chapter 2 : markets and instruments

... In the absence of a split, stock C would sell for 110, and the value of the index would be: (95 + 45 + 110)/3 = 83.333 After the split, stock C sells at 55. Therefore, we need to set the divisor (d) such that: 83.333 = (95 + 45 + 55)/d d = 2.340 ...

... In the absence of a split, stock C would sell for 110, and the value of the index would be: (95 + 45 + 110)/3 = 83.333 After the split, stock C sells at 55. Therefore, we need to set the divisor (d) such that: 83.333 = (95 + 45 + 55)/d d = 2.340 ...

New EDHEC-Risk Institute research examines dynamic hedging of

... available for trading A new research paper, "Option Pricing and Hedging in the Presence of Cross-Hedge Risk," drawn from the "Structured Products and Derivative Instruments" research chair at EDHEC-Risk Institute supported by the French Banking Federation (FBF), addresses dynamic hedging of an optio ...

... available for trading A new research paper, "Option Pricing and Hedging in the Presence of Cross-Hedge Risk," drawn from the "Structured Products and Derivative Instruments" research chair at EDHEC-Risk Institute supported by the French Banking Federation (FBF), addresses dynamic hedging of an optio ...

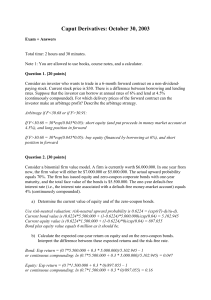

489f10h4_soln.pdf

... economist, with a proposal: “The single period binomial pricing is all right as far as it goes, but it certainly is simplistic. Why not modify it slightly to make it a little more realistic? Specifically, assume the stock can take three values at time T , say it goes up by a factor U with probabilit ...

... economist, with a proposal: “The single period binomial pricing is all right as far as it goes, but it certainly is simplistic. Why not modify it slightly to make it a little more realistic? Specifically, assume the stock can take three values at time T , say it goes up by a factor U with probabilit ...

SOA Exam MFE Flash Cards

... Above: A gap option must be exercised when S K1 for a call or S K1 for a put. Since the owner can lose money at exercise, the term “option” is a bit of a misnomer. This possible negative payoff is reflected in a lower option price. Exchange Option An exchange option, also called an outperforman ...

... Above: A gap option must be exercised when S K1 for a call or S K1 for a put. Since the owner can lose money at exercise, the term “option” is a bit of a misnomer. This possible negative payoff is reflected in a lower option price. Exchange Option An exchange option, also called an outperforman ...

Option Price and Portfolio Simulation

... ◦ Use sorted time series data to identify the percentile value associated with the desired VaR ◦ Specify probability distributions & correlations for relevant market risk factors and build a simulation model that describes the relationship between the market risk factors and the asset return. After ...

... ◦ Use sorted time series data to identify the percentile value associated with the desired VaR ◦ Specify probability distributions & correlations for relevant market risk factors and build a simulation model that describes the relationship between the market risk factors and the asset return. After ...

Greeks

... d1 : a standardized variable. d2 : Under BSM, this variable is the truly standardized normal variable with φ(0, 1) under the risk-neutral measure. delta: Used frequently in the industry, quoted in absolute percentages. I ...

... d1 : a standardized variable. d2 : Under BSM, this variable is the truly standardized normal variable with φ(0, 1) under the risk-neutral measure. delta: Used frequently in the industry, quoted in absolute percentages. I ...

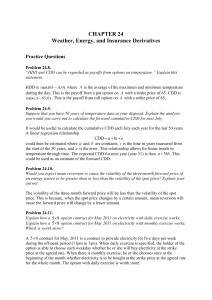

Chapter 24

... The volatility of the three-month forward price will be less than the volatility of the spot price. This is because, when the spot price changes by a certain amount, mean reversion will cause the forward price will change by a lesser amount. Problem 24.11. Explain how a 5 8 option contract for May ...

... The volatility of the three-month forward price will be less than the volatility of the spot price. This is because, when the spot price changes by a certain amount, mean reversion will cause the forward price will change by a lesser amount. Problem 24.11. Explain how a 5 8 option contract for May ...

financial market 2 - Institute of Bankers in Malawi

... policy influences the level of aggregate demand within the economy. It is viewed to be expansionary if government increases expenditure relative to taxation in order to boost the level of spending within an economy and thereby bringing more people into employment and enhancing economy. On the other ...

... policy influences the level of aggregate demand within the economy. It is viewed to be expansionary if government increases expenditure relative to taxation in order to boost the level of spending within an economy and thereby bringing more people into employment and enhancing economy. On the other ...

