International Banking - Module A Part II

... option) or sell (‘put’ option) an asset under specified conditions (price, time) and assumes the obligation to sell or buy it. • The party who has the right but not the obligation is the ‘buyer’ of the option and pays a fee or premium to the ‘writer’ or ‘seller’ of the option. • The asset could be a ...

... option) or sell (‘put’ option) an asset under specified conditions (price, time) and assumes the obligation to sell or buy it. • The party who has the right but not the obligation is the ‘buyer’ of the option and pays a fee or premium to the ‘writer’ or ‘seller’ of the option. • The asset could be a ...

FUTURE // noun [C, usually pl

... an exchange of different types of payments between two companies, for example payments in different currencies or with different interest rates: The increased volume of swaps has boosted futures trading on the Mexican derivatives exchange. 3 (Finance) an act of exchanging one investment or asset for ...

... an exchange of different types of payments between two companies, for example payments in different currencies or with different interest rates: The increased volume of swaps has boosted futures trading on the Mexican derivatives exchange. 3 (Finance) an act of exchanging one investment or asset for ...

Options for Enhancing Risk-Adjusted Returns Covered Call

... Option: The right, but not the obligation, to buy or sell an underlying instrument, such as a stock, a futures contract or an index value, at a specified price for a certain, fixed period of time. Out-of-the-money: A call option is out-of-the-money if the strike price is greater than the market pric ...

... Option: The right, but not the obligation, to buy or sell an underlying instrument, such as a stock, a futures contract or an index value, at a specified price for a certain, fixed period of time. Out-of-the-money: A call option is out-of-the-money if the strike price is greater than the market pric ...

Installment options and static hedging

... has the right to ‘walk away’: if any installment is not paid then the contract terminates with no further payments on either side. This provides useful extra optionality to the buyer while, as we shall see, the seller can hedge the option using simple static hedges that largely eliminate model risk. ...

... has the right to ‘walk away’: if any installment is not paid then the contract terminates with no further payments on either side. This provides useful extra optionality to the buyer while, as we shall see, the seller can hedge the option using simple static hedges that largely eliminate model risk. ...

Lachov G

... The Bulgarian land market has been under development for the past 15 years. Many of the actual owners have got back their land but the problems with land market, land pricing and opportunity to invest in agricultural land still exist. At the moment, sale transactions in Bulgarian land exist only bet ...

... The Bulgarian land market has been under development for the past 15 years. Many of the actual owners have got back their land but the problems with land market, land pricing and opportunity to invest in agricultural land still exist. At the moment, sale transactions in Bulgarian land exist only bet ...

Binomial Trees

... One principle underlying two angles If you can replicate, you can hedge: Long the option contract, short the replicating portfolio. The replication portfolio is composed of stock and bond. Since bond only generates parallel shifts in payoff and does not play any role in offsetting/hedging risks, it ...

... One principle underlying two angles If you can replicate, you can hedge: Long the option contract, short the replicating portfolio. The replication portfolio is composed of stock and bond. Since bond only generates parallel shifts in payoff and does not play any role in offsetting/hedging risks, it ...

9 Complete and Incomplete Market Models

... But the second integral can not be written as an integral w.r.t. dS̃s . ...

... But the second integral can not be written as an integral w.r.t. dS̃s . ...

An item that is intrinsically valueless is

... A change in money supply. A change in government expenditure. An increase in the costs of production of commodity “X” will: Select correct option: Shift demand outwards Shift demand inwards Shift supply outwards Shift supply inwards ...

... A change in money supply. A change in government expenditure. An increase in the costs of production of commodity “X” will: Select correct option: Shift demand outwards Shift demand inwards Shift supply outwards Shift supply inwards ...

Corruption in the financial markets 29012009

... Financial analysts: Should give a professional advise, but often influenced by employer. M&A corruption & blackmail + Insider info Auditors: Certify accounts but give consulting; greatly improved since 2003. Rating agencies:" rate” companies + “sell” ratings ⇒ encourage off balance, securitisa ...

... Financial analysts: Should give a professional advise, but often influenced by employer. M&A corruption & blackmail + Insider info Auditors: Certify accounts but give consulting; greatly improved since 2003. Rating agencies:" rate” companies + “sell” ratings ⇒ encourage off balance, securitisa ...

Information on the projected cost (fair value) of

... 2008-2009, implemented in the Company on the basis of the resolution passed during the Ordinary General Meeting of Shareholders of Talex Spółka Akcyjna held on 22 April 2008 (the “Program”): ...

... 2008-2009, implemented in the Company on the basis of the resolution passed during the Ordinary General Meeting of Shareholders of Talex Spółka Akcyjna held on 22 April 2008 (the “Program”): ...

Intermediate Financial Management, 5th Ed.

... What are the assumptions of the Black-Scholes Option Pricing Model? The stock underlying the call option provides no dividends during the call option’s life. There are no transactions costs for the sale/purchase of either the stock or the option. kRF is known and constant during the option’s life ...

... What are the assumptions of the Black-Scholes Option Pricing Model? The stock underlying the call option provides no dividends during the call option’s life. There are no transactions costs for the sale/purchase of either the stock or the option. kRF is known and constant during the option’s life ...

The parameter sensitivity of the Margrabe Best-of

... at the beginning of the year. While the yearly rebalancing corresponds to a reversal trade, the intra-year weight adjustments chase the momentum of the best performing asset by replicating the value of Margrabe option to exchange an asset for another. In practice, this means that the Margrabe portfo ...

... at the beginning of the year. While the yearly rebalancing corresponds to a reversal trade, the intra-year weight adjustments chase the momentum of the best performing asset by replicating the value of Margrabe option to exchange an asset for another. In practice, this means that the Margrabe portfo ...

The Black-Scholes-Merton Approach to Pricing Options

... value of a portfolio when changes occur in the market-place. For example, suppose we invest W amount of wealth in a portfolio consisting of w1 units of a stock s, w2 units of a bond b, and one short unit of a call option c with the same underlying type of stock. The total value of the portfolio is: ...

... value of a portfolio when changes occur in the market-place. For example, suppose we invest W amount of wealth in a portfolio consisting of w1 units of a stock s, w2 units of a bond b, and one short unit of a call option c with the same underlying type of stock. The total value of the portfolio is: ...

STAT 473. Practice Problems for Exam 2 Spring 2015 Description

... (F) In addition, you must review all the examples seen in class. (G) Any material seen in class could potentially be tested in your actual exam. ...

... (F) In addition, you must review all the examples seen in class. (G) Any material seen in class could potentially be tested in your actual exam. ...

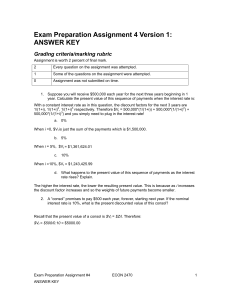

Phd Economics, Siena - Finance – Final exam (16 April 2014

... 3. A restaurant chain wants to open a new restaurant in Siena, and it has two options: 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with ...

... 3. A restaurant chain wants to open a new restaurant in Siena, and it has two options: 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with ...