What is Implied by Implied Volatility?

... concept implies a lot more. With the concept of implied volatility, we step beyond the analysis of the Black-Scholes formula and the success or failure of inverting it. We question the validity, the significance, and the implications of such an act. We wonder what it may mean for the whole intellect ...

... concept implies a lot more. With the concept of implied volatility, we step beyond the analysis of the Black-Scholes formula and the success or failure of inverting it. We question the validity, the significance, and the implications of such an act. We wonder what it may mean for the whole intellect ...

Reservation bid and ask prices for options and covered

... in order to dynamically hedge their warrant position generate reservation bid and ask warrant prices which are consistent with empirical evidence on the values and bid-ask spreads of covered warrants. In addition, our model has wider implications for characteristics of bid and ask prices for structu ...

... in order to dynamically hedge their warrant position generate reservation bid and ask warrant prices which are consistent with empirical evidence on the values and bid-ask spreads of covered warrants. In addition, our model has wider implications for characteristics of bid and ask prices for structu ...

Compare Portfolio Strategies

... inefficiencies that can be found. c. Most reasonable approaches only examine factors that reflect the fundamental operating condition of the company or other factors cited in the academic literature. 4. Discounted Cash Flow Models. On the one hand, Multi-Factor models try to find the best factors an ...

... inefficiencies that can be found. c. Most reasonable approaches only examine factors that reflect the fundamental operating condition of the company or other factors cited in the academic literature. 4. Discounted Cash Flow Models. On the one hand, Multi-Factor models try to find the best factors an ...

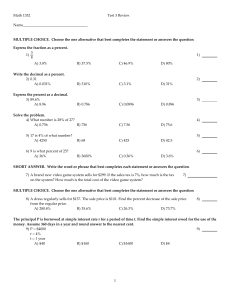

1. The primary operating goal of a publicly

... shares of Wal-Mart stock to you as a birthday gift. Capital market instruments include both long-term debt and common stocks. If your uncle in New York sold 100 shares of Microsoft through his broker to an investor in Los Angeles, this would be a primary market transaction.. While the two frequently ...

... shares of Wal-Mart stock to you as a birthday gift. Capital market instruments include both long-term debt and common stocks. If your uncle in New York sold 100 shares of Microsoft through his broker to an investor in Los Angeles, this would be a primary market transaction.. While the two frequently ...

Oligopoly

... Therefore, firms tend to maintain the same price. Substantial cost changes will have no effect on output and price as long as MC shifts between C1 & C2. Another reason why price is stable. ...

... Therefore, firms tend to maintain the same price. Substantial cost changes will have no effect on output and price as long as MC shifts between C1 & C2. Another reason why price is stable. ...

International Derivatives Brochure

... Conversely, this represents a negative movement of R20 for the seller of the International Derivatives SSF contract. The exchange will require that the seller pay R20 into his variation margin account which will then be paid into the buyer’s variation margin account. The margin required to be paid ...

... Conversely, this represents a negative movement of R20 for the seller of the International Derivatives SSF contract. The exchange will require that the seller pay R20 into his variation margin account which will then be paid into the buyer’s variation margin account. The margin required to be paid ...

VALUE STOCKS At the cusp of re-rating

... This report is published by Aranca, a customized research and analytics services provider to global clients. The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or ...

... This report is published by Aranca, a customized research and analytics services provider to global clients. The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or ...

Option Pricing Implications of a Stochastic Jump Rate

... Since the Black-Scholes option pricing model was introduced in 1973, it has become the most widely used and most powerful tool for trading in option markets. Over the past two decades, however, researchers have found signiÞcant deviations of market prices from predictions by the model. Out-of-money ...

... Since the Black-Scholes option pricing model was introduced in 1973, it has become the most widely used and most powerful tool for trading in option markets. Over the past two decades, however, researchers have found signiÞcant deviations of market prices from predictions by the model. Out-of-money ...

press release

... over (y) $10.00 (being the exercise price per share) times (z) 12,545,330 (being a number of shares subject to the options before the application of potential anti-dilution). The terms of exercise under the options allow for exercise using cash, as well as, with the consent of the board of the Compa ...

... over (y) $10.00 (being the exercise price per share) times (z) 12,545,330 (being a number of shares subject to the options before the application of potential anti-dilution). The terms of exercise under the options allow for exercise using cash, as well as, with the consent of the board of the Compa ...

Snímek 1

... • If spot-futures parity is not observed, then arbitrage is possible • If the futures price is too high, short the futures and acquire the stock by borrowing the money at the riskfree rate • If the futures price is too low, go long futures, short the stock and invest the proceeds at the riskfree rat ...

... • If spot-futures parity is not observed, then arbitrage is possible • If the futures price is too high, short the futures and acquire the stock by borrowing the money at the riskfree rate • If the futures price is too low, go long futures, short the stock and invest the proceeds at the riskfree rat ...

1 - How useful are implied distributions? Evidence from stock

... Investors, risk-managers and policy-makers all need to forecast the probability distribution of prices if they are to take rational decisions. Conventionally, an estimate of the variance is obtained from recent data on returns. A month of data may give a reasonable estimate of the variance, but obse ...

... Investors, risk-managers and policy-makers all need to forecast the probability distribution of prices if they are to take rational decisions. Conventionally, an estimate of the variance is obtained from recent data on returns. A month of data may give a reasonable estimate of the variance, but obse ...

The Supernormal Growth Example

... growth, dividend yield and capital gains yield are constant. Dividend yield is sufficiently large (19%) to offset negative capital gains. ...

... growth, dividend yield and capital gains yield are constant. Dividend yield is sufficiently large (19%) to offset negative capital gains. ...

The Use of Derivative Financial Instruments to

... instruments called derivatives. Among other things, these derivatives are used for helping to manage interest-rate risk. Examples are financial futures, options and interest-rate swaps. They are called derivatives because they are based on (or derived from) actual (“physical”) financial instruments. ...

... instruments called derivatives. Among other things, these derivatives are used for helping to manage interest-rate risk. Examples are financial futures, options and interest-rate swaps. They are called derivatives because they are based on (or derived from) actual (“physical”) financial instruments. ...

Uncovering the Gem: Hidden Elements in ASC Valuation

... former is not under any compulsion to buy and the latter is not under any compulsion to sell and when both have reasonable knowledge of the relevant facts.” ...

... former is not under any compulsion to buy and the latter is not under any compulsion to sell and when both have reasonable knowledge of the relevant facts.” ...