JSE Equity Options Brochure

... the market opinion about the volatility of the underlying. The prices of deep in-the-money options and deep out-the-money options are relatively insensitive to volatility. This is because deep in-the-money and deep out-the-money option prices are nearly equal to their intrinsic values. At-the-money ...

... the market opinion about the volatility of the underlying. The prices of deep in-the-money options and deep out-the-money options are relatively insensitive to volatility. This is because deep in-the-money and deep out-the-money option prices are nearly equal to their intrinsic values. At-the-money ...

EMH Lecture

... • Investors may expect higher returns from expensive stocks but they may be repeatedly surprised by disappointing earnings reports • Thus, the relationship between risk and return appears to be upside-down ...

... • Investors may expect higher returns from expensive stocks but they may be repeatedly surprised by disappointing earnings reports • Thus, the relationship between risk and return appears to be upside-down ...

Explanation and Benefits of Fair Value Accounting

... Although judgment is invo lved in the fair valuation process, most firms have a robust internal control process for ensuring valuations are reasonable and consistent. Management review and oversight are key to ensuring accuracy. Valuation models are subject to independent review as part of the inter ...

... Although judgment is invo lved in the fair valuation process, most firms have a robust internal control process for ensuring valuations are reasonable and consistent. Management review and oversight are key to ensuring accuracy. Valuation models are subject to independent review as part of the inter ...

Implied PDF terminology and concepts

... In theory, if the two were unequal then by selling the higher priced asset/portfolio, buying the lower priced and holding the two positions until expiry, an investor could make a risk free profit. ...

... In theory, if the two were unequal then by selling the higher priced asset/portfolio, buying the lower priced and holding the two positions until expiry, an investor could make a risk free profit. ...

Contract Specifications for Option Contract on EURUSD

... Deep-out-of-the-money short options may show zero or minimal Scan Risk given the price and volatility moves in the 16 market scenarios, yet still present risk in the event that these options move closer-to-the-money or in-the-money, thereby generating potentially large losses. Hence a Short Option M ...

... Deep-out-of-the-money short options may show zero or minimal Scan Risk given the price and volatility moves in the 16 market scenarios, yet still present risk in the event that these options move closer-to-the-money or in-the-money, thereby generating potentially large losses. Hence a Short Option M ...

June 13th 2008 - Neil H. Gendreau, CFP

... level of risk depends in part on the fluctuation of the underlying security, but also on which strategy is deployed. When properly implemented, stock options can help reduce the risk of owning individual stocks, especially with concentrated positions. 8. Swaps/Futures – A swap contract is when one p ...

... level of risk depends in part on the fluctuation of the underlying security, but also on which strategy is deployed. When properly implemented, stock options can help reduce the risk of owning individual stocks, especially with concentrated positions. 8. Swaps/Futures – A swap contract is when one p ...

II,1-3 Powerpoint

... Inventory dates must be the same each year so accurate comparisons can be made. ...

... Inventory dates must be the same each year so accurate comparisons can be made. ...

[in the value of the land] due to adjacent capital activity is recorded

... AEG arguments for recording as OCVA • The price of land is not only determined by the economic use, location, size, but also by surrounding amenities which, therefore, should be considered quality elements • When these surrounding amenities change the adjacent land changes simultaneously. These ext ...

... AEG arguments for recording as OCVA • The price of land is not only determined by the economic use, location, size, but also by surrounding amenities which, therefore, should be considered quality elements • When these surrounding amenities change the adjacent land changes simultaneously. These ext ...

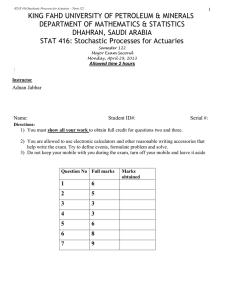

Exam2 - Academic Information System (KFUPM AISYS)

... If no claim are made in one year, the policyholder moves to the next higher level, or remain at the 75% level. If one claim is made in one year, the policyholder moves down one level, or remains at the 0% level. If two or more claims are made, the policyholder moves straight down to, or remains at, ...

... If no claim are made in one year, the policyholder moves to the next higher level, or remain at the 75% level. If one claim is made in one year, the policyholder moves down one level, or remains at the 0% level. If two or more claims are made, the policyholder moves straight down to, or remains at, ...

Investor Brochure - Mackenzie Global Low Volatility Fund

... Many people react to the market’s ups and downs by making emotional decisions about their investments. Research shows that investors tend to put more money into equity funds when the stock market is nearing its high, and sell when the market reaches a low point (see chart below). In other words, vol ...

... Many people react to the market’s ups and downs by making emotional decisions about their investments. Research shows that investors tend to put more money into equity funds when the stock market is nearing its high, and sell when the market reaches a low point (see chart below). In other words, vol ...

![[in the value of the land] due to adjacent capital activity is recorded](http://s1.studyres.com/store/data/020789002_1-92143a88d7d4a451cd958365da5db994-300x300.png)