* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Uncovering the Gem: Hidden Elements in ASC Valuation

Beta (finance) wikipedia , lookup

Systemic risk wikipedia , lookup

Modified Dietz method wikipedia , lookup

Land banking wikipedia , lookup

Private equity secondary market wikipedia , lookup

Investment fund wikipedia , lookup

Greeks (finance) wikipedia , lookup

Financialization wikipedia , lookup

Present value wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Real estate appraisal wikipedia , lookup

Financial economics wikipedia , lookup

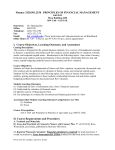

Uncovering the Gem: Hidden Elements in ASC Valuation Presented by Lorin E. Patterson, JD, Partner, Reed Smith LLP Todd J. Mello, ASA, AVA, MBA, Principal, HealthCare Appraisers Presentation Outline • Regulatory Considerations • Practical Considerations • Valuation Framework & Issues Specific to ASCs • Factors Affecting Value • Selection and Application of Appropriate Valuation Methodologies • Other Relevant Issues (Partnership Life Cycle; Impact of Changes in Reimbursement; Minority Interest and related discounts; Industry Multiples) • Managing the Valuation Process Regulatory Considerations • Cardinal Rule: In healthcare ventures, ALL relationships MUST be conducted on FAIR MARKET VALUE terms. – Adherence provides participants the best protection against possible liability under Federal and State anti-kickback statutes and other applicable laws. – “Kickbacks” can include any form of remuneration, including overpayments or underpayments for interests in physician-owned ASCs. Regulatory Considerations • Risk Scenarios: Surgery Center grappling with the “Price of Success.” – Years of successful operations result in prohibitively high unit prices making recruiting additional investors difficult. • Unreasonably low price or easy terms offered to “heavy hitter” physician investors. – The “spread” between FMV value and price offered could be a kickback. Regulatory Considerations • Risk Scenarios – Hospital anxious to maintain market share and appease groups of specialists overpays for share in existing ASC or offers to provide services or benefits (e.g., below FMV rent) to the venture on non-FMV terms. • Again, “spread” between FMV and actual terms could be deemed a kickback to procure referrals. • Real world example: Advisory Opinion 07-05 (6/19/2007). OIG issues unfavorable opinion where Hospital buys units in ASC directly from orthopedic surgeon at possibly inflated prices. Practical Considerations • When validating FMV, a third-party appraisal by an experienced third-party appraiser will be the best means of procuring protection. – Not necessarily required. – Keep in mind that businesses are being valued – not referrals. Practical Considerations • Occasions where third-party valuations may be appropriate or necessary: – Combination between two existing healthcare ventures. – “Out of the ordinary course” sale of interests in existing ASC to group practice, corporate partner or hospital. – Commencement of service or other relationships between referral sources. Practical Considerations – “Out of the ordinary course” buyouts of participants in existing healthcare ventures. – The commencement of a re-syndication by an existing ASC to a number of physician investors. Practical Considerations • Occasions when obtaining an appraisal may not be necessary: – In connection with the raising of capital by a newly formed healthcare venture (value of interests will be speculative). – True arms-length negotiations between participants of a healthcare venture. – Buyouts of existing participants where means of valuation is set forth within the governing documents (e.g., through the use of a formula). Valuation Framework What is the ownership interest being valued? What is the purpose of the valuation? Pending transaction (e.g., a physician buy in/out or a transaction with an ASC company) Compliance with federal ASC safe harbors and IRS private inurement issues Shareholder disputes/litigation What is the standard of value? Fair Market Value (“FMV”) Fair Value Investment Value What is the premise of value? Going concern Liquidation Definition of FMV IRS Definition: In Revenue Ruling 59-60 the Internal Revenue Service defines fair market value as “the amount at which property would change hands between a willing seller and a willing buyer when the former is not under any compulsion to buy and the latter is not under any compulsion to sell and when both have reasonable knowledge of the relevant facts.” – CMS Definition: “the value in arm's-length transactions, consistent with the general market value. “General market value” means