* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Foreign Currency Derivatives

Present value wikipedia , lookup

Business valuation wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Purchasing power parity wikipedia , lookup

Reserve currency wikipedia , lookup

Currency war wikipedia , lookup

Financial economics wikipedia , lookup

Greeks (finance) wikipedia , lookup

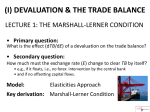

Foreign Currency Derivatives Learning Objectives • Examine how foreign currency futures are quoted, • • • • valued, and used for speculation purposes Illustrate how foreign currency futures differ from forward contracts Analyze how foreign currency options are quoted and used for speculation purposes Consider the distinction between buying and writing options in terms of whether profits and losses are limited or unlimited Explain how foreign currency options are valued Copyright © 2003 Pearson Education, Inc. Slide 7-1 Foreign Currency Derivatives Financial management in the 21st century needs to consider the use of financial derivatives These derivatives, so named because their values are derived from the underlying asset, are a powerful tool used for two distinct management objectives: • Speculation – the financial manager takes a position in the • expectation of profit Hedging – the financial manager uses the instruments to reduce the risks of the corporation’s cash flow In the wrong hands, derivatives can cause a corporation to collapse (Barings, Allied Irish Bank), but used wisely they allow a financial manager the ability to plan cash flows Copyright © 2003 Pearson Education, Inc. Slide 7-2 Foreign Currency Derivatives The financial manager must first understand the basics of the structure and pricing of these tools The derivatives that will be discussed will be • Foreign Currency Futures • Foreign Currency Options Copyright © 2003 Pearson Education, Inc. Slide 7-3 Foreign Currency Futures A foreign currency futures contract is an alternative to a forward contract • It calls for future delivery of a standard amount of currency at a fixed time and price • These contracts are traded on exchanges with the largest being the International Monetary Market located in the Chicago Mercantile Exchange Copyright © 2003 Pearson Education, Inc. Slide 7-4 Foreign Currency Futures Contract Specifications • Size of contract – called the notional principal, trading in each currency must be done in an even multiple • Method of stating exchange rates – “American terms” are used; quotes are in US dollar cost per unit of foreign currency, also known as direct quotes • Maturity date – contracts mature on the 3rd Wednesday of January, March, April, June, July, September, October or December Copyright © 2003 Pearson Education, Inc. Slide 7-5 Foreign Currency Futures Contract Specifications • Last trading day – contracts may be traded through the second business day prior to maturity date • Collateral & maintenance margins – the purchaser or trader must deposit an initial margin or collateral; this requirement is similar to a performance bond – At the end of each trading day, the account is marked to market and the balance in the account is either credited if value of contracts is greater or debited if value of contracts is less than account balance Copyright © 2003 Pearson Education, Inc. Slide 7-6 Foreign Currency Futures Contract Specifications • Settlement – only 5% of futures contracts are settled by physical delivery, most often buyers and sellers offset their position prior to delivery date – The complete buy/sell or sell/buy is termed a round turn • Commissions – customers pay a commission to their broker to • execute a round turn and only a single price is quoted Use of a clearing house as a counterparty – All contracts are agreements between the client and the exchange clearing house. Consequently clients need not worry about the performance of a specific counterparty since the clearing house is guaranteed by all members of the exchange Copyright © 2003 Pearson Education, Inc. Slide 7-7 Using Foreign Currency Futures Any investor wishing to speculate on the movement of a currency can pursue one of the following strategies • Short position – selling a futures