1 An investor expects the value of a $1,000 investment to triple

... 2. A firm has a total debt of $1,000,000 and equity of $600,000. What is the debt/net worth ratio and the debt-to-total assets ratio for the firm? Show your calculations. ...

... 2. A firm has a total debt of $1,000,000 and equity of $600,000. What is the debt/net worth ratio and the debt-to-total assets ratio for the firm? Show your calculations. ...

When Valuing a Manufacturing Business, Work With a Pro

... To value manufacturing companies, valuators consider and use one or some combination of these general approaches: Income. This method converts anticipated economic benefits, such as earnings or cash flows, into a present value that takes into account the risk associated with a company. Market. Using ...

... To value manufacturing companies, valuators consider and use one or some combination of these general approaches: Income. This method converts anticipated economic benefits, such as earnings or cash flows, into a present value that takes into account the risk associated with a company. Market. Using ...

The Investment Environment

... Some industry grow faster than the GDP and are expected to continue in their growth. E.g IT industry has experienced higher rate than GDP in 1998. ...

... Some industry grow faster than the GDP and are expected to continue in their growth. E.g IT industry has experienced higher rate than GDP in 1998. ...

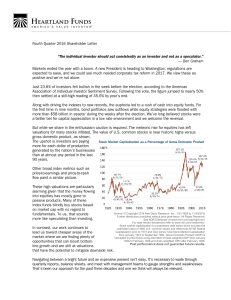

Past performance does not guarantee future results.

... The statements and opinions expressed in this article are those of the presenter(s). Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and a ...

... The statements and opinions expressed in this article are those of the presenter(s). Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and a ...

Written exam 2008 spring

... amount, meaning the capital structure has not changed? The question is wrong because you can’t change proportion of debt and have the same capital structure, sorry b) Increasing growth rate? Higher cash-flows – higher value of the company c) The company takes on more debt and gets a higher financial ...

... amount, meaning the capital structure has not changed? The question is wrong because you can’t change proportion of debt and have the same capital structure, sorry b) Increasing growth rate? Higher cash-flows – higher value of the company c) The company takes on more debt and gets a higher financial ...