the price that an asset would bring, as the result of bona fide bargaining between well-informed buyers and sellers who are not otherwise in a position to generate business for the other party, on the date of acquisition of the asset.” Usually, the fair market price is the price at which bona fide sales have been consummated for assets of like type, quality, and quantity in a particular market at the time of acquisition.” Valuation Issues Specific to ASCs Physician ownership makeup or lack thereof is critical Physician risk is the most important risk factor in ASC valuation Value related to distributions (i.e., dividends) as compared to capital appreciation – much higher liquidity built into investment Divestiture typically required upon retirement, relocation, and inactivity – buyout typically formulaic or fair market value Importance of restrictive covenants Numerous regulatory hurdles – anti kickback statutes and potentially private inurement regulations Publicly traded corporations are generally not relevant comparisons Sales of similarly sized blocks of stock often not comparable In valuing entity, important to understand uniqueness of industry Primary Factors Affecting Value TWO PRIMARY DRIVERS OF ASC SHAREHOLDER VALUE Future Cash Flow available to shareholders (Distributions) Volatility or Risk associated with future cash flow There are a multitude of variables that impact the assessment of risk and the projection of future cash flow. The value of a business is not based upon historical earnings but rather future earnings! Historical earnings are only relevant to the extent they help predict future earnings. Future earnings in a surgery center partnership can be very volatile! Proper partnership management can reduce volatility. Factors Affecting Risk of Future Cash Flow Cash Flow Projection Factors Case volume, mix, and reimbursement Expected changes in volume and reimbursement Opportunities for expansion (rooms, surgeons) Stability of operating expenses Risk Assessment Factors Diversification (e.g., # of surgeons, number & type of specialties, payors) Size and demographics of physician ownership, appropriate non-competes and ability to attract new investors Financial leverage, working capital, and on-going capital expenditures Nature of payor contracts; is there a substantial portion of “out of network?” Quality and age of facility and equipment Competent management Barriers to entry (e.g. CON) Valuation Methodology Selecting the Valuation Approach Asset-Based Approaches PURPOSE: Measures the value of an ASC by identifying and individually valuing the ASC’s tangible and intangible assets and liabilities. Based upon the Principle of Substitution; i.e., the premise that a prudent individual will pay no more for a property than he/she would pay to acquire a substitute property with the same utility. Asset-based approaches are useful when: The ASC has no expected earnings or other attributes of value whereby an “orderly liquidation value” yields the highest valuation; or To establish a “floor” of value when using other valuation methods Valuation Methodology Selecting the Valuation Approach Market Approach PURPOSE: Measures the value of an ASC by evaluating comparable companies and/or transactions in the marketplace. Market Valuation Methodologies include: Guideline Publicly Traded Company Method – generally not applicable Comparative Transaction Method – depends Market Approach may be useful if: Valuing a controlling (as opposed to a minority) interest Truly comparable entities are available Valuation Methodology Selecting the Valuation Approach Income Approach PURPOSE: Measures the value of an ASC by determining the present value of its expected future cash flow stream. Income Methodologies include: Capitalization of Earnings Discounted Cash Flow Income Approach is useful when: The ASC is generating significant, normalized cash flow from operations to fund ongoing distributions When valuing minority interest in cash flowing centers When the ASC has significant intangible value and when reasonable market comparables are not available Valuation Methodology Decision Tree ASC Unprofitable Profitable Profitable Attributes Going Concern Risk Stable Earnings Trending Earnings Income approach Income approach Capitalization of earnings Discounted Cash Flow Asset approach Compare value to market transactions Adjust for atypical working capital Use asset approach to establish floor of value Depending upon standard of value and size of interest, apply discounts Other Relevant Valuation Issues • ASC Partnership Life Cycle • Minority vs. Controlling Interest Valuation • Pending Changes in Medicare