contract based on view that currency will fall in value • Long position – purchase a futures contract based on view that currency will rise in value • Example: Amber McClain believes that Mexican peso will fall in value against the US dollar, she looks at quotes in the WSJ for Mexican peso futures Copyright © 2003 Pearson Education, Inc. Slide 7-8 Using Foreign Currency Futures Maturity Open High Low Settle Change High Low Open Interest Mar .10953 .10988 .10930 .10958 --- .11000 .09770 34,481 June .10790 .10795 .10778 .10773 --- .10800 .09730 3,405 Sept .10615 .10615 .10610 .10573 --- .10615 .09930 1,4181 All contracts are for 500,000 new Mexican pesos. “Open,” “High” and “Low” all refer to the price on the day. “Settle” is the closing price on the day and “Change” indicates the change in the settle price from the previous day. “High” and “Low” to the right of Change indicates the highest and lowest prices for this specific contact during its trading history. “Open Interest” indicates the number of contracts outstanding Source: Wall Street Journal, February 22, 2002, p.C13 Copyright © 2003 Pearson Education, Inc. Slide 7-9 Using Foreign Currency Futures Example (cont.): Amber believes that the value of the peso will fall, so she sells a March futures contract By taking a short position on the Mexican peso, Amber locks-in the right to sell 500,000 Mexican pesos at maturity at a set price above their current spot price Using the quotes from the table, Amber sells one March contract for 500,000 pesos at the settle price: $.10958/Ps Value at maturity (Short position) = -Notional principal (Spot – Forward) Copyright © 2003 Pearson Education, Inc. Slide 7-10 Using Foreign Currency Futures To calculate the value of Amber’s position we use the following formula Value at maturity (Short position) = -Notional principal (Spot – Forward) Using the settle price from the table and assuming a spot rate of $.09500/Ps at maturity, Amber’s profit is Value = -Ps 500,000 ($0.09500/ Ps - $.10958/ Ps) = $7,290 Copyright © 2003 Pearson Education, Inc. Slide 7-11 Using Foreign Currency Futures If Amber believed that the Mexican peso would rise in value, she would take a long position on the peso Value at maturity (Long position) = Notional principal (Spot – Forward) Using the settle price from the table and assuming a spot rate of $.11000/Ps at maturity, Amber’s profit is Value = Ps 500,000 ($0.11000/ Ps - $.10958/ Ps) = $210 Copyright © 2003 Pearson Education, Inc. Slide 7-12 Foreign Currency Futures Versus Forward Contracts Characteristic Foreign Currency Futures Forward Contracts Size of Contract Standardized contracts per currency any size desired Maturity fixed maturities, longest typically being one year any maturity up to one year, sometimes longer Location trading occurs on organized exchange trading occurs between individuals and banks Pricing open outcry process on exchange floor prices are determined by bid/ask quotes Margin/Collateral initial margin that is marked to market on a daily basis no explicit collateral Settlement rarely delivered, settlement normally takes place through purchase of offsetting position contract is delivered upon, can offset position Commissions single commission covers purchase& sell Trading hours traditional exchange hours no explicit commissions; banks earn money through bid/ask spread markets open 24 hours Counterparties unknown, go through clearing house parties in direct contact Liquidity liquid but relatively small in total sales volume and value Copyright © 2003 Pearson Education, Inc. liquid and relatively large in sales volume Slide 7-13 Foreign Currency Options A foreign currency option is a contract giving the purchaser of the option the right to buy or sell a given amount of currency at a fixed price per unit for a specified time period • The most important part of clause is the “right, but not the obligation” to take an action • Two basic types of options, calls and puts – Call – buyer has right to purchase currency – Put – buyer has right to sell currency • The buyer of the option is the holder and the seller of the option is termed the writer Copyright © 2003 Pearson Education, Inc. Slide 7-14 Foreign Currency Options Every option