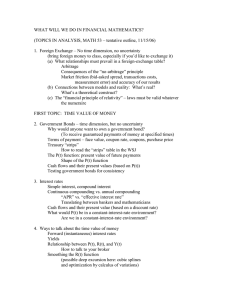

TopicsInAnalysis

... Are daily returns normally distributed? Are daily returns independent? What is the mean of daily returns for your company? Confidence intervals for the mean What is the standard deviation of daily returns? Confidence intervals for the standard deviation How stable is it over time? Volatility – defin ...

... Are daily returns normally distributed? Are daily returns independent? What is the mean of daily returns for your company? Confidence intervals for the mean What is the standard deviation of daily returns? Confidence intervals for the standard deviation How stable is it over time? Volatility – defin ...

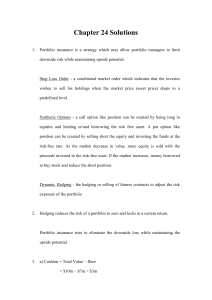

24. Portfolio Insurance and Synthetic Options

... Stop Loss Order - a conditional market order which indicates that the investor wishes to sell his holdings when the market price (asset price) drops to a predefined level. ...

... Stop Loss Order - a conditional market order which indicates that the investor wishes to sell his holdings when the market price (asset price) drops to a predefined level. ...

PowerPoint **

... any remaining difference in option moneyness using option’s vega”? • What kind of volatility used to calculate daily delta when constructing daily rebalanced deltaneutral option portfolio? • This paper also estimates VRP by controlling for exposure to price jump risk. Given the possibility that pric ...

... any remaining difference in option moneyness using option’s vega”? • What kind of volatility used to calculate daily delta when constructing daily rebalanced deltaneutral option portfolio? • This paper also estimates VRP by controlling for exposure to price jump risk. Given the possibility that pric ...

Question 1

... not directly reflect any market expectations on the development of the currency rate. Only if there is no risk premium on currency risk, the forward rate equals the expected currency rate (see section 3.15 of Hull) Question 2. [15 points] Give an intuitive explanation of why early exercise of an Ame ...

... not directly reflect any market expectations on the development of the currency rate. Only if there is no risk premium on currency risk, the forward rate equals the expected currency rate (see section 3.15 of Hull) Question 2. [15 points] Give an intuitive explanation of why early exercise of an Ame ...

OPTIONS, GREEKS, AND RISK MANAGEMENT Jelena Paunović *

... Options are financial derivatives representing a contract which gives the right to the holder, but not the obligation, to buy or sell an underlying asset at a pre-defined strike price during a certain period of time. These derivative contracts can derive their value from almost any underlying asset ...

... Options are financial derivatives representing a contract which gives the right to the holder, but not the obligation, to buy or sell an underlying asset at a pre-defined strike price during a certain period of time. These derivative contracts can derive their value from almost any underlying asset ...

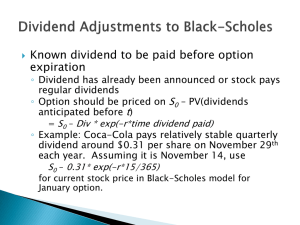

PowerPoint Slides

... price for a change in the underlying stock • Recall that at maturity c=max(0,ST-X) and p=max(0,X-ST) – This should help make the sign of the derivatives obvious ...

... price for a change in the underlying stock • Recall that at maturity c=max(0,ST-X) and p=max(0,X-ST) – This should help make the sign of the derivatives obvious ...

The Greek Letters

... The theta (Θ) of a portfolio of options is the rate of change of the value of the portfolio with respect to the passage of time with all else remaining the same. Theta is sometimes referred to as the time decay of the portfolio. The theta of a call or put is usually negative. A negative theta means ...

... The theta (Θ) of a portfolio of options is the rate of change of the value of the portfolio with respect to the passage of time with all else remaining the same. Theta is sometimes referred to as the time decay of the portfolio. The theta of a call or put is usually negative. A negative theta means ...

DERIVATIVES-II

... Suppose that stock price of an asset is $100 and option price is $10. imagine n investor who has sold 20 option contracts, that is option to buy 20 shares. The investor’s position can be hedged by buying , Delta*20 shares (Assume delta is 0.6), 12 shares. So if the stock price goes up $1, the option ...

... Suppose that stock price of an asset is $100 and option price is $10. imagine n investor who has sold 20 option contracts, that is option to buy 20 shares. The investor’s position can be hedged by buying , Delta*20 shares (Assume delta is 0.6), 12 shares. So if the stock price goes up $1, the option ...

Key Issues and Ideas - BYU Marriott School

... Homework 3: Understand Chapter 2 Problems: 4, 6, 10, 13 Chapter 3 Problems: 1, 5, 16 Chapter 2 1. In what ways is preferred stock like long-term debt? In what ways is it like equity? 6. Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $4 ...

... Homework 3: Understand Chapter 2 Problems: 4, 6, 10, 13 Chapter 3 Problems: 1, 5, 16 Chapter 2 1. In what ways is preferred stock like long-term debt? In what ways is it like equity? 6. Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $4 ...