Reimbursement; potential impact to nonMedicare payors • Industry Consolidation, Valuation, and Competition ASC Partnership Life Cycle ASC Life Cycle START UP GROWTH MATURE DECLINE 10.0 $ (in millions) 8.0 6.0 4.0 2.0 (2.0) 1 2 3 4 5 6 7 8 9 10 (4.0) Years REVENUE EBITDA 11 12 13 14 15 ASC Partnership Life Cycle Consequences of Decline Stage High Staff Turnover High Volume Physicians Slowing Down Non-Owner Physicians Disgruntled/ Exiting Facility Lack of Sufficient Capital to Reinvest in Business Capital Calls Deferred Maintenance on Equipment and Building ASC becomes less attractive to outside physicians ASC Partnership Life Cycle Relationship to Value Unmanaged Partnerships will Eventually Enter into Decline Stage Profits Decline Faster than Revenues ASC Partnerships are difficult to turn around Quality Governing Documents Assist in Extending the Life Cycle (e.g. divestiture guidelines, restrictive covenants, safe harbor requirements) Accurate Valuations are Crucial to Sustaining ASC Partnerships Future Cash Flow and risk are related to life cycle Valuing Minority Interests Simply stated: Interests providing absolute control (i.e., greater than a 50% interest whereby key aspects of control are not diminished by governing documents or otherwise) are worth more than interests which do not have the same control rights Control granted by the governing documents (examples on next slide) Concept of “effective” control – physicians control with their feet Valuation Guidance: absence of control adjustments in financial projection (preferable approach) or application of minority interest discount (reliance on published studies or other; more difficult to quantify and support) Valuing Minority Interests Matters Subject to Control Capital Calls Admission of new investors Borrowings greater than a certain amount Acquisition of equipment greater than a certain amount Selling, assigning or otherwise disposing or encumbering assets Entering into material contracts Selling, liquidating, or merging the entity Changing the core governing documents Typical ASC ownership agreements are very friendly to the minority shareholder Note: Physicians display a certain level of control regardless of ownership interest level Additional Valuation Considerations Medicare reimbursement reasonably “certain” through 2011; additional uncertainty and hence risk related to non-Medicare payors Despite declining public EBITDA multiples between 2004 and 2006 (see next slide), market multiples for controlling interests remain strong; a 12/06 survey performed by HealthCare Appraisers indicates that 92% of ASC respondents are observing multiples of 6X EBITDA or higher Multiples paid also driven by private equity transactions (e.g. USPI and Symbion) Despite continued consolidation within industry, per an August 2007 Market Letter published by Verispan the top 5 outpatient surgery center chains still account only for 10.5% of the market share Minority interest multiples are based upon the individual center’s facts and circumstances and are more difficult to determine Market multiples are interesting “rules of thumb” and are easy to calculate; however, do not generally constitute an appropriate method for calculating fair market value Additional Valuation Considerations Ticker AMSG NOVA SMBI USPI Company Name AmSurg Corp. NovaMed, Inc. Symbion, Inc. United Surgical Partners MVIC / EBITDA Multiples 2003 2004 2005 2006 6.98 6.91 5.00 4.52 7.87 11.01 8.71 10.51 9.31 7.85 6.42 8.96 12.29 10.65 8.29 Managing the Valuation Process • Opposing parties will have inherently conflicting interests during the valuation process. – Adding “structure” will streamline the process significantly. • Avoid “dueling valuations” unless a means of reconciling differences is agreed upon. – Consider joint engagement of a single appraiser selected from a list of qualified appraisers. Managing the Valuation Process • Determine the degree of involvement of both parties in the valuation process. – Both parties may have the right to individually meet with the appraiser and submit factors which they feel are most pertinent. – Both parties may have the right to receive drafts of the appraisal report and comment upon it. – Agreement may be reached as to what price within the range of fair market value in the final report value (e.g., mid-point) will be used in the purchase agreement. Todd J. Mello, ASA, AVA, MBA Principal HealthCare Appraisers, Inc. 858 Happy Canyon Road, Suite 240 Castle Rock, CO 80108 (303) 688-0700 [email protected] Lorin E. Patterson, JD, Partner Reed Smith LLP 3110 Fairview Park Drive, Suite 1400 Falls Church, VA 22042 (703) 641-4368 [email protected]