko`s Presentation

... 5,000 shares of IBM, for $925,000. And to eliminate my put, I entering into an offsetting put, price is now $7.00 per share (netting me $35,000). • Short side, notional value $925,000 • Long side, notional value $925,000 ...

... 5,000 shares of IBM, for $925,000. And to eliminate my put, I entering into an offsetting put, price is now $7.00 per share (netting me $35,000). • Short side, notional value $925,000 • Long side, notional value $925,000 ...

DEXIA « Impact Seminar

... Black Scholes differential equation: assumptions • S follows the geometric Brownian motion: dS = µS dt + S dz – Volatility constant – No dividend payment (until maturity of option) – Continuous market – Perfect capital markets – Short sales possible – No transaction costs, no taxes – Constant i ...

... Black Scholes differential equation: assumptions • S follows the geometric Brownian motion: dS = µS dt + S dz – Volatility constant – No dividend payment (until maturity of option) – Continuous market – Perfect capital markets – Short sales possible – No transaction costs, no taxes – Constant i ...

Download attachment

... underlying security, its lifetime, its volatility and the exercise price. It also assumes that share price movements follow a continuous stochastic log-normal distribution. It is possible to set up a perfect “risk-free” cover by using this model (as it assumes that the gains and losses from buying s ...

... underlying security, its lifetime, its volatility and the exercise price. It also assumes that share price movements follow a continuous stochastic log-normal distribution. It is possible to set up a perfect “risk-free” cover by using this model (as it assumes that the gains and losses from buying s ...

FIN432 Investments

... 7. An investor bought one ABC $25 (exercise price is $25) call contract for a premium of $5 per share. At the maturity (expiration), ABC stock price is $30. Which is the net profit/loss of this investment? a) $500 b) $0 * c) -$500 d) $100 8. An investor sold one ABC $25 (exercise price is $25) call ...

... 7. An investor bought one ABC $25 (exercise price is $25) call contract for a premium of $5 per share. At the maturity (expiration), ABC stock price is $30. Which is the net profit/loss of this investment? a) $500 b) $0 * c) -$500 d) $100 8. An investor sold one ABC $25 (exercise price is $25) call ...

Options on Futures Contracts - Feuz Cattle and Beef Market Analysis

... What can one do with an option once he/she buys it? Let it expire (do nothing more with it) Lose the premium that was paid Offset it: If one April LC put is purchased then can ...

... What can one do with an option once he/she buys it? Let it expire (do nothing more with it) Lose the premium that was paid Offset it: If one April LC put is purchased then can ...

FROM NAVIER-STOKES TO BLACK-SCHOLES

... Before we jump into the mathematics and numerical analysis of partial differential equations we try to sketch the financial context in which they are used. It is impossible to discuss the context in any great detail and we refer the reader to Wilmott [11]. It is written in a style that should appeal ...

... Before we jump into the mathematics and numerical analysis of partial differential equations we try to sketch the financial context in which they are used. It is impossible to discuss the context in any great detail and we refer the reader to Wilmott [11]. It is written in a style that should appeal ...

1 Binomial Model Hull, Chapter 11 + Sections 17.1 and 17.2

... Step 3u (i = 3). Suppose that instead the stock price goes up to 90. The call you sold is inthe-money at expiration. Buy one share of stock and let the call be exercised, incurring a loss of 90 – 80 = 10. You also own 0.167 shares of stock currently trading at 90/share, for a total value of 0.167 x ...

... Step 3u (i = 3). Suppose that instead the stock price goes up to 90. The call you sold is inthe-money at expiration. Buy one share of stock and let the call be exercised, incurring a loss of 90 – 80 = 10. You also own 0.167 shares of stock currently trading at 90/share, for a total value of 0.167 x ...

VPFF Risk Derivates

... performance, for example, cash settlement, of the contract on the date stated in the contract. No premiums are paid since both parties have equal obligations under a futures contract. A swap agreement means that the parties agree to make payments to each other on a regular basis, for example calcula ...

... performance, for example, cash settlement, of the contract on the date stated in the contract. No premiums are paid since both parties have equal obligations under a futures contract. A swap agreement means that the parties agree to make payments to each other on a regular basis, for example calcula ...

Presentation of paper (in PowerPoint)

... Swap contracts, in comparison to forwards, futures and options, are one of the more recent innovations in derivatives contract design. The first currency swap contract, between the World Bank and IBM, dates to August of 1981. The basic idea in a swap contract is that the counterparties agree to swap ...

... Swap contracts, in comparison to forwards, futures and options, are one of the more recent innovations in derivatives contract design. The first currency swap contract, between the World Bank and IBM, dates to August of 1981. The basic idea in a swap contract is that the counterparties agree to swap ...

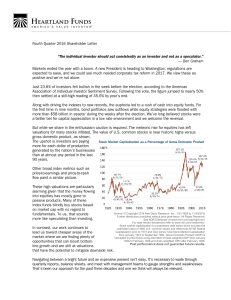

Recent volatility in the markets has resulted in more fear and anxiety

... Recent volatility in the markets has resulted in more fear and anxiety among investors, but it may have also created a fresh opportunity for longer term investors. Keeping the proper perspective may help to see the opportunities that exists in the volatility. With earnings season behind us, the vola ...

... Recent volatility in the markets has resulted in more fear and anxiety among investors, but it may have also created a fresh opportunity for longer term investors. Keeping the proper perspective may help to see the opportunities that exists in the volatility. With earnings season behind us, the vola ...

Past performance does not guarantee future results.

... expenses carefully before investing or sending money. This and other important information can be found in the Funds’ prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Please read the prospectus carefully before investing. Investing involves risk, including ...

... expenses carefully before investing or sending money. This and other important information can be found in the Funds’ prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Please read the prospectus carefully before investing. Investing involves risk, including ...

Binomial Model

... create a riskless portfolio This can be extended to that an appropriate combination of any two of the securities (options, stock and bonds) can be used to create a portfolio equal to the third. 4) In the n period model, delta changes from period to period. So riskless hedge portfolio need to be re ...

... create a riskless portfolio This can be extended to that an appropriate combination of any two of the securities (options, stock and bonds) can be used to create a portfolio equal to the third. 4) In the n period model, delta changes from period to period. So riskless hedge portfolio need to be re ...