* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Derivatives - Escuela FEF

Survey

Document related concepts

Transcript

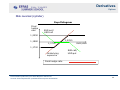

Derivatives Options Derivatives 2 Options Hans Buysse Derivatives Options Foreign exchange derivatives – Options – Combined Options – Exotic Options – Case 3 Futures Cheapest to Deliver Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 2 Derivatives Options Plain vanilla FX Options Using options as a FX hedge (CRO) – Within 6 months BF Trading will receive USD 100.000. Our treasurer still fears a dollar decrease (spot EUR/USD 1.1274-1.1284). He wishes to hedge this risk but he would also like to benefit from a possible upside. Therefore he buys a put with a premium of 0.0248 EUR per USD. – Definition : you receive the right, during a defined period (USA) or during a certain moment, to buy currencies (call) or to sell currencies (put) at a determined price. For this, you have to pay a premium. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 3 Derivatives Options The option family… Profit from option strategy versus doing nothing Realised profit Through option ecercise 0.84 0.86 0.8862 0.90 0.92 spot rate At expiry No excercise, cost = premium -1 OPTION CALL PUT Buying Sale (write) RIGHT to buy OBLIGATION to supply Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation Buying RIGHT to sell Sale (write) OBLIGATION to purchase 4 Derivatives Options FX options as a hedge Scenarios 6 months later: – USD/EUR: 0.84 (ie. EUR/USD 1.1905), Excercise option (sell dollars at 0.8862 or 1,1284). Realised profit = intrinsic value. Intrinsic value > 0 ==> option in the money: (88.620 – 2.480) – 84.000 = 2.140 EUR – USD/EUR: 0.8862. Optie at the money. No excercise. – USD/EUR: 0.92 (ie. EUR/USD 1, 0870). Option excercise implies negative intrinsic value: far out of the money. premium = intrinsic value + time value call: formula B&S ==> Garman Kohlagen put: calculate call + apply put-call parity (cf slide) Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 5 Derivatives 4.2 Currency options Options FX options as a hedge • Call option: gives the holder the right to buy the underlying asset by a certain date for a certain price • Put option: gives the holder the right to sell the underlying asset by a certain date for a certain price • Exercise / strike price: the price in the option contract • Expiration date / maturity: – The end date in the contract at which or before which the option has to be exercised – American options can be exercised any time up to the expiration date – European options can be exercised only on the expiration date Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 6 Derivatives Options A currency call option grants the holder the right to buy a specific currency at a specific price (exercise or strike price) within a specific period of time r = domestic rate rf = foreign rate T-t = option life (years) S0 = spot rate X = Strike rate σ = volatility d1= d2 = At expiration date a call option is – in the money if spot rate > strike price – at the money if spot rate = strike price – out of the money if spot rate < strike price ln( S 0 / K ) + ( σ σ Black-Scholes (Garman Kohlhagen) model Call option: C 0 = S0e Put option: P0 = Xe − qT −rT * N(d 1 ) − Xe * N( − d2 ) − S 0 e Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation d1 − σ −rT − qT 2 / 2 )( T − t ) (T − t ) (T − t) * N(d 2 ) * N( − d1 ) 7 Derivatives Options Currency options Input parameters: – Fixed rate of exchange (Strike or exercise price) – Interest rates (domestic and foreign) – Volatility of exchange rate (σ) – Call currency / put currency – Settlement and expiry date – Style (American or European) Intrinsic time value and expectation value Intrinsic value of a call option Exercise rate Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 8 Derivatives Options Currency options Delta Strike Forward Lognormal distribution with voly σ Spot rate Trade date Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation Exercise date 9 Derivatives Options Currency options Determinants of option premium, and their impact on the premium Call premium Put premium Appreciation spot rate higher Lower Depreciation spot rate Lower Higher Increased volatility Higher Higher Decreased volatility Lower Lower Interest currency 1 higher / currency 2 lower Lower Higher Interest currency 1 higher / currency 2 lower higher Lower Decrease time to maturity lower Lower * Currency 1 is the quotation currency of the option and currency 2 is the currency for the quotation of the premium Derivatives Options Selling a call option Our treasurer of BF Trading likes options, but does not want to pay a premium. •Therefore, he is going to sell a call option to the bank (obligation to deliver USD through exercise). This option gives the right to buy dollars at a rate of EUR/USD 1.12840 over 6 months (call). BF Trading receives a premium for selling this option: 0.0297 EUR per USD. •Example: BF Trading sells call USD 6 mth, excercise price 1.12840 EUR/USD or 0.8862 USD/EUR, for USD 100.000. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 11 Derivatives Options Selling a call (cont’d) 1. Scenarios 6 mths later USD/EUR 0.84. No exercise. BF Trading sells her dollars in the market and receives 84.000 + premium (EUR 2.970) = EUR 86.970 ==> this is not a hedge!!! USD/EUR 0.8862 Receipt of EUR 88.620 + EUR 2.970 USD/EUR 0.92. Excercise of the call by the bank. BF Trading receives EUR 88.620 + EUR 2.970 instead of 92.000. 