Illinois Tool Works Inc.

... • Globally diversified revenue base • Strong dividend history • Multiple end markets and product groups • High number of operating segments and product lines • Unproven track record of management team • Very uncertain future due to current strategy ...

... • Globally diversified revenue base • Strong dividend history • Multiple end markets and product groups • High number of operating segments and product lines • Unproven track record of management team • Very uncertain future due to current strategy ...

Dynamic Volatility Targeting

... equity holders as creditors in a company’s capital structure; thereby cash flows to fixed income investments are less risky given this seniority. The fundamental differences between equity and bond investments are further highlighted by their volatility. The volatility of the MSCI ACWI exceeded 74% ...

... equity holders as creditors in a company’s capital structure; thereby cash flows to fixed income investments are less risky given this seniority. The fundamental differences between equity and bond investments are further highlighted by their volatility. The volatility of the MSCI ACWI exceeded 74% ...

Lecture Notes

... reduce risk. But it may also use leverage, which increases the level of risk and the potential rewards. Hedge funds can invest in virtually anything anywhere. They can hold stocks, bonds, and government securities in all global markets. They may purchase currencies, derivatives, commodities, and tan ...

... reduce risk. But it may also use leverage, which increases the level of risk and the potential rewards. Hedge funds can invest in virtually anything anywhere. They can hold stocks, bonds, and government securities in all global markets. They may purchase currencies, derivatives, commodities, and tan ...

Five for first-timers - The South African Financial Markets Journal

... you want to avoid putting all your eggs in one basket. Keep in mind though that no matter how much you diversify your portfolio, there is always an element of risk involved whenever you invest. ...

... you want to avoid putting all your eggs in one basket. Keep in mind though that no matter how much you diversify your portfolio, there is always an element of risk involved whenever you invest. ...

Sanlam Investment Management Value Fund Class A1

... long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equiti ...

... long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equiti ...

Asian basket options and implied correlations in energy

... possible upside, while limiting the downside risk. An optimal hedge would be achieved in this case by a basket or spread option: an option whose underlying asset is a basket or a spread, i.e., a portfolio of several assets, possibly containing long and short positions. An appropriate basket or sprea ...

... possible upside, while limiting the downside risk. An optimal hedge would be achieved in this case by a basket or spread option: an option whose underlying asset is a basket or a spread, i.e., a portfolio of several assets, possibly containing long and short positions. An appropriate basket or sprea ...

The Returns and Risks From Investing

... For comparing performance over time or across different securities Total Return is a percentage relating all cash flows received during a given time period, denoted CFt +(PE - PB), to the start of period ...

... For comparing performance over time or across different securities Total Return is a percentage relating all cash flows received during a given time period, denoted CFt +(PE - PB), to the start of period ...

Derivatives - Karvy Fortune

... price minus the spot price. There will be a different basis for each delivery month for each contract. In a normal market, basis will be positive. This reflects that futures prices normally exceed spot prices. Cost of carry: The relationship between futures prices and spot prices can be summarized ...

... price minus the spot price. There will be a different basis for each delivery month for each contract. In a normal market, basis will be positive. This reflects that futures prices normally exceed spot prices. Cost of carry: The relationship between futures prices and spot prices can be summarized ...

Applying fuzzy parameters in pricing financial derivatives inspired by

... facilitating turnover, increasing flux liquidity and securing against the overestimation of possible emission reductions and the risk connected with such errors. Therefore, it is necessary to use adequate financial mathematics tools to solve problems arising from the issuing or pricing of such instr ...

... facilitating turnover, increasing flux liquidity and securing against the overestimation of possible emission reductions and the risk connected with such errors. Therefore, it is necessary to use adequate financial mathematics tools to solve problems arising from the issuing or pricing of such instr ...

Homework Assignment 3

... Which project offers the greatest amount of profits at the level of society? Which will the entrepreneur choose if they have total control of the funds and are risk neutral? Explain the difference. D. Assume that the entrepreneur own an apartment which you estimate can be resold for $30,000. Before ...

... Which project offers the greatest amount of profits at the level of society? Which will the entrepreneur choose if they have total control of the funds and are risk neutral? Explain the difference. D. Assume that the entrepreneur own an apartment which you estimate can be resold for $30,000. Before ...

