Omega:A Sharper Ratio

... may be “unbiased” with respect to market valuations. But those same valuations, in turn, may well be biased (misaligned) with respect to a counterfactual benchmark in which prices reflect the right signals for economic behaviour.” Borio and Tsatsaronis BIS The Finance Development Centre ...

... may be “unbiased” with respect to market valuations. But those same valuations, in turn, may well be biased (misaligned) with respect to a counterfactual benchmark in which prices reflect the right signals for economic behaviour.” Borio and Tsatsaronis BIS The Finance Development Centre ...

16: Asset Valuation: Derivative Investments

... Arbitrage is defined as the existence of riskless profit without investment and involves selling an asset and simultaneously buying the same asset for a lower price. Since the trades cancel each other, no investment is required. Because it is done simultaneously, a profit is guaranteed, making the ...

... Arbitrage is defined as the existence of riskless profit without investment and involves selling an asset and simultaneously buying the same asset for a lower price. Since the trades cancel each other, no investment is required. Because it is done simultaneously, a profit is guaranteed, making the ...

FASB Statement 149 and Redeemable Preferred

... The other two categories of instruments are (i) financial instruments embodying, or indexed to, an obligation to repurchase the company’s equity shares that requires or could require settlement by transfer of assets (e.g., written put options or forward contracts), that are physically settled or net ...

... The other two categories of instruments are (i) financial instruments embodying, or indexed to, an obligation to repurchase the company’s equity shares that requires or could require settlement by transfer of assets (e.g., written put options or forward contracts), that are physically settled or net ...

Prudential Short Duration High Yield Income Fund

... securities that have not been rated by an NRSRO. Average maturity is the average time to maturity for a bond. Duration measures investment risk that takes into account both a bond’s interest payments and its value to maturity. Sharpe ratio measures the quality of the returns for an investment on a r ...

... securities that have not been rated by an NRSRO. Average maturity is the average time to maturity for a bond. Duration measures investment risk that takes into account both a bond’s interest payments and its value to maturity. Sharpe ratio measures the quality of the returns for an investment on a r ...

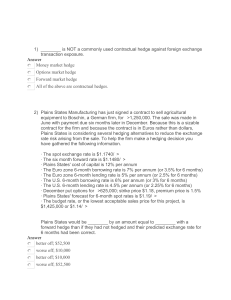

______ is NOT a commonly used contractual hedge against foreign

... with closest maturity are traded at USD0.8350 per 100 JPY. Futures contract expires 18 days after on February 19th. . Suppose the exporter takes a futures position equal to 50% of its cash position (JPY200m) at USD0.8350. Also Company treasurer buys an over the counter put option for the JPY150m por ...

... with closest maturity are traded at USD0.8350 per 100 JPY. Futures contract expires 18 days after on February 19th. . Suppose the exporter takes a futures position equal to 50% of its cash position (JPY200m) at USD0.8350. Also Company treasurer buys an over the counter put option for the JPY150m por ...

Optimal Option Portfolio Strategies: Deepening the Puzzle of Index

... There are a few papers that also address optimal portfolio allocation with options. Liu and Pan (2003) model stochastic volatility and jump processes and derive the optimal portfolio policy of a CRRA investor across one stock, a 5% OTM put option, and cash. Although they obtain an analytic solution ...

... There are a few papers that also address optimal portfolio allocation with options. Liu and Pan (2003) model stochastic volatility and jump processes and derive the optimal portfolio policy of a CRRA investor across one stock, a 5% OTM put option, and cash. Although they obtain an analytic solution ...

The energy market: From energy products to energy derivatives and

... appropriate model. It is well known that the energy market is very complicated and hard to model correctly, referring to the price processes. New models are probably being developed at the very moment that you are reading this paper. In this paper the most common and intuitively clear mathematical m ...

... appropriate model. It is well known that the energy market is very complicated and hard to model correctly, referring to the price processes. New models are probably being developed at the very moment that you are reading this paper. In this paper the most common and intuitively clear mathematical m ...

Delta Dental of South Dakota Foundation Dentist Loan Repayment

... Award recipients are also required to accept two patients/cases per award year from the Donated Dental Services Program or an approved alternative. Note: To qualify for Option II, the dentist must satisfy one of the state’s highest need areas, as identified by Delta Dental. Please respond to the fol ...

... Award recipients are also required to accept two patients/cases per award year from the Donated Dental Services Program or an approved alternative. Note: To qualify for Option II, the dentist must satisfy one of the state’s highest need areas, as identified by Delta Dental. Please respond to the fol ...

