Cost Concepts—Key Questions

... Sunk costs no longer affect decision making in the short run (within the production cycle) Sunk Costs Should you harvest a poor crop even if you expect to not cover total costs? Diminishing Returns Chapter 7 (pages 113-124) In an agricultural production process, how does adding more units of inpu ...

... Sunk costs no longer affect decision making in the short run (within the production cycle) Sunk Costs Should you harvest a poor crop even if you expect to not cover total costs? Diminishing Returns Chapter 7 (pages 113-124) In an agricultural production process, how does adding more units of inpu ...

magna retirement savings plans stable value fund

... Guarantees for the GFC portion are based upon the claims-paying ability of the issuing insurance company. Insurance products from the Principal Financial Group® are issued by Principal National Life Insurance Company (except in New York) and Principal Life Insurance Company. Plan administrative serv ...

... Guarantees for the GFC portion are based upon the claims-paying ability of the issuing insurance company. Insurance products from the Principal Financial Group® are issued by Principal National Life Insurance Company (except in New York) and Principal Life Insurance Company. Plan administrative serv ...

Deriving Simple and Adjusted Financial Rates of Return on

... plot strata such as county, ownership, and forest type. Table 2 details the sample size, BGP, TVG, and FVG of Mississippi timber lands by forest type for the 1977–94 period. FVG is computed in $250 increments ranging from $250 to $1500. This sample set is more likely to represent the true trend for ...

... plot strata such as county, ownership, and forest type. Table 2 details the sample size, BGP, TVG, and FVG of Mississippi timber lands by forest type for the 1977–94 period. FVG is computed in $250 increments ranging from $250 to $1500. This sample set is more likely to represent the true trend for ...

Chapter 23 Hedging with Financial Derivatives

... Answer: TRUE 9) Futures trading is regulated by the Commodity Futures Trading Commission. Answer: TRUE 10) Open interest allows investors to change the interest rate on futures contracts. Answer: TRUE 11) To reduce the interest rate risk of holding a portfolio of securities, futures contracts should ...

... Answer: TRUE 9) Futures trading is regulated by the Commodity Futures Trading Commission. Answer: TRUE 10) Open interest allows investors to change the interest rate on futures contracts. Answer: TRUE 11) To reduce the interest rate risk of holding a portfolio of securities, futures contracts should ...

4.5 Applications of Exponential Functions

... Calculator: raise 0.5 to (12÷6 or 2) then multiply by 200. ...

... Calculator: raise 0.5 to (12÷6 or 2) then multiply by 200. ...

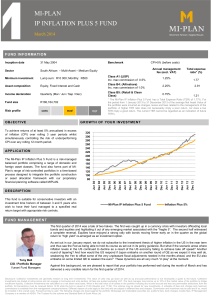

Our Portfolio Management Portfolios

... Holdings are subject to change daily, so any securities discussed in this profile may or may not be included in your account if you invest in this investment strategy. Do not assume that any holdings mentioned were, or will be, profitable. The performance, holdings, sector weightings, portfolio trai ...

... Holdings are subject to change daily, so any securities discussed in this profile may or may not be included in your account if you invest in this investment strategy. Do not assume that any holdings mentioned were, or will be, profitable. The performance, holdings, sector weightings, portfolio trai ...

FM11 Ch 07 Show

... which must be paid before dividends can be paid on common stock. However, unlike bonds, preferred stock dividends can be omitted without fear of pushing the firm into bankruptcy. ...

... which must be paid before dividends can be paid on common stock. However, unlike bonds, preferred stock dividends can be omitted without fear of pushing the firm into bankruptcy. ...

The Financialization of Commodity Futures Markets Christopher L. Gilbert

... Increased price comovement • The increased comovement of food prices (and indeed commodity prices generally) with crude oil prices, stock market returns and exchange rate changes over the recent pas has been widely noted (Büyükşahin, Haigh and Robe, 2010; UNCTAD, 2011). • Tang and Xiong (2012) find ...

... Increased price comovement • The increased comovement of food prices (and indeed commodity prices generally) with crude oil prices, stock market returns and exchange rate changes over the recent pas has been widely noted (Büyükşahin, Haigh and Robe, 2010; UNCTAD, 2011). • Tang and Xiong (2012) find ...

Valuations in Mining and Exploration Seminar ‐ AIG (QLD)

... may be a high chance for discovery of a small deposit, which might be viable in favourable geographical situations – So, value nil • A small alluvial deposit with near 100% chance of success may be valued similarly to a valid but unlikely project campaign targeting a world class deposit with 0. ...

... may be a high chance for discovery of a small deposit, which might be viable in favourable geographical situations – So, value nil • A small alluvial deposit with near 100% chance of success may be valued similarly to a valid but unlikely project campaign targeting a world class deposit with 0. ...