2. So selling options is trading and not hedging Profit of this option strategy Versus doing nothing 1 profit = premium because the Option is not exercised 0.84 0.86 0.8862 0.90 0.92 Loss becausse of exercise Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation spot rate At expiry 12 Derivatives Options Foreign exchange derivatives – Options – Combined Options – Exotic Options – Case 3 Futures Cheapest to Deliver Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 13 Derivatives Options Spreads & Combinations of options • Positions of different options can be used to create a tailor made pay off scheme: – Based on underlying exposure – Based on own vision • Spreads are positions in two or more options of the same type (2 calls or 2 puts) – Bull, bear, butterfly, calendar, etc • Combinations are positions in two or more options of both calls and puts – Strangle, straddle, strips and straps Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 14 Derivatives 4.6 Bull spread Options Spreads Spread of buying a call option with strike K and selling a call with strike L with same expiration date – K<L This spread is used to limit the exposure of the hedger on the underlying asset but leaves him with limited flexibility – In return for giving up the potential of call option K the hedger receives the premium of call option L Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 15 Derivatives Options Risk Reversals or Cylinder Options Both bull & bear combinations are also known as risk reversals or cylinders: – The purchase of an out-of-the-money option of one type (put or call), and the sale of an out-of-the-money option of the other type, with the same currency pair, maturity and amount. – The most popular version is a zero premium strategy, where the premium of the option sold offsets the premium of the option purchased. – When sold to a hedger with an underlying exposure, this is called variously a cylinder, collar or range forward, and it creates a risk reward profile like a spread. – As it offers some profit potential, limited risk and no out-of-pocket cost, it is probably the most frequently used option hedge. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 16 Derivatives Options Combined option or Cylinder option • Combination: risk hedging + advantage of USD increase & not paying a premium • Definition: forward contract with variable rate. Definition of a minimum and maximum rate for a transaction. • i.e.: combined option of “buy call sell put” or “buy put sell call” Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 17 Derivatives Options Example of a combined option BF Trading contracts a combined option with the bank, supplying USD within 6 months at a rate between 0.8820 – 0.8920 (provisie 0,2 of 177,24 EUR). Scenarios 6 mths later: – USD/EUR: 0.86 BF Trading sells USD at the minimum rate of 0.8820 – USD/EUR > 0.8820, < 0.8920 ==> transaction at spot rate – USD/EUR: 0.91 BF Trading must sell USD at 0.8920 Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 18 Derivatives Options Second example of a Risk reversal (cylinder) Risk reversal – Notional: – Maturity: – Buy EUR put / USD call Strike: – Sell EUR call / USD put Strike: €10mln 2m 1,1700 1,2250 Buy a EUR put / USD call option struck below the forward rate and fund the purchase of this option by selling a EUR call / USD put with a strike above the forward. – The current EUR / USD spot rate is 1,2000. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 19 Derivatives Options Risk reversal (cylinder) Payoff diagram Final hedge rate EUR put/ USD call 1,2250 1,1980 1,2250 1,1700 EUR/USD 1,1700 Underlying exposure EUR call/ USD put Final hedge rate Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 20 Derivatives Options Risk reversal (cylinder) Advantages – Fully hedged below the strike of the purchased EUR put / USD call option – Participation in beneficial FX moves up to the strike of the sold EUR call / USD put option – Zero premium Disadvantages – Participation in beneficial moves above 1,2250, and is not hedged until 1,1700 The purchaser of a cylinder expects a limited move of the rate in a favorable direction, but also requires a hedge for unfavorable moves – The cylinder is an effective instrument for the purchaser which is willing to risk a limited loss in order to have the opportunity to make a limited profit Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 21 Derivatives Options Straddle & Strangle Combination of a purchased put option and a call option at the same exercise price – This is called a straddle – By purchasing both options, the speculator may gain if the currency moves substantially in either direction, or if it moves in one direction followed by the other Combination of a purchased put option and a call option with different exercise price – Call strike is higher than put strike – This is called a strangle or bottom vertical combination Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 22 Derivatives Options Foreign exchange derivatives – Options – Combined Options – Exotic Options – Case 3 Futures Cheapest to Deliver Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 23 Derivatives Options Exotic options Exotic option: option offering a variation from the standard pay-offs of the European or American call and put options Variations from vanilla options: – Path dependency explicitly in the pay-off • The contract not only depends on what the underlying asset price is on the expiration date but also on how it got there (Asian options and barrier options) – Pay-offs that depend on choices made by the holder at points in time