Financial Maths Solutions

... A outdoor setting has a marked price of C $980. The store offers a discount of 5% to account customers and a further 5% discount for accounts that are settled within 7 days. Calculate the price paid for the outdoor setting by an account customer who settles their account within 7 days. A $735 B $882 ...

... A outdoor setting has a marked price of C $980. The store offers a discount of 5% to account customers and a further 5% discount for accounts that are settled within 7 days. Calculate the price paid for the outdoor setting by an account customer who settles their account within 7 days. A $735 B $882 ...

PSF Portfolio Optimization Conservative

... Weighted (Wtd) Price is the average weighted price, which is generated from the portfolio by weighting the price of each bond by its relative size in the portfolio. This number reveals if the portfolio favors bonds selling at prices above or below face value (premium or discount securities, respecti ...

... Weighted (Wtd) Price is the average weighted price, which is generated from the portfolio by weighting the price of each bond by its relative size in the portfolio. This number reveals if the portfolio favors bonds selling at prices above or below face value (premium or discount securities, respecti ...

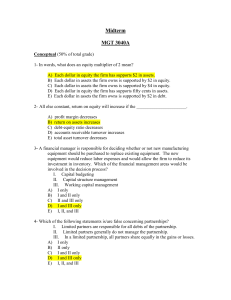

Answers to Midterm 3040A

... 20- The concept that a dollar received today is worth more than a dollar received tomorrow is referred to as the: A) Present value. B) Simple interest value. C) Compound value. D) Time value of money. E) Future value of money. 21- You are choosing between investments offered by two different banks. ...

... 20- The concept that a dollar received today is worth more than a dollar received tomorrow is referred to as the: A) Present value. B) Simple interest value. C) Compound value. D) Time value of money. E) Future value of money. 21- You are choosing between investments offered by two different banks. ...

Information and Probability The area of the whole board is πR 2, the

... some point, the contract expires and trade is no longer possible. For example, we could write a contract today at a price of K entitling you to a copy of the answers to the final exam at a price of $1,000 a week before the final. This “locks in” a price in the future, so if you feel like you are str ...

... some point, the contract expires and trade is no longer possible. For example, we could write a contract today at a price of K entitling you to a copy of the answers to the final exam at a price of $1,000 a week before the final. This “locks in” a price in the future, so if you feel like you are str ...

FIA Meeting

... Good dividend payer historic dividend yield of 7.9%. 10 year average dividend yield is above 6%. Expected 2012FY dividend yield of 6.3% in extremely tough operating environment ...

... Good dividend payer historic dividend yield of 7.9%. 10 year average dividend yield is above 6%. Expected 2012FY dividend yield of 6.3% in extremely tough operating environment ...

CAPITAL BUDGETING AND POLICY EVALUATION USING OPTION PRICING THEORY Peter Seed

... Option pricing theory has been used in capital budgeting problems where there are significant flexibility and strategic options involved. For example, the right to expand, abandon or defer a project or the opportunity to develop a new project or market - also known as growth options. Recent applicat ...

... Option pricing theory has been used in capital budgeting problems where there are significant flexibility and strategic options involved. For example, the right to expand, abandon or defer a project or the opportunity to develop a new project or market - also known as growth options. Recent applicat ...

Satrix Balanced Index Fund

... The year 2016 was definitely full of surprises starting with the Bank of Japan stunning the market with a surprise move to negative interest rates, muted Chinese GDP growth and the Brexit vote that wiped out about $2 trillion of global stocks overnight and knocked the British pound to 31-year lows. ...

... The year 2016 was definitely full of surprises starting with the Bank of Japan stunning the market with a surprise move to negative interest rates, muted Chinese GDP growth and the Brexit vote that wiped out about $2 trillion of global stocks overnight and knocked the British pound to 31-year lows. ...

Answers

... company. If this is not the case, a marginal cost of capital or a project-specific discount rate must be used to assess the acceptability of an investment project. The business risk of an investment project will be the same as current business operations if the project is an extension of existing bu ...

... company. If this is not the case, a marginal cost of capital or a project-specific discount rate must be used to assess the acceptability of an investment project. The business risk of an investment project will be the same as current business operations if the project is an extension of existing bu ...

1) Eurobonds versus Domestic Bonds

... Since I am selling euros and buying dollars, I should buy the put to hedge the risk of my profits. d. In the figure from parts (a) and (b), plot your “all in” profits using the option hedge (combined profits of crab contract, option contract, and option price) as a function of the exchange rate in o ...

... Since I am selling euros and buying dollars, I should buy the put to hedge the risk of my profits. d. In the figure from parts (a) and (b), plot your “all in” profits using the option hedge (combined profits of crab contract, option contract, and option price) as a function of the exchange rate in o ...