has three different price elements • The strike or exercise price is the exchange rate at which the foreign currency can be purchased or sold • The premium, the cost, price or value of the option itself paid at time option is purchased • The underlying or actual spot rate in the market There are two types of option maturities • American options may be exercised at any time during the life of the option • European options may not be exercised until the specified maturity date Copyright © 2003 Pearson Education, Inc. Slide 7-15 Foreign Currency Options Options may also be classified as per their payouts • At-the-money (ATM) options have an exercise price equal to the spot rate of the underlying currency • In-the-money (ITM) options may be profitable, excluding premium costs , if exercised immediately • Out-of-the-money (OTM) options would not be profitable, excluding the premium costs, if exercised Copyright © 2003 Pearson Education, Inc. Slide 7-16 Foreign Currency Options Markets The increased use of currency options has lead the creation of several markets where financial managers can access these derivative instruments • Over-the-Counter (OTC) Market – OTC options are most frequently written by banks for US dollars against British pounds, Swiss francs, Japanese yen, Canadian dollars and the euro – Main advantage is that they are tailored to purchaser – Counterparty risk exists – Mostly used by individuals and banks Copyright © 2003 Pearson Education, Inc. Slide 7-17 Foreign Currency Options Markets • Organized Exchanges – similar to the futures market, currency options are traded on an organized exchange floor – The Chicago Mercantile and the Philadelphia Stock Exchange serve options markets – Clearinghouse services are provided by the Options Clearinghouse Corporation (OCC) Copyright © 2003 Pearson Education, Inc. Slide 7-18 Foreign Currency Options Markets Table shows option prices on Swiss franc taken from the Wall Street Journal Calls - Last Options & Underlying 58.51 58.51 58.51 58.51 58.51 58.51 58.51 Strike Price 56 56 1/2 57 57 1/2 58 58 1/2 59 Aug --1.13 0.75 0.71 0.50 0.30 Sep ----1.05 -0.66 Puts - Last Dec 2.76 -1.74 -1.28 -1.21 Aug 0.04 0.06 0.10 0.17 0.27 0.50 0.90 Sep 0.22 0.30 0.38 0.55 0.89 0.99 1.36 Dec 1.16 -1.27 -1.81 --- Each option = 62,500 Swiss francs. The August, September and December listings are the option maturity dates Copyright © 2003 Pearson Education, Inc. Slide 7-19 Foreign Currency Options Markets • The spot rate means that 58.51 cents, or $0.5851 was the price of one Swiss franc • The strike price means the price per franc that must be paid for the option. The August call option of 58 ½ means $0.5850/Sfr • The premium, or cost, of the August 58 ½ option was 0.50 per franc, or $0.0050/Sfr – For a call option on 62,500 Swiss francs, the total cost would be Sfr62,500 x $0.0050/Sfr = $312.50 Copyright © 2003 Pearson Education, Inc. Slide 7-20 Foreign Currency Speculation Speculating in the spot market • Hans Schmidt is a currency speculator. He is willing to risk his money based on his view of currencies and he may do so in the spot, forward or options market • Assume Hans has $100,000 and he believes that the six month spot for Swiss francs will be $0.6000/Sfr. – Speculation in the spot market requires that view is currency appreciation Copyright © 2003 Pearson Education, Inc. Slide 7-21 Foreign Currency Speculation Speculating in the spot market • Hans should take the following steps • Use the $100,000 to purchase Sfr170,910.96 today at a spot rate of $0.5851/Sfr • Hold the francs indefinitely, because Hans is in the spot market he is not committed to the six month target • When target exchange rate is reached, sell the Sfr170,910.96 at new spot rate of $0.6000/Sfr, receiving Sfr170,910.96 x $0.6000/Sfr = $102,546.57 • This results in a profit of $2,546.57 or 2.5% ignoring cost of interest income and opportunity costs Copyright © 2003 Pearson Education, Inc. Slide 7-22 Foreign Currency Speculation Speculating in the forward market • If Hans were to speculate in the forward market, his viewpoint • • • • would be that the future spot rate will differ from the forward rate Today, Hans should purchase Sfr173,611.11 forward six months