Options-Implied Probability Density Functions for Real Interest Rates

... same methodology to obtain the annualized implied volatility of options on ten-year nominal Treasury futures—a long-standing and very liquid options market. These are shown in Figure 2. The options-implied volatility of a ten-year nominal futures contract was also elevated in early 2009, but not as ...

... same methodology to obtain the annualized implied volatility of options on ten-year nominal Treasury futures—a long-standing and very liquid options market. These are shown in Figure 2. The options-implied volatility of a ten-year nominal futures contract was also elevated in early 2009, but not as ...

KCR-Presentation-Final_a

... their buy-and-hold counterpart. Note that bonds were only in a bull market during the test period. All six systems have a lower drawdown than their buyand-hold counterpart. Therefore, all six systems have a better risk-adjusted return than their buy-and-hold counterpart. What happens when you combin ...

... their buy-and-hold counterpart. Note that bonds were only in a bull market during the test period. All six systems have a lower drawdown than their buyand-hold counterpart. Therefore, all six systems have a better risk-adjusted return than their buy-and-hold counterpart. What happens when you combin ...

25 Lease Analysis

... cost" of the lease payments versus the present value of the total charges if the equipment is purchased. However, in a recent evaluation, Susan and Tom got into a heated discussion about the appropriate discount rate to use in determining the present value costs of leasing and of purchasing. The fol ...

... cost" of the lease payments versus the present value of the total charges if the equipment is purchased. However, in a recent evaluation, Susan and Tom got into a heated discussion about the appropriate discount rate to use in determining the present value costs of leasing and of purchasing. The fol ...

Collateral and Credit Issues in Derivatives Pricing

... One result of the 2008 credit crisis is a regulatory requirement that most standardized over-thecounter derivatives be cleared through central clearing parties (CCPs). A CCP operates similarly to an exchange clearing house and requires the two sides to a derivatives transaction to post both initial ...

... One result of the 2008 credit crisis is a regulatory requirement that most standardized over-thecounter derivatives be cleared through central clearing parties (CCPs). A CCP operates similarly to an exchange clearing house and requires the two sides to a derivatives transaction to post both initial ...

Asset Classes and Financial Instruments

... the credit crisis led to a wave of investor redemptions similar to a run on a bank. Only three days after the Lehman bankruptcy, Putman’s Prime Money Market Fund announced that it was liquidating due to heavy redemptions. Fearing further outflows, the U.S. Treasury announced that it would make feder ...

... the credit crisis led to a wave of investor redemptions similar to a run on a bank. Only three days after the Lehman bankruptcy, Putman’s Prime Money Market Fund announced that it was liquidating due to heavy redemptions. Fearing further outflows, the U.S. Treasury announced that it would make feder ...

The £13 billion sale of former Northern Rock assets (Summary)

... 1 In 2008 Northern Rock (NR) was nationalised because of the financial crisis as it was unable to fund itself through the securitisation and wholesale funding markets. A request for emergency funding from the Bank of England led to a run on its deposit base. As a result, the taxpayer acquired all o ...

... 1 In 2008 Northern Rock (NR) was nationalised because of the financial crisis as it was unable to fund itself through the securitisation and wholesale funding markets. A request for emergency funding from the Bank of England led to a run on its deposit base. As a result, the taxpayer acquired all o ...

property, plant and equipment (ppe) structure

... Identifying useful lives within approved ranges for all types of PPE Deciding useful lives of asset components (e.g. plumbing and heating system of a building) Identifying situations of control over shared assets Determining if further classes are needed for disclosure and respective lives ...

... Identifying useful lives within approved ranges for all types of PPE Deciding useful lives of asset components (e.g. plumbing and heating system of a building) Identifying situations of control over shared assets Determining if further classes are needed for disclosure and respective lives ...

CDS Spread Determinants

... We find that, in general, the results for the sub-sample periods are very similar to each other and to the whole sample period results. In general, our results in Table 4 suggest that the theoretical explanatory variables remain robust to explain the CDS spread for different time periods in Japan. ...

... We find that, in general, the results for the sub-sample periods are very similar to each other and to the whole sample period results. In general, our results in Table 4 suggest that the theoretical explanatory variables remain robust to explain the CDS spread for different time periods in Japan. ...

The Optimal Rotation Period 01 Renewable Resources

... log a tree depends on the specific goal of the decision maker. This fact has not always been stated precisely. The chapter provides a survey of the different approaches and clarifies the conditions for their application. ...

... log a tree depends on the specific goal of the decision maker. This fact has not always been stated precisely. The chapter provides a survey of the different approaches and clarifies the conditions for their application. ...