* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download The Supernormal Growth Example

Greeks (finance) wikipedia , lookup

Internal rate of return wikipedia , lookup

Financialization wikipedia , lookup

Modified Dietz method wikipedia , lookup

Present value wikipedia , lookup

Short (finance) wikipedia , lookup

Financial economics wikipedia , lookup

Stock trader wikipedia , lookup

Employee stock option wikipedia , lookup

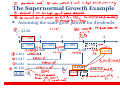

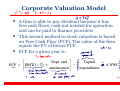

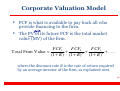

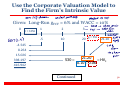

The Supernormal Growth Example Assuming the same grow pattern for dividends: D0 = $2.00. 0 rs = 13% g = 30% 1 2 g = 30% 2.600 2.301 2.647 3.045 46.114 54.107 = P̂0 3 g = 30% 3.380 4 g = 6% 4.394 4.658 4.658 = $66.54 P̂3 = 0.13 − 0.06 21 The Supernormal Growth Example • Dividend yield (first year) = $2.60/$54.11 = 4.81% • Capital gains yield (first year) = 13.00% – 4.81% = 8.19% • During nonconstant growth, dividend yield and capital gains yield are not constant, and capital gains yield ≠ g. • After t = 3, the stock has constant growth and dividend yield = 7%, while capital gains yield = 6%. 22 Nonconstant-Growth Stock Valuation Example: g = 0% for 3 years before long-run growth at the rate of 6%? 0 r = 13% s g = 0% D0 = $2.00. 1.77 1 2 g = 0% 2.00 3 g = 0% 2.00 4 g = 6% 2.00 2.12 1.57 1.39 20.99 25.72 = P̂0 2.12 P̂3 = = $30.29 0.13 − 0.06 23 Nonconstant-Growth Stock Valuation Example continued, • Dividend yield (first year) = $2.00/$25.72 = 7.78% • Capital gains yield (first year) = 13.00% – 7.78% = 5.22% • After t = 3, the stock has constant growth and dividend yield = 7%, while capital gains yield = 6%. 24 Stock Paying Decreasing Dividends • If the stock was expected to decreasing stream of dividends, say, with g = -6%, would anyone buy the stock, and what is its value? • Yes. Even though the dividends are declining, the stock is still producing cash flows and therefore has positive value. Pˆ0 = D0 (1 + g) D1 = rs − g rs − g $2.00 × (0.94) $1.88 = = = $9.89 0.13 − (−0.06) 0.19 25 Stock Paying Decreasing Dividends The example continued: • Capital gains yield = g = -6.00% • Dividend yield = 13.00% – (-6.00%) = 19.00% • Since the stock is experiencing constant growth, dividend yield and capital gains yield are constant. Dividend yield is sufficiently large (19%) to offset negative capital gains. 26 About the Discounted Dividend Model This model is more conceptual than practical The formula gives the fundamental reason why shares of stock have value It may not be very practical for actual stock valuation It is wrong to think that a firm can boost its stock price by changing its dividend policy, as seen below 27 Illustration of Irrelevance of Dividend Policy A no-growth firm pays out all its earnings $100 every year. rS=10%. 100 100 100 Total Stock value = 1 + 2 + 3 + L = $1, 000 1.1 1.1 1.1 Alternatively, the firm retains its first year’s earning and invest in a normal return project (project that yields 10%). Dividends: D1=0, D2=110, D3=110, D4=110, … 110 110 110 Total Stock value = 2 + 3 + 4 + L = $1, 000 1.1 1.1 1.1 28 Implications for Stock Valuation You may see why actual dividend payout does not matter through the relation between dividend and future growth. If more cash will be paid out as dividend, less will be invested in business, and lower will be the future grow g; and vice versa. Applying the Discounted Dividend Model, you may get the same stock price What determines the stock value is not the dividend actually paid, but the firm’s dividendpaying ability. 29 Corporate Valuation Model A firm is able to pay dividend because it has free cash flows, cash not needed for operation and can be paid to finance providers This second method to stock valuation is based on Free Cash Flow (FCF). The value of the firm equals the PV of future FCF. FCF for a given year is: Depr. and Capital FCF = EBIT(1 − T) + − + ∆ NWC amortization expenditures 30 Corporate Valuation Model • FCF is what is available to pay back all who provide financing to the firm. • The PV of its future FCF is the total market value (MV) of the firm. FCF3 FCF1 FCF2 Total Firm Value = + + + ...... 2 3 (1 + R ) (1 + R ) (1 + R ) where the discount rate R is the rate of return required by an average investor of the firm, as explained next. 32 Technical Issues Regarding the Corporate Valuation Model • If the firm has more than equity shares in its capital structure, the discount rate used in PV calculation is the average of the rates of return required by different groups of investors. • This rate is called the Weighted Average Cost of Capital (WACC), which will be studied in detail later. • The weight for one kind of capital in WACC is the value of this kind of capital as a percentage of the total capital. Continued Continued 33 Technical Issues Regarding the Corporate Valuation Model • Similar to discounted dividend model, we may simplify by assuming that at some point FCF will grow at a constant rate thereafter. • Horizon value (HVN) represents value of firm at the point when growth becomes constant. • This method is better for being more practical • No need for assumptions about the firm’s dividend policy • The input for FCF comes from comprehensive forecast of future accounting performance. 35 Use the Corporate Valuation Model to Find the Firm’s Intrinsic Value Given: Long-Run gFCF = 6% and WACC = 10% 0 r = 10% 1 -5 -4.545 8.264 15.026 398.197 416.942 2 3 10 20 4 g = 6% 21.20 21.20 530 = = HV3 0.10 − 0.06 Continued Continued 36