Expected Returns on Major Asset Classes

... Expected returns are arguably the most important input into investment decisions. Many investors determine their expectations for returns on investments in highly subjective ways, based on discretionary views. More objective predictions are anchored on historical experience, financial theories, and ...

... Expected returns are arguably the most important input into investment decisions. Many investors determine their expectations for returns on investments in highly subjective ways, based on discretionary views. More objective predictions are anchored on historical experience, financial theories, and ...

Cash Conversion Cycle and Firms` Profitability – A

... how to sustain and improve profitability, hence they have to keep an eye on the factors affecting the profitability. The present study is concerned about evaluating how cash conversion cycle affects the profitability of manufacturing sector organizations listed at Karachi stock exchange of Pakistan. ...

... how to sustain and improve profitability, hence they have to keep an eye on the factors affecting the profitability. The present study is concerned about evaluating how cash conversion cycle affects the profitability of manufacturing sector organizations listed at Karachi stock exchange of Pakistan. ...

Billabong International Limited

... The Group’s segment information for the prior period has therefore also been presented on a constant currency basis (i.e. using the current period monthly average exchange rates to convert the prior period foreign earnings) to remove the impact of foreign exchange movements from the Group’s performa ...

... The Group’s segment information for the prior period has therefore also been presented on a constant currency basis (i.e. using the current period monthly average exchange rates to convert the prior period foreign earnings) to remove the impact of foreign exchange movements from the Group’s performa ...

Customer relationships and the heterogeneity of firm performance

... processes that create value also varies. Hence, relationship performance heterogeneity will play a significant role in determining the heterogeneity of firm performance. Matching the heterogeneous need in the market (by segmenting) with the heterogeneous resource base in a firm has been explored alr ...

... processes that create value also varies. Hence, relationship performance heterogeneity will play a significant role in determining the heterogeneity of firm performance. Matching the heterogeneous need in the market (by segmenting) with the heterogeneous resource base in a firm has been explored alr ...

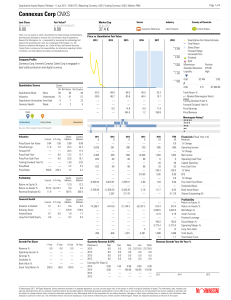

Connexus Corp CNXS

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

... and an investor’s principal value will fluctuate so that, when redeemed, an investor’s shares may be worth more or less than their original cost. A security’s current investment performance may be lower or higher than the investment performance noted within the report. The quantitative equity rating ...

EAST WEST BANCORP INC (Form: 10-Q, Received

... verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including, but not limited to, those described in the documents incorporated by reference. When considering these forward-looking statements, you should keep in mind these risks and uncert ...

... verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including, but not limited to, those described in the documents incorporated by reference. When considering these forward-looking statements, you should keep in mind these risks and uncert ...

Some Theoretical Considerations Regarding Net Asset Values for

... bonds, and repurchase agreements. Most money funds maintain a stable redemption value of shares, usually set at a value equal to one, and pay dividends that re‡ect the prevailing short-term interest rates. As of September 2012, there were 632 money market funds in the United States with total assets ...

... bonds, and repurchase agreements. Most money funds maintain a stable redemption value of shares, usually set at a value equal to one, and pay dividends that re‡ect the prevailing short-term interest rates. As of September 2012, there were 632 money market funds in the United States with total assets ...

Active Management Performance Cycles

... stock returns, pairwise correlation of stock returns, small cap tilt, and international tilt for large cap managers. Due to the sheer scope of this topic, we limited our analysis to large cap US equity. We selected this asset class because of the extended period of relative underperformance for this ...

... stock returns, pairwise correlation of stock returns, small cap tilt, and international tilt for large cap managers. Due to the sheer scope of this topic, we limited our analysis to large cap US equity. We selected this asset class because of the extended period of relative underperformance for this ...

... similar framework—characterized by both Epstein-Zin preferences and reducedform consumption and inflation empirics—to match the level and variation of risk premiums in bond and foreign exchange markets. An advantage of these endowment economy studies is that bond prices depend only on the joint stoc ...

CAM Government Securities Investment Fund ANNUAL REPORT

... year then ended, in compliance with International Financial Reporting Standards (“IFRS”). In preparing the financial statements, management is responsible for: ● properly selecting and applying accounting policies; ● presenting information, including accounting policies, in a manner that provides re ...

... year then ended, in compliance with International Financial Reporting Standards (“IFRS”). In preparing the financial statements, management is responsible for: ● properly selecting and applying accounting policies; ● presenting information, including accounting policies, in a manner that provides re ...

External Financing and Customer Capital: A Financial Theory

... because it endogenously chooses to hold more cash on its balance sheet. However, this does not imply that price stickiness is good in terms of boosting the firm’s value. In fact, holding too much cash is costly in our model. Particularly, our model shows that the firm’s enterprise value, which is mo ...

... because it endogenously chooses to hold more cash on its balance sheet. However, this does not imply that price stickiness is good in terms of boosting the firm’s value. In fact, holding too much cash is costly in our model. Particularly, our model shows that the firm’s enterprise value, which is mo ...

bondch11s

... 9% mortgage for the loan's first five months, and Figure 11.2-1 shows the pattern of scheduled interest and principal payments over the life of mortgage. The figure highlights the pattern that in the early life of the mortgage most of the monthly payments go towards paying interest, while in the lat ...

... 9% mortgage for the loan's first five months, and Figure 11.2-1 shows the pattern of scheduled interest and principal payments over the life of mortgage. The figure highlights the pattern that in the early life of the mortgage most of the monthly payments go towards paying interest, while in the lat ...