at the forward quote of $0.5760/Sfr. This step requires no cash outlay In six months, fulfill the contract receiving Sfr173,611.11 at $0.5760/Sfr at a cost of $100,000 Simultaneously sell the Sfr173,611.11 in the spot market at Hans’ expected spot rate of $0.6000/Sfr, receiving Sfr173,611.11 x $0.6000/Sfr = $104,166.67 This results in a profit of $4,166.67 with no investment required Copyright © 2003 Pearson Education, Inc. Slide 7-23 Foreign Currency Speculation Speculating in the options market • If Hans were to speculate in the options market, his viewpoint would determine what type of option to buy or sell • As a buyer of a call option, Hans purchases the August call on francs at a strike price of 58 ½ ($0.5850/Sfr) and a premium of 0.50 or $0.0050/Sfr • At spot rates below the strike price, Hans would not exercise his option because he could purchase francs cheaper on the spot market than via his call option Copyright © 2003 Pearson Education, Inc. Slide 7-24 Foreign Currency Speculation Speculating in the options market • Hans’ only loss would be limited to the cost of the option, or the premium ($0.0050/Sfr) • At all spot rates above the strike of 58 ½ Hans would exercise the option, paying only the strike price for each Swiss franc – If the franc were at 59 ½, Hans would exercise his options buying Swiss francs at 58 ½ instead of 59 ½ Copyright © 2003 Pearson Education, Inc. Slide 7-25 Foreign Currency Speculation Speculating in the options market • Hans could then sell his Swiss francs on the spot market at 59 ½ for a profit Profit = Spot rate – (Strike price + Premium) = $0.595/Sfr – ($0.585/Sfr + $0.005/Sfr) = $0.005/Sfr Copyright © 2003 Pearson Education, Inc. Slide 7-26 Foreign Currency Speculation Speculating in the options market • Hans could also wait to see if the Swiss franc appreciates more, this is the value to the holder of a call option – limited loss, unlimited upside • Hans’ break-even price can also be calculated by combining the premium cost of $0.005/Sfr with the cost of exercising the option, $0.585/Sfr – This matched the proceeds from exercising the option at a price of $0.590/Sfr Copyright © 2003 Pearson Education, Inc. Slide 7-27 Profit & Loss for the Buyer of a Call Option “At the money” Strike price Profit (US cents/SF) “Out of the money” “In the money” + 1.00 + 0.50 0 - 0.50 Unlimited profit 57.5 58.0 58.5 59.0 59.5 Spot price (US cents/SF) Limited loss Break-even price - 1.00 Loss The buyer of a call option on SF, with a strike price of 58.5 cents/SF, has a limited loss of 0.50 cents/SF at spot rates less than 58.5 (“out of the money”), and an unlimited profit potential at spot rates above 58.5 cents/SF (“in the money”). Copyright © 2003 Pearson Education, Inc. Slide 7-28 Foreign Currency Speculation Speculating in the options market • Hans could also write a call, if the future spot rate is below 58 ½, then the holder of the option would not exercise it and Hans would keep the premium • If Hans went uncovered and the option was exercised against him, he would have to purchase Swiss francs on the spot market at a higher rate than he is obligated to sell them at • Here the writer of a call option has limited profit and unlimited losses if uncovered Copyright © 2003 Pearson Education, Inc. Slide 7-29 Foreign Currency Speculation Speculating in the options market • Hans’ payout on writing a call option would be Profit = Premium – (Spot rate - Strike price) = $0.005/Sfr – ($0.595/Sfr + $0.585/Sfr) = - $0.005/Sfr Copyright © 2003 Pearson Education, Inc. Slide 7-30 Profit & Loss for the Writer of a Call Option “At the money” Strike price Profit (US cents/SF) + 1.00 + 0.50 0 Break-even price Limited profit 57.5 - 0.50 58.0 58.5 59.0 59.5 Spot price (US cents/SF) Unlimited loss - 1.00 Loss The writer of a call option on SF, with a strike price of 58.5 cents/SF, has a limited profit of 0.50 cents/SF at spot rates less than 58.5, and an unlimited loss potential at spot rates above (to the right of) 59.0 cents/SF. Copyright © 2003 Pearson Education, Inc. Slide 7-31 Foreign Currency Speculation Speculating in the options market • Hans could also buy a put, the only difference from • • • • buying a call is that Hans now has the right to