Bond Valuation

... maturity and duration, but duration increases at a decreasing rate with maturity There is an inverse relation between YTM and duration Sinking funds and call provisions can have a dramatic effect on a bond’s duration ...

... maturity and duration, but duration increases at a decreasing rate with maturity There is an inverse relation between YTM and duration Sinking funds and call provisions can have a dramatic effect on a bond’s duration ...

Chapter 10

... parties where one party will realize a gain and the other party will realize a loss due to a change in value of the factor underlying the instrument. Option holders pay a specific “up front” price that gives them the right to buy (“call”) or sell (“put”) a specific quantity at a specific price of a ...

... parties where one party will realize a gain and the other party will realize a loss due to a change in value of the factor underlying the instrument. Option holders pay a specific “up front” price that gives them the right to buy (“call”) or sell (“put”) a specific quantity at a specific price of a ...

Irmgard Marboe

... Sources: national law, general principles of law (PECL, UNIDROIT Principles, New Lex Mercatoria, …) “full compensation”: E.g. “The aggrieved party is entitled to damages for loss caused by the other party's non-performance of its contractual obligations. It is entitled, subject to the provisions of ...

... Sources: national law, general principles of law (PECL, UNIDROIT Principles, New Lex Mercatoria, …) “full compensation”: E.g. “The aggrieved party is entitled to damages for loss caused by the other party's non-performance of its contractual obligations. It is entitled, subject to the provisions of ...

Special Risks in Securities Trading

... financial instruments deposited with that dealer will not form part of their bankruptcy assets, but will be kept separate for your benefit. However, insolvency proceedings can delay the transfer of the financial instruments to you or another securities dealer. If a third-party custodian becomes inso ...

... financial instruments deposited with that dealer will not form part of their bankruptcy assets, but will be kept separate for your benefit. However, insolvency proceedings can delay the transfer of the financial instruments to you or another securities dealer. If a third-party custodian becomes inso ...

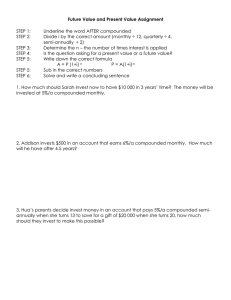

Future Value and Present Value Assignment

... Underline the word AFTER compounded Divide i by the correct amount (monthly ÷ 12, quarterly ÷ 4, semi-annually ÷ 2) Determine the n – the number of times interest is applied Is the question asking for a present value or a future value? Write down the correct formula A = P (1+i) n P = A(1+i)-n Sub in ...

... Underline the word AFTER compounded Divide i by the correct amount (monthly ÷ 12, quarterly ÷ 4, semi-annually ÷ 2) Determine the n – the number of times interest is applied Is the question asking for a present value or a future value? Write down the correct formula A = P (1+i) n P = A(1+i)-n Sub in ...

Chapter 9 Put and Call Options

... So who sold you the option? A counter-party, who may have also been a small trader like you, wrote (offered to sell) this option at this price by posting a limit order to sell any number of contracts (it may have been more than one) for $5.35 per contract and that became Best Ask.6 To be clear, when ...

... So who sold you the option? A counter-party, who may have also been a small trader like you, wrote (offered to sell) this option at this price by posting a limit order to sell any number of contracts (it may have been more than one) for $5.35 per contract and that became Best Ask.6 To be clear, when ...

Case Objectives - Trinity University

... Always remember that as interest rates go up, note prices fall in trading markets and vice versa. As a result, call options are “in-the-money” if spot (current) interest rates fall below strike rates. Put options are “inthe-money” if spot rates rise above strike rates. The difference between a spot ...

... Always remember that as interest rates go up, note prices fall in trading markets and vice versa. As a result, call options are “in-the-money” if spot (current) interest rates fall below strike rates. Put options are “inthe-money” if spot rates rise above strike rates. The difference between a spot ...

Chapter 14 - Capital Markets

... A security, such as a CMO, is called a “derivative” because its value is derived from some underlying, more basic security such as a mortgage. Other examples include futures contracts on commodities, metals, and foreign currencies and options on common stocks or indexes of common stocks. ...

... A security, such as a CMO, is called a “derivative” because its value is derived from some underlying, more basic security such as a mortgage. Other examples include futures contracts on commodities, metals, and foreign currencies and options on common stocks or indexes of common stocks. ...