Solution 1:

... An investment proposal should be judged in whether or not it provides: ► A return equal to the return require by the investor ► A return more than required by investor ► A return less than required by investor ► A return equal to or more than required by investor Question No: 32 ( Marks: 1 ) - Pleas ...

... An investment proposal should be judged in whether or not it provides: ► A return equal to the return require by the investor ► A return more than required by investor ► A return less than required by investor ► A return equal to or more than required by investor Question No: 32 ( Marks: 1 ) - Pleas ...

View the Entire Research Piece as a PDF here.

... classes and currencies. It is our view that central bank policy is at the core of this phenomenon, as central bank market intervention has reached unprecedented levels in the aftermath of the financial crisis. From the late 1980s, the Fed, under chairman Allan Greenspan, had the tendency to lower in ...

... classes and currencies. It is our view that central bank policy is at the core of this phenomenon, as central bank market intervention has reached unprecedented levels in the aftermath of the financial crisis. From the late 1980s, the Fed, under chairman Allan Greenspan, had the tendency to lower in ...

Liquor Store Business Valuation

... page 78 and compare the adjusted book value of $248,544 ($175,968 + $5,376 + $67,200) for the total invested capital to the values concluded by the market approach (see Table 4-2 on page 79), and the concluded value of the income approach in Table 4-6 on page 84. It must be noted that not all compan ...

... page 78 and compare the adjusted book value of $248,544 ($175,968 + $5,376 + $67,200) for the total invested capital to the values concluded by the market approach (see Table 4-2 on page 79), and the concluded value of the income approach in Table 4-6 on page 84. It must be noted that not all compan ...

asset value guarantees under equity-based products

... i n v e s t m e n t risk and has no g u a r a n t e e as to the asset value of his c o n t r a c t a t a n y point in time. I t is both reasonable and a p p r o p r i a t e for a life insurance c o m p a n y to offer an a d d i t i o n a l assurance under such p r o d u c t s whereby the i n v e s t ...

... i n v e s t m e n t risk and has no g u a r a n t e e as to the asset value of his c o n t r a c t a t a n y point in time. I t is both reasonable and a p p r o p r i a t e for a life insurance c o m p a n y to offer an a d d i t i o n a l assurance under such p r o d u c t s whereby the i n v e s t ...

A General Equilibrium Analysis of Option and Stock Market

... Geometric Brownian Motion process and the rate of return on the instantaneous bond is a constant. Since there is a linear relationship between the changes in the price of the stock (the underlying primary security) and the sources of uncertainty (the Brownian Motions), the arrival of the relevant in ...

... Geometric Brownian Motion process and the rate of return on the instantaneous bond is a constant. Since there is a linear relationship between the changes in the price of the stock (the underlying primary security) and the sources of uncertainty (the Brownian Motions), the arrival of the relevant in ...

Fixed rate bonds

... Coupon Rate : Interest rate that the issuer pays to the bondholder (expressed as a percentage of the bond’s face value). ...

... Coupon Rate : Interest rate that the issuer pays to the bondholder (expressed as a percentage of the bond’s face value). ...

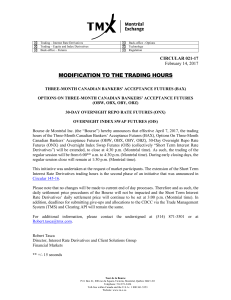

Modification to the Trading Hours

... (Montréal time) on the Friday immediately preceding the third Wednesday of the contract month, provided it is a business day. If it is not a business day, trading will cease on the first preceding business day. ...

... (Montréal time) on the Friday immediately preceding the third Wednesday of the contract month, provided it is a business day. If it is not a business day, trading will cease on the first preceding business day. ...

A Copula-based Approach to Option Pricing and Risk Assessment

... restricts the association between margins to be linear as measured by the covariance. The real association between two asset returns is often much more complicated. In recent years, copulas are often used as an alternative to measure the association between assets. The basic idea of copulas is to se ...

... restricts the association between margins to be linear as measured by the covariance. The real association between two asset returns is often much more complicated. In recent years, copulas are often used as an alternative to measure the association between assets. The basic idea of copulas is to se ...

Non-collateralised Structured Products Launch

... Upon the occurrence of a Mandatory Call Event, trading in the CBBCs will be suspended immediately and, subject to the limited circumstances set out in the Conditions in which a Mandatory Call Event may be reversed, the CBBCs will be terminated and all Post MCE Trades will be invalid and will be canc ...