sell currency at the strike price If the franc drops to $0.575/Sfr Hans will deliver to the writer of the put and receive $0.585/Sfr The francs can be purchased on the spot market at $0.575/Sfr With the cost of the option being $0.005/Sfr, Hans realizes a net gain of $0.005/Sfr As with a call option - limited loss, unlimited gain Copyright © 2003 Pearson Education, Inc. Slide 7-32 Foreign Currency Speculation Speculating in the options market • Hans’ payout on buying a put option would be Profit = Strike price – (Spot rate + Premium) = $0.585/Sfr – ($0.575/Sfr + $0.005/Sfr) = $0.005/Sfr Copyright © 2003 Pearson Education, Inc. Slide 7-33 Profit & Loss for the Buyer of a Put Option “At the money” Strike price Profit (US cents/SF) “In the money” “Out of the money” + 1.00 + 0.50 0 Profit up to 58.0 57.5 58.5 59.0 59.5 Spot price (US cents/SF) Limited loss - 0.50 - 1.00 58.0 Break-even price Loss The buyer of a put option on SF, with a strike price of 58.5 cents/SF, has a limited loss of 0.50 cents/SF at spot rates greater than 58.5 (“out of the money”), and an unlimited profit potential at spot rates less than 58.5 cents/SF (“in the money”) up to 58.0 cents. Copyright © 2003 Pearson Education, Inc. Slide 7-34 Foreign Currency Speculation Speculating in the options market • And of course, Hans could write a put, thereby obliging him to purchase francs at the strike price • If the franc drops below 58 ½ Hans will lose more than the premium received • If the spot rate does not fall below 58 ½ then the option will not be exercised and Hans will keep the premium from the option • As with a call option - unlimited loss, limited gain Copyright © 2003 Pearson Education, Inc. Slide 7-35 Foreign Currency Speculation Speculating in the options market • Hans’ payout on writing a put option would be Profit = Premium – (Strike price - Spot rate) = $0.005/Sfr – ($0.585/Sfr + $0.575/Sfr) = - $0.005/Sfr Copyright © 2003 Pearson Education, Inc. Slide 7-36 Profit & Loss for the Writer of a Put Option “At the money” Profit (US cents/SF) Strike price + 1.00 + 0.50 Break-even price Limited profit 0 57.5 58.0 58.5 59.0 59.5 Spot price (US cents/SF) - 0.50 - 1.00 Unlimited loss up to 58.0 Loss The writer of a put option on SF, with a strike price of 58.5 cents/SF, has a limited profit of 0.50 cents/SF at spot rates greater than 58.5, and an unlimited loss potential at spot rates less than 58.5 cents/SF up to 58.0 cents. Copyright © 2003 Pearson Education, Inc. Slide 7-37 Option Pricing and Valuation The pricing of any option combines six elements • • • • • • Present spot rate, $1.70/£ Time to maturity, 90 days Forward rate for matching maturity (90 days), $1.70/£ US dollar interest rate, 8.00% p.a. British pound interest rate, 8.00% p.a. Volatility, the standard deviation of daily spot rate movement, 10.00% p.a. Copyright © 2003 Pearson Education, Inc. Slide 7-38 Option Pricing and Valuation The intrinsic value is the financial gain if the option is exercised immediately (at-the-money) • This value will reach zero when the option is out-ofthe-money • When the spot rate rises above the strike price, the option will be in-the-money • At maturity date, the option will have a value equal to its intrinsic value Copyright © 2003 Pearson Education, Inc. Slide 7-39 Option Pricing and Valuation When the spot rate is $1.74/£, the option is ITM and has an intrinsic value of $1.74 - $1.70/£, or 4 cents per pound When the spot rate is $1.70/£, the option is ATM and its intrinsic value is $1.70 - $1.70/£, or zero cents per pound When the spot rate is is $1.66/£, the option is OTM and has no intrinsic value, only a fool would exercise this option Copyright © 2003 Pearson Education, Inc. Slide 7-40 Option Pricing and Valuation Option Premium (US cents/£) Strike Price of $1.70/£ -- Valuation on first day of 90-day maturity -- 6.0 5.67 Total value 5.0 4.00 4.0 3.30 3.0 2.0 1.67 Time value Intrinsic value 1.0 0.0 1.66 1.67 1.68 1.69 1.70 1.71 1.72 1.73 1.74 Spot rate ($/£) Copyright © 2003 Pearson Education, Inc. Slide 7-41 Option Pricing and Valuation The time value of the option exists because the price of the underlying currency can potentially move further into the money between today and maturity • In