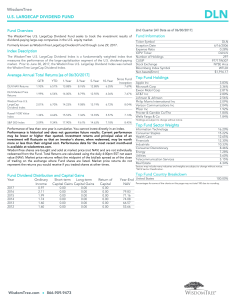

WisdomTree LargeCap Dividend Fund

... Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 866.909.9473, or visit WisdomTree.com WisdomTree.com to view or download a prospectus. Investo ...

... Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 866.909.9473, or visit WisdomTree.com WisdomTree.com to view or download a prospectus. Investo ...

probability prediction with static Merton-D-Vine copula model

... indicator (default probability) will be evaluated. The analysis proceeds from the medium term risk of credit situation, i. e. for the 4 year ahead estimate. With regard to the permanent financial market off, it will be considered if these models can point out the quality and changes in companies´ fi ...

... indicator (default probability) will be evaluated. The analysis proceeds from the medium term risk of credit situation, i. e. for the 4 year ahead estimate. With regard to the permanent financial market off, it will be considered if these models can point out the quality and changes in companies´ fi ...

Lazard Emerging Markets Equity Portfolio

... Beta is a relative measure of the sensitivity of a fund’s return to changes in the benchmark’s return. The beta of the fund versus its benchmark is the amount (and direction) the fund has historically moved when the benchmark moved by one unit. Standard deviation measures the dispersion or “spread” ...

... Beta is a relative measure of the sensitivity of a fund’s return to changes in the benchmark’s return. The beta of the fund versus its benchmark is the amount (and direction) the fund has historically moved when the benchmark moved by one unit. Standard deviation measures the dispersion or “spread” ...

Derivatives Digest

... return as trading in stock can, yet at the same time your risk is also limited as index movements are smooth, less volatile without unwarranted swings. Paisewallah: How can I use volume and open interest figures to predict the market movement? Sharekhan: The total outstanding position in the market ...

... return as trading in stock can, yet at the same time your risk is also limited as index movements are smooth, less volatile without unwarranted swings. Paisewallah: How can I use volume and open interest figures to predict the market movement? Sharekhan: The total outstanding position in the market ...

Study Guide Exit Exam

... Calculate the effective annual rate for an interest rate compounded more than one time per year Prepare a loan amortization table Understand the effect of time and interest rate on present and future values of a cash flow Asset Valuation Calculate the price of a bond Calculate the yield to ...

... Calculate the effective annual rate for an interest rate compounded more than one time per year Prepare a loan amortization table Understand the effect of time and interest rate on present and future values of a cash flow Asset Valuation Calculate the price of a bond Calculate the yield to ...

here

... particular, our investors are risk-neutral, and short-selling is prohibited. Our main result is an explicit formula for the minimal equilibrium price. We also characterize this price as the unique classical solution (with linear growth at infinity) of a certain second-order, linear differential equa ...

... particular, our investors are risk-neutral, and short-selling is prohibited. Our main result is an explicit formula for the minimal equilibrium price. We also characterize this price as the unique classical solution (with linear growth at infinity) of a certain second-order, linear differential equa ...

Risk Management and Financial Institutions

... Theta: time decay of the portfolio. Theta is usually negative for an option. An exception could be an in-the-money European put option on a non-dividend-paying stock or an in-the-money European call option on a currency with a very high interest rate. It makes sense to hedge against changes in the p ...

... Theta: time decay of the portfolio. Theta is usually negative for an option. An exception could be an in-the-money European put option on a non-dividend-paying stock or an in-the-money European call option on a currency with a very high interest rate. It makes sense to hedge against changes in the p ...

A financial derivative is a contract whose return depends on the

... must exceed the risk-free rate r (in % per period). Otherwise, the stock would be overpriced, and an arbitrage opportunity would arise. Similarly, the risk-free rate r must exceed the rate of return on the stock under a downward movement, that is, d 1. Example (continued): The risk-free rate is r = ...

... must exceed the risk-free rate r (in % per period). Otherwise, the stock would be overpriced, and an arbitrage opportunity would arise. Similarly, the risk-free rate r must exceed the rate of return on the stock under a downward movement, that is, d 1. Example (continued): The risk-free rate is r = ...

Lecture

... The costs are incurred and paid at different times and places, by different agencies and groups(e.g., users, neighbors, taxpayers), and in monetary and nonmonetary terms . When the cost is acceptable and low, this gives indication that the performance is well. ...

... The costs are incurred and paid at different times and places, by different agencies and groups(e.g., users, neighbors, taxpayers), and in monetary and nonmonetary terms . When the cost is acceptable and low, this gives indication that the performance is well. ...

Idiosyncratic risk and long-run stock performance following

... idiosyncratic stock volatility due to learning, it should be necessary and interesting to investigate whether and how financial analysts improve their accuracy of earnings forecasts via learning about the firm-specific information over time. ...

... idiosyncratic stock volatility due to learning, it should be necessary and interesting to investigate whether and how financial analysts improve their accuracy of earnings forecasts via learning about the firm-specific information over time. ...

Derivatives-chapter1

... An option is the right to either buy or sell something at a set price, within a set period of time ...

... An option is the right to either buy or sell something at a set price, within a set period of time ...

a new perspective

... the earnings will not be equal to the estimates. If one is careful in selecting the stocks to invest in, it is likely that a greater number of the differences will be in the investors favor. In order to complete our analysis we divide the annual earnings by 365, the number of days in the year. The $ ...

... the earnings will not be equal to the estimates. If one is careful in selecting the stocks to invest in, it is likely that a greater number of the differences will be in the investors favor. In order to complete our analysis we divide the annual earnings by 365, the number of days in the year. The $ ...

Derivatives - Escuela FEF

... Summer School Reproduction prohibited without express authorisation ...

... Summer School Reproduction prohibited without express authorisation ...

the discussion note

... approximately risk-free interest-bearing asset and the market index. Within this analytical framework, active management means uncovering inefficiently priced assets, or “chasing alpha”. The research agenda associated with this simple, stylised portfolio model was to “test market efficiency”. Resear ...

... approximately risk-free interest-bearing asset and the market index. Within this analytical framework, active management means uncovering inefficiently priced assets, or “chasing alpha”. The research agenda associated with this simple, stylised portfolio model was to “test market efficiency”. Resear ...

The Returns and Risks From Investing

... When cumulating or compounding, negative returns are problem ...

... When cumulating or compounding, negative returns are problem ...