... Upon the occurrence of a Mandatory Call Event, trading in the CBBCs will be suspended immediately and, subject to the limited circumstances set out in the Conditions in which a Mandatory Call Event may be reversed, the CBBCs will be terminated and all Post MCE Trades will be invalid and will be canc ...

Underlying - UBS

... companies referred to in this term sheet. UBS' trading and/or hedging activities related to this transaction may have an impact on the price of the underlying asset and may affect the likelihood that any relevant barrier is crossed. UBS has policies and procedures designed to minimise the risk that ...

... companies referred to in this term sheet. UBS' trading and/or hedging activities related to this transaction may have an impact on the price of the underlying asset and may affect the likelihood that any relevant barrier is crossed. UBS has policies and procedures designed to minimise the risk that ...

Pricing and Hedging of swing options in the European electricity and

... This report uses an approach in [Keppo, 2004] to price and hedge swing options. Keppo assumes no specific spot price dynamics and proves that the swing options can be priced in terms of forwards and european call options. Further on he finds a lower boundary which only depends on a Forward curve at ...

... This report uses an approach in [Keppo, 2004] to price and hedge swing options. Keppo assumes no specific spot price dynamics and proves that the swing options can be priced in terms of forwards and european call options. Further on he finds a lower boundary which only depends on a Forward curve at ...

Fill-up on knowledge - db-X markets

... towards zero. The price of the warrant upon expiry will be no more than its intrinsic value. A warrant always has an intrinsic value – also known as parity – if it can be exercised at a profit. This is determined by whether the spot price of the underlying is above or below the strike price. In this ...

... towards zero. The price of the warrant upon expiry will be no more than its intrinsic value. A warrant always has an intrinsic value – also known as parity – if it can be exercised at a profit. This is determined by whether the spot price of the underlying is above or below the strike price. In this ...

Dr. Krzysztof Ostaszewski, FSA, CFA, MAAA Actuarial Program

... There are two main types of financial assets: - Bonds (or loans): assets that specify in advance the amount of income that will be forwarded to the financial asset holder. - Stocks (or shares): assets that allow the asset holder to share in both good and bad fortunes of income producer, but do not s ...

... There are two main types of financial assets: - Bonds (or loans): assets that specify in advance the amount of income that will be forwarded to the financial asset holder. - Stocks (or shares): assets that allow the asset holder to share in both good and bad fortunes of income producer, but do not s ...

A. Returns to targets

... prices, the front-end and back-end prices. The raider offers to pay the front-end price for controlling interest in the firm. If he takes over, then the minority stockholders are forced to sell their shares for the back-end price. As long as the back-end price is less than the value of a share under ...

... prices, the front-end and back-end prices. The raider offers to pay the front-end price for controlling interest in the firm. If he takes over, then the minority stockholders are forced to sell their shares for the back-end price. As long as the back-end price is less than the value of a share under ...

Simple, Compound Interest, Depreciation, Growth

... The value of Ibrar’s house increases by x% in the third year. At the end of the third year the value of Ibrar’s house is £140 000 b) Work out the value of x. ...

... The value of Ibrar’s house increases by x% in the third year. At the end of the third year the value of Ibrar’s house is £140 000 b) Work out the value of x. ...

Seeking higher returns or lower risk through ETFs

... stocks with a similar profile and risk to the broad market. The ETF aims to target four proven drivers of return in Australian equities: quality (financially healthy firms), value (inexpensive stocks), size (smaller companies) and momentum (stocks in a rising price trend). Using back-tested data, th ...

... stocks with a similar profile and risk to the broad market. The ETF aims to target four proven drivers of return in Australian equities: quality (financially healthy firms), value (inexpensive stocks), size (smaller companies) and momentum (stocks in a rising price trend). Using back-tested data, th ...

Chap008

... Bonds of similar risk (and maturity) will be priced to yield about the same return, regardless of the coupon rate. If you know the price of one bond, you can estimate its YTM and use that to find the price of the second bond. This is a useful concept that can be transferred to valuing assets oth ...

... Bonds of similar risk (and maturity) will be priced to yield about the same return, regardless of the coupon rate. If you know the price of one bond, you can estimate its YTM and use that to find the price of the second bond. This is a useful concept that can be transferred to valuing assets oth ...

Compound Interest

... so that the interest computed at the end of the next payment period is based on this new amount (old principle + interest), the interest is said to have been compounded. Example 1: A great bank pays 10% interest per year compounded semi-annually on a certain savings account. If $5000 is deposited in ...

... so that the interest computed at the end of the next payment period is based on this new amount (old principle + interest), the interest is said to have been compounded. Example 1: A great bank pays 10% interest per year compounded semi-annually on a certain savings account. If $5000 is deposited in ...