prior to the expiration date • e.g. compound options – Options that are a function of more than one asset price • e.g. basket options Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 24 Derivatives Options Exotic options This section will cover the following types: – Vanilla participating forward – Barrier option – Participation forward (American knock-in forward) – Cancellation forward (American knock-out forward) – Compound option – Chooser option – Digital option – Asian option • Average Rate Option • Average Strike Option Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 25 Derivatives Options Participating forward Principle : – Our treasurer wants a combined option but he wants to take advantage of possible increases too. – Thus, he wants to conclude a participating forward with his bank, i.e. a forward contract for which the rate at the expiration date depends on : • the guaranteed limit rate • participating percentage on the spot rate volatility – If the client defines the guaranteed limit rate, the bank defines the participating percentage. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 26 Derivatives Options Example participating forward • BF Trading contracts a participating forward, 6 months, 100.000 USD. The guaranteed selling limit rate : USD/EUR 0.8419; % of participation = 79% • Scenarios after 6 mths: – USD/EUR 0.82. BF Trading sells USD at EUR 0.8419 – USD/EUR 92. BF Trading sells USD at 0.8419 + (0.79 x (0.92-0.8419) = 0.9036 USD/EUR or 1.1067 EUR/USD. Korte Termijn Financieel Management Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 27 Derivatives Options Participating forward Participating forward – A binding obligation to buy or sell a certain amount of foreign currency, on a certain date. A Participating Forward allows you the flexibility to specify a worst rate at which you will deal for the total amount, while enabling you to enjoy the full benefit of favorable exchange rate movements on a pre-agreed proportion of the total. – You are therefore guaranteed the worst rate at which you will deal on the total amount, with the ability to enjoy unlimited upside on the pre-agreed proportion. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 28 Derivatives Options Vanilla participating forward EUR put / USD call option – Notional: – Maturity: – Strike: – Premium: zero – Participation: €10mln 2m 1.1800 50% The current EUR/USD spot rate is again 1,2000 and the strike price is 1.1800 for 2m forward. You buy a EUR/USD put option for 100% and sell a EUR/USD call for 50% of the notional. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 29 Derivatives Options Vanilla participating forward Payoff diagram Final hedge rate EUR put/ USD call 1,1980 1,1980 EUR/USD Underlying exposure Final hedge rate Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 30 Derivatives Options Vanilla participating forward Advantages – Fully hedged below the strike of the option. The worst case hedge rate is the strike of the option, here 1,1800 – The option, unlike the forward, allows to benefit for 50% from upward movements in EUR/USD – Zero premium strategy Disadvantages – Only benefit for 50% in favorable spot moves Purchaser of a vanilla participating forward: – The purchaser has an underlying position and expects that the exchange rate will move in a favorable direction, but requires at the same time a hedge. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 31 Derivatives 5.3 Barrier option Options Barrier options: – Options where the payoff depends on whether the underlying asset’s price reaches a certain level during a certain period of time. – A number of different types of barrier options regularly trade in the over-the-counter market. – Can be classified as either knock-out options or knock-in options. – A knock-out option ceases to exist when the underlying asset price reaches a certain barrier; a knock-in option comes into existence only when the underlying asset price reaches a barrier. The price depends upon the probability of the barrier being reached, and the value of the underlying option if it is reached. – They are therefore sensitive to volatility Barrier options are applicable for any investor/borrower where their underlying rate view is dependent upon a trigger level in the same or different market being reached. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 32 Derivatives 5.3 Barrier option Options Example – Consider a knock-in call option with a strike price of EUR 100 and a knock-in barrier at EUR 110. – Suppose the option was purchased when the underlying asset was at EUR 90. If the option expired with the underlying asset at EUR 103, but the underlying asset never reached the barrier level of EUR 110 during the life of the option, the option would expire worthless. – On the other hand, if the underlying asset first rose to the EUR 110 barrier, this would cause the option to knock-in. It would then be worth EUR 3 when it expired with the underlying asset at EUR103. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 33 Derivatives 5.3 Barrier option Options Advantages: – – – – Cheaper than standard options Flexibility in setting the barrier level and thus the cost of the option Can be linked to any underlying Customized to clients exposures Disadvantages: – The rate protection is contingent upon an ‘independent’ event – The option cease to exist if spot trades lower than knock-out level. – In case knock-out, the purchaser will loose it’s protection and will have to re-hedge it’s underlying exposure at a worse rate compared to the initial rate. – In case the purchaser re-hedges instantly, the purchaser loses the difference between the knock-out level and the initial strike rate. The currency view of the purchaser is that the currency will appreciate (call), or depreciate (put), but to a limited extend (not beyond barrier). Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 34 Derivatives Options Foreign exchange derivatives – Options – Combined Options – Exotic Options – Case 3 Hedging with Options Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 35 Derivatives Options Case 3 Hedging with options We are in June, 2012 and you manage a portfolio of 40 million EUR representing the assets of a pension fund of a major German company (reference currency: EUR). 20% of the portfolio is invested in U.S. equities. You think that the Euro Sovereign Debt Crisis will recover and therefore by December you fear a further weakening of the US dollar against the EUR. For this reason you decide to hedge your portfolio against this eventuality. The EUR/USD spot rate currently is 1.30 [1.30 USD for 1 EUR], the continuously compounded interest rates for all maturities are REUR = 1.25% for the EUR, and RUSD = 0.15% for the dollar. You have at your disposal the following European options on the EUR/USD exchange rate which expire in December. Answer the following questions assuming – in order to determine the amount to be hedged – that the value in EUR of the U.S. equities remains constant between June and December. Call EUR/ Put USD Strike K = 1.25 Strike K = 1.30 Price C (in USD per 1 EUR notional) 0.0612 0.0331 delta 0.69 0.48 Put EUR/ Call USD Price P (in USD per 1 EUR notional) 0.0184 0.0402 Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation delta -0.30 -0.51 36 Derivatives Options Question A a) You decide to use options with strike K = 1.30. Which position do you take? On what notional amount? Which premium do you receive/pay? [Specify the currency]. b) What is the break-even rate of the EUR/USD at maturity [i.e. the exchange rate beyond which the hedge generates a profit]? c) You are persuaded that in December the EUR/USD exchange rate will anyway lie above 1.25. Which further option position can you take in order to profit from your idea and to reduce the initial cost of the hedging strategy? What is the total cost of this new hedging strategy? And what is the new break-even rate? d) Draw in a graph the final value of the hedging strategy as of c) (for 1 EUR of notional) as a function of the EUR/USD exchange rate ST at maturity, inserting all the relevant levels [strikes, break even points, initial cost, …]. e) Calculate the delta of the hedging strategy, and using this figure calculate the approximated change in value of the option strategy when the spot rate increases from 1.30 to 1.31 (all other variables remaining the same). f) In order to hedge the USD denominated part of your portfolio against a drop of the USD against the EUR, instead of using options you consider using a forward contract. Calculate the forward rate (maturity 6 months) and detail the forward position you should take. What are the pros/cons of such a hedge with respect to a hedge that uses options? Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 37 Derivatives Options Solution: a) The current US stocks position amounts to 40 Mio EUR x 20% = 8 million EUR [which corresponds to 8 million x 1.30 = 10.4 million USD]. Assuming that the counter value in EUR of the US stock remains constant between June and December, in order to hedge against a fall of the USD [which means the EUR becomes more expensive] we have to BUY a put 10.4 million USD / call 8 million EUR with strike K = 1.30, spending 0.0331 USD per EUR. Therefore the total cost is 8 million x 0.0331 = 264,800 USD. b) 1.30 + 0.0331 = 1.3331. c) Considering that 8 million x 1.25 = 10 million USD, we SELL a call 10 million USD / put 8 million EUR with strike K = 1.25 collecting 0.0184 USD per 1 EUR. The total cost of the hedging strategy becomes 8 million x [0.0331 - 0.0184] = 8 million x 0.0147 = 117,600 USD. The break-even point is: 1.30 + 0.0147 = 1.3147. Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 38 Derivatives Options Solution (cont’d): Value in USD of the hedging strategy EUR/USD ST ‐0.0147 1.25 1.30 1.3147 Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 39 Derivatives Options Solution (cont’d): e) The delta of the strategy [long put USD K = 1.30 and short call USD K = 1.25] is: [0.48 – (–0.30)] = 0.78. If the spot exchange rate increases by 0.01 [i.e. the dollar weakens: more dollars are needed for 1 EUR] the strategy increases in value by: 8 million · 0.01 x 0.78 = 62,400 USD. f) Therefore he has to buy forward 8 million EUR – sell 10.343200 million USD [implying a forward rate of 1.2929] maturity 6 months Pros: The hedge which uses forward contracts has no initial cost; at the contrary the hedge which uses options has an initial cost. The break-even point of the ‘forward’ hedge (1.2929) is lower than the one with options (1.3147) Cons: the ‘forward’ hedge does not allow to profit from a USD strengthening; at the contrary the ‘options‘ hedge does, up to a certain limit (1.25). Documentation produced by Prof Hans Buysse or the EFFAS Summer School Reproduction prohibited without express authorisation 40 Derivatives Clairfield International Options Hans Buysse Partner ABAF-BVFA Deputy Chairman EFFAS Board member and treasurer ACIIA Council member XBRL Europe Board member ESMA CWG CRSC member Tel: +32 475 444 632 email: [email protected] www.clairfield.com