the exhibit, time value is shown as the area between total value and intrinsic value Copyright © 2003 Pearson Education, Inc. Slide 7-42 Option Pricing and Valuation Option volatility is defined as the standard deviation of the daily percentage changes in the underlying exchange rate • It is the most important variable because of the exchange rate’s perceived likelihood to move either in or out of the range in which the option would be exercised • Volatility is stated per annum • Example: 12.6% p.a. volatility would have to be converted for a single day as follows 12.6% 12.6% 0.66% daily vola tility 365 19.105 Copyright © 2003 Pearson Education, Inc. Slide 7-43 Option Pricing and Valuation For our $1.70/£ call option, an increase in annual volatility of 1 percentage point will increase the option premium from $0.033/£ to $0 .036/£ • The marginal change in option premium is equal to the change in option premium itself divided by the change in volatility premium $0.036 $0.033 0.30 volatilit y .11 .10 Copyright © 2003 Pearson Education, Inc. Slide 7-44 Option Pricing and Valuation The primary problem with volatility is that it is unobservable, there is no single correct method for its calculation Thus, volatility is viewed in three ways • Historic – normally measured as the percentage movement in the spot rate on a daily basis, or other time period • Forward-looking – a trader may adjust recent historic volatilities for expected market swings • Implied – calculated by backing out of the market option premium Copyright © 2003 Pearson Education, Inc. Slide 7-45 Summary of Learning Objectives A foreign currency futures contract is an exchange- traded agreement calling for future delivery of a standard amount of foreign currency at a fixed time, place and price Foreign currency futures contracts are in reality standardized forward contracts. Unlike forward contracts, however, trading occurs on the floor of an organized exchange. They also require collateral and are normally settled through the purchase of an offsetting position Copyright © 2003 Pearson Education, Inc. Slide 7-46 Summary of Learning Objectives Futures differ from forward contracts by size of contract, maturity, location of trading, pricing , collateral/margin requirements, method of settlement, commissions, trading hours, counterparties and liquidity Financial managers typically prefer foreign currency forwards over futures out of simplicity of use and position maintenance. Financial speculators prefer futures over forwards because of the liquidity of the market Copyright © 2003 Pearson Education, Inc. Slide 7-47 Summary of Learning Objectives Foreign currency options are financial contracts that give the holder the right, but not the obligation, to buy or sell a specified amount of currency at a predetermined price on or before a specified maturity date The use of currency options as a speculative device for a buyer arise from the fact that an option gains in value as the underlying currency rises or falls. The amount of loss when the underlying currency moves opposite the desired direction is limited to the premium of the option The use of currency options as a speculative device for a seller arise from the option premium. If the option expires out-ofthe-money, the writer has earned and retains the entire premium Copyright © 2003 Pearson Education, Inc. Slide 7-48 Summary of Learning Objectives Speculation is an attempt to profit by trading on expectations about prices in the future. • In the foreign exchange market, one speculates by taking • position on a currency and then closing that position after the exchange rate has moved. A profit results only if the rate moves in the direction that was expected Currency option valuation is a complex combination of the current spot rate, the specific strike price, the forward rate, currency volatility and time to maturity The total value of an option is the sum of its intrinsic and time value. • Intrinsic value depends on the relationship between the option’s strike price and the spot rate at any single point in time, whereas time value estimates how the intrinsic value may change prior to the option’s maturity Copyright © 2003 Pearson Education